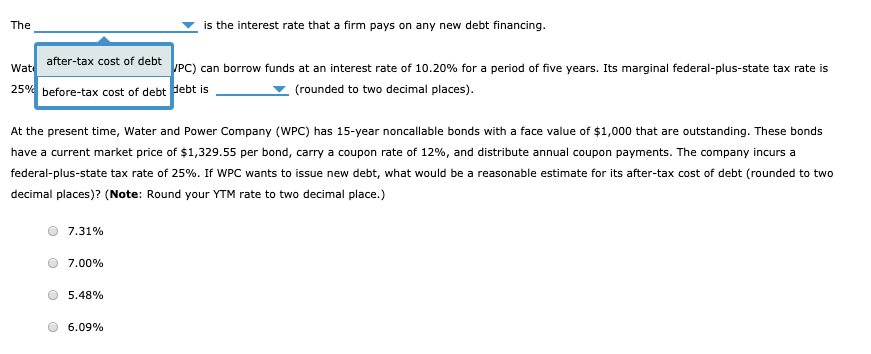

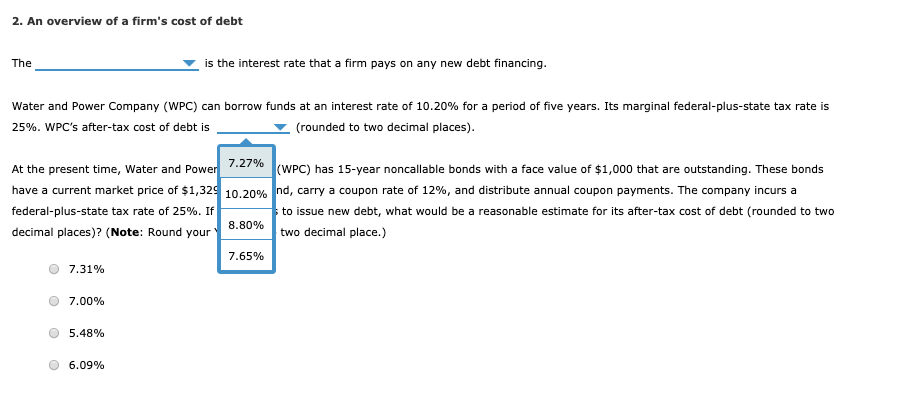

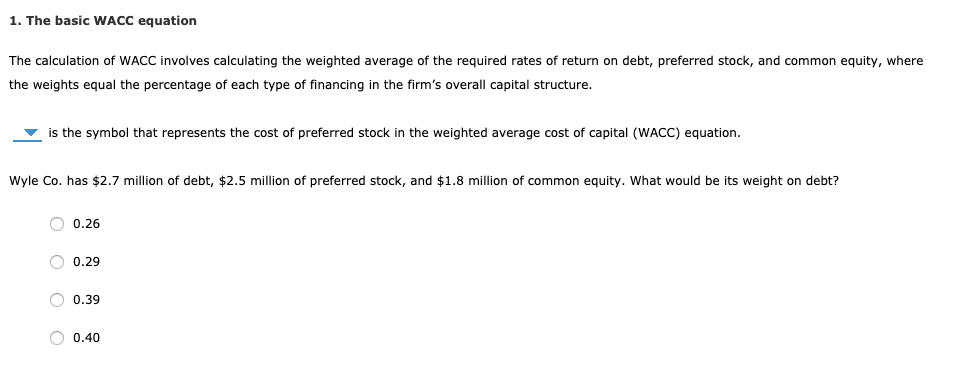

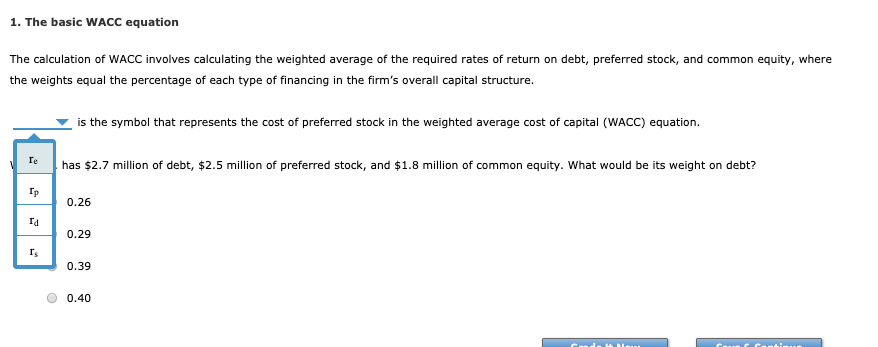

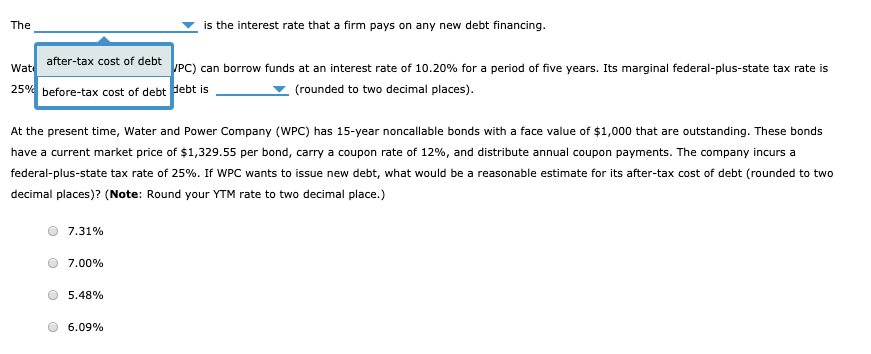

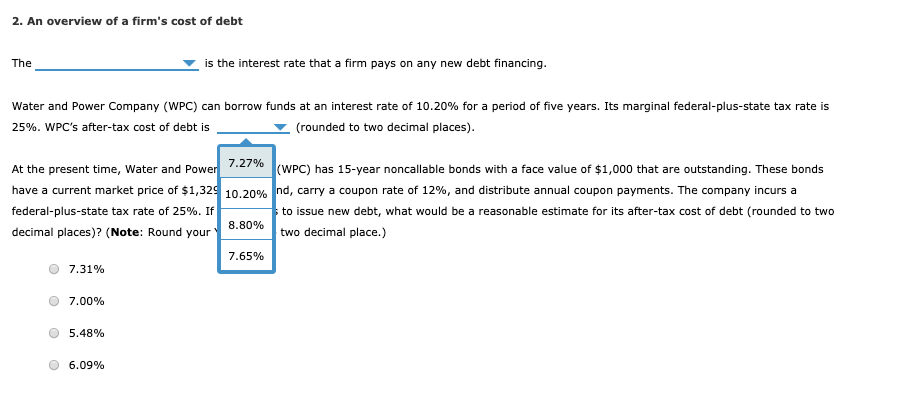

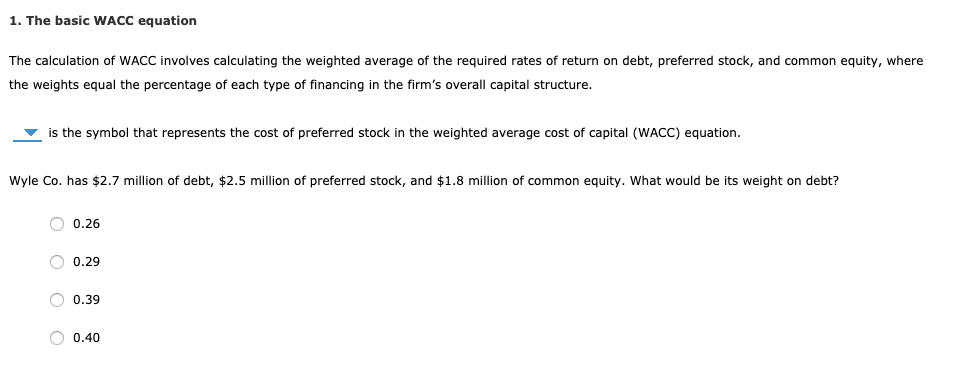

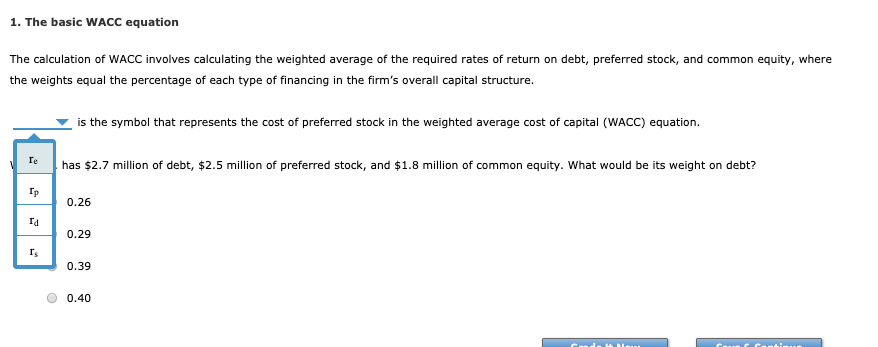

The is the interest rate that a firm pays on any new debt financing. Wat after-tax cost of debt VPC) can borrow funds at an interest rate of 10.20% for a period of five years. Its marginal federal-plus-state tax rate is 25% before-tax cost of debt Pebt is __ (rounded to two decimal places). At the present time, Water and Power Company (WPC) has 15-year noncallable bonds with a face value of $1,000 that are outstanding. These bonds have a current market price of $1,329.55 per bond, carry a coupon rate of 12%, and distribute annual coupon payments. The company incurs a federal-plus-state tax rate of 25%. If WPC wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two decimal places)? (Note: Round your YTM rate to two decimal place.) 7.31% 7.00% 5.48% 6.09% 2. An overview of a firm's cost of debt The is the interest rate that a firm pays on any new debt financing. Water and Power Company (WPC) can borrow funds at an interest rate of 10.20% for a period of five years. Its marginal federal-plus-state tax rate is 25%. WPC's after-tax cost of debt is (rounded to two decimal places). At the present time, Water and Power 7.27% have a current market price of $1,329 10.20% federal-plus-state tax rate of 25%. If 8.80% decimal places)? (Note: Round your (WPC) has 15-year noncallable bonds with a face value of $1,000 that are outstanding. These bonds nd, carry a coupon rate of 12%, and distribute annual coupon payments. The company incurs a to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two two decimal place.) 7.65% 7.31% 7.00% 5.48% O 6.09% 1. The basic WACC equation The calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm's overall capital structure. is the symbol that represents the cost of preferred stock in the weighted average cost of capital (WACC) equation. Wyle Co. has $2.7 million of debt, $2.5 million of preferred stock, and $1.8 million of common equity. What would be its weight on debt? 0.26 O 0.29 O 0.39 O 0.40 1. The basic WACC equation The calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm's overall capital structure. is the symbol that represents the cost of preferred stock in the weighted average cost of capital (WACC) equation. has $2.7 million of debt, $2.5 million of preferred stock, and $1.8 million of common equity. What would be its weight on debt? 0.26 0.29 0.39 0.40