Question

The Jets Company recorded a deferred tax liability of $18,750 on December 31 of Year 1, due to the book value of equipment exceeding

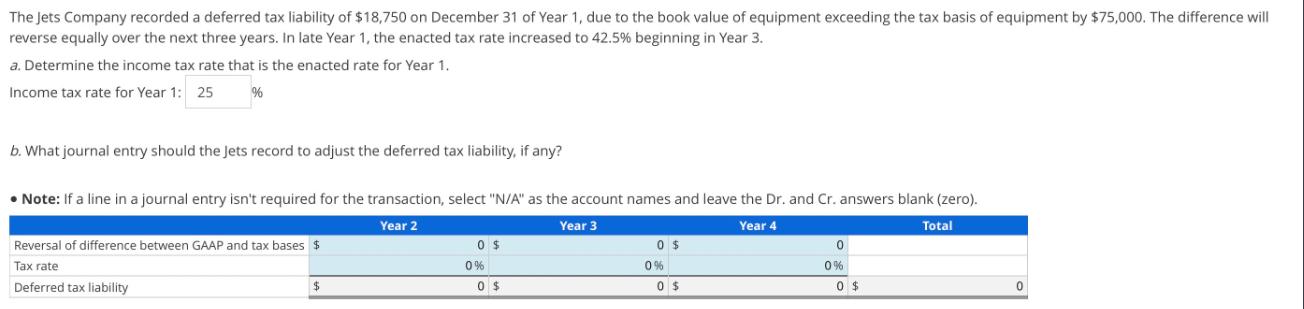

The Jets Company recorded a deferred tax liability of $18,750 on December 31 of Year 1, due to the book value of equipment exceeding the tax basis of equipment by $75,000. The difference will reverse equally over the next three years. In late Year 1, the enacted tax rate increased to 42.5% beginning in Year 3. a. Determine the income tax rate that is the enacted rate for Year 1. Income tax rate for Year 1: 25 % b. What journal entry should the Jets record to adjust the deferred tax liability, if any? Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). Year 2 Year 3 Year 4 Total Reversal of difference between GAAP and tax bases $ Tax rate: Deferred tax liability $ 0 $ 0% 0 $ 0 $ 0% 0 $ 0 0% 0 $ 0

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Theory and Analysis Text and Cases

Authors: Richard G. Schroeder, Myrtle W. Clark, Jack M. Cathey

10th edition

470646284, 978-0470646281

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App