Question

The manufacturing and selling data for Lost Online Inc. for the year 2019 is given below: - - - - Selling price .. $20 /kg

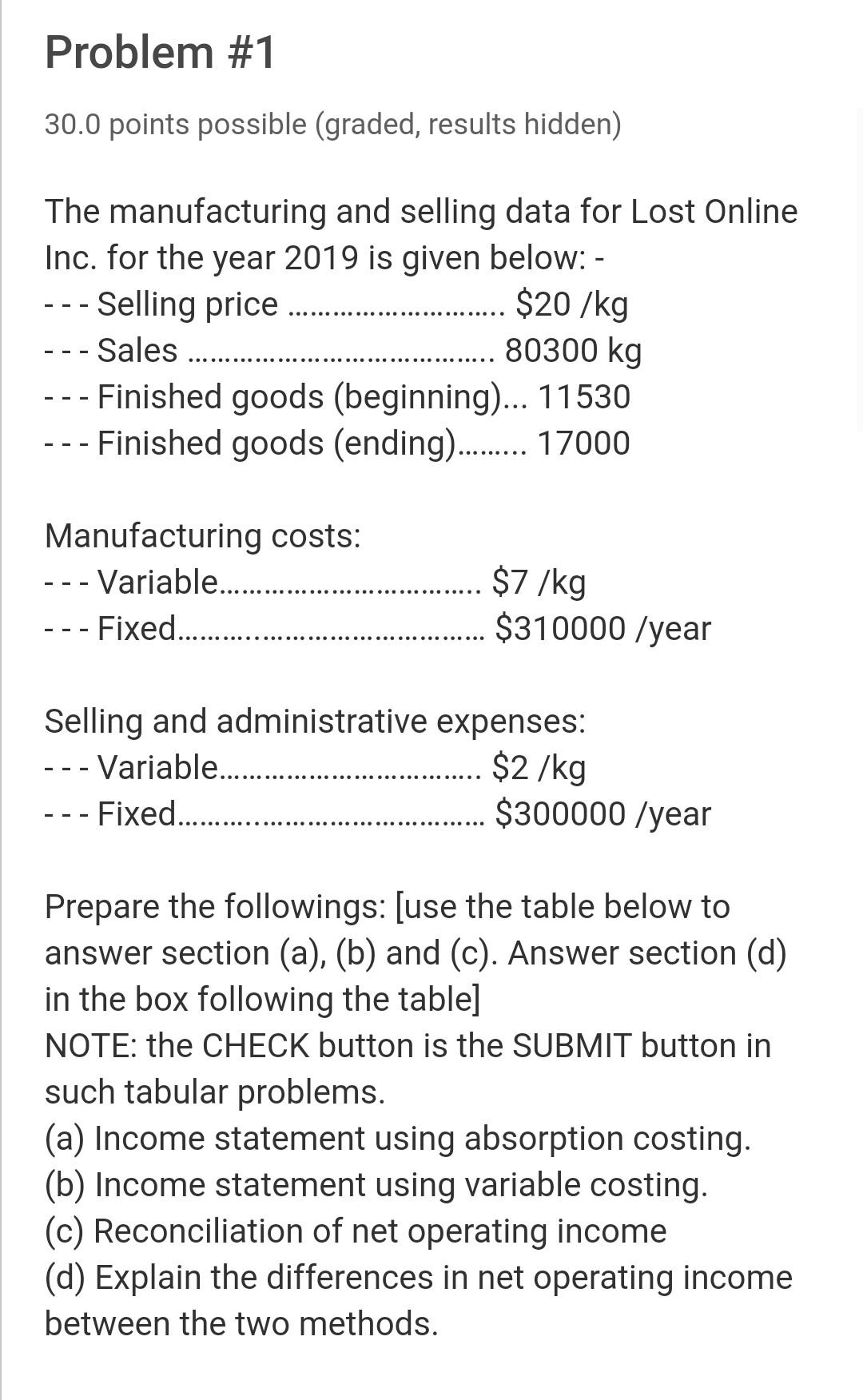

The manufacturing and selling data for Lost Online Inc. for the year 2019 is given below: - - - - Selling price .. $20 /kg - - - Sales .. 80300 kg - - - Finished goods (beginning)... 11530 - - - Finished goods (ending)... 17000

Manufacturing costs: - - - Variable.. $7 /kg - - - Fixed.. $310000 /year

Selling and administrative expenses: - - - Variable.. $2 /kg - - - Fixed.. $300000 /year

Prepare the followings: [use the table below to answer section (a), (b) and (c). Answer section (d) in the box following the table] NOTE: the CHECK button is the SUBMIT button in such tabular problems. (a) Income statement using absorption costing. (b) Income statement using variable costing. (c) Reconciliation of net operating income (d) Explain the differences in net operating income between the two methods.

Problem #1 30.0 points possible (graded, results hidden) ........ The manufacturing and selling data for Lost Online Inc. for the year 2019 is given below: - --- Selling price $20 /kg --- Sales ...... 80300 kg --- Finished goods (beginning)... 11530 --- Finished goods (ending)......... 17000 Manufacturing costs: -- Variable............. --- Fixed...... $7 /kg $310000 /year Selling and administrative expenses: --- Variable... $2 /kg - Fixed............ $300000 /year Prepare the followings: [use the table below to answer section (a), (b) and (c). Answer section (d) in the box following the table] NOTE: the CHECK button is the SUBMIT button in such tabular problems. (a) Income statement using absorption costing. (b) Income statement using variable costing. (c) Reconciliation of net operating income (d) Explain the differences in net operating income between the two methods. (a) Absorption costing income statement Details $ $ text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response (b) Variable costing income statement Details $ text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response text response numeric response numeric response numeric response numeric response text response (c) Reconciling the net income of the two methods Details $ text response numeric response text response numeric response text response numeric responseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started