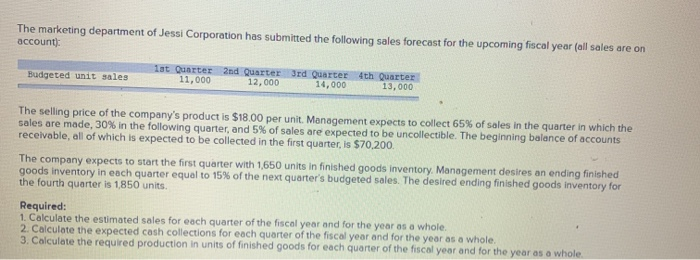

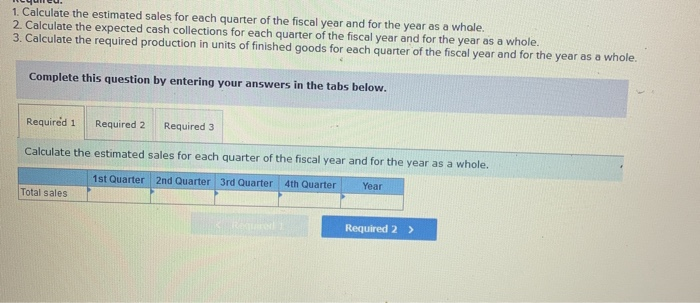

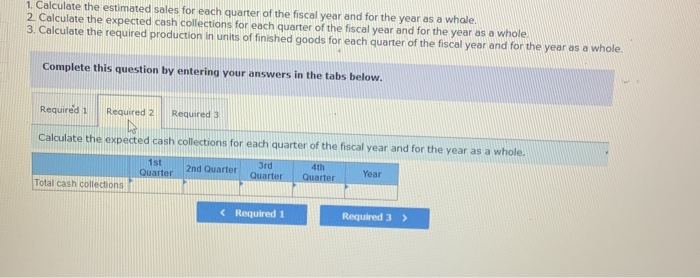

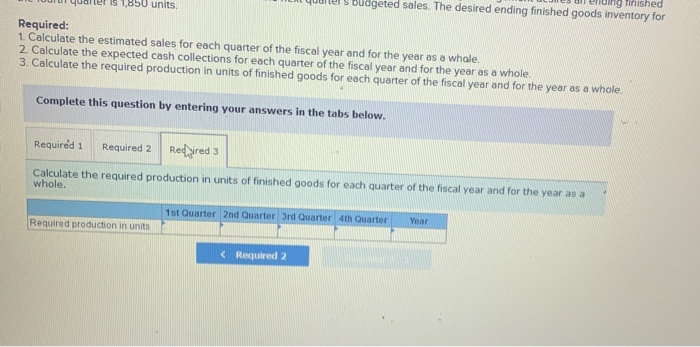

The marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year (all sales are on account): Ist Quarter 2nd Quarter 3rd Quarter 4th Quarter 11,000 12,000 14,000 13,000 Budgeted unit sales The selling price of the company's product is $18.00 per unit. Management expects to collect 65% of sales in the quarter in which the sales are made, 30% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $70.200 The company expects to start the first quarter with 1650 units in finished goods inventory Management desires an ending finished goods inventory in each quarter equal to 15% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 1,850 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2. Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 3. Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whole 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2. Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 3. Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whole. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Total sales Required 2 > 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2. Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 3. Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whole. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 1st od 3rd 2nd Quarter Quarter 4th Year Quarter Quarter Total cash collections (Required 1 Required 3 > yures budgeted sales. The desired ending finished goods inventory lor que $ 1,050 units Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2. Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 3. Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whole Complete this question by entering your answers in the tabs below. Required 1 Required 2 Red Sired 3 Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whole. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Required production in units