Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Kingstone Ltd is currently considering expanding its production of a new product by acquiring a new plant machinery. The following information is available

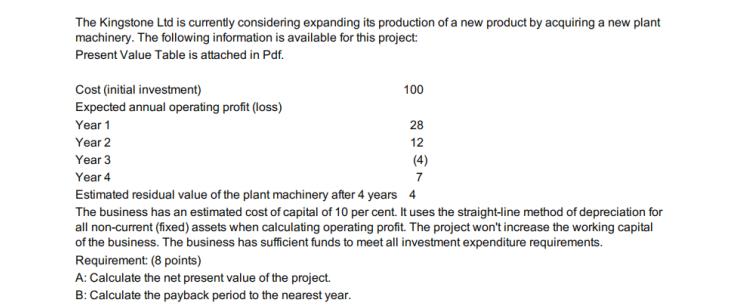

The Kingstone Ltd is currently considering expanding its production of a new product by acquiring a new plant machinery. The following information is available for this project: Present Value Table is attached in Pdf. Cost (initial investment) Expected annual operating profit (loss) Year 1 Year 2 Year 3 Year 4 100 Requirement: (8 points) A: Calculate the net present value of the project. B: Calculate the payback period to the nearest year. 28 12 7 Estimated residual value of the plant machinery after 4 years 4 The business has an estimated cost of capital of 10 per cent. It uses the straight-line method of depreciation for all non-current (fixed) assets when calculating operating profit. The project won't increase the working capital of the business. The business has sufficient funds to meet all investment expenditure requirements.

Step by Step Solution

★★★★★

3.53 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Net Present Value NPV of the project youll need to discount the expected cash flows ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started