Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The machinery and equipment at the factory cost 1,500,000. The value at which they appear on the statement of financial position is 400,000. In

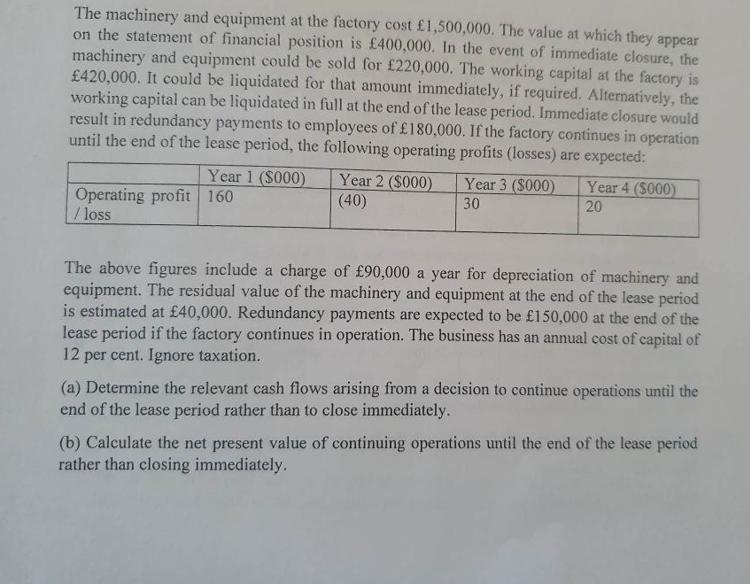

The machinery and equipment at the factory cost 1,500,000. The value at which they appear on the statement of financial position is 400,000. In the event of immediate closure, the machinery and equipment could be sold for 220,000. The working capital at the factory is 420,000. It could be liquidated for that amount immediately, if required. Alternatively, the working capital can be liquidated in full at the end of the lease period. Immediate closure would result in redundancy payments to employees of 180,000. If the factory continues in operation until the end of the lease period, the following operating profits (losses) are expected: Year 1 ($000) Operating profit 160 /loss Year 2 ($000) (40) Year 3 ($000) 30 Year 4 ($000) 20 The above figures include a charge of 90,000 a year for depreciation of machinery and equipment. The residual value of the machinery and equipment at the end of the lease period is estimated at 40,000. Redundancy payments are expected to be 150,000 at the end of the lease period if the factory continues in operation. The business has an annual cost of capital of 12 per cent. Ignore taxation. (a) Determine the relevant cash flows arising from a decision to continue operations until the end of the lease period rather than to close immediately. (b) Calculate the net present value of continuing operations until the end of the lease period rather than closing immediately. The machinery and equipment at the factory cost 1,500,000. The value at which they appear on the statement of financial position is 400,000. In the event of immediate closure, the machinery and equipment could be sold for 220,000. The working capital at the factory is 420,000. It could be liquidated for that amount immediately, if required. Alternatively, the working capital can be liquidated in full at the end of the lease period. Immediate closure would result in redundancy payments to employees of 180,000. If the factory continues in operation until the end of the lease period, the following operating profits (losses) are expected: Year 1 ($000) Operating profit 160 /loss Year 2 ($000) (40) Year 3 ($000) 30 Year 4 ($000) 20 The above figures include a charge of 90,000 a year for depreciation of machinery and equipment. The residual value of the machinery and equipment at the end of the lease period is estimated at 40,000. Redundancy payments are expected to be 150,000 at the end of the lease period if the factory continues in operation. The business has an annual cost of capital of 12 per cent. Ignore taxation. (a) Determine the relevant cash flows arising from a decision to continue operations until the end of the lease period rather than to close immediately. (b) Calculate the net present value of continuing operations until the end of the lease period rather than closing immediately. The machinery and equipment at the factory cost 1,500,000. The value at which they appear on the statement of financial position is 400,000. In the event of immediate closure, the machinery and equipment could be sold for 220,000. The working capital at the factory is 420,000. It could be liquidated for that amount immediately, if required. Alternatively, the working capital can be liquidated in full at the end of the lease period. Immediate closure would result in redundancy payments to employees of 180,000. If the factory continues in operation until the end of the lease period, the following operating profits (losses) are expected: Year 1 ($000) Operating profit 160 /loss Year 2 ($000) (40) Year 3 ($000) 30 Year 4 ($000) 20 The above figures include a charge of 90,000 a year for depreciation of machinery and equipment. The residual value of the machinery and equipment at the end of the lease period is estimated at 40,000. Redundancy payments are expected to be 150,000 at the end of the lease period if the factory continues in operation. The business has an annual cost of capital of 12 per cent. Ignore taxation. (a) Determine the relevant cash flows arising from a decision to continue operations until the end of the lease period rather than to close immediately. (b) Calculate the net present value of continuing operations until the end of the lease period rather than closing immediately.

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a The relevant cash flows arising from a decision to continue operations until the end of the lease ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started