Question

The ledger of Camila Ramirez and Ping Xue, attorneys-at-law, contains the following accounts and balances after adjustments have been recorded on December 31, 20Y2: Ramirez

The ledger of Camila Ramirez and Ping Xue, attorneys-at-law, contains the following accounts and balances after adjustments have been recorded on December 31, 20Y2:

| Ramirez and Xue | |||

| Trial Balance | |||

| December 31, 20Y2 | |||

| Debit Balances | Credit Balances | ||

| Cash | 52,500 | ||

| Accounts Receivable | 50,000 | ||

| Supplies | 1,900 | ||

| Land | 125,000 | ||

| Building | 135,600 | ||

| Accumulated DepreciationBuilding | 78,100 | ||

| Office Equipment | 57,500 | ||

| Accumulated DepreciationOffice Equipment | 24,300 | ||

| Accounts Payable | 37,300 | ||

| Salaries Payable | 4,000 | ||

| Camila Ramirez, Capital | 130,000 | ||

| Camila Ramirez, Drawing | 56,300 | ||

| Ping Xue, Capital | 75,000 | ||

| Ping Xue, Drawing | 81,300 | ||

| Professional Fees | 448,300 | ||

| Salary Expense | 182,500 | ||

| Depreciation ExpenseBuilding | 18,100 | ||

| Property Tax Expense | 11,300 | ||

| Heating and Lighting Expense | 9,000 | ||

| Supplies Expense | 6,500 | ||

| Depreciation ExpenseOffice Equipment | 5,600 | ||

| Miscellaneous Expense | 3,900 | ||

| 797,000 | 797,000 | ||

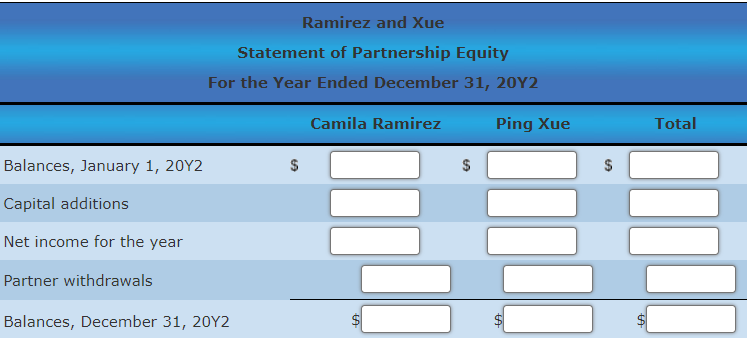

The balance in Xue' capital account includes an additional investment of $13,000 made on May 5, 20Y2.

Required:

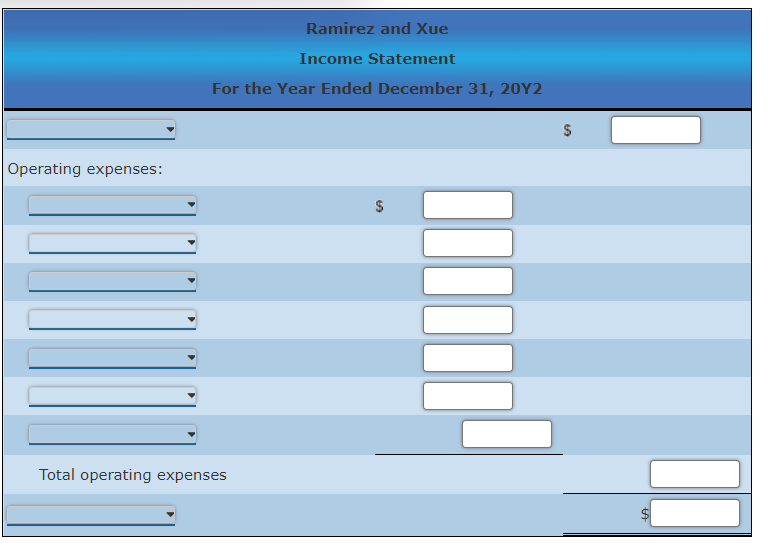

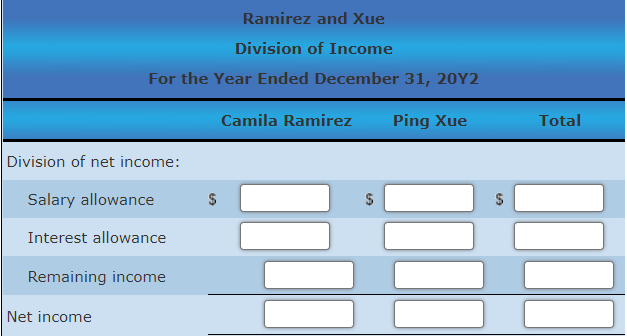

1. Prepare an income statement for 20Y2, indicating the division of net income. The partnership agreement provides for salary allowances of $49,000 to Ramirez and $59,000 to Xue, allowances of 10% on each partner's capital balance at the beginning of the fiscal year, and equal division of the remaining net income or net loss.

2. Prepare a statement of partnership equity for 20Y2. If any amounts are zero, enter in "0".

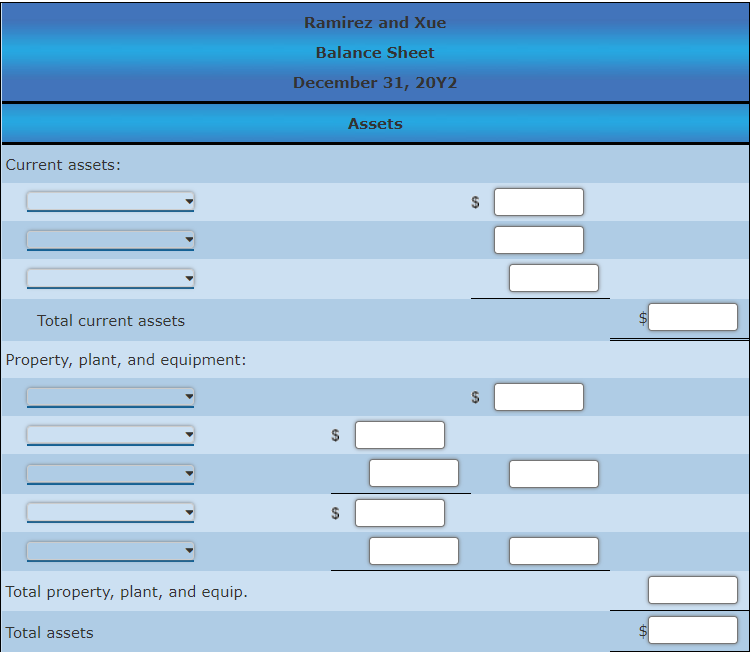

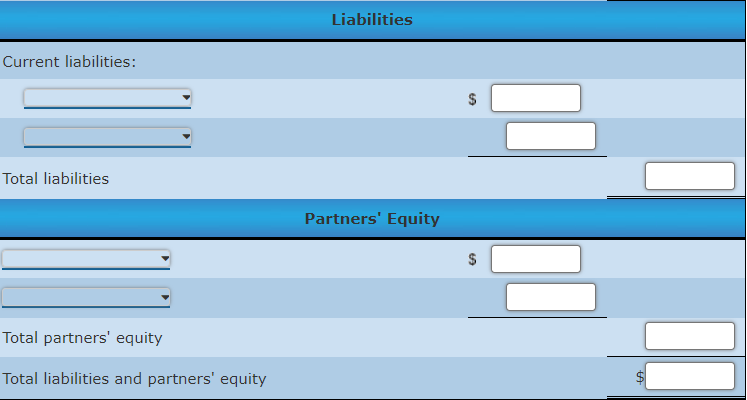

3. Prepare a balance sheet as of the end of 20Y2.

Ramirez and Xue Income Statement For the Year Ended December 31, 2012 Operating expenses: $ IIII Total operating expenses ta Ramirez and Xue Division of Income For the Year Ended December 31, 20Y2 Camila Ramirez Ping Xue Total Division of net income: Salary allowance $ $ $ Interest allowance Remaining income Net income Ramirez and Xue Statement of Partnership Equity For the Year Ended December 31, 2012 Camila Ramirez Ping Xue Total Balances, January 1, 2012 $ Capital additions Net income for the year Partner withdrawals Balances, December 31, 20Y2 Ramirez and Xue Balance Sheet December 31, 20Y2 Assets Current assets: $ Total current assets $ Property, plant, and equipment: $ $ $ Total property, plant, and equip. Total assets Liabilities Current liabilities: $ $ Total liabilities Partners' Equity $ Total partners' equity Total liabilities and partners' equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started