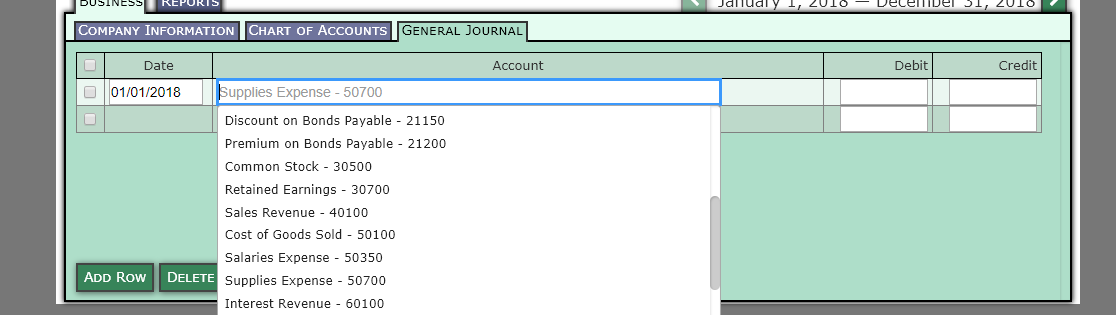

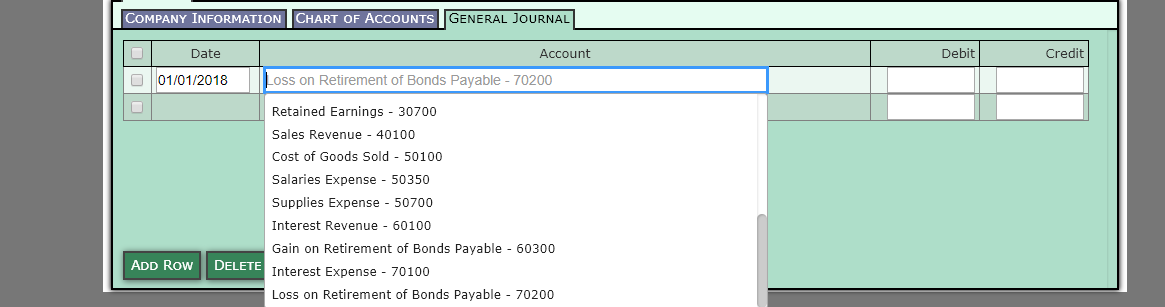

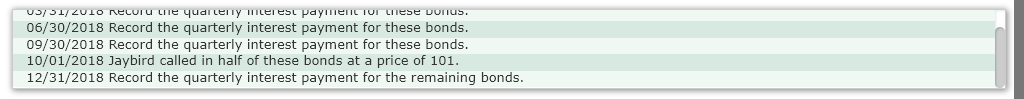

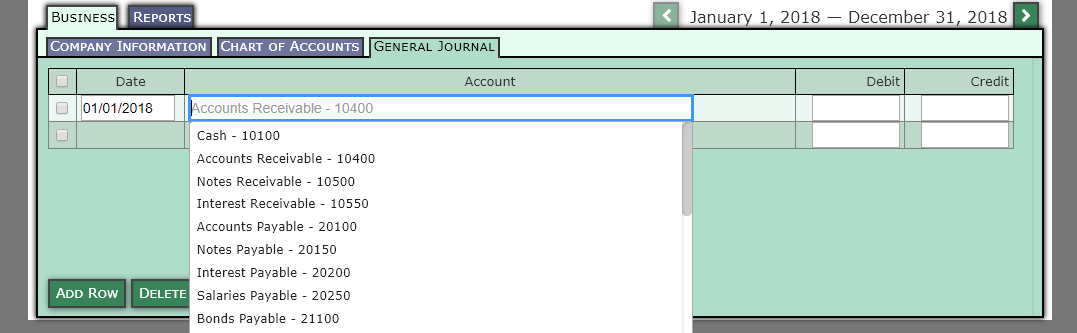

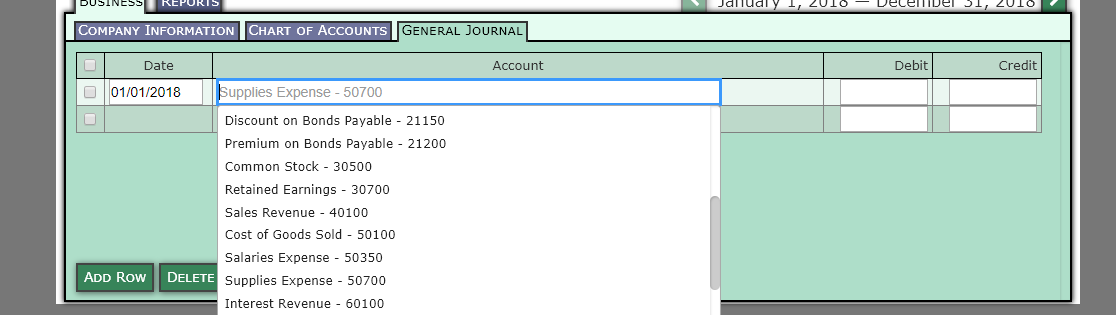

The last three pictures are the account titles that I am required to use. Thank you!

The last three pictures are the account titles that I am required to use. Thank you!

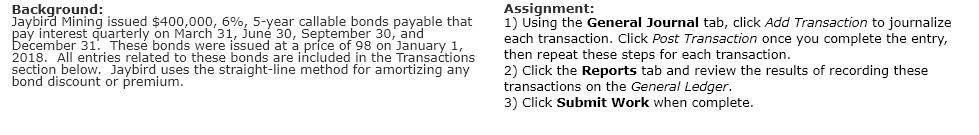

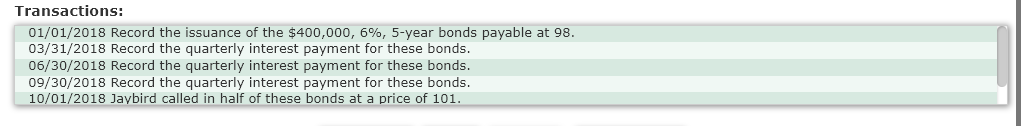

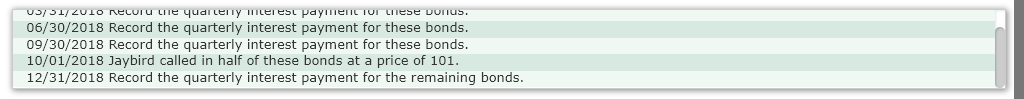

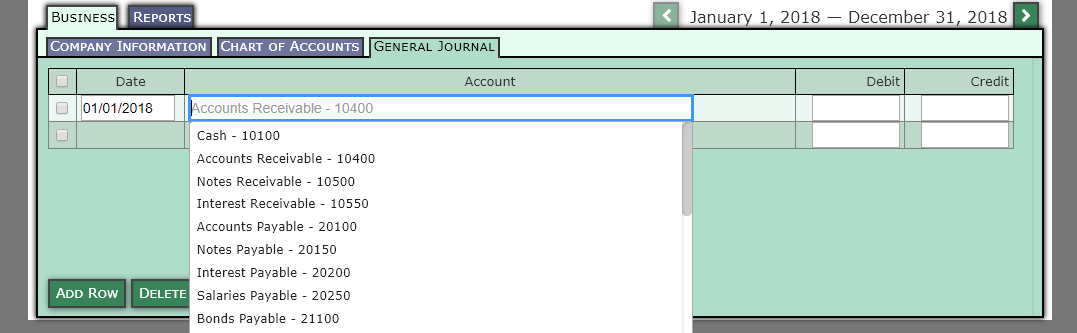

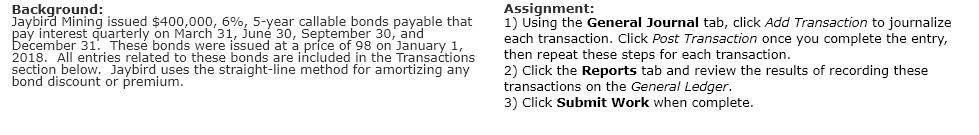

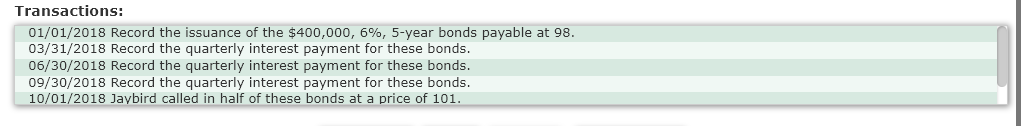

Background: Jaybird Mining issued $400,000, 6%, 5-year callable bonds payable that pay interest quarterly on March 31, June 30, September 30, and December 31. These bonds were issued at a price of 98 on January 1, 2018. All entries related to these bonds are included in the Transactions section below. Jaybird uses the straight-line method for amortizing any bond discount or premium. Assignment: 1) Using the General Journal tab, click Add Transaction to journalize each transaction. Click Post Transaction once you complete the entry, then repeat these steps for each transaction. 2) Click the Reports tab and review the results of recording these transactions on the General Ledger. 3) Click Submit Work when complete. Transactions: 01/01/2018 Record the issuance of the $400,000, 6%, 5-year bonds payable at 98. 03/31/2018 Record the quarterly interest payment for these bonds. 06/30/2018 Record the quarterly interest payment for these bonds. 09/30/2018 Record the quarterly interest payment for these bonds. 10/01/2018 Jaybird called in half of these bonds at a price of 101. 09/11 2010 recoru the quarterly merest payment to these bonus. 06/30/2018 Record the quarterly interest payment for these bonds. 09/30/2018 Record the quarterly interest payment for these bonds. 10/01/2018 Jaybird called in half of these bonds at a price of 101. 12/31/2018 Record the quarterly interest payment for the remaining bonds. BUSINESS REPORTS COMPANY INFORMATION CHART OF ACCOUNTS GENERAL JOURNAL Account Debit Credit Date O 01/01/2018 Accounts Receivable - 10400 Cash - 10100 Accounts Receivable - 10400 Notes Receivable - 10500 Interest Receivable - 10550 Accounts Payable - 20100 Notes Payable - 20150 Interest Payable - 20200 ADD Row DELETE Salaries Payable - 20250 Bonds Payable - 21100 Jalludly 1, 2010 December 31, 2010 BUSINESS REPORTS COMPANY INFORMATION CHART OF ACCOUNTS GENERAL JOURNAL 0 Account Debit Credit Date 01/01/2018 Supplies Expense - 50700 Discount on Bonds Payable - 21150 Premium on Bonds Payable - 21200 Common Stock - 30500 Retained Earnings - 30700 Sales Revenue - 40100 Cost of Goods Sold - 50100 Salaries Expense - 50350 Supplies Expense - 50700 Interest Revenue - 60100 ADD Row DELETE COMPANY INFORMATION CHART OF ACCOUNTS GENERAL JOURNAL Date Account O 01/01/2018 Loss on Retirement of Bonds Payable - 70200 Debit Credit Retained Earnings - 30700 Sales Revenue - 40100 Cost of Goods Sold - 50100 Salaries Expense - 50350 Supplies Expense - 50700 Interest Revenue - 60100 Gain on Retirement of Bonds Payable - 60300 Interest Expense - 70100 Loss on Retirement of Bonds Payable - 70200 ADD Row DELETE

The last three pictures are the account titles that I am required to use. Thank you!

The last three pictures are the account titles that I am required to use. Thank you!