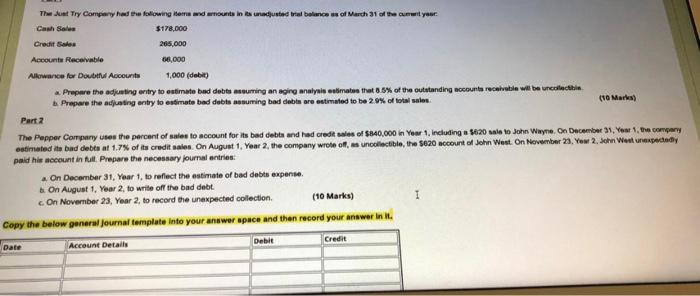

The Just Try Company had the following Herred mountains usted trial blancs of March 31 of the curier. Cash Sale $178.000 Credit Sales 265,000 Account Receivable 66,000 Alkware for Dout Account 1,000 (debit) a Prepare the adjusting witry to estimate bad debts suming an aging analysis estimates that 86% of the outstanding accounts receivable will be collectie Prepare the adjusting entry to estimate bad debts assuring bad debts are estimated to be 20% of total sales (10 Mars Part 2 The Pepper Company uses the percent of sales to account for its bad debts and had credit sales of $840,000 in Your 1, including a 5620 sale to John Wayne On December 11 Year 1, the company estimated the bad debts at 1.7% of its credit sales. On August 1, Year 2, the company wrote of, as uncollectible, the 5820 account of John West. On November 23, Yow 2. John West unexpected paid his account in full. Prepare the necessary journal entries On December 31, Year 1 to reflect the estimate of bad debts expense On August 1 Year 2 to write of the bad debt c. On November 23, Year 2, to record the unexpected collection (10 Marks) I Copy the below general Journal template into your answer space and then record your answer in Date Account Details Debit Credit The Just Try Company had the following Herred mountains usted trial blancs of March 31 of the curier. Cash Sale $178.000 Credit Sales 265,000 Account Receivable 66,000 Alkware for Dout Account 1,000 (debit) a Prepare the adjusting witry to estimate bad debts suming an aging analysis estimates that 86% of the outstanding accounts receivable will be collectie Prepare the adjusting entry to estimate bad debts assuring bad debts are estimated to be 20% of total sales (10 Mars Part 2 The Pepper Company uses the percent of sales to account for its bad debts and had credit sales of $840,000 in Your 1, including a 5620 sale to John Wayne On December 11 Year 1, the company estimated the bad debts at 1.7% of its credit sales. On August 1, Year 2, the company wrote of, as uncollectible, the 5820 account of John West. On November 23, Yow 2. John West unexpected paid his account in full. Prepare the necessary journal entries On December 31, Year 1 to reflect the estimate of bad debts expense On August 1 Year 2 to write of the bad debt c. On November 23, Year 2, to record the unexpected collection (10 Marks) I Copy the below general Journal template into your answer space and then record your answer in Date Account Details Debit Credit