Answered step by step

Verified Expert Solution

Question

1 Approved Answer

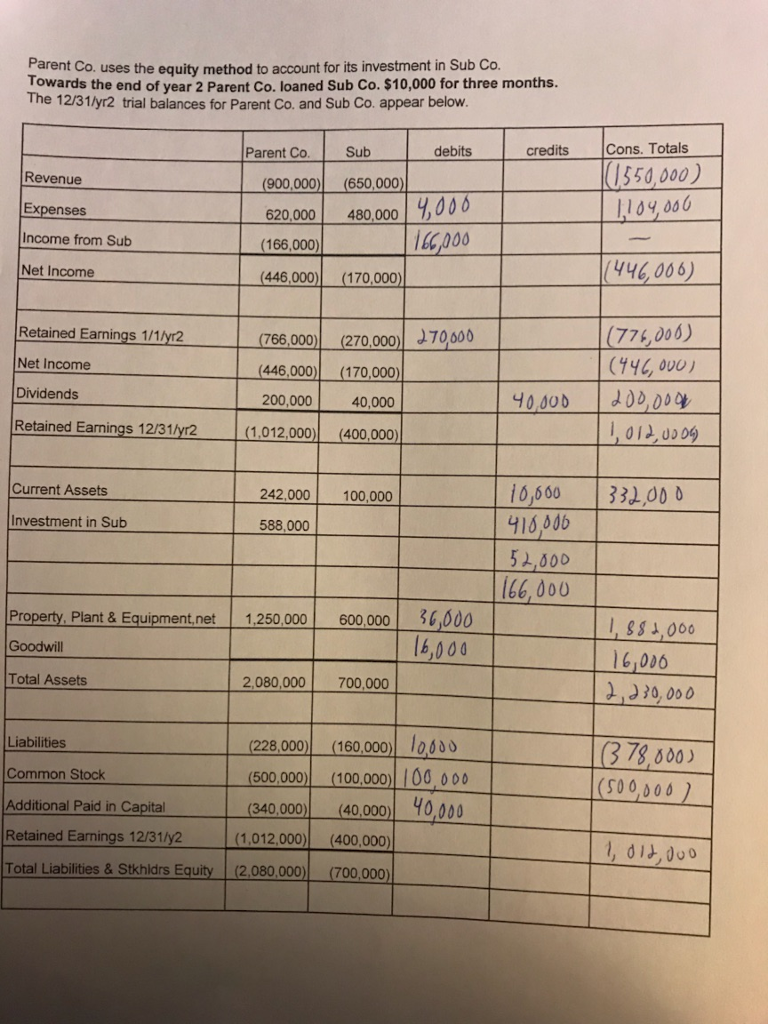

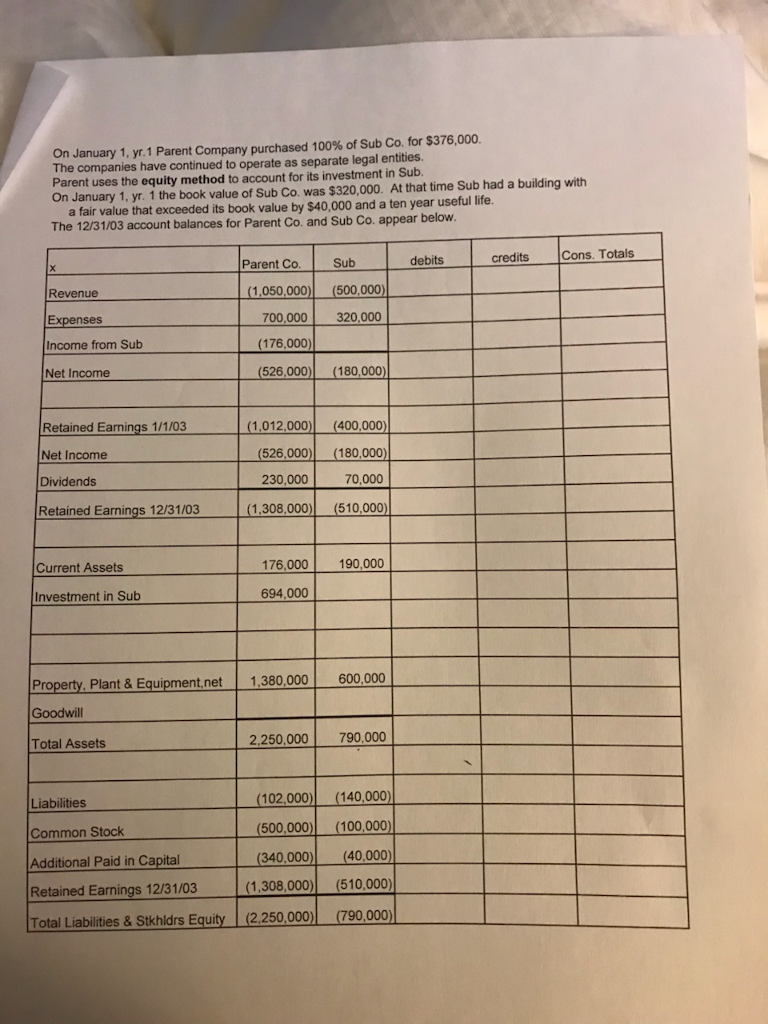

The last one (blank form is year 3). Need to fill it out based on year 1 (first page) and year 2 (second page). On

The last one (blank form is year 3). Need to fill it out based on year 1 (first page) and year 2 (second page).

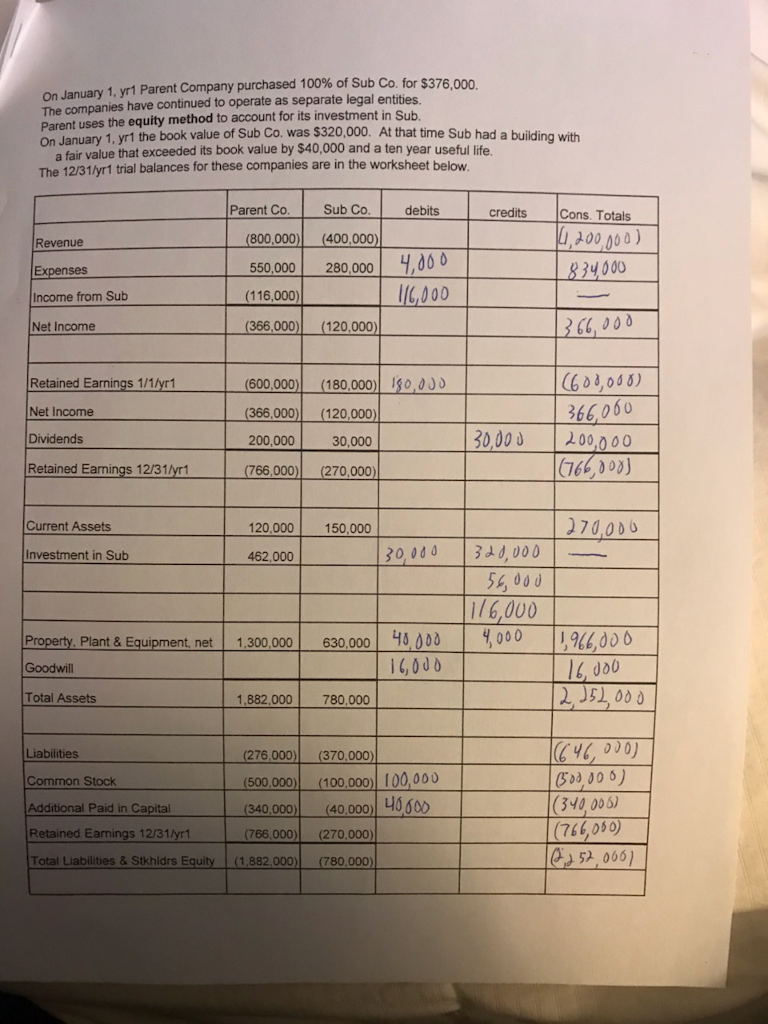

On January 1, yr1 Parent Company purchased 100% of Sub Co. for 5376,000, The companies have continued to operate as separate legal entities. Parent uses the equity method to account for its investment in Sub anuary 1, Yr1 the book value of Sub Co. was $320,000. At that time Sub had a building with a fair value that exceeded its book value by $40,000 and a ten year useful life. The 12/31/yr1 trial balances for these companies are in the worksheet below. Parent Co. Sub Co. debits credits Cons. Totals Li,300 00) 4 000 (800,000) (400,000) 550.000 280.000 4,00 (116,000) 366,000) (120,000) Revenue nses C,00O Income from Sub Net Income Retained Earnings 1/1yr1 Net Income Dividends 600,000) (180,000 130,0 (366,000) (120,000) 200,000 (766,000)(270,000) 66,060 00,000 | (7663 03) 30,000 30,000 Eetaineds tamin 1237268, 270.00) Earnings 12/31yr1 Current Assets 120,000 150,000 70000 nvestment in Sub 462,000 30 110 | 3dd, 000 |-- 54000 1/6,000 Proerty, Plant &Equpment net 1,300000 630,000 4300 1,94600 0 Goodwill 2351, o00 46, 000) (340,006) Total Assets 1.882,000 780,000 Liabilities Common Stock Additional Paid in Capital Retained Earnings 12/31/yr1 Total Liabilities & Stkhidrs Equity(1.882,000) (780.000 (276,000) (370,000 500,000 (100,000 1 (40,00010600 (340,000 (766,000) (270,000) 766, 0s0 52,066Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started