Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The lindenburg Company, a manufacturer and wholesaler of refurbished cars has experienced low profitability in recent years. a new president joined who has asked you

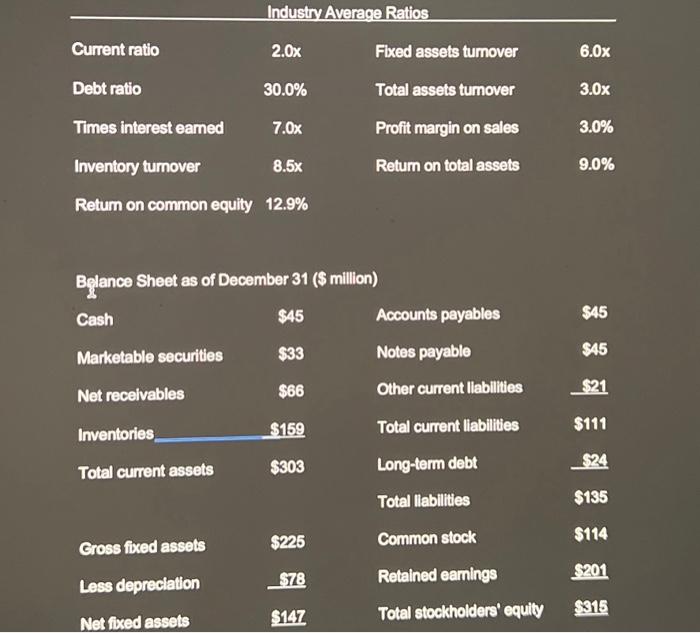

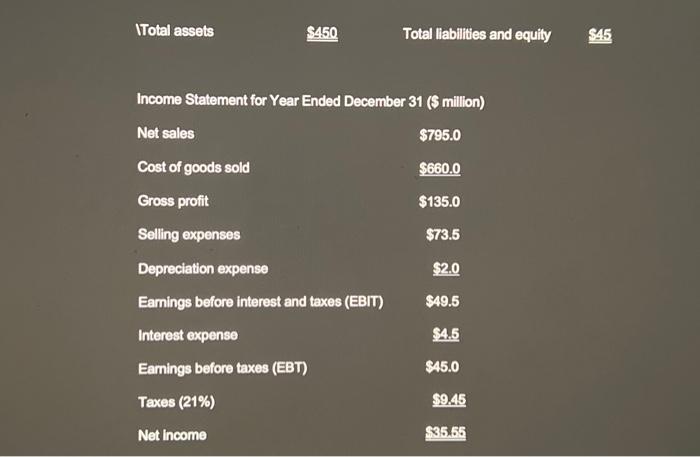

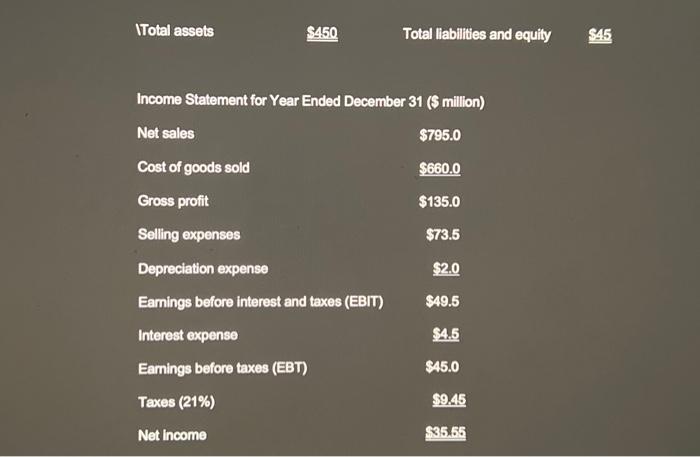

The lindenburg Company, a manufacturer and wholesaler of refurbished cars has experienced low profitability in recent years. a new president joined who has asked you to make an analysis of the firm's financial position using the DuPont chart. The most recent industry average ratios and lindenburg's financial statements are pictured below

ITotal assets $450 Total liabilities and equity Income Statement for Year Ended December 31 (\$ million) Net sales Cost of goods sold Gross profit Selling expenses Depreciation expense Eamings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Taxes (21\%) Net income $795.0 $660.0 $135.0 $73.5 $2.0 $49.5 S.5 S5.0 $9.45 $5,65 1) Calculate those ratios that you think would be useful in this analysis. Explain why you chose those ratios.

2) Make a DuPont equation for Lindenburg's and compare the company's ratios to the industry average ratios. Be sure to include

-tax burden

-interest burden

-operating profit margin

- asset turnover ratios in your derivation of the DuPont. What can you infer?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started