The last 2 pages are what need to be filled in to complete the question. The first 2 pictures are the information needed. Thanks.

The last 2 pages are what need to be filled in to complete the question. The first 2 pictures are the information needed. Thanks.

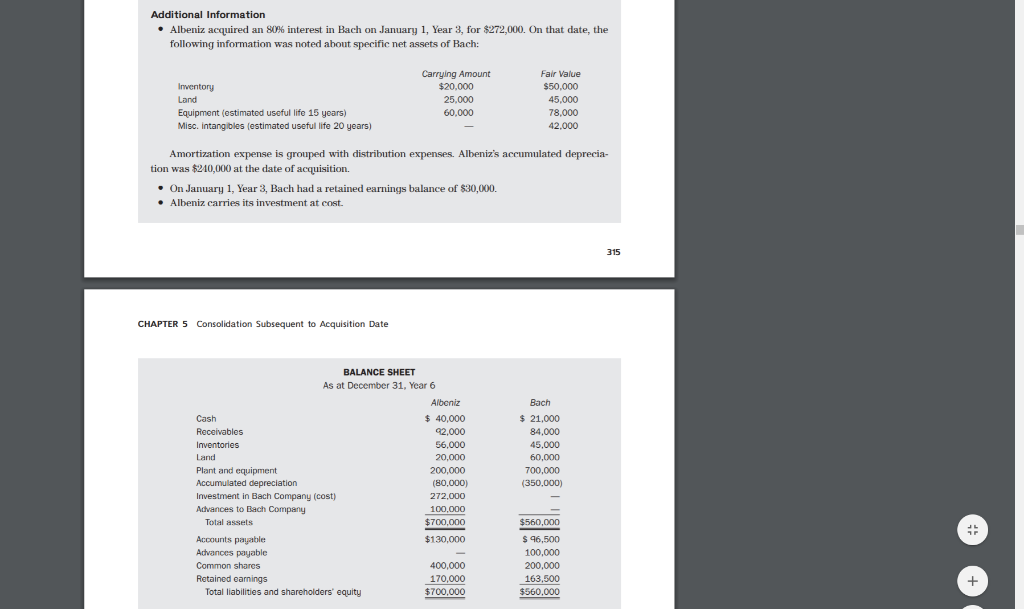

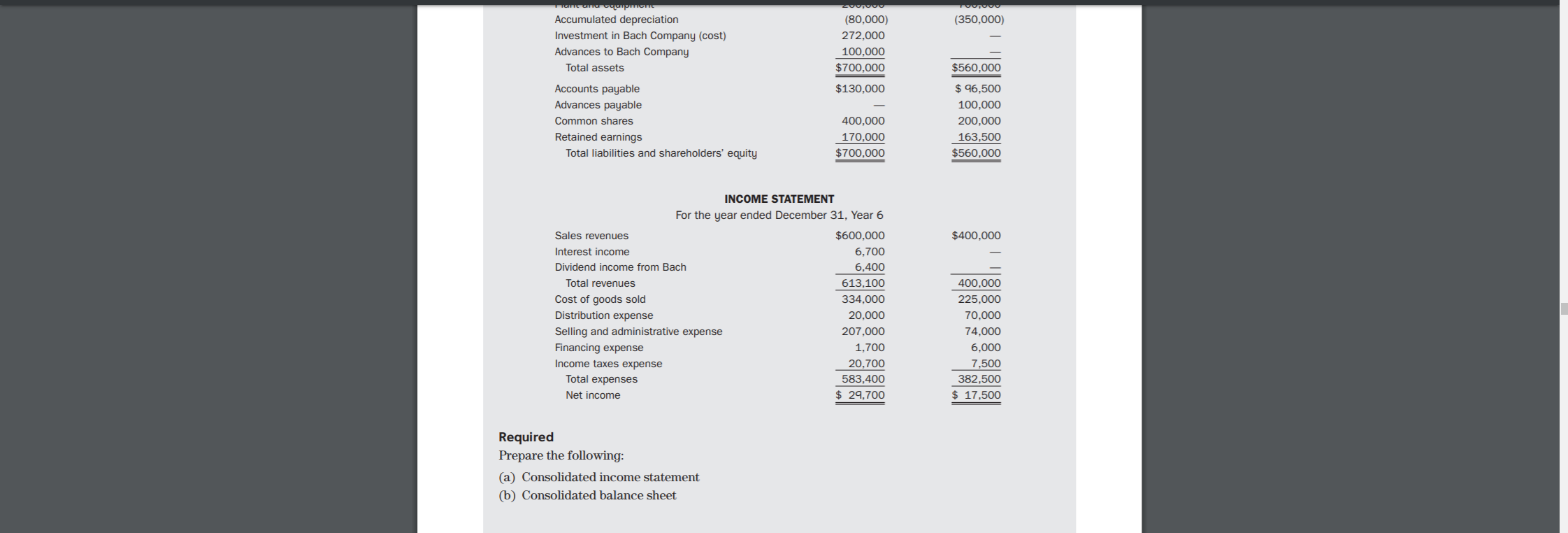

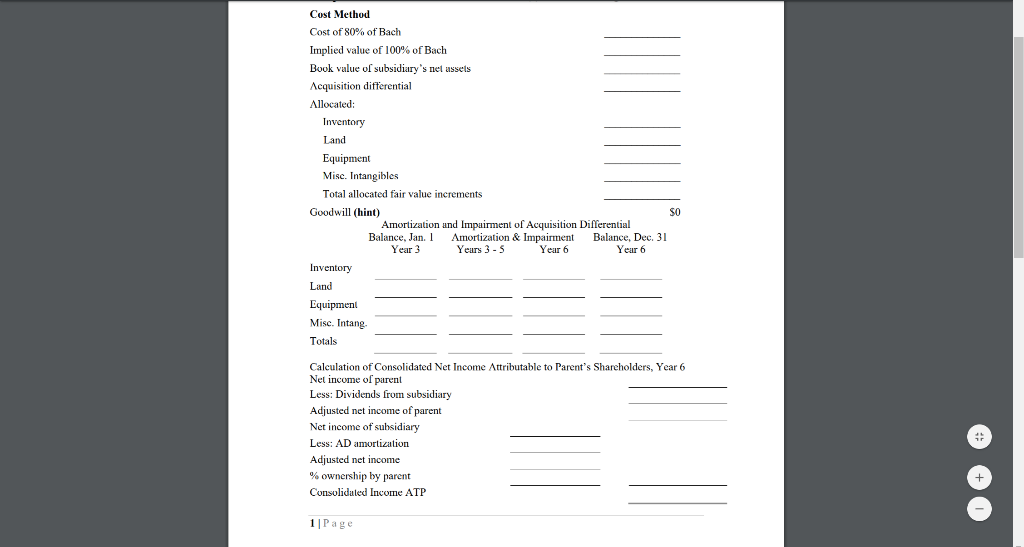

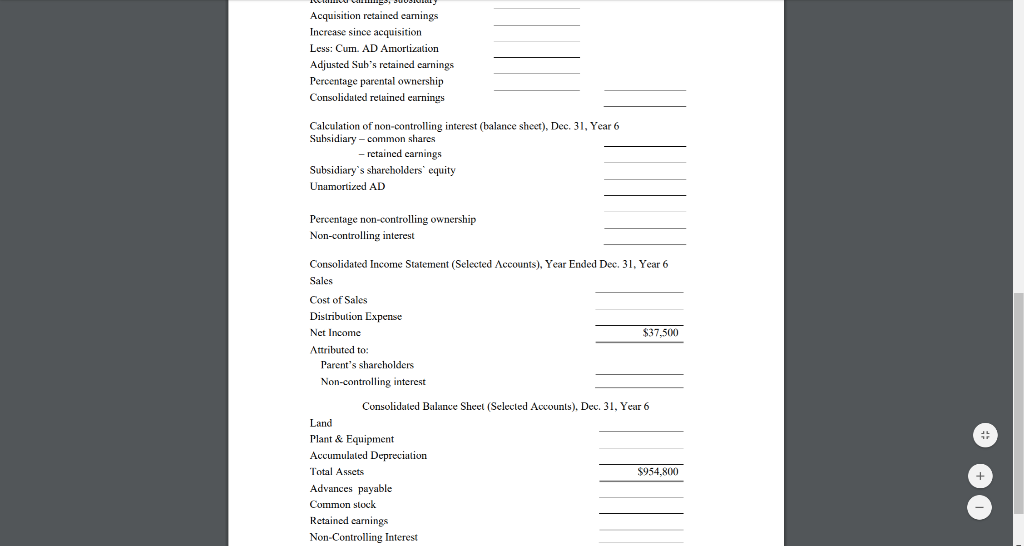

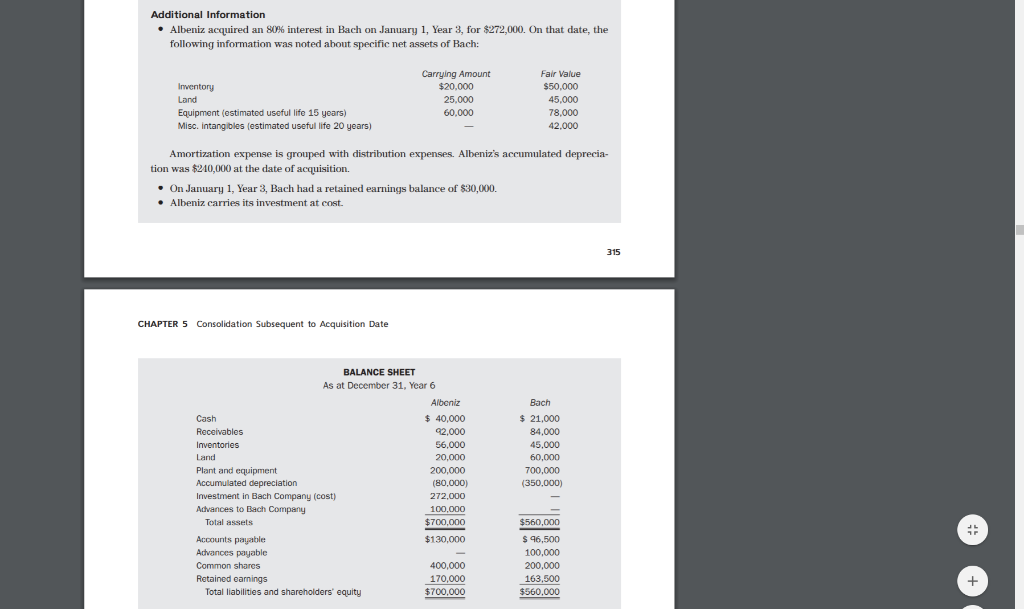

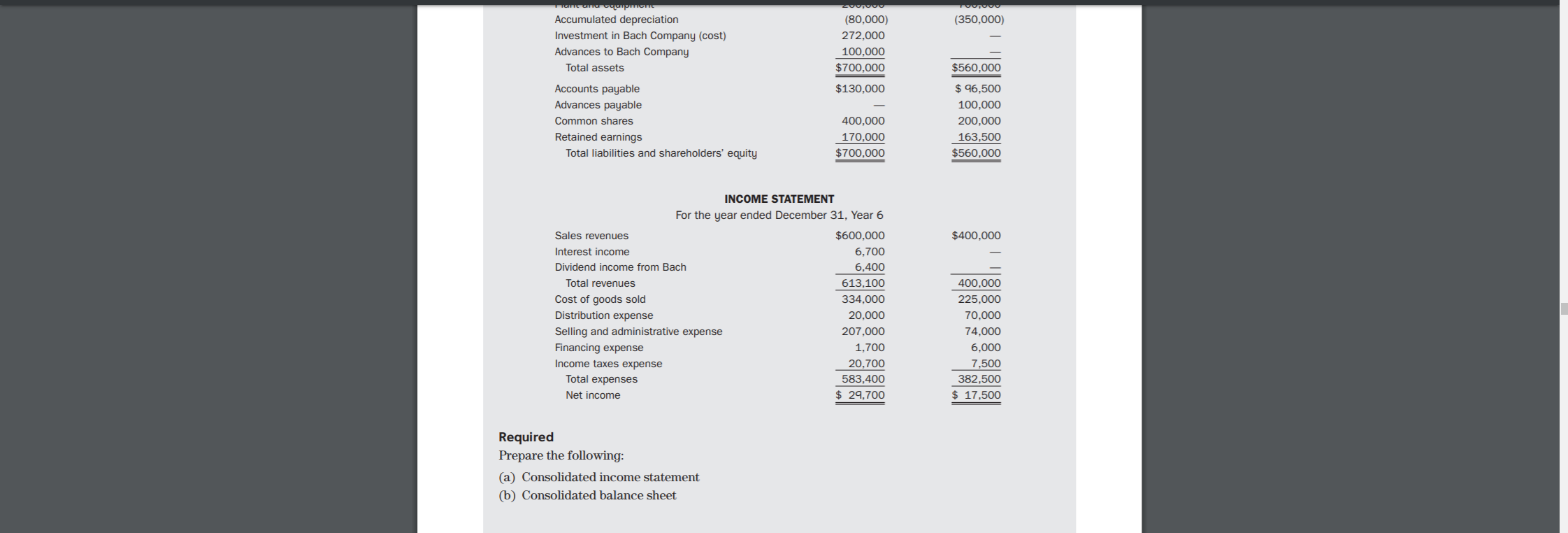

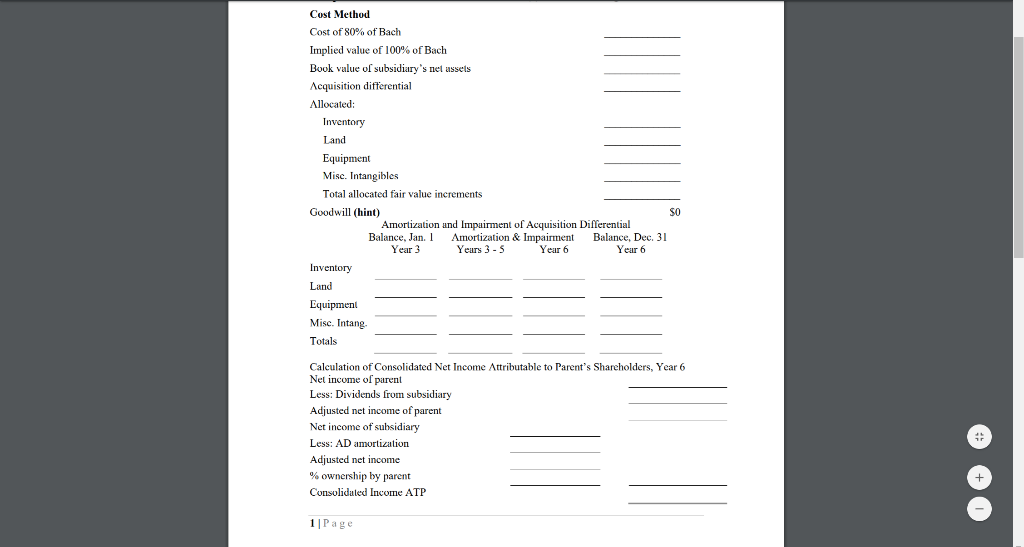

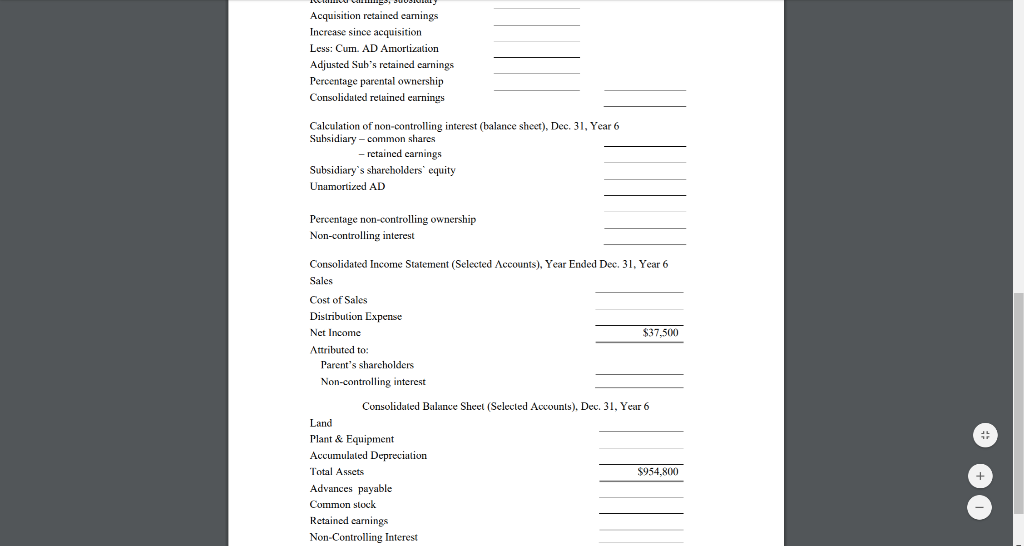

Additional Information Albeniz acquired an 80% interest in Bach on January 1, Year 3, for $272,000. On that date, the following information was noted about specific net assets of Bach: Inventory Land Equipment (estimated useful life 15 years) Misc. intangibles (estimated useful life 20 years) Carrying Amount $20.000 25,000 60,000 Fair Value $50,000 45,000 78,000 42.000 Amortization expense is grouped with distribution expenses. Albeniz's accumulated deprecia- tion was $210,000 at the date of acquisition, On January 1, Year 3, Bach had a retained earnings balance of $30,000. Albeniz carries its investment at cost. 315 CHAPTER 5 Consolidation Subsequent to Acquisition Date BALANCE SHEET As at December 31, Year 6 Albeniz Cash $ 40,000 Receivables 22.000 Inventories 56.000 Land 20,000 Plant and equipment 200,000 Accumulated depreciation (80,000) Investment in Bach Company (cost) 272.000 Advances to Bach Company 100,000 Total assets $700,000 Accounts payable $130,000 Advances payable Common shares 400,000 Retained earnings 170,000 Total liabilities and shareholders' equity $700,000 Bach $ 21,000 84,000 45.000 60,000 700,000 (350,000) $560,000 $ 46,500 100,000 200,000 163,500 $560,000 + (350,000) Inquipmore Accumulated depreciation Investment in Bach Company (cost) Advances to Bach Company Total assets zove (80,000) 272,000 100,000 $700,000 $560,000 $130,000 Accounts payable Advances payable Common shares Retained earnings Total liabilities and shareholders' equity 400,000 170,000 $700,000 $ 96,500 100,000 200,000 163,500 $560,000 $400,000 INCOME STATEMENT For the year ended December 31, Year 6 Sales revenues $600,000 Interest income 6,700 Dividend income from Bach 6,400 Total revenues 613,100 Cost of goods sold 334,000 Distribution expense 20,000 Selling and administrative expense 207,000 Financing expense 1.700 Income taxes expense 20,700 Total expenses 583,400 Net income $ 29,700 400,000 225,000 70,000 74,000 6,000 7,500 382,500 $ 17,500 Required Prepare the following: (a) Consolidated income statement (6) Consolidated balance sheet Cost Method Cost of 80% of Bach Implied value of 100% of Bach Book value of subsidiary's net ussels Acquisition differential Allocated: Inventory Land Equipment Misc. Intangibles Total allocated fair value increments Goodwill (hint) SO Amortization and Impairment of Acquisition Differential Balance, Jan. 1 Amortization & Impairment Balance, Dec. 31 Year 3 Years 3 - 5 Year 6 Year 6 Inventory Land Equipment Misc. Intang Totals Parent's Shareholders, Year 6 Calculation of Consolidated Net Income Attributable Net income of parent Less: Dividends from subsidiary Adjusted net income of parent No Net income of subsidiary Less: AD amortization Adjusted net income % ownership by parent Consolidated Income ATP 1 Page Acquisition retained carings Increase since acquisition Less: Cum. AD Amortization Adjusted Sub's retained carnings Percentage parental ownership Consoliduted retained earnings Calculation of non-controlling interest (balance sheet), Dec. 31, Year 6 Subsidiary - common shares - retained carnings Subsidiary's shareholders equity Unamortized AD Percentage non-controlling ownership Non-controlling interest Consolidated Income Statement (Selected Accounts), Year Ended Dec. 31. Year 6 Sales Cost of Sales Distribution Expense Net Income $37,500 Attributed to: Parent's shareholders Non-controlling interest Consolidated Balance Sheel (Selected Accounts). Dec. 31, Year 6 Land Plant & Equipment Accumulated Depreciation Total Assets $954,800 Advances payable Common stock Retained earnings Non-Controlling Interest Additional Information Albeniz acquired an 80% interest in Bach on January 1, Year 3, for $272,000. On that date, the following information was noted about specific net assets of Bach: Inventory Land Equipment (estimated useful life 15 years) Misc. intangibles (estimated useful life 20 years) Carrying Amount $20.000 25,000 60,000 Fair Value $50,000 45,000 78,000 42.000 Amortization expense is grouped with distribution expenses. Albeniz's accumulated deprecia- tion was $210,000 at the date of acquisition, On January 1, Year 3, Bach had a retained earnings balance of $30,000. Albeniz carries its investment at cost. 315 CHAPTER 5 Consolidation Subsequent to Acquisition Date BALANCE SHEET As at December 31, Year 6 Albeniz Cash $ 40,000 Receivables 22.000 Inventories 56.000 Land 20,000 Plant and equipment 200,000 Accumulated depreciation (80,000) Investment in Bach Company (cost) 272.000 Advances to Bach Company 100,000 Total assets $700,000 Accounts payable $130,000 Advances payable Common shares 400,000 Retained earnings 170,000 Total liabilities and shareholders' equity $700,000 Bach $ 21,000 84,000 45.000 60,000 700,000 (350,000) $560,000 $ 46,500 100,000 200,000 163,500 $560,000 + (350,000) Inquipmore Accumulated depreciation Investment in Bach Company (cost) Advances to Bach Company Total assets zove (80,000) 272,000 100,000 $700,000 $560,000 $130,000 Accounts payable Advances payable Common shares Retained earnings Total liabilities and shareholders' equity 400,000 170,000 $700,000 $ 96,500 100,000 200,000 163,500 $560,000 $400,000 INCOME STATEMENT For the year ended December 31, Year 6 Sales revenues $600,000 Interest income 6,700 Dividend income from Bach 6,400 Total revenues 613,100 Cost of goods sold 334,000 Distribution expense 20,000 Selling and administrative expense 207,000 Financing expense 1.700 Income taxes expense 20,700 Total expenses 583,400 Net income $ 29,700 400,000 225,000 70,000 74,000 6,000 7,500 382,500 $ 17,500 Required Prepare the following: (a) Consolidated income statement (6) Consolidated balance sheet Cost Method Cost of 80% of Bach Implied value of 100% of Bach Book value of subsidiary's net ussels Acquisition differential Allocated: Inventory Land Equipment Misc. Intangibles Total allocated fair value increments Goodwill (hint) SO Amortization and Impairment of Acquisition Differential Balance, Jan. 1 Amortization & Impairment Balance, Dec. 31 Year 3 Years 3 - 5 Year 6 Year 6 Inventory Land Equipment Misc. Intang Totals Parent's Shareholders, Year 6 Calculation of Consolidated Net Income Attributable Net income of parent Less: Dividends from subsidiary Adjusted net income of parent No Net income of subsidiary Less: AD amortization Adjusted net income % ownership by parent Consolidated Income ATP 1 Page Acquisition retained carings Increase since acquisition Less: Cum. AD Amortization Adjusted Sub's retained carnings Percentage parental ownership Consoliduted retained earnings Calculation of non-controlling interest (balance sheet), Dec. 31, Year 6 Subsidiary - common shares - retained carnings Subsidiary's shareholders equity Unamortized AD Percentage non-controlling ownership Non-controlling interest Consolidated Income Statement (Selected Accounts), Year Ended Dec. 31. Year 6 Sales Cost of Sales Distribution Expense Net Income $37,500 Attributed to: Parent's shareholders Non-controlling interest Consolidated Balance Sheel (Selected Accounts). Dec. 31, Year 6 Land Plant & Equipment Accumulated Depreciation Total Assets $954,800 Advances payable Common stock Retained earnings Non-Controlling Interest

The last 2 pages are what need to be filled in to complete the question. The first 2 pictures are the information needed. Thanks.

The last 2 pages are what need to be filled in to complete the question. The first 2 pictures are the information needed. Thanks.