Answered step by step

Verified Expert Solution

Question

1 Approved Answer

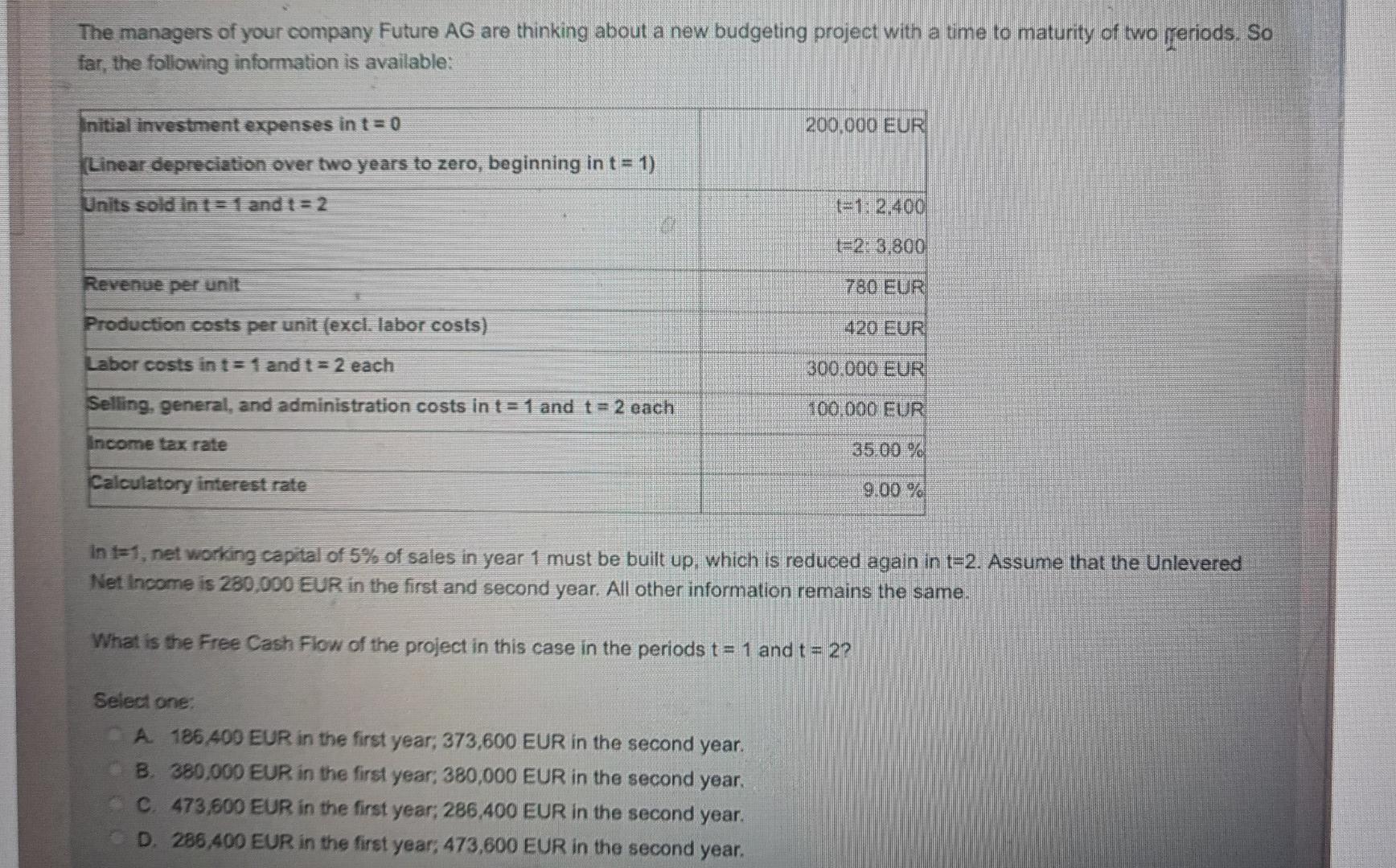

The managers of your company Future AG are thinking about a new budgeting project with a time to maturity of two periods. So far, the

The managers of your company Future AG are thinking about a new budgeting project with a time to maturity of two periods. So far, the following information is available: 200.000 EUR Initial investment expenses in t = 0 (Linear depreciation over two years to zero, beginning in t= 1) Units sold in tand t = 2 1:2.4001 23.800 Revenue per unit 780 EUR Production costs per unit (excl. labor costs) 420 EUR Labor costs in t= fandt = 2 each 300.000 EUR Selling, general, and administration costs in t = 1 and t = 2 each 100.000 EUR income tax rate 35.00 % Calculatory interest rate 9.00 In t=1, net working capital of 5% of sales in year 1 must be built up, which is reduced again in t=2. Assume that the Unlevered Net Income is 280.000 EUR in the first and second year. All other information remains the same. What is the Free Cash Flow of the project in this case in the periods t = 1 and t = 2? Select one A 186 400 EUR in the first year, 373,600 EUR in the second year. B. 380.000 EUR in the first year, 380,000 EUR in the second year. C. 473,600 EUR in the first year: 286,400 EUR in the second year. D. 286 400 EUR in the first year, 473,600 EUR in the second year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started