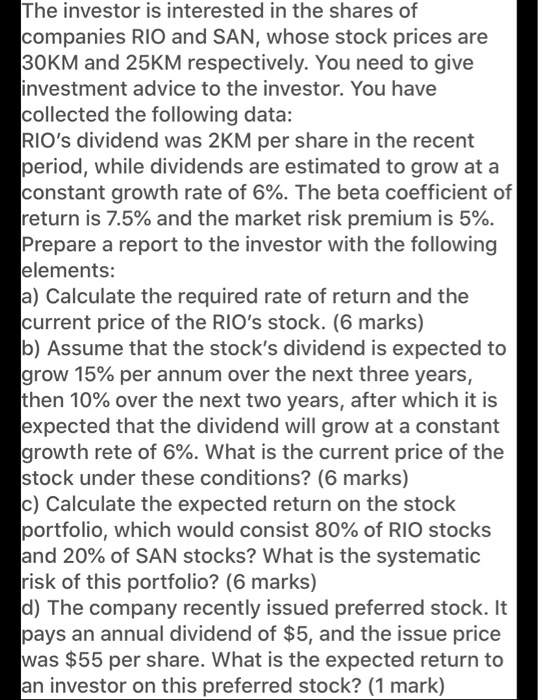

The investor is interested in the shares of companies RIO and SAN, whose stock prices are 30KM and 25KM respectively. You need to give investment advice to the investor. You have collected the following data: RIO's dividend was 2KM per share in the recent period, while dividends are estimated to grow at a constant growth rate of 6%. The beta coefficient of return is 7.5% and the market risk premium is 5%. Prepare a report to the investor with the following elements: a) Calculate the required rate of return and the current price of the RIO's stock. (6 marks) b) Assume that the stock's dividend is expected to grow 15% per annum over the next three years, then 10% over the next two years, after which it is expected that the dividend will grow at a constant growth rete of 6%. What is the current price of the stock under these conditions? (6 marks) c) Calculate the expected return on the stock portfolio, which would consist 80% of RIO stocks and 20% of SAN stocks? What is the systematic risk of this portfolio? (6 marks) d) The company recently issued preferred stock. It pays an annual dividend of $5, and the issue price was $55 per share. What is the expected return to an investor on this preferred stock? (1 mark) The investor is interested in the shares of companies RIO and SAN, whose stock prices are 30KM and 25KM respectively. You need to give investment advice to the investor. You have collected the following data: RIO's dividend was 2KM per share in the recent period, while dividends are estimated to grow at a constant growth rate of 6%. The beta coefficient of return is 7.5% and the market risk premium is 5%. Prepare a report to the investor with the following elements: a) Calculate the required rate of return and the current price of the RIO's stock. (6 marks) b) Assume that the stock's dividend is expected to grow 15% per annum over the next three years, then 10% over the next two years, after which it is expected that the dividend will grow at a constant growth rete of 6%. What is the current price of the stock under these conditions? (6 marks) c) Calculate the expected return on the stock portfolio, which would consist 80% of RIO stocks and 20% of SAN stocks? What is the systematic risk of this portfolio? (6 marks) d) The company recently issued preferred stock. It pays an annual dividend of $5, and the issue price was $55 per share. What is the expected return to an investor on this preferred stock? (1 mark)