Answered step by step

Verified Expert Solution

Question

1 Approved Answer

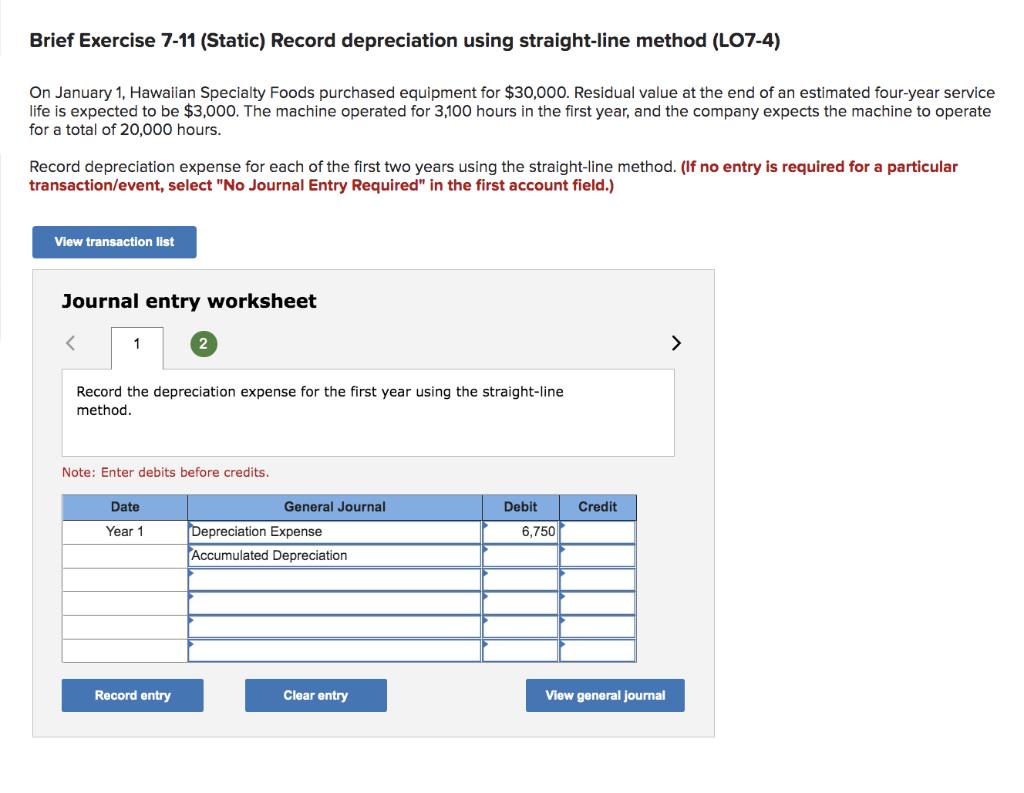

Brief Exercise 7-11 (Static) Record depreciation using straight-line method (LO7-4) On January 1, Hawaiian Specialty Foods purchased equipment for $30,000. Residual value at the

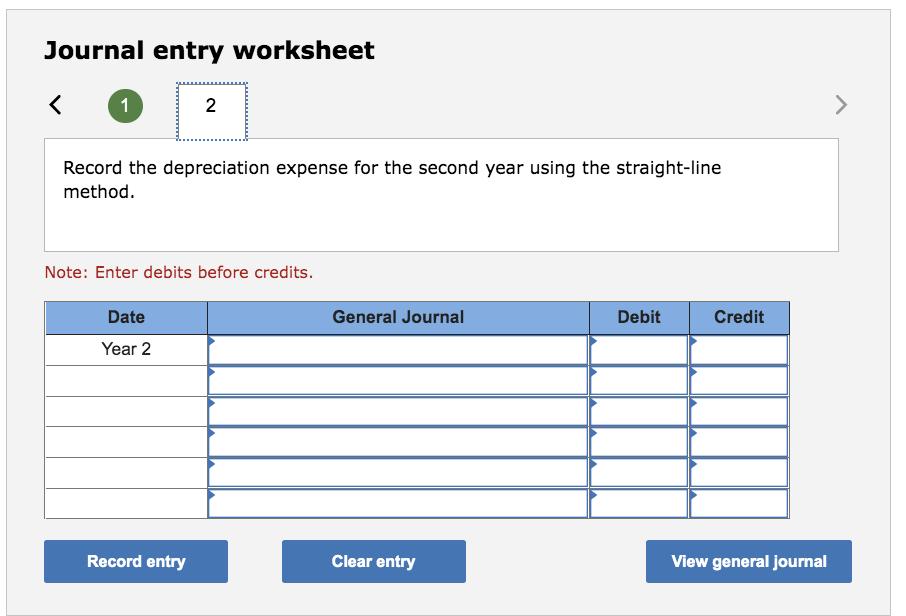

Brief Exercise 7-11 (Static) Record depreciation using straight-line method (LO7-4) On January 1, Hawaiian Specialty Foods purchased equipment for $30,000. Residual value at the end of an estimated four-year service life is expected to be $3,000. The machine operated for 3,100 hours in the first year, and the company expects the machine to operate for a total of 20,000 hours. Record depreciation expense for each of the first two years using the straight-line method. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet < 1 Record the depreciation expense for the first year using the straight-line method. 2 Note: Enter debits before credits. Date Year 1 Record entry General Journal Depreciation Expense Accumulated Depreciation Clear entry Debit 6,750 Credit View general journal > Journal entry worksheet 1 Record the depreciation expense for the second year using the straight-line method. 2 Note: Enter debits before credits. Date Year 2 Record entry General Journal Clear entry Debit Credit View general journal

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Ans d Solution When the body is throw...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started