Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The investment Seyran Ltd is 55% holding in Isune Ltd. An offer of Gel 350 has been made for Seyram Ltd's holding and has

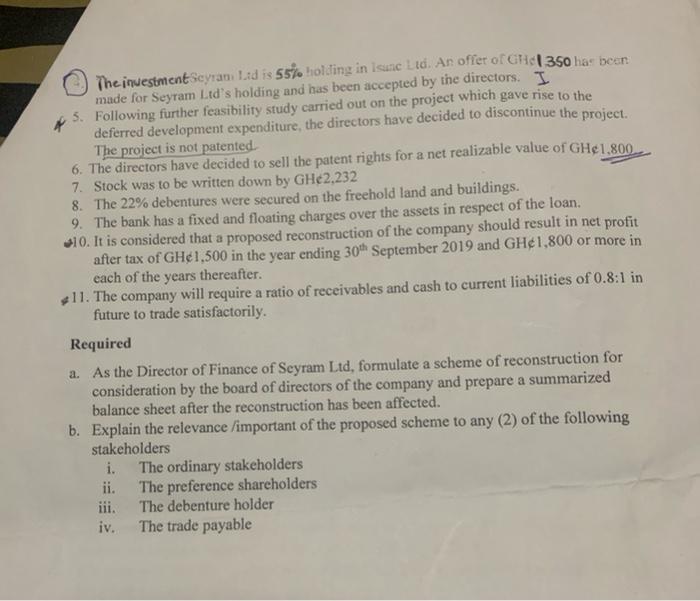

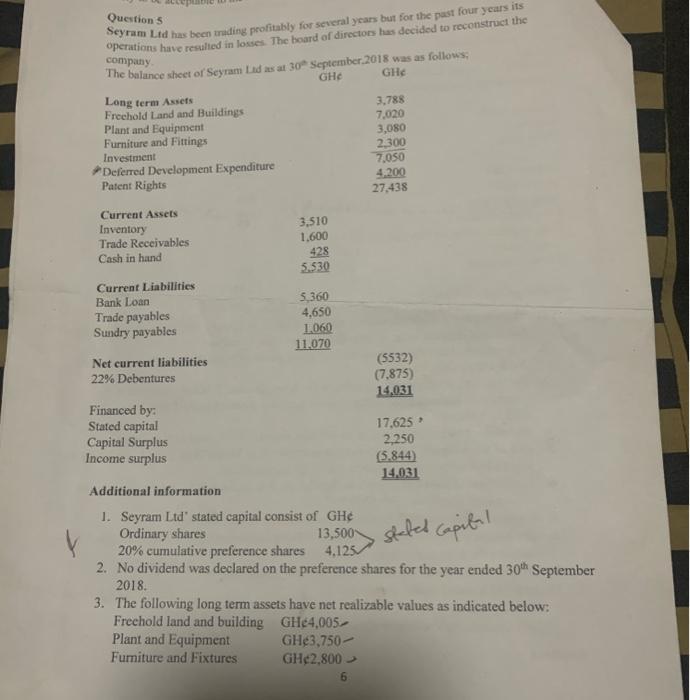

The investment Seyran Ltd is 55% holding in Isune Ltd. An offer of Gel 350 has been made for Seyram Ltd's holding and has been accepted by the directors. I 5. Following further feasibility study carried out on the project which gave rise to the deferred development expenditure, the directors have decided to discontinue the project. The project is not patented. 6. The directors have decided to sell the patent rights for a net realizable value of GHe1,800 7. Stock was to be written down by GH 2,232 8. The 22% debentures were secured on the freehold land and buildings. 9. The bank has a fixed and floating charges over the assets in respect of the loan. 10. It is considered that a proposed reconstruction of the company should result in net profit after tax of GHe 1,500 in the year ending 30th September 2019 and GH1,800 or more in each of the years thereafter. 11. The company will require a ratio of receivables and cash to current liabilities of 0.8:1 in future to trade satisfactorily. Required a. As the Director of Finance of Seyram Ltd, formulate a scheme of reconstruction for consideration by the board of directors of the company and prepare a summarized balance sheet after the reconstruction has been affected. b. Explain the relevance /important of the proposed scheme to any (2) of the following stakeholders i. The ordinary stakeholders ii. The preference shareholders iii. The debenture holder iv. The trade payable Question 5 Seyram Ltd has been trading profitably for several years but for the past four years its operations have resulted in losses. The board of directors has decided to reconstruct the company. The balance sheet of Seyram Lad as at 30 September 2018 was as follows; GH GHe Long term Assets 3,788 Freehold Land and Buildings 7,020 Plant and Equipment 3,080 Furniture and Fittings 2,300 Investment 7,050 Deferred Development Expenditure 4.200 Patent Rights 27,438 Current Assets Inventory Trade Receivables Cash in hand Current Liabilities Bank Loan Trade payables Sundry payables Net current liabilities (5532) (7,875) 22% Debentures 14,031 Financed by: Stated capital 17,625 Capital Surplus 2,250 Income surplus (5.844) 14,031 Additional information 1. Seyram Ltd' stated capital consist of GHe Ordinary shares 13,500 stated capital 20% cumulative preference shares 4.125 2. No dividend was declared on the preference shares for the year ended 30th September 2018. 3. The following long term assets have net realizable values as indicated below: Freehold land and building GH4,005- Plant and Equipment GH3,750- Furniture and Fixtures GH2,800 >> 6 3,510 1,600 428 5.530 5,360 4,650 1,060 11,070

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

A 2447 2448 2449 2450 Long term Assets 2451 Freehold Land and Buildings 2452 Plant and Eq...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started