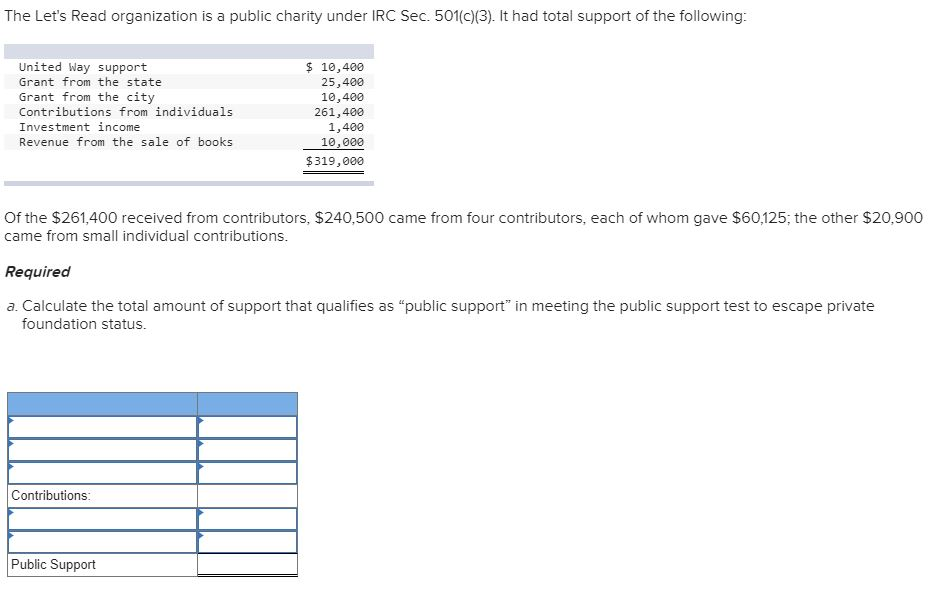

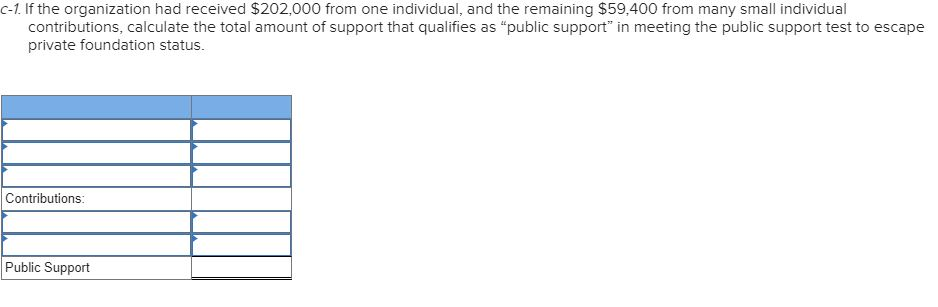

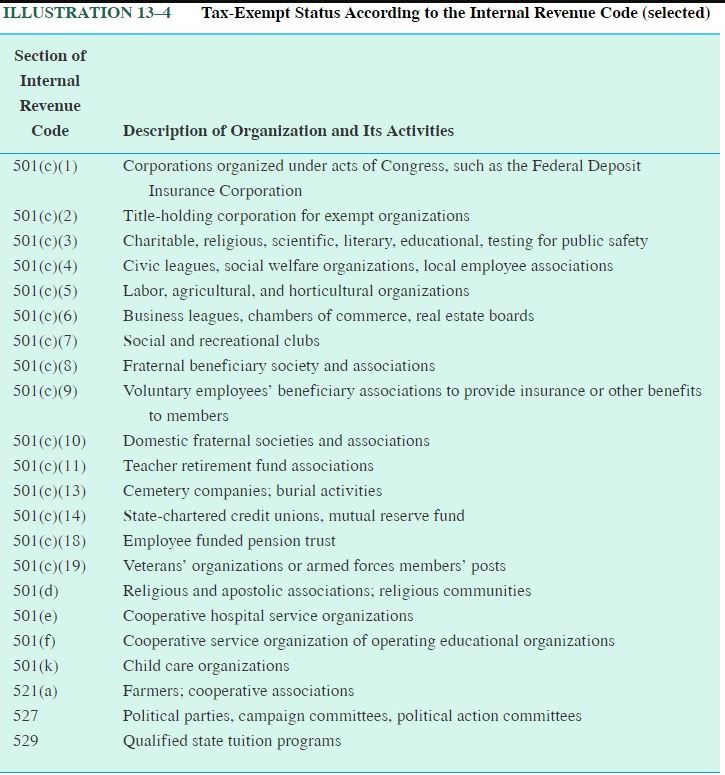

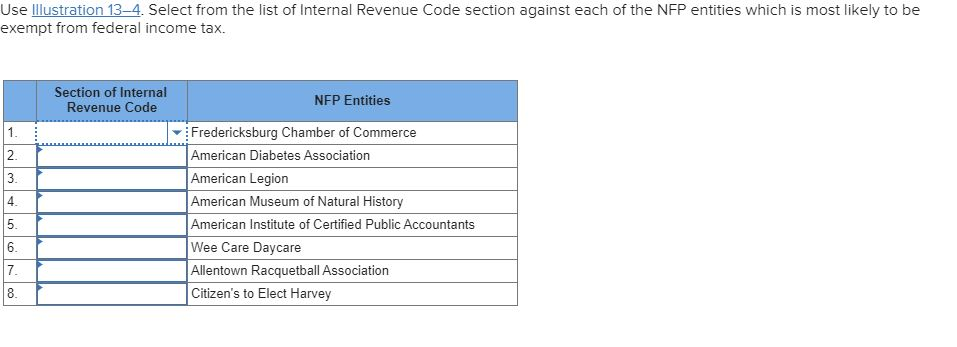

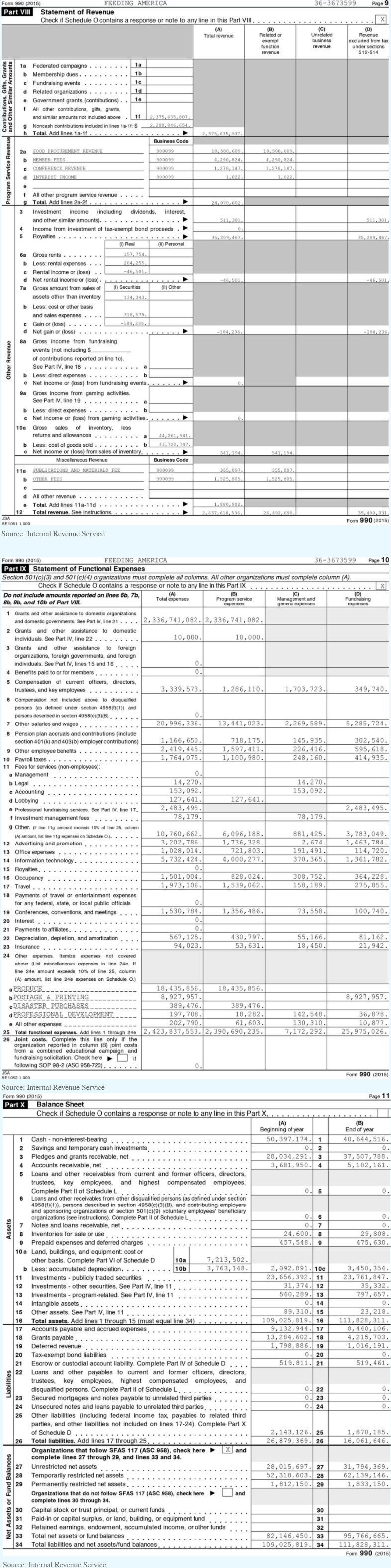

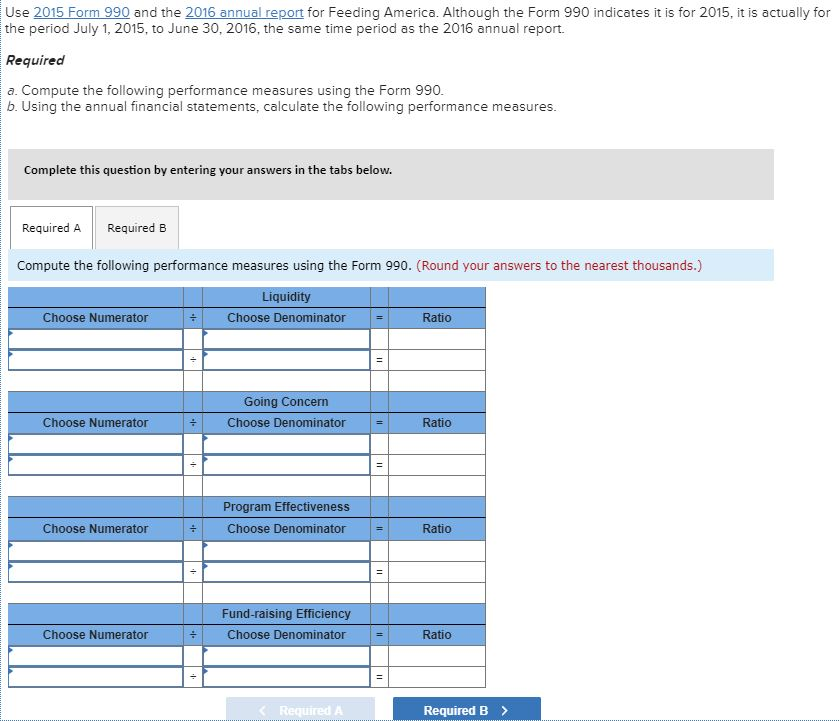

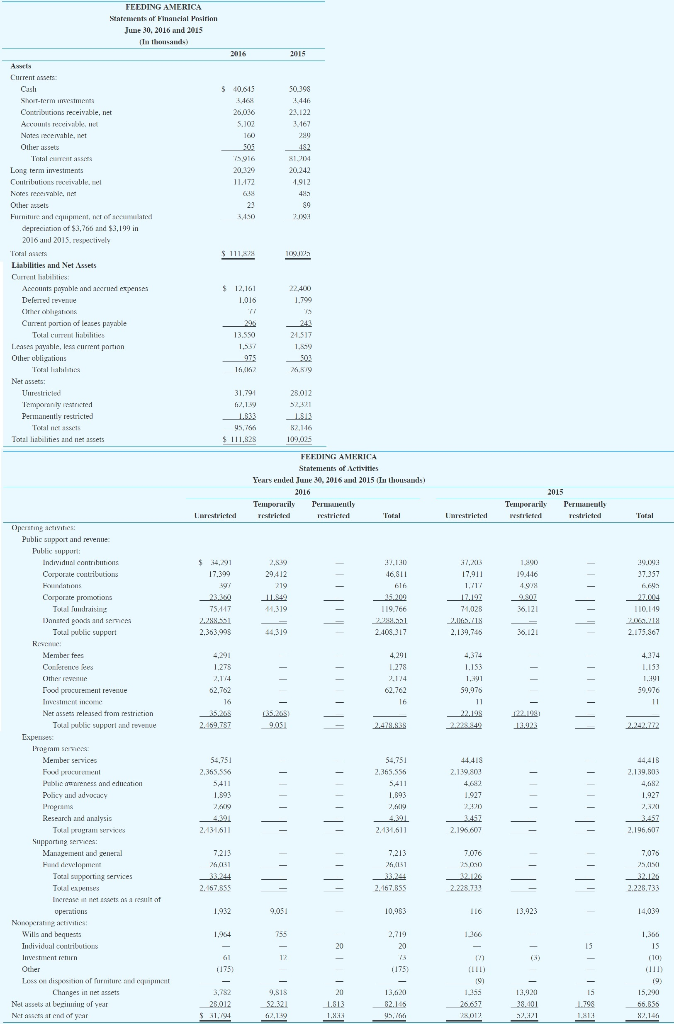

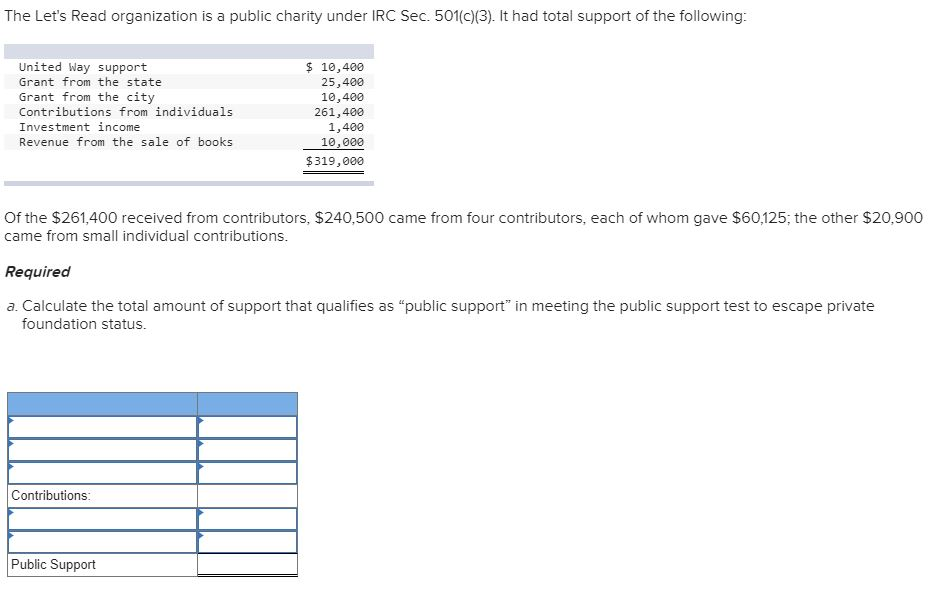

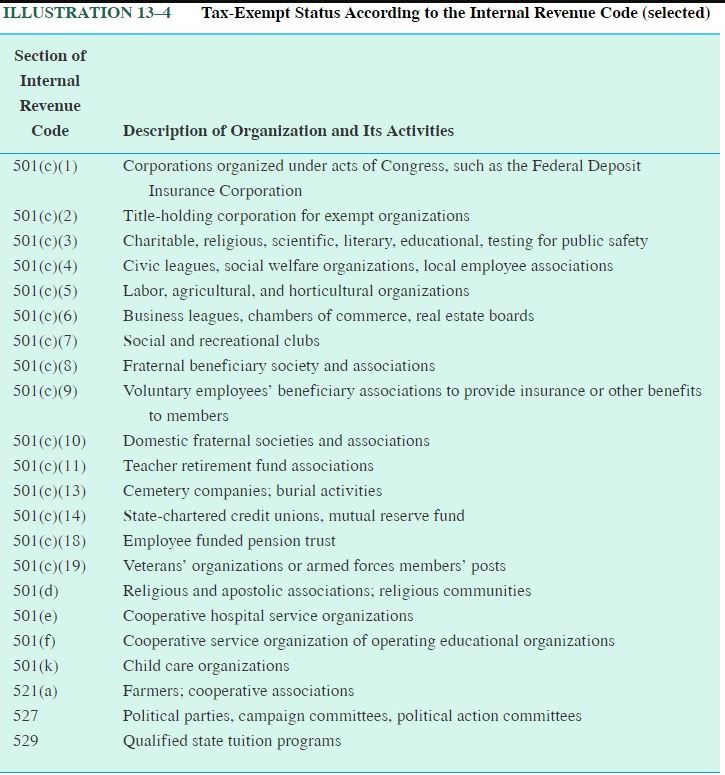

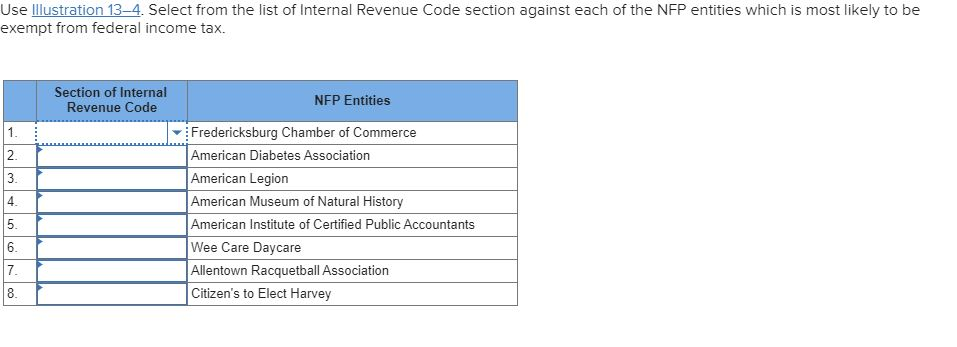

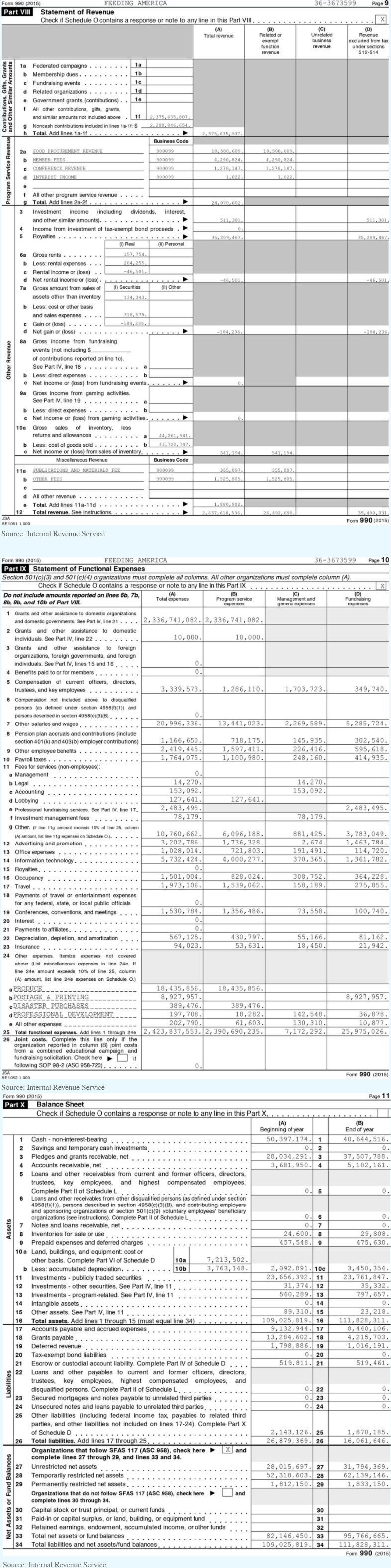

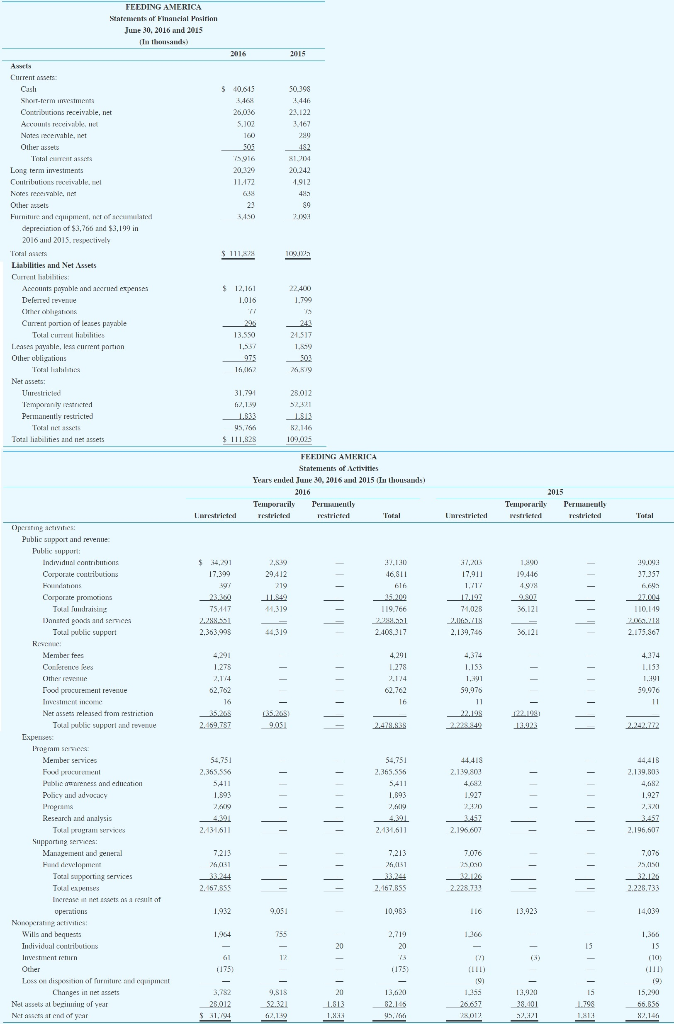

The Let's Read organization is a public charity under IRC Sec. 501(c)(3). It had total support of the following: United Way support Grant from the state Grant from the city Contributions from individuals Investment income Revenue from the sale of books $ 10,400 25,400 10,400 261,400 1,400 10,000 $319,000 Of the $261,400 received from contributors, $240,500 came from four contributors, each of whom gave $60,125, the other $20,900 came from small individual contributions. Required a. Calculate the total amount of support that qualifies as "public support" in meeting the public support test to escape private foundation status. Contributions: Public Support C-1. If the organization had received $202,000 from one individual, and the remaining $59,400 from many small individual contributions, calculate the total amount of support that qualifies as "public support" in meeting the public support test to escape private foundation status. Contributions: Public Support ILLUSTRATION 13-4 Tax-Exempt Status According to the Internal Revenue Code (selected) Section of Internal Revenue Code Description of Organization and Its Activities 501(C)(1) 501(c)(2) 501(C)(3) 501(c)(4) 501(c)(5) 501(c)(6) 501(c)(7) 501(C)(8) 501(C)(9) 501(C)(10) 501(C)(11) 501(c)(13) 501(C)(14) 501(C)(18) 501(c)(19) 501(d) 501(e) 501(f) 501(k) 521(a) 527 529 Corporations organized under acts of Congress, such as the Federal Deposit Insurance Corporation Title-holding corporation for exempt organizations Charitable, religious, scientific, literary, educational, testing for public safety Civic leagues, social welfare organizations, local employee associations Labor, agricultural, and horticultural organizations Business leagues, chambers of commerce, real estate boards Social and recreational clubs Fraternal beneficiary society and associations Voluntary employees' beneficiary associations to provide insurance or other benefits to members Domestic fraternal societies and associations Teacher retirement fund associations Cemetery companies, burial activities State-chartered credit unions, mutual reserve fund Employee funded pension trust Veterans' organizations or armed forces members' posts Religious and apostolic associations, religious communities Cooperative hospital service organizations Cooperative service organization of operating educational organizations Child care organizations Farmers, cooperative associations Political parties, campaign committees, political action committees Qualified state tuition programs Use Illustration 13-4. Select from the list of Internal Revenue Code section against each of the NFP entities which is most likely to be exempt from federal income tax. Section of Internal Revenue Code NFP Entities + Fredericksburg Chamber of Commerce American Diabetes Association American Legion American Museum of Natural History American Institute of Certified Public Accountants Wee Care Daycare Allentown Racquetball Association Citizen's to Elect Harvey N 00 36-3673599 Page 9 Form 990 (2015) FEEDING AMERICA Part VIII Statement of Revenue Check if Schedule O contains a response or note to any line in this Part VIII...... (A) (B) Total revenue Related or exempt function (C) Unrelated business revenue (D) Revenue excluded from tax under sections 512-514 revenue sa Contributions, Gifts, Grants and Other Similar Amounts Program Service Revenue 1a Federated campaigns ..... b Membership dues ........ c Fundraising events ........ d Related organizations ........ 1d . Government grants (contributions).. 1e f All other contributions, gifts, grants and similar amounts not included above. 1f2, 375,635,807. g Noncash contributions included in lines 1a-1t: $ 2.288,846,654. h Total. Add lines 1a-1f .................. Business Code 2a FOOD PROCUREMENT REVENUE 900099 b MEMBER FEES 900099 CONFERENCE REVENUE 900099 d INTEREST INCOME 900099 + 2,375, 635,807. 1 18,500, 609. 9, 290, 824. ,278,147. 1,022. 1 18,500, 609. 4, 290, 824. 1,278,147. 1 .022. 24,070,602 511,301. 511,301. 35,209,467. 35,209,467 -46,501. -46,501. -184,236. -184,236. f All other program service revenue ..... g Total. Add lines 2a-21. 3 Investment income (including dividends, interest and other similar amounts)............... 4 Income from investment of tax-exempt bond proceeds. 5 Royalties .......... (1) Real (In Personal 6a Gross rents ........ 157,754. b Less: rental expenses... 204, 255. c Rental income or loss).. - 46,501. d Net rental income or (loss). 7a Gross amount from sales of (i) Securities () Other assets other than inventory 134, 343. b Less: cost or other basis and sales expenses.... 318,579. c Gain or loss).......L -184,236. d Net gain or loss)........... 8a Gross income from fundraising events (not including $ of contributions reported on line 1c). See Part IV, line 18 ........... a b Less: direct expenses.......... b C Net income or loss) from fundraising events... 9a Gross income from gaming activities See Part IV, line 19.... b Less: direct expenses.......... b c Net income or (loss) from gaming activities.. 10a Gross sales of inventory. less returns and allowances......... a 44, 261,941. b Less: cost of goods sold ......... bL 43,720, 747. C Net income or (loss) from sales of inventory... Miscellaneous Revenue Business Code 11a PUBLICATIONS AND MATERIALS FEE 900099 b OTHER FEES 900099 Other Revenue 541, 194. 541,194. 355,097. 1,525,805. 355,097. 1,525, 805. 1,880, 902. 2,437,618,536. 26, 492,699. d All other revenue .......... e Total. Add lines 11a-110 ............... 12 Total revenue. See instructions. . . JSA 5E 1051 1.000 Source: Internal Revenue Service 35,490,031 Form 990 (2015) (D) expenses Form 990 (2015) FEEDING AMERICA 36-3673599 Page 10 Part IX Statement of Functional Expenses Section 501(c)(3) and 501(c)(4) organizations must complete all columns. All other organizations must complete column (A). Check if Schedule o contains a response or note to any line in this part IX Do not include amounts reported on lines 6b, 7b, Total (A) (B) Program service Total expenses Management and 8b, 9b, and 10b of Part VII. Fundraising expenses general expenses 1 Grants and other assistance to domestic organizations and domestic governments. See Part IV, line 21.... 2,336, 741,082.2, 336, 741,082. 2 Grants and other assistance to domestic 10,000. individuals. See Part IV, line 22 ......... 10,000. 3 Grants and other assistance to foreign organizations, foreign governments, and foreign individuals. See Part IV, lines 15 and 16... 4 Benefits paid to or for members......... 5 Compensation of current officers, directors, trustees, and key employees.......... 3,339,573. 1,286,110. 1,703, 723. 349,740. 6 Compensation not included above, to disqualified persons (as defined under section 4958(1)(1)) and persons described in section 4958(c)(3)(B) 7 Other salaries and wages 20,996, 336. 13,441,023. 2, 269,589. 5,285,724. 8 Pension plan accruals and contributions (include section 401(k) and 403(b) employer contributions) 1,166,650. 718,175. 145,935. 302,540. 9 Other employee benefits ............ 2,419,445. 1.597.411 1,597, 411. 226,416. 595,618. 10 Payroll taxes ............ 1,764,075. 1,100,980. 248, 160. 414, 935. 11 Fees for services (non-employees): a Management. b Legal 14,270.1 14,270. c Accounting ......... 153,092. 153,092. d Lobbying . 127,641. . 127,641.1 . . . . . . . . . . . . e Professional fundraising services. See Part IV line 17. 2,483, 495. 2,483,495. f Investment management fees......... 78, 179. 78, 179. g Other. I line 11g amount exceeds 10% of line 25, column 10,760, 662. 6,096,188. 881, 425. (A) amount, list line 11g expenses on Schedule 0.). ..... 3,783,049. 12 Advertising and promotion ........... 3, 202,786. 1,736, 328. 2,674. 1, 463,784. 13 Office expenses......... 1,028,014. 721,803. 114,720. 14 Information technology...... 5,732,424. 4,000, 277. 370, 365. 1, 361,782. 15 Royalties............ 0.1 1,501,004. 828,024. 308, 752. 16 Occupancy .................. 364, 228. 17 Travel ........ 1,973, 106. 1,539,062.1 158, 189. 275,855. 18 Payments of travel or entertainment expenses for any federal, state, or local public officials 19 Conferences, conventions, and meetings. 1,530, 784. 1,356, 486. 73,558. 100,740. 20 Interest . . . . . . . . . . . . . . . 21 Payments to affiliates.............. 22 Depreciation, depletion, and amortization .... 567, 125. 430, 797. 55,166. 81,162. 23 Insurance ............ 94,023. 53,631. 18, 450. 21,942. 24 Other expenses. Itemize expenses not covered above (List miscellaneous expenses in line 24e. If line 24e amount exceeds 10% of line 25, column (A) amount, list line 24e expenses on Schedule o.) a PRODUCE 18,435,856. 18,435,856. b POSTAGE & PRINTING -- 8,927,957. 8,927,957. DISASTER PURCHASES 389,476.1 389,476. PROFESSIONAL DEVELOPMENT 197, 708. 18,282. 142,548. 36,878. e All other expenses -------- 202,790. 61,603. 130,310. 10,877. 25 Total functional expenses. Add lines 1 through 240 2,423,837,553. 2,390,690, 235. 7, 172, 292. 25, 975,026. 26 Joint costs. Complete this line only if the organization reported in column (B) joint costs from a combined educational campaign and fundraising solicitation. Check here if following SOP 98-2 (ASC 958-720). ...... USA Form 990 (2015) 5E 1052 1.000 Source: Internal Revenue Service Form 990 (2015) Page 11 Part X Balance Sheet Check if Schedule o contains a response or note to any line in this part X. . (A) (B) Beginning of year End of year 1 Cash - non-interest-bearing ... 50,397,174. 1 40,644,516. 2 Savings and temporary cash investments.. 0. 2 0. 3 Pledges and grants receivable, net ... 28,034, 291. 3 37,507, 788. 4 Accounts receivable, net .. 3,681,950. 4 5 , 102, 161. 5 Loans and other receivables from current and former officers, directors, trustees, key employees, and highest compensated employees. Complete Part II of Schedule L. 0.5 Loans and other receivables from other disqualified persons (as defined under section 4958(1)(1)), persons described in section 4958(c)(3)(B), and contributing employers and sponsoring organizations of section 501(c)(9) voluntary employees' beneficiary organizations (see instructions). Complete Part II of Schedule L 0. 6 7 Notes and loans receivable, net 0. 7 8 Inventories for sale or use 24,600. 8 29,808. 9 Prepaid expenses and deferred charges ...... 457,548. 9 475, 630. 10a Land, buildings, and equipment: cost or other basis. Complete Part VI of Schedule D 10a 7,213,502. b Less: accumulated depreciation.......... 10b 3,763, 148. 2,092,891. 10c 3, 450, 354. 11 Investments - publicly traded securities .................... 23,656,392. 11 23,761, 847. 12 Investments - other securities. See Part IV, line 11.. 31,374. 121 35,332. 13 Investments - program-related. See Part IV, line 11. 560,289. 13 797,657. 14 Intangible assets....... 0.14 0. 15 Other assets. See Part IV, line 11.... 89, 310. 15 23, 218. 16 Total assets. Add lines 1 through 15 (must equal line 34) 109,025,819.16 111,828, 311. 17 Accounts payable and accrued expenses. 9, 132, 944. 17 8, 440, 106. 18 Grants payable............................ 13,284, 602. 18 4,215,703. 19 Deferred revenue ................................ 1,798,886. 19 1,016, 191. 20 Tax-exempt bond liabilities ... 0. 20 w a o . . . . . . . . . . . . . Escrow or custodial account liability. Complete Part IV of Schedule D.... 519, 811. 21 519, 461. Loans and other payables to current and former officers, directors, trustees, key employees, highest compensated employees, and disqualified persons. Complete Part II of Schedule L..... 0.22 Secured mortgages and notes payable to unrelated third parties ....... 0.23 24 Unsecured notes and loans payable to unrelated third parties 0.24 25 Other liabilities (including federal income tax payables to related third parties, and other liabilities not included on lines 17-24). Complete Part X of Schedule D ............ 2,143, 126. 25 1,870, 185. 26 Total liabilities. Add lines 17 through 25................. Add lines 17 through 25 26,879, 369.26 16,061, 646. Organizations that follow SFAS 117 (ASC 958), check here and complete lines 27 through 29, and lines 33 and 34. Unrestricted net assets 28,015, 697.27 31,794,369. Temporarily restricted net assets.. 52,318,603. 28 62,139,146. Permanently restricted net assets... 1,812,150. 29 1,833, 150. Organizations that do not follow SFAS 117 (ASC 958), check here D complete lines 30 through 34. Capital stock or trust principal, or current funds ....... 30 31 Paid-in or capital surplus, or land, building, or equipment fund 31 32 Retained earnings, endowment, accumulated income, or other funds 33 Total net assets or fund balances... 82,146, 450. 33 95,766, 665. 34 Total liabilities and net assets/fund balances. . . . . . 109,025,819. 34 111,828, 311. Form 990 (2015) Source: Internal Revenue Service Liabilities Net Assets or Fund Balances Use 2015 Form 990 and the 2016 annual report for Feeding America. Although the Form 990 indicates it is for 2015, it is actually for the period July 1, 2015, to June 30, 2016, the same time period as the 2016 annual report. Required a. Compute the following performance measures using the Form 990. b. Using the annual financial statements, calculate the following performance measures. Complete this question by entering your answers in the tabs below. Required A Required B Compute the following performance measures using the Form 990. (Round your answers to the nearest thousands.) Liquidity Choose Denominator Choose Numerator = Ratio Going Concern Choose Denominator Choose Numerator = = Ratio Program Effectiveness Choose Denominator Choose Numerator + = Ratio Fund-raising Efficiency Choose Denominator Choose Numerator + = Ratio FEEDING AMERICA Statements of Financial Pasirion June 30, 2016 and 2015 2016 2015 Current awer 5 40.615 5098 Short-term immcns Coccions receivable, net Acum exibel Notes mahlenet Oihussets 20.036 5.100 15916 20.329 11.172 20242 1912 59 $111.27 1 Long term imestments Contribu a blemel Mones resemble. A Other wel Furniture and equipment, Tosca depreciation of S3,766 and $3.199 in 2016 und 2015. Spectively Tonalas Liabilities and Net.Assets Current this Accounts ponin and authens Delew me Cinners Current portion of leaces payable Total C linic Lea b le, less current portion Otheebligations $ 12,161 1.016 1.709 13.50 24.517 1.990 16.06 Net assets: 31.791 1:2.1.50 Te c ted Permanently restricted 2012 52,921 SIE 2.146 104025 Torallibilities and net accets $ 111.525 a ul FEEDING AMERICA Statements of Activities Years emed June 30, 2016 and 2015 L 2016 l l restricted restricted Temporarily to Permanently restricted Lurestricted Total Umestricted Total Public support and revenue Plupport: Individual controls Cooperate concibutions $ 2.50 14,291 17.300 16.811 37.357 1.800 1916 19 os 36.121 1349 1119 Corporate promocions . [Ir.jsir Danied ach and some Tocal public support .12.2015 17.911 1,717 1124192 74.028 2.1 .18 2.139.745 36209 119.766 2. 2. 1 2.406,317 75447 2.2 . 1 2.353.995 2. 110.119 2 . 44319 36.121 4.374 1.153 Member fees Conference Res Othere Tood procurent revenue 1.275 2,174 62.762 1.278 2.174 62.762 1..991 50075 1.391 59.970 35.25 2. 50.737 135.265 9.05 122.004 1203 Ner assets released from restriction Tocal public supporld revenue Expenses Tramm Member services 54.751 2.365.556 5,411 1.593 54,751 2.365.555 5,411 1.193 44415 2.139.802 2.139,803 Pabloneness and education Policy and advocacy 1.927 2.321 3457 2.196,507 4.191 2.31611 2.3.611 2.1957 Research and analysis Total e s Supporting Service: Management and peneral 2016 7.213 26.0151 2015 25.01 24 2.57.355 2.167.855 2.278.733 2.225.733 10.963 116 13.923 14,039 Tocal portiervices Tales Increase in Essets as a result of Uptions Navis Wills and bequests Individual contribubus Investment renn Other Les i on of furniture Changes in accets Nelasses al beginning of your Not re of year 20 u75) 75 ILIT) 9.SIS 23.012 $ 51,794 82.145 166 38.001 32.121 62,159 X2,146 The Let's Read organization is a public charity under IRC Sec. 501(c)(3). It had total support of the following: United Way support Grant from the state Grant from the city Contributions from individuals Investment income Revenue from the sale of books $ 10,400 25,400 10,400 261,400 1,400 10,000 $319,000 Of the $261,400 received from contributors, $240,500 came from four contributors, each of whom gave $60,125, the other $20,900 came from small individual contributions. Required a. Calculate the total amount of support that qualifies as "public support" in meeting the public support test to escape private foundation status. Contributions: Public Support C-1. If the organization had received $202,000 from one individual, and the remaining $59,400 from many small individual contributions, calculate the total amount of support that qualifies as "public support" in meeting the public support test to escape private foundation status. Contributions: Public Support ILLUSTRATION 13-4 Tax-Exempt Status According to the Internal Revenue Code (selected) Section of Internal Revenue Code Description of Organization and Its Activities 501(C)(1) 501(c)(2) 501(C)(3) 501(c)(4) 501(c)(5) 501(c)(6) 501(c)(7) 501(C)(8) 501(C)(9) 501(C)(10) 501(C)(11) 501(c)(13) 501(C)(14) 501(C)(18) 501(c)(19) 501(d) 501(e) 501(f) 501(k) 521(a) 527 529 Corporations organized under acts of Congress, such as the Federal Deposit Insurance Corporation Title-holding corporation for exempt organizations Charitable, religious, scientific, literary, educational, testing for public safety Civic leagues, social welfare organizations, local employee associations Labor, agricultural, and horticultural organizations Business leagues, chambers of commerce, real estate boards Social and recreational clubs Fraternal beneficiary society and associations Voluntary employees' beneficiary associations to provide insurance or other benefits to members Domestic fraternal societies and associations Teacher retirement fund associations Cemetery companies, burial activities State-chartered credit unions, mutual reserve fund Employee funded pension trust Veterans' organizations or armed forces members' posts Religious and apostolic associations, religious communities Cooperative hospital service organizations Cooperative service organization of operating educational organizations Child care organizations Farmers, cooperative associations Political parties, campaign committees, political action committees Qualified state tuition programs Use Illustration 13-4. Select from the list of Internal Revenue Code section against each of the NFP entities which is most likely to be exempt from federal income tax. Section of Internal Revenue Code NFP Entities + Fredericksburg Chamber of Commerce American Diabetes Association American Legion American Museum of Natural History American Institute of Certified Public Accountants Wee Care Daycare Allentown Racquetball Association Citizen's to Elect Harvey N 00 36-3673599 Page 9 Form 990 (2015) FEEDING AMERICA Part VIII Statement of Revenue Check if Schedule O contains a response or note to any line in this Part VIII...... (A) (B) Total revenue Related or exempt function (C) Unrelated business revenue (D) Revenue excluded from tax under sections 512-514 revenue sa Contributions, Gifts, Grants and Other Similar Amounts Program Service Revenue 1a Federated campaigns ..... b Membership dues ........ c Fundraising events ........ d Related organizations ........ 1d . Government grants (contributions).. 1e f All other contributions, gifts, grants and similar amounts not included above. 1f2, 375,635,807. g Noncash contributions included in lines 1a-1t: $ 2.288,846,654. h Total. Add lines 1a-1f .................. Business Code 2a FOOD PROCUREMENT REVENUE 900099 b MEMBER FEES 900099 CONFERENCE REVENUE 900099 d INTEREST INCOME 900099 + 2,375, 635,807. 1 18,500, 609. 9, 290, 824. ,278,147. 1,022. 1 18,500, 609. 4, 290, 824. 1,278,147. 1 .022. 24,070,602 511,301. 511,301. 35,209,467. 35,209,467 -46,501. -46,501. -184,236. -184,236. f All other program service revenue ..... g Total. Add lines 2a-21. 3 Investment income (including dividends, interest and other similar amounts)............... 4 Income from investment of tax-exempt bond proceeds. 5 Royalties .......... (1) Real (In Personal 6a Gross rents ........ 157,754. b Less: rental expenses... 204, 255. c Rental income or loss).. - 46,501. d Net rental income or (loss). 7a Gross amount from sales of (i) Securities () Other assets other than inventory 134, 343. b Less: cost or other basis and sales expenses.... 318,579. c Gain or loss).......L -184,236. d Net gain or loss)........... 8a Gross income from fundraising events (not including $ of contributions reported on line 1c). See Part IV, line 18 ........... a b Less: direct expenses.......... b C Net income or loss) from fundraising events... 9a Gross income from gaming activities See Part IV, line 19.... b Less: direct expenses.......... b c Net income or (loss) from gaming activities.. 10a Gross sales of inventory. less returns and allowances......... a 44, 261,941. b Less: cost of goods sold ......... bL 43,720, 747. C Net income or (loss) from sales of inventory... Miscellaneous Revenue Business Code 11a PUBLICATIONS AND MATERIALS FEE 900099 b OTHER FEES 900099 Other Revenue 541, 194. 541,194. 355,097. 1,525,805. 355,097. 1,525, 805. 1,880, 902. 2,437,618,536. 26, 492,699. d All other revenue .......... e Total. Add lines 11a-110 ............... 12 Total revenue. See instructions. . . JSA 5E 1051 1.000 Source: Internal Revenue Service 35,490,031 Form 990 (2015) (D) expenses Form 990 (2015) FEEDING AMERICA 36-3673599 Page 10 Part IX Statement of Functional Expenses Section 501(c)(3) and 501(c)(4) organizations must complete all columns. All other organizations must complete column (A). Check if Schedule o contains a response or note to any line in this part IX Do not include amounts reported on lines 6b, 7b, Total (A) (B) Program service Total expenses Management and 8b, 9b, and 10b of Part VII. Fundraising expenses general expenses 1 Grants and other assistance to domestic organizations and domestic governments. See Part IV, line 21.... 2,336, 741,082.2, 336, 741,082. 2 Grants and other assistance to domestic 10,000. individuals. See Part IV, line 22 ......... 10,000. 3 Grants and other assistance to foreign organizations, foreign governments, and foreign individuals. See Part IV, lines 15 and 16... 4 Benefits paid to or for members......... 5 Compensation of current officers, directors, trustees, and key employees.......... 3,339,573. 1,286,110. 1,703, 723. 349,740. 6 Compensation not included above, to disqualified persons (as defined under section 4958(1)(1)) and persons described in section 4958(c)(3)(B) 7 Other salaries and wages 20,996, 336. 13,441,023. 2, 269,589. 5,285,724. 8 Pension plan accruals and contributions (include section 401(k) and 403(b) employer contributions) 1,166,650. 718,175. 145,935. 302,540. 9 Other employee benefits ............ 2,419,445. 1.597.411 1,597, 411. 226,416. 595,618. 10 Payroll taxes ............ 1,764,075. 1,100,980. 248, 160. 414, 935. 11 Fees for services (non-employees): a Management. b Legal 14,270.1 14,270. c Accounting ......... 153,092. 153,092. d Lobbying . 127,641. . 127,641.1 . . . . . . . . . . . . e Professional fundraising services. See Part IV line 17. 2,483, 495. 2,483,495. f Investment management fees......... 78, 179. 78, 179. g Other. I line 11g amount exceeds 10% of line 25, column 10,760, 662. 6,096,188. 881, 425. (A) amount, list line 11g expenses on Schedule 0.). ..... 3,783,049. 12 Advertising and promotion ........... 3, 202,786. 1,736, 328. 2,674. 1, 463,784. 13 Office expenses......... 1,028,014. 721,803. 114,720. 14 Information technology...... 5,732,424. 4,000, 277. 370, 365. 1, 361,782. 15 Royalties............ 0.1 1,501,004. 828,024. 308, 752. 16 Occupancy .................. 364, 228. 17 Travel ........ 1,973, 106. 1,539,062.1 158, 189. 275,855. 18 Payments of travel or entertainment expenses for any federal, state, or local public officials 19 Conferences, conventions, and meetings. 1,530, 784. 1,356, 486. 73,558. 100,740. 20 Interest . . . . . . . . . . . . . . . 21 Payments to affiliates.............. 22 Depreciation, depletion, and amortization .... 567, 125. 430, 797. 55,166. 81,162. 23 Insurance ............ 94,023. 53,631. 18, 450. 21,942. 24 Other expenses. Itemize expenses not covered above (List miscellaneous expenses in line 24e. If line 24e amount exceeds 10% of line 25, column (A) amount, list line 24e expenses on Schedule o.) a PRODUCE 18,435,856. 18,435,856. b POSTAGE & PRINTING -- 8,927,957. 8,927,957. DISASTER PURCHASES 389,476.1 389,476. PROFESSIONAL DEVELOPMENT 197, 708. 18,282. 142,548. 36,878. e All other expenses -------- 202,790. 61,603. 130,310. 10,877. 25 Total functional expenses. Add lines 1 through 240 2,423,837,553. 2,390,690, 235. 7, 172, 292. 25, 975,026. 26 Joint costs. Complete this line only if the organization reported in column (B) joint costs from a combined educational campaign and fundraising solicitation. Check here if following SOP 98-2 (ASC 958-720). ...... USA Form 990 (2015) 5E 1052 1.000 Source: Internal Revenue Service Form 990 (2015) Page 11 Part X Balance Sheet Check if Schedule o contains a response or note to any line in this part X. . (A) (B) Beginning of year End of year 1 Cash - non-interest-bearing ... 50,397,174. 1 40,644,516. 2 Savings and temporary cash investments.. 0. 2 0. 3 Pledges and grants receivable, net ... 28,034, 291. 3 37,507, 788. 4 Accounts receivable, net .. 3,681,950. 4 5 , 102, 161. 5 Loans and other receivables from current and former officers, directors, trustees, key employees, and highest compensated employees. Complete Part II of Schedule L. 0.5 Loans and other receivables from other disqualified persons (as defined under section 4958(1)(1)), persons described in section 4958(c)(3)(B), and contributing employers and sponsoring organizations of section 501(c)(9) voluntary employees' beneficiary organizations (see instructions). Complete Part II of Schedule L 0. 6 7 Notes and loans receivable, net 0. 7 8 Inventories for sale or use 24,600. 8 29,808. 9 Prepaid expenses and deferred charges ...... 457,548. 9 475, 630. 10a Land, buildings, and equipment: cost or other basis. Complete Part VI of Schedule D 10a 7,213,502. b Less: accumulated depreciation.......... 10b 3,763, 148. 2,092,891. 10c 3, 450, 354. 11 Investments - publicly traded securities .................... 23,656,392. 11 23,761, 847. 12 Investments - other securities. See Part IV, line 11.. 31,374. 121 35,332. 13 Investments - program-related. See Part IV, line 11. 560,289. 13 797,657. 14 Intangible assets....... 0.14 0. 15 Other assets. See Part IV, line 11.... 89, 310. 15 23, 218. 16 Total assets. Add lines 1 through 15 (must equal line 34) 109,025,819.16 111,828, 311. 17 Accounts payable and accrued expenses. 9, 132, 944. 17 8, 440, 106. 18 Grants payable............................ 13,284, 602. 18 4,215,703. 19 Deferred revenue ................................ 1,798,886. 19 1,016, 191. 20 Tax-exempt bond liabilities ... 0. 20 w a o . . . . . . . . . . . . . Escrow or custodial account liability. Complete Part IV of Schedule D.... 519, 811. 21 519, 461. Loans and other payables to current and former officers, directors, trustees, key employees, highest compensated employees, and disqualified persons. Complete Part II of Schedule L..... 0.22 Secured mortgages and notes payable to unrelated third parties ....... 0.23 24 Unsecured notes and loans payable to unrelated third parties 0.24 25 Other liabilities (including federal income tax payables to related third parties, and other liabilities not included on lines 17-24). Complete Part X of Schedule D ............ 2,143, 126. 25 1,870, 185. 26 Total liabilities. Add lines 17 through 25................. Add lines 17 through 25 26,879, 369.26 16,061, 646. Organizations that follow SFAS 117 (ASC 958), check here and complete lines 27 through 29, and lines 33 and 34. Unrestricted net assets 28,015, 697.27 31,794,369. Temporarily restricted net assets.. 52,318,603. 28 62,139,146. Permanently restricted net assets... 1,812,150. 29 1,833, 150. Organizations that do not follow SFAS 117 (ASC 958), check here D complete lines 30 through 34. Capital stock or trust principal, or current funds ....... 30 31 Paid-in or capital surplus, or land, building, or equipment fund 31 32 Retained earnings, endowment, accumulated income, or other funds 33 Total net assets or fund balances... 82,146, 450. 33 95,766, 665. 34 Total liabilities and net assets/fund balances. . . . . . 109,025,819. 34 111,828, 311. Form 990 (2015) Source: Internal Revenue Service Liabilities Net Assets or Fund Balances Use 2015 Form 990 and the 2016 annual report for Feeding America. Although the Form 990 indicates it is for 2015, it is actually for the period July 1, 2015, to June 30, 2016, the same time period as the 2016 annual report. Required a. Compute the following performance measures using the Form 990. b. Using the annual financial statements, calculate the following performance measures. Complete this question by entering your answers in the tabs below. Required A Required B Compute the following performance measures using the Form 990. (Round your answers to the nearest thousands.) Liquidity Choose Denominator Choose Numerator = Ratio Going Concern Choose Denominator Choose Numerator = = Ratio Program Effectiveness Choose Denominator Choose Numerator + = Ratio Fund-raising Efficiency Choose Denominator Choose Numerator + = Ratio FEEDING AMERICA Statements of Financial Pasirion June 30, 2016 and 2015 2016 2015 Current awer 5 40.615 5098 Short-term immcns Coccions receivable, net Acum exibel Notes mahlenet Oihussets 20.036 5.100 15916 20.329 11.172 20242 1912 59 $111.27 1 Long term imestments Contribu a blemel Mones resemble. A Other wel Furniture and equipment, Tosca depreciation of S3,766 and $3.199 in 2016 und 2015. Spectively Tonalas Liabilities and Net.Assets Current this Accounts ponin and authens Delew me Cinners Current portion of leaces payable Total C linic Lea b le, less current portion Otheebligations $ 12,161 1.016 1.709 13.50 24.517 1.990 16.06 Net assets: 31.791 1:2.1.50 Te c ted Permanently restricted 2012 52,921 SIE 2.146 104025 Torallibilities and net accets $ 111.525 a ul FEEDING AMERICA Statements of Activities Years emed June 30, 2016 and 2015 L 2016 l l restricted restricted Temporarily to Permanently restricted Lurestricted Total Umestricted Total Public support and revenue Plupport: Individual controls Cooperate concibutions $ 2.50 14,291 17.300 16.811 37.357 1.800 1916 19 os 36.121 1349 1119 Corporate promocions . [Ir.jsir Danied ach and some Tocal public support .12.2015 17.911 1,717 1124192 74.028 2.1 .18 2.139.745 36209 119.766 2. 2. 1 2.406,317 75447 2.2 . 1 2.353.995 2. 110.119 2 . 44319 36.121 4.374 1.153 Member fees Conference Res Othere Tood procurent revenue 1.275 2,174 62.762 1.278 2.174 62.762 1..991 50075 1.391 59.970 35.25 2. 50.737 135.265 9.05 122.004 1203 Ner assets released from restriction Tocal public supporld revenue Expenses Tramm Member services 54.751 2.365.556 5,411 1.593 54,751 2.365.555 5,411 1.193 44415 2.139.802 2.139,803 Pabloneness and education Policy and advocacy 1.927 2.321 3457 2.196,507 4.191 2.31611 2.3.611 2.1957 Research and analysis Total e s Supporting Service: Management and peneral 2016 7.213 26.0151 2015 25.01 24 2.57.355 2.167.855 2.278.733 2.225.733 10.963 116 13.923 14,039 Tocal portiervices Tales Increase in Essets as a result of Uptions Navis Wills and bequests Individual contribubus Investment renn Other Les i on of furniture Changes in accets Nelasses al beginning of your Not re of year 20 u75) 75 ILIT) 9.SIS 23.012 $ 51,794 82.145 166 38.001 32.121 62,159 X2,146