The last time I posted this question, it was only partly answered. Thank you for answering a-h!

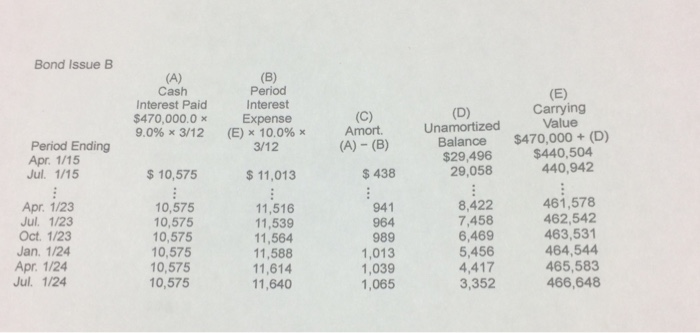

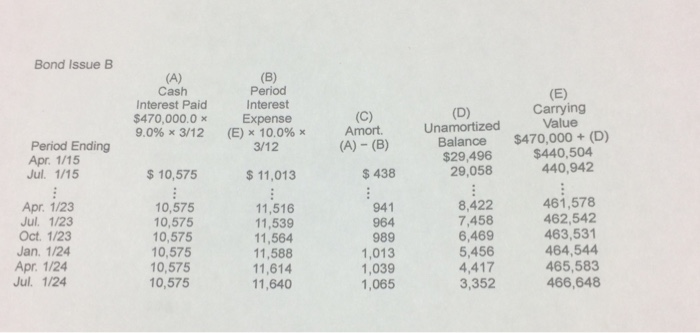

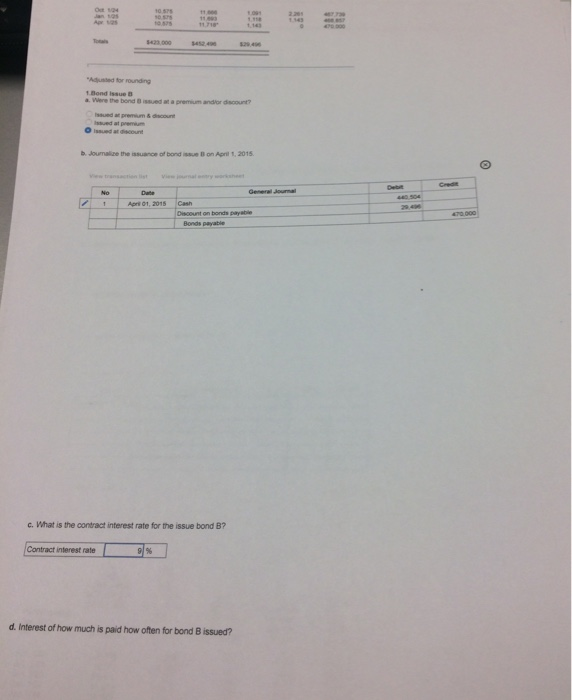

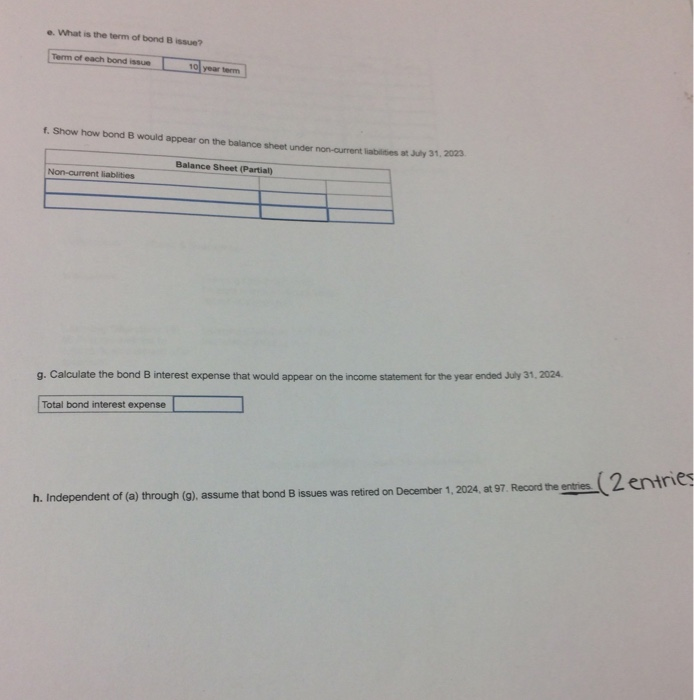

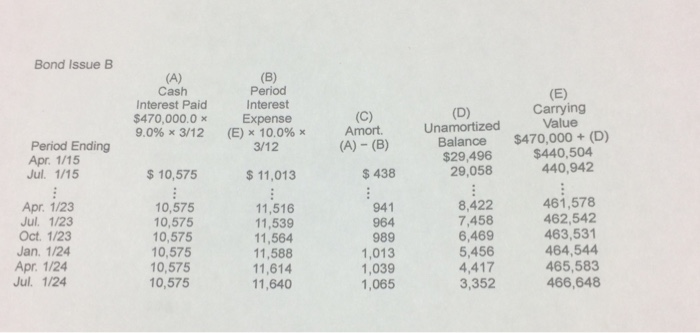

Bond Issue B Cash Period Interest Interest Paid $470,000.0 9. Expense Carrying Value (E) x 10.096 x 3/12 0% x 312 Amort. Unamortized Period Ending (A) - (B) 438 Balance $29,496 29,058 $470,000+ (D) $440,504 Apr. 1/15 Jul. 1/15 $10,575 $11,013 440,942 Apr. 1/23 Jul. 1/23 Oct. 1/23 Jan. 1/24 10,575 10,575 10,575 10,575 10,575 10,575 11,516 11,539 11,564 11,588 11,614 11,640 941 964 989 1,013 1,039 1,065 8,422 7,458 6,469 5,456 4,417 3,352 461,578 462,542 463,531 464,544 465,583 466,648 Apr. 1/24 Jul. 1/24 423,00094524 Adjusted for rounding t Bond Issue a. Were the bond 8 issued at a premium andlor discount? O Issued at discount b. Joumalize the issuance of bond issue B on April 1, 2015 ert 01, 2015 Cea Bonds payable c. What is the contract interest rate for the issue bond B? Contract interest rate d. Interest of how much is paid how often for bond B issued? e. What is the term of bond B issue? Term of each bond a10year term B would appear on the balance sheet under non-current liabilities at July 31, 2023 Balance Sheet (Partial) g. Calculate the bond B interest expense that would appear on the income statement for the year ended July 31, 2024 Total bond interest expense Record the entries (2entries h. Independent of (a) through (g), assume that bond B issues was retired on December 1, 2024, at 97 0) assume that bondBsues wasretired on December 1,2024 at 7. Recor the satres(2entries Bond Issue B Cash Period Interest Interest Paid $470,000.0 9. Expense Carrying Value (E) x 10.096 x 3/12 0% x 312 Amort. Unamortized Period Ending (A) - (B) 438 Balance $29,496 29,058 $470,000+ (D) $440,504 Apr. 1/15 Jul. 1/15 $10,575 $11,013 440,942 Apr. 1/23 Jul. 1/23 Oct. 1/23 Jan. 1/24 10,575 10,575 10,575 10,575 10,575 10,575 11,516 11,539 11,564 11,588 11,614 11,640 941 964 989 1,013 1,039 1,065 8,422 7,458 6,469 5,456 4,417 3,352 461,578 462,542 463,531 464,544 465,583 466,648 Apr. 1/24 Jul. 1/24 423,00094524 Adjusted for rounding t Bond Issue a. Were the bond 8 issued at a premium andlor discount? O Issued at discount b. Joumalize the issuance of bond issue B on April 1, 2015 ert 01, 2015 Cea Bonds payable c. What is the contract interest rate for the issue bond B? Contract interest rate d. Interest of how much is paid how often for bond B issued? e. What is the term of bond B issue? Term of each bond a10year term B would appear on the balance sheet under non-current liabilities at July 31, 2023 Balance Sheet (Partial) g. Calculate the bond B interest expense that would appear on the income statement for the year ended July 31, 2024 Total bond interest expense Record the entries (2entries h. Independent of (a) through (g), assume that bond B issues was retired on December 1, 2024, at 97 0) assume that bondBsues wasretired on December 1,2024 at 7. Recor the satres(2entries