Answered step by step

Verified Expert Solution

Question

1 Approved Answer

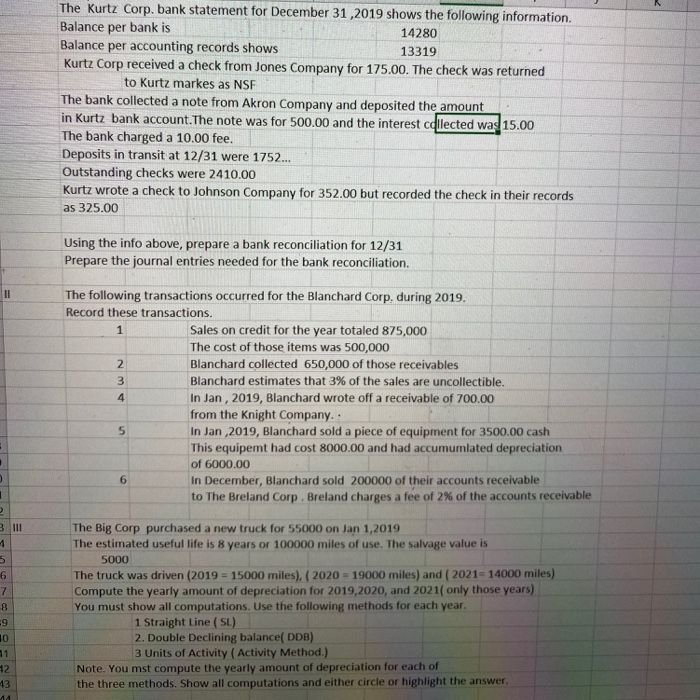

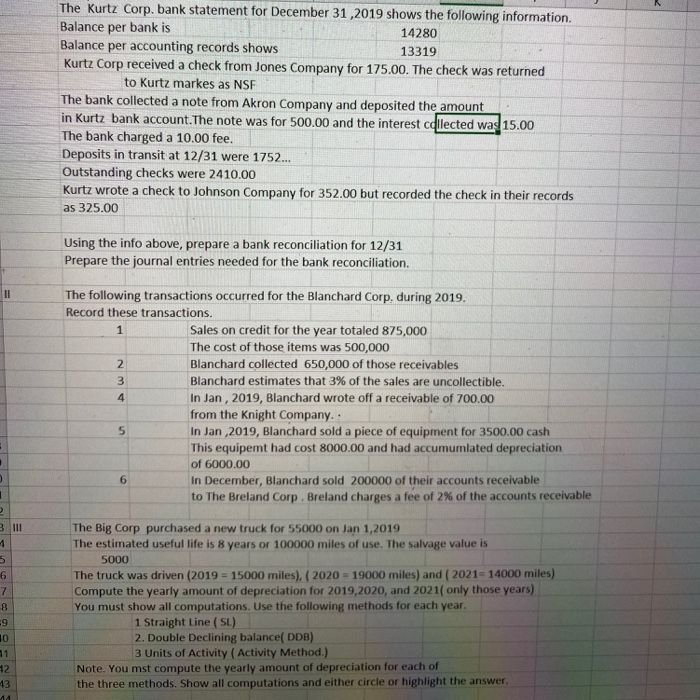

The Kurtz Corp, bank statement for December 31,2019 shows the following information. Balance per bank is 14280 Balance per accounting records shows 13319 Kurtz Corp

The Kurtz Corp, bank statement for December 31,2019 shows the following information. Balance per bank is 14280 Balance per accounting records shows 13319 Kurtz Corp received a check from Jones Company for 175.00. The check was returned to Kurtz markes as NSF The bank collected a note from Akron Company and deposited the amount in Kurtz bank account.The note was for 500.00 and the interest collected was 15.00 The bank charged a 10.00 fee. Deposits in transit at 12/31 were 1752... Outstanding checks were 2410.00 Kurtz wrote a check to Johnson Company for 352.00 but recorded the check in their records as 325.00 Using the info above, prepare a bank reconciliation for 12/31 Prepare the journal entries needed for the bank reconciliation, The following transactions occurred for the Blanchard Corp, during 2019. Record these transactions. Sales on credit for the year totaled 875,000 The cost of those items was 500,000 Blanchard collected 650,000 of those receivables Blanchard estimates that 3% of the sales are uncollectible In Jan, 2019, Blanchard wrote off a receivable of 700.00 from the Knight Company.. In Jan,2019, Blanchard sold a piece of equipment for 3500.00 cash This equipemt had cost 8000.00 and had accumumlated depreciation of 6000.00 In December, Blanchard sold 200000 of their accounts receivable to The Breland Corp. Breland charges a fee of 2% of the accounts receivable own NE The Big Corp purchased a new truck for 55000 on Jan 1, 2019 The estimated useful life is 8 years or 100000 miles of use. The salvage value is 5000 The truck was driven (2019 = 15000 miles), (2020 = 19000 miles) and (202114000 miles) Compute the yearly amount of depreciation for 2019,2020, and 2021 only those years) You must show all computations. Use the following methods for each year, 1 Straight Line (SL) 2. Double Declining balance DDB) 3 Units of Activity (Activity Method.) Note. You mst compute the yearly amount of depreciation for each of the three methods. Show all computations and either circle or highlight the

The Kurtz Corp, bank statement for December 31,2019 shows the following information. Balance per bank is 14280 Balance per accounting records shows 13319 Kurtz Corp received a check from Jones Company for 175.00. The check was returned to Kurtz markes as NSF The bank collected a note from Akron Company and deposited the amount in Kurtz bank account.The note was for 500.00 and the interest collected was 15.00 The bank charged a 10.00 fee. Deposits in transit at 12/31 were 1752... Outstanding checks were 2410.00 Kurtz wrote a check to Johnson Company for 352.00 but recorded the check in their records as 325.00 Using the info above, prepare a bank reconciliation for 12/31 Prepare the journal entries needed for the bank reconciliation, The following transactions occurred for the Blanchard Corp, during 2019. Record these transactions. Sales on credit for the year totaled 875,000 The cost of those items was 500,000 Blanchard collected 650,000 of those receivables Blanchard estimates that 3% of the sales are uncollectible In Jan, 2019, Blanchard wrote off a receivable of 700.00 from the Knight Company.. In Jan,2019, Blanchard sold a piece of equipment for 3500.00 cash This equipemt had cost 8000.00 and had accumumlated depreciation of 6000.00 In December, Blanchard sold 200000 of their accounts receivable to The Breland Corp. Breland charges a fee of 2% of the accounts receivable own NE The Big Corp purchased a new truck for 55000 on Jan 1, 2019 The estimated useful life is 8 years or 100000 miles of use. The salvage value is 5000 The truck was driven (2019 = 15000 miles), (2020 = 19000 miles) and (202114000 miles) Compute the yearly amount of depreciation for 2019,2020, and 2021 only those years) You must show all computations. Use the following methods for each year, 1 Straight Line (SL) 2. Double Declining balance DDB) 3 Units of Activity (Activity Method.) Note. You mst compute the yearly amount of depreciation for each of the three methods. Show all computations and either circle or highlight the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started