Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The MacCauley Company has sales of $250 million and total expenses (excluding depreciation) of $190 million. Straight-line depreciation on the company's assets is $20 million,

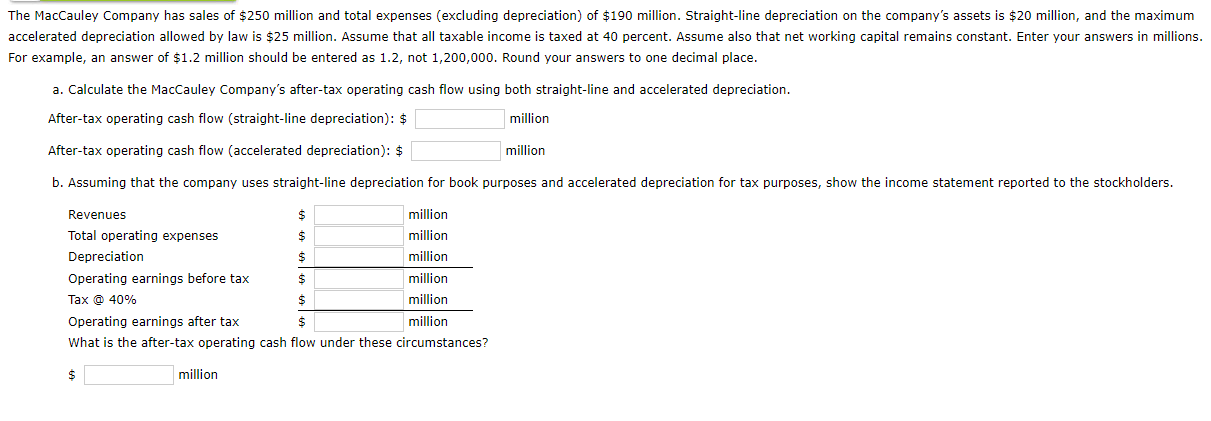

The MacCauley Company has sales of $250 million and total expenses (excluding depreciation) of $190 million. Straight-line depreciation on the company's assets is $20 million, and the maximum accelerated depreciation allowed by law is $25 million. Assume that all taxable income is taxed at 40 percent. Assume also that net working capital remains constant. Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2 , not 1,200,000. Round your answers to one decimal place. a. Calculate the MacCauley Company's after-tax operating cash flow using both straight-line and accelerated depreciation. After-tax operating cash flow (straight-line depreciation): $ million After-tax operating cash flow (accelerated depreciation): $ million b. Assuming that the company uses straight-line depreciation for book purposes and accelerated depreciation for tax purposes, show the income statement reported to the stockholders. What is the after-tax operating cash flow under these circumstances? $ million

The MacCauley Company has sales of $250 million and total expenses (excluding depreciation) of $190 million. Straight-line depreciation on the company's assets is $20 million, and the maximum accelerated depreciation allowed by law is $25 million. Assume that all taxable income is taxed at 40 percent. Assume also that net working capital remains constant. Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2 , not 1,200,000. Round your answers to one decimal place. a. Calculate the MacCauley Company's after-tax operating cash flow using both straight-line and accelerated depreciation. After-tax operating cash flow (straight-line depreciation): $ million After-tax operating cash flow (accelerated depreciation): $ million b. Assuming that the company uses straight-line depreciation for book purposes and accelerated depreciation for tax purposes, show the income statement reported to the stockholders. What is the after-tax operating cash flow under these circumstances? $ million Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started