Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The interest rate a company pays on loan depends in part on the extent to which its default risk ratio is above / below 3

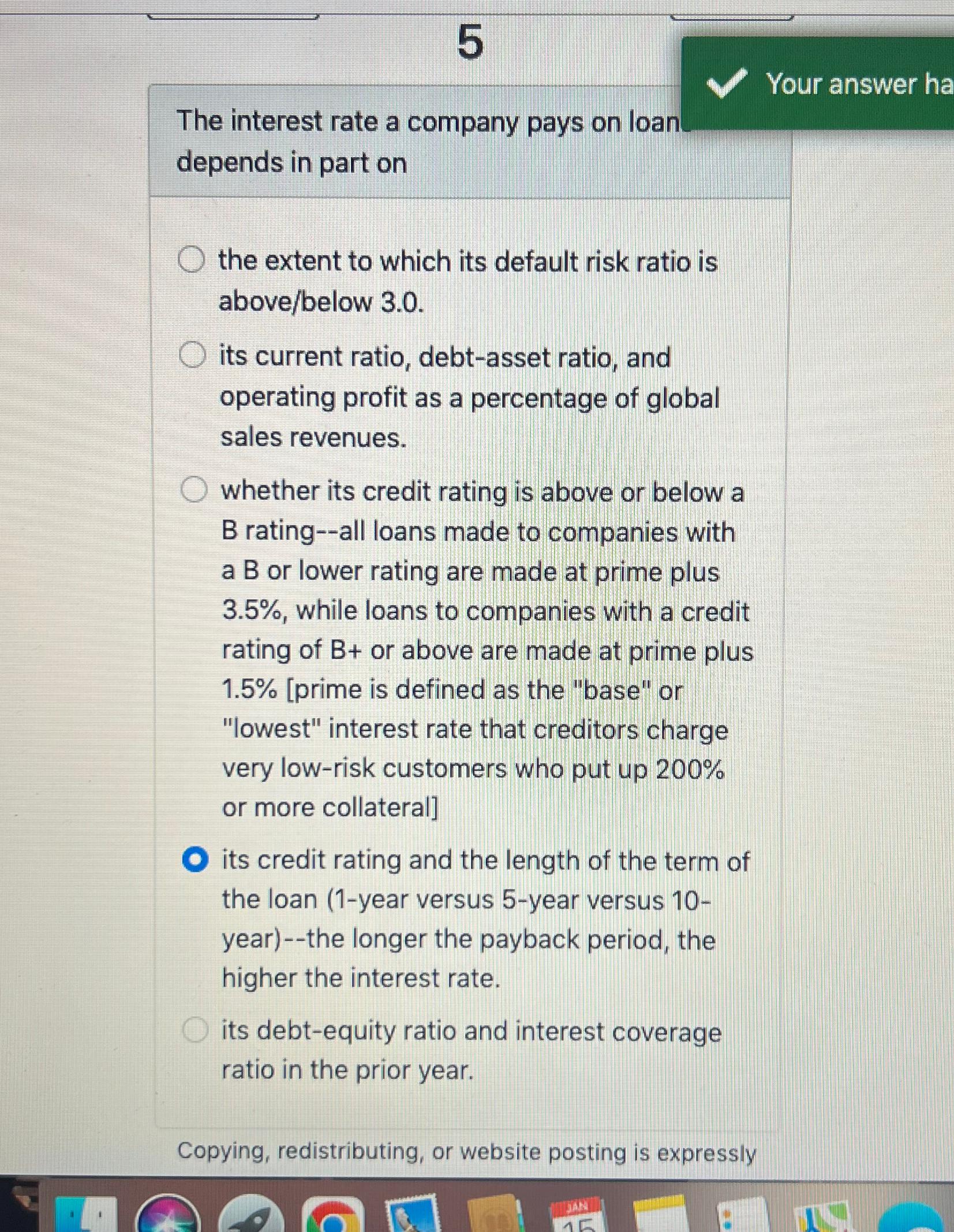

The interest rate a company pays on loan depends in part on

the extent to which its default risk ratio is abovebelow

its current ratio, debtasset ratio, and operating profit as a percentage of global sales revenues.

whether its credit rating is above or below a ratingall loans made to companies with a or lower rating are made at prime plus while loans to companies with a credit rating of or above are made at prime plus prime is defined as the "base" or "lowest" interest rate that creditors charge very lowrisk customers who put up or more collateral

its credit rating and the length of the term of the loan year versus year versus yearthe longer the payback period, the higher the interest rate.

its debtequity ratio and interest coverage ratio in the prior year.

Copying, redistributing, or website posting is expressly

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started