Answered step by step

Verified Expert Solution

Question

1 Approved Answer

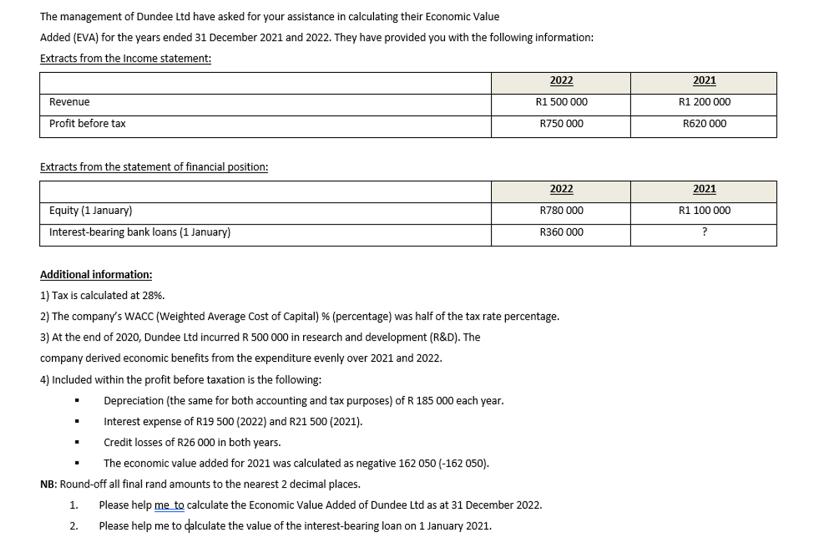

The management of Dundee Ltd have asked for your assistance in calculating their Economic Value Added (EVA) for the years ended 31 December 2021

The management of Dundee Ltd have asked for your assistance in calculating their Economic Value Added (EVA) for the years ended 31 December 2021 and 2022. They have provided you with the following information: Extracts from the Income statement: Revenue Profit before tax Extracts from the statement of financial position: Equity (1 January) Interest-bearing bank loans (1 January) Additional information: 2022 R1 500 000 R750 000 2022 2021 R1 200 000 R620 000 2021 R780 000 R360 000 R1 100 000 ? 1) Tax is calculated at 28%. 2) The company's WACC (Weighted Average Cost of Capital) % (percentage) was half of the tax rate percentage. 3) At the end of 2020, Dundee Ltd incurred R 500 000 in research and development (R&D). The company derived economic benefits from the expenditure evenly over 2021 and 2022. 4) Included within the profit before taxation is the following: Depreciation (the same for both accounting and tax purposes) of R 185 000 each year. Interest expense of R19 500 (2022) and R21 500 (2021). Credit losses of R26 000 in both years. The economic value added for 2021 was calculated as negative 162 050 (-162 050). NB: Round-off all final rand amounts to the nearest 2 decimal places. 1. Please help me to calculate the Economic Value Added of Dundee Ltd as at 31 December 2022. 2. Please help me to calculate the value of the interest-bearing loan on 1 January 2021.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started