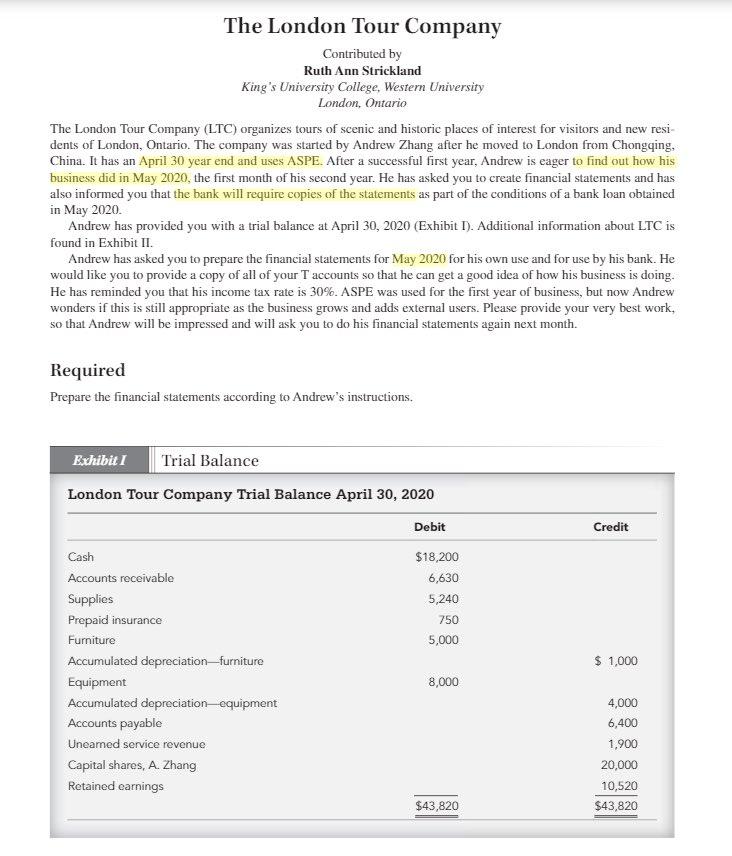

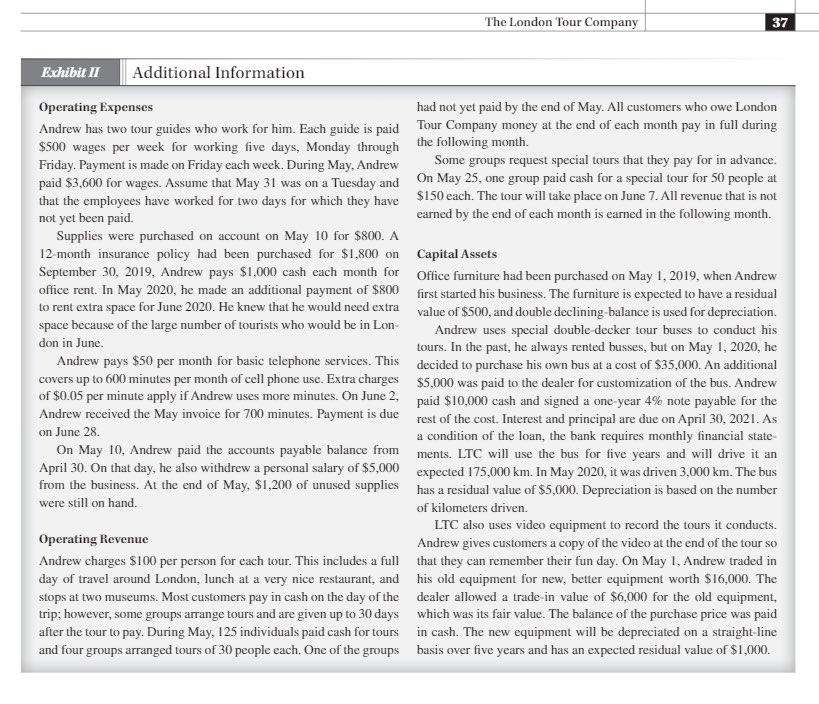

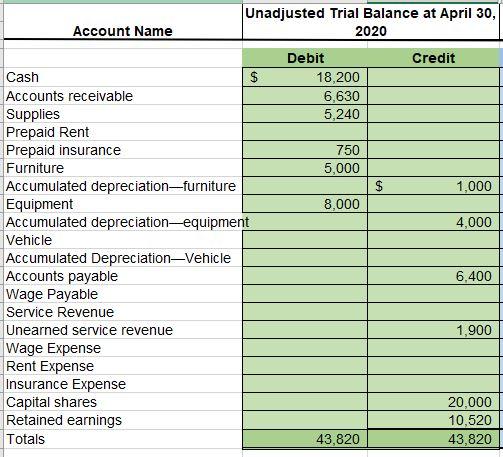

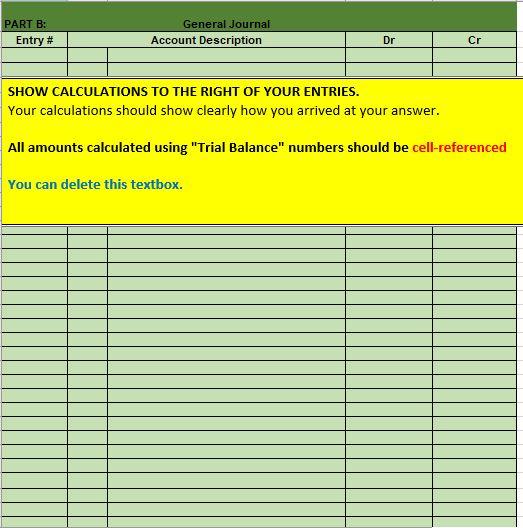

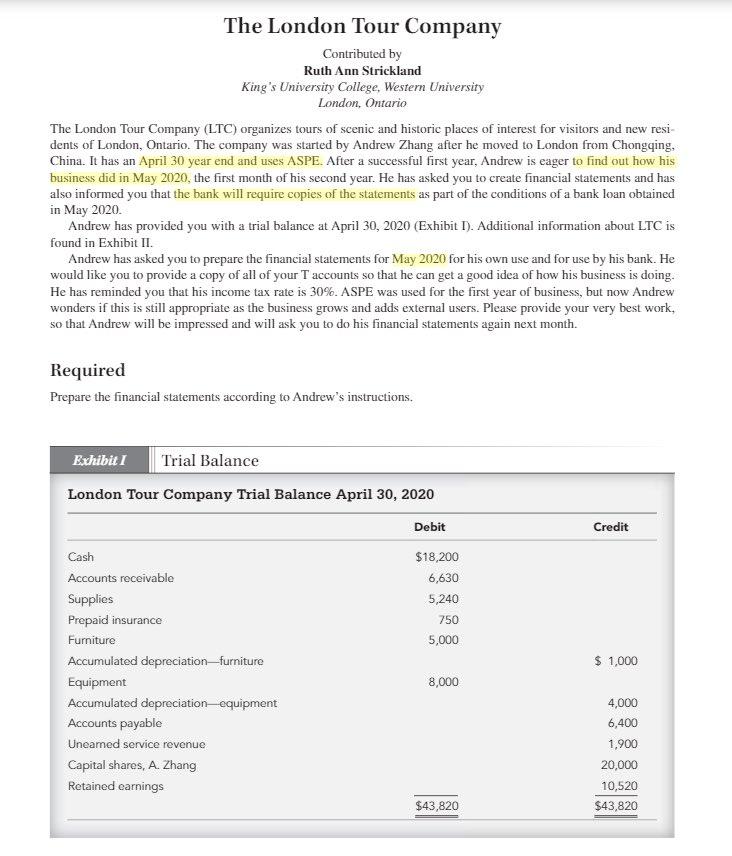

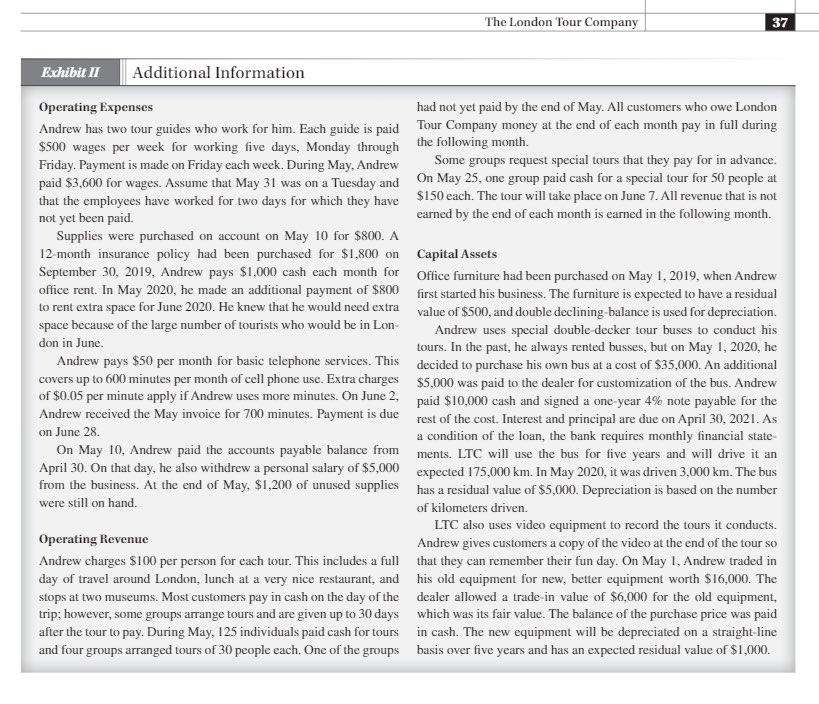

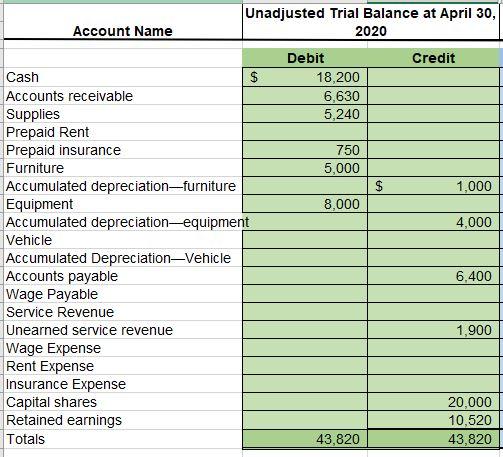

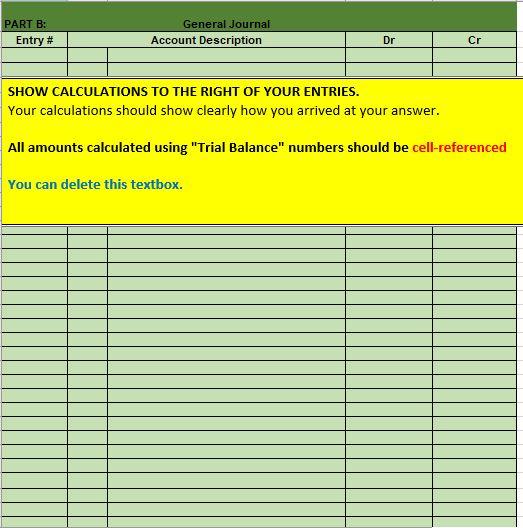

The London Tour Company Contributed by Ruth Ann Strickland King's University College, Western University London, Ontario The London Tour Company (LTC) organizes tours of scenic and historic places of interest for visitors and new resi- dents of London, Ontario. The company was started by Andrew Zhang after he moved to London from Chongqing, China. It has an April 30 year end and uses ASPE. After a successful first year, Andrew is eager to find out how his business did in May 2020, the first month of his second year. He has asked you to create financial statements and has also informed you that the bank will require copies of the statements as part of the conditions of a bank loan obtained in May 2020. Andrew has provided you with a trial balance at April 30, 2020 (Exhibit 1). Additional information about LTC is found in Exhibit II. Andrew has asked you to prepare the financial statements for May 2020 for his own use and for use by his bank. He would like you to provide a copy of all of your accounts so that he can get a good idea of how his business is doing. He has reminded you that his income tax rate is 30%. ASPE was used for the first year of business, but now Andrew wonders if this is still appropriate as the business grows and adds external users. Please provide your very best work, so that Andrew will be impressed and will ask you to do his financial statements again next month. Required Prepare the financial statements according to Andrew's instructions. Exhibit I Trial Balance London Tour Company Trial Balance April 30, 2020 Debit Credit $18,200 6,630 5,240 750 5,000 $ 1,000 Cash Accounts receivable Supplies Prepaid insurance Furniture Accumulated depreciation-furniture Equipment Accumulated depreciation equipment Accounts payable Uneamed service revenue Capital shares, A. Zhang Retained earnings 8,000 4,000 6,400 1,900 20,000 10,520 $43,820 $43,820 The London Tour Company 37 Exhibit II Additional Information Operating Expenses had not yet paid by the end of May. All customers who owe London Andrew has two tour guides who work for him. Each guide is paid Tour Company money at the end of each month pay in full during $500 wages per week for working five days, Monday through the following month. Friday. Payment is made on Friday each week. During May, Andrew Some groups request special tours that they pay for in advance. paid $3,600 for wages. Assume that May 31 was on a Tuesday and On May 25, one group paid cash for a special tour for 50 people at that the employees have worked for two days for which they have $150 each. The tour will take place on June 7. All revenue that is not not yet been paid. earned by the end of each month is earned in the following month. Supplies were purchased on account on May 10 for $800. A 12 month insurance policy had been purchased for $1,800 on Capital Assets September 30, 2019, Andrew pays $1,000 cash each month for Office furniture had been purchased on May 1, 2019, when Andrew office rent. In May 2020, he made an additional payment of $800 first started his business. The furniture is expected to have a residual to rent extra space for June 2020. He knew that he would need extra value of $500, and double declining balance is used for depreciation. space because of the large number of tourists who would be in Lon Andrew uses special double decker tour buses to conduct his don in June. tours. In the past, he always rented busses, but on May 1, 2020, he Andrew pays $50 per month for basic telephone services. This decided to purchase his own bus at a cost of $35,000. An additional covers up to 600 minutes per month of cell phone use. Extra charges $5,000 was paid to the dealer for customization of the bus. Andrew of $0.05 per minute apply if Andrew uses more minutes. On June 2, paid $10,000 cash and signed a one-year 4% note payable for the Andrew received the May invoice for 700 minutes. Payment is due rest of the cost. Interest and principal are due on April 30, 2021. As on June 28. a condition of the loan, the bank requires monthly financial state On May 10, Andrew paid the accounts payable balance from ments. LTC will use the bus for five years and will drive it an April 30. On that day, he also withdrew a personal salary of $5,000 expected 175.000 km. In May 2020, it was driven 3,000 km. The bus from the business. At the end of May, $1,200 of unused supplies has a residual value of $5,000. Depreciation is based on the number were still on hand. of kilometers driven LTC also uses video equipment to record the tours it conducts. Operating Revenue Andrew gives customers a copy of the video at the end of the tour so Andrew charges $100 per person for each tour. This includes a full that they can remember their fun day. On May 1, Andrew traded in day of travel around London, lunch at a very nice restaurant, and his old equipment for new, better equipment worth $16,000. The stops at two museums. Most customers pay in cash on the day of the dealer allowed a trade-in value of $6,000 for the old equipment, trip; however, some groups arrange tours and are given up to 30 days which was its fair value. The balance of the purchase price was paid after the tour to pay. During May, 125 individuals paid cash for tours in cash. The new equipment will be depreciated on a straight-line and four groups arranged tours of 30 people each. One of the groups basis over five years and has an expected residual value of $1,000. $ Unadjusted Trial Balance at April 30, Account Name 2020 Debit Credit Cash 18,200 Accounts receivable 6,630 Supplies 5,240 Prepaid Rent Prepaid insurance 750 Furniture 5,000 Accumulated depreciation-furniture $ 1,000 Equipment 8,000 Accumulated depreciation equipment 4,000 Vehicle Accumulated DepreciationVehicle Accounts payable 6,400 Wage Payable Service Revenue Unearned service revenue 1,900 Wage Expense Rent Expense Insurance Expense Capital shares 20,000 Retained earnings 10,520 Totals 43,820 43,820 PART B: Entry # General Journal Account Description Dr Cr SHOW CALCULATIONS TO THE RIGHT OF YOUR ENTRIES. Your calculations should show clearly how you arrived at your answer. All amounts calculated using "Trial Balance" numbers should be cell-referenced You can delete this textbox. The London Tour Company Contributed by Ruth Ann Strickland King's University College, Western University London, Ontario The London Tour Company (LTC) organizes tours of scenic and historic places of interest for visitors and new resi- dents of London, Ontario. The company was started by Andrew Zhang after he moved to London from Chongqing, China. It has an April 30 year end and uses ASPE. After a successful first year, Andrew is eager to find out how his business did in May 2020, the first month of his second year. He has asked you to create financial statements and has also informed you that the bank will require copies of the statements as part of the conditions of a bank loan obtained in May 2020. Andrew has provided you with a trial balance at April 30, 2020 (Exhibit 1). Additional information about LTC is found in Exhibit II. Andrew has asked you to prepare the financial statements for May 2020 for his own use and for use by his bank. He would like you to provide a copy of all of your accounts so that he can get a good idea of how his business is doing. He has reminded you that his income tax rate is 30%. ASPE was used for the first year of business, but now Andrew wonders if this is still appropriate as the business grows and adds external users. Please provide your very best work, so that Andrew will be impressed and will ask you to do his financial statements again next month. Required Prepare the financial statements according to Andrew's instructions. Exhibit I Trial Balance London Tour Company Trial Balance April 30, 2020 Debit Credit $18,200 6,630 5,240 750 5,000 $ 1,000 Cash Accounts receivable Supplies Prepaid insurance Furniture Accumulated depreciation-furniture Equipment Accumulated depreciation equipment Accounts payable Uneamed service revenue Capital shares, A. Zhang Retained earnings 8,000 4,000 6,400 1,900 20,000 10,520 $43,820 $43,820 The London Tour Company 37 Exhibit II Additional Information Operating Expenses had not yet paid by the end of May. All customers who owe London Andrew has two tour guides who work for him. Each guide is paid Tour Company money at the end of each month pay in full during $500 wages per week for working five days, Monday through the following month. Friday. Payment is made on Friday each week. During May, Andrew Some groups request special tours that they pay for in advance. paid $3,600 for wages. Assume that May 31 was on a Tuesday and On May 25, one group paid cash for a special tour for 50 people at that the employees have worked for two days for which they have $150 each. The tour will take place on June 7. All revenue that is not not yet been paid. earned by the end of each month is earned in the following month. Supplies were purchased on account on May 10 for $800. A 12 month insurance policy had been purchased for $1,800 on Capital Assets September 30, 2019, Andrew pays $1,000 cash each month for Office furniture had been purchased on May 1, 2019, when Andrew office rent. In May 2020, he made an additional payment of $800 first started his business. The furniture is expected to have a residual to rent extra space for June 2020. He knew that he would need extra value of $500, and double declining balance is used for depreciation. space because of the large number of tourists who would be in Lon Andrew uses special double decker tour buses to conduct his don in June. tours. In the past, he always rented busses, but on May 1, 2020, he Andrew pays $50 per month for basic telephone services. This decided to purchase his own bus at a cost of $35,000. An additional covers up to 600 minutes per month of cell phone use. Extra charges $5,000 was paid to the dealer for customization of the bus. Andrew of $0.05 per minute apply if Andrew uses more minutes. On June 2, paid $10,000 cash and signed a one-year 4% note payable for the Andrew received the May invoice for 700 minutes. Payment is due rest of the cost. Interest and principal are due on April 30, 2021. As on June 28. a condition of the loan, the bank requires monthly financial state On May 10, Andrew paid the accounts payable balance from ments. LTC will use the bus for five years and will drive it an April 30. On that day, he also withdrew a personal salary of $5,000 expected 175.000 km. In May 2020, it was driven 3,000 km. The bus from the business. At the end of May, $1,200 of unused supplies has a residual value of $5,000. Depreciation is based on the number were still on hand. of kilometers driven LTC also uses video equipment to record the tours it conducts. Operating Revenue Andrew gives customers a copy of the video at the end of the tour so Andrew charges $100 per person for each tour. This includes a full that they can remember their fun day. On May 1, Andrew traded in day of travel around London, lunch at a very nice restaurant, and his old equipment for new, better equipment worth $16,000. The stops at two museums. Most customers pay in cash on the day of the dealer allowed a trade-in value of $6,000 for the old equipment, trip; however, some groups arrange tours and are given up to 30 days which was its fair value. The balance of the purchase price was paid after the tour to pay. During May, 125 individuals paid cash for tours in cash. The new equipment will be depreciated on a straight-line and four groups arranged tours of 30 people each. One of the groups basis over five years and has an expected residual value of $1,000. $ Unadjusted Trial Balance at April 30, Account Name 2020 Debit Credit Cash 18,200 Accounts receivable 6,630 Supplies 5,240 Prepaid Rent Prepaid insurance 750 Furniture 5,000 Accumulated depreciation-furniture $ 1,000 Equipment 8,000 Accumulated depreciation equipment 4,000 Vehicle Accumulated DepreciationVehicle Accounts payable 6,400 Wage Payable Service Revenue Unearned service revenue 1,900 Wage Expense Rent Expense Insurance Expense Capital shares 20,000 Retained earnings 10,520 Totals 43,820 43,820 PART B: Entry # General Journal Account Description Dr Cr SHOW CALCULATIONS TO THE RIGHT OF YOUR ENTRIES. Your calculations should show clearly how you arrived at your answer. All amounts calculated using "Trial Balance" numbers should be cell-referenced You can delete this textbox