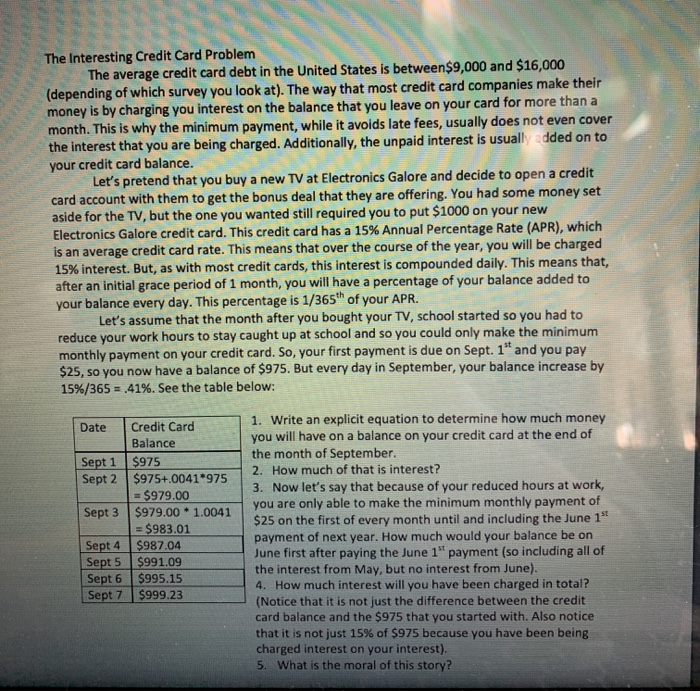

The Interesting Credit Card Problem The average credit card debt in the United States is between$9,000 and $16,000 (depending of which survey you look at). The way that most credit card companies make their money is by charging you interest on the balance that you leave on your card for more than a month. This is why the minimum payment, while it avoids late fees, usually does not even cover the interest that you are being charged. Additionally, the unpaid interest is usually added on to your credit card balance. Let's pretend that you buy a new TV at Electronics Galore and decide to open a credit card account with them to get the bonus deal that they are offering. You had some money set aside for the TV, but the one you wanted still required you to put $1000 on your new Electronics Galore credit card. This credit card has a 15% Annual Percentage Rate (APR), which is an average credit card rate. This means that over the course of the year, you will be charged 15% interest. But, as with most credit cards, this interest is compounded daily. This means that, after an initial grace period of 1 month, you will have a percentage of your balance added to your balance every day. This percentage is 1/365 of your APR. Let's assume that the month after you bought your TV, school started so you had to reduce your work hours to stay caught up at school and so you could only make the minimum monthly payment on your credit card. So, your first payment is due on Sept. 1" and you pay $25, so you now have a balance of $975. But every day in September, your balance increase by 15%/365 = .41%. See the table below: Date Credit Card Balance Sept 1 $975 Sept 2 $975+.0041*975 = $979.00 Sept 3 $979.00 - 1.0041 = $983.01 Sept 4 $987.04 Sept 5 $991.09 Sept 6 $995.15 Sept7 $999.23 1. Write an explicit equation to determine how much money you will have on a balance on your credit card at the end of the month of September. 2. How much of that is interest? 3. Now let's say that because of your reduced hours at work, you are only able to make the minimum monthly payment of $25 on the first of every month until and including the June 1 payment of next year. How much would your balance be on June first after paying the June 1"payment (so including all of the interest from May, but no interest from June). 4. How much interest will you have been charged in total? (Notice that it is not just the difference between the credit card balance and the $975 that you started with. Also notice that it is not just 15% of $975 because you have been being charged interest on your interest). 5. What is the moral of this story? The Interesting Credit Card Problem The average credit card debt in the United States is between$9,000 and $16,000 (depending of which survey you look at). The way that most credit card companies make their money is by charging you interest on the balance that you leave on your card for more than a month. This is why the minimum payment, while it avoids late fees, usually does not even cover the interest that you are being charged. Additionally, the unpaid interest is usually added on to your credit card balance. Let's pretend that you buy a new TV at Electronics Galore and decide to open a credit card account with them to get the bonus deal that they are offering. You had some money set aside for the TV, but the one you wanted still required you to put $1000 on your new Electronics Galore credit card. This credit card has a 15% Annual Percentage Rate (APR), which is an average credit card rate. This means that over the course of the year, you will be charged 15% interest. But, as with most credit cards, this interest is compounded daily. This means that, after an initial grace period of 1 month, you will have a percentage of your balance added to your balance every day. This percentage is 1/365 of your APR. Let's assume that the month after you bought your TV, school started so you had to reduce your work hours to stay caught up at school and so you could only make the minimum monthly payment on your credit card. So, your first payment is due on Sept. 1" and you pay $25, so you now have a balance of $975. But every day in September, your balance increase by 15%/365 = .41%. See the table below: Date Credit Card Balance Sept 1 $975 Sept 2 $975+.0041*975 = $979.00 Sept 3 $979.00 - 1.0041 = $983.01 Sept 4 $987.04 Sept 5 $991.09 Sept 6 $995.15 Sept7 $999.23 1. Write an explicit equation to determine how much money you will have on a balance on your credit card at the end of the month of September. 2. How much of that is interest? 3. Now let's say that because of your reduced hours at work, you are only able to make the minimum monthly payment of $25 on the first of every month until and including the June 1 payment of next year. How much would your balance be on June first after paying the June 1"payment (so including all of the interest from May, but no interest from June). 4. How much interest will you have been charged in total? (Notice that it is not just the difference between the credit card balance and the $975 that you started with. Also notice that it is not just 15% of $975 because you have been being charged interest on your interest). 5. What is the moral of this story