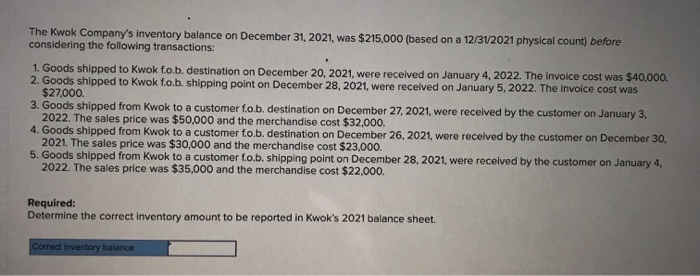

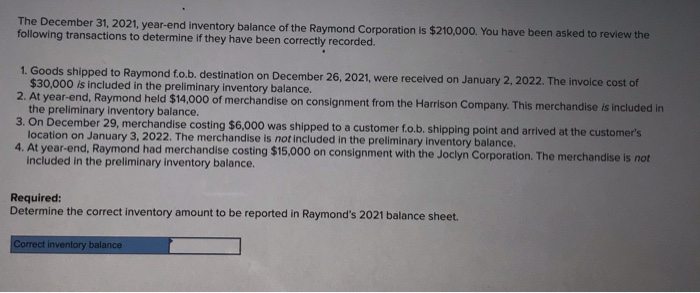

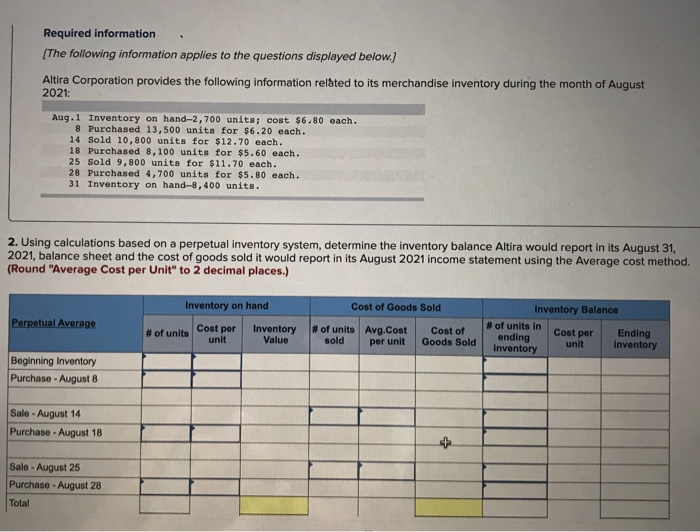

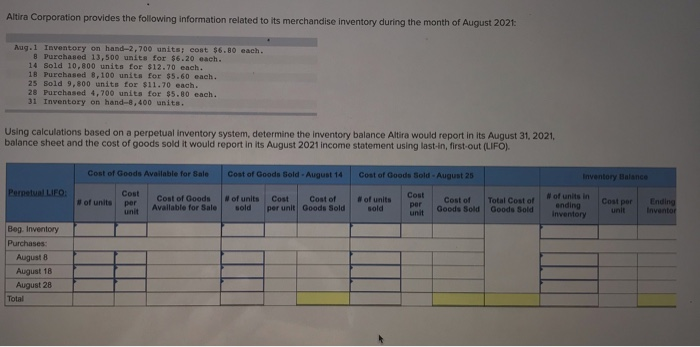

The Kwok Company's inventory balance on December 31, 2021, was $215,000 (based on a 12/312021 physical count) before considering the following transactions: 1. Goods shipped to Kwok fo.b. destination on December 20, 2021. were received on January 4, 2022. The invoice cost was $40,000 2. Goods shipped to Kwok fo.b, shipping point on December 28, 2021, were received on January 5, 2022. The invoice cost was $27.000 3. Goods shipped from Kwok to a customer fo.b, destination on December 27, 2021, were received by the customer on January 3, 2022. The sales price was $50,000 and the merchandise cost $32,000. 4. Goods shipped from Kwok to a customer fo.b. destination on December 26, 2021, were received by the customer on December 30, 2021. The sales price was $30,000 and the merchandise cost $23,000. 5. Goods shipped from Kwok to a customer fo.b. shipping point on December 28, 2021, were received by the customer on January 4, 2022. The sales price was $35,000 and the merchandise cost $22.000 Required: Determine the correct inventory amount to be reported in Kwok's 2021 balance sheet. Correct inventory balance The December 31, 2021 year-end inventory balance of the Raymond Corporation is $210,000. You have been asked to review the following transactions to determine if they have been correctly recorded. 1. Goods shipped to Raymond fo.b, destination on December 26, 2021, were received on January 2, 2022. The invoice cost of $30,000 is included in the preliminary inventory balance. 2. At year-end, Raymond held $14,000 of merchandise on consignment from the Harrison Company. This merchandise is included in the preliminary Inventory balance. 3. On December 29. merchandise costing $6,000 was shipped to a customer f.ob. shipping point and arrived at the customer's location on January 3, 2022. The merchandise is not included in the preliminary Inventory balance 4. At year-end, Raymond had merchandise costing $15,000 on consignment with the Joclyn Corporation. The merchandise is not included in the preliminary Inventory balance. Required: Determine the correct inventory amount to be reported in Raymond's 2021 balance sheet. Correct inventory balance Required information . The following information applies to the questions displayed below.) Altira Corporation provides the following information related to its merchandise inventory during the month of August 2021: Aug.1 Inventory on hand-2,700 units; cost $6.80 each. 8 Purchased 13,500 units for $6.20 each. 14 Sold 10,800 units for $12.70 each. 18 Purchased 8,100 units for $5.60 each. 25 Sold 9,800 units for $11.70 each. 28 Purchased 4,700 units for $5.80 each. 31 Inventory on hand-8, 400 units. 2. Using calculations based on a perpetual inventory system, determine the inventory balance Altira would report in its August 31, 2021, balance sheet and the cost of goods sold it would report in its August 2021 income statement using the Average cost method. (Round "Average Cost per Unit" to 2 decimal places.) Inventory on hand Cost of Goods Sold Perpetual Average of units Cost per unit Inventory Value of units Avg.Cost sold per unit Cost of Goods Sold Inventory Balance of units in Cost per Ending ending unit Inventory Inventory Beginning Inventory Purchase - August 8 Sale - August 14 Purchase - August 18 Salo - August 25 Purchase - August 28 Total Altra Corporation provides the following information related to its merchandise Inventory during the month of August 2025 Aug.1 Inventory on hand-2.700 units cost $6.80 each 8Purchased 13,500 units for $6.20 each. 14 Sold 10,800 units for $12.70 each. 18 Purehased 8,100 units for $5.60 each. 25 Sold 9,800 units for $11.70 each. 28 Purchased 4,700 units for $5.00 each. 31 Inventory on hand-8,400 units. Using calculations based on a perpetual inventory system, determine the inventory balance Altira would report in its August 31, 2021 balance sheet and the cost of goods sold it would report in its August 2021 income statement using last.in, first-out (LIFO). Cost of Goods Available for Sale Cost of Goods Sold - August 14 Cost of Goods Sold - August 25 Inventory Balance Pernetual LIFO: of units Cost per Cost of Goods Available for Sale of units sold Cost Cost of per unit Goods Sold of units sold Cost per Cost of Goods Sold Total Cost of Goods Sold #of units in ending Cost por unit Inventor Bog Inventory Purchases August 8 August 18 August 28