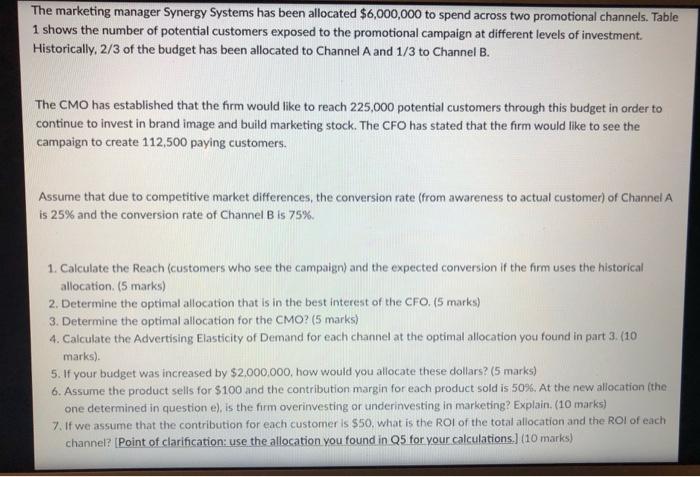

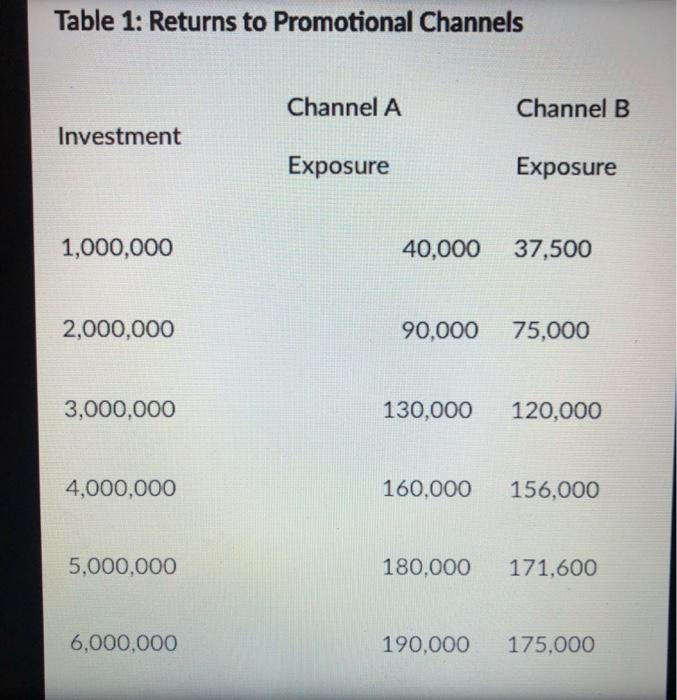

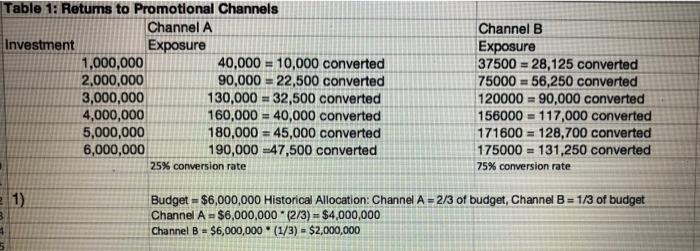

The marketing manager Synergy Systems has been allocated $6,000,000 to spend across two promotional channels. Table 1 shows the number of potential customers exposed to the promotional campaign at different levels of investment Historically, 2/3 of the budget has been allocated to Channel A and 1/3 to Channel B. The CMO has established that the firm would like to reach 225.000 potential customers through this budget in order to continue to invest in brand image and build marketing stock. The CFO has stated that the firm would like to see the campaign to create 112,500 paying customers. Assume that due to competitive market differences, the conversion rate (from awareness to actual customer) of Channel A is 25% and the conversion rate of Channel B is 75%. 1. Calculate the Reach (customers who see the campaign) and the expected conversion if the firm uses the historical allocation. (5 marks) 2. Determine the optimal allocation that is in the best interest of the CFO. (5 marks) 3. Determine the optimal allocation for the CMO? (5 marks) 4. Calculate the Advertising Elasticity of Demand for each channel at the optimal allocation you found in part 3. (10 marks). 5. If your budget was increased by $2,000,000, how would you allocate these dollars? (5 marks) 6. Assume the product sells for $100 and the contribution margin for each product sold is 50%. At the new allocation (the one determined in question e), is the form overinvesting or underinvesting in marketing? Explain. (10 marks) 7. If we assume that the contribution for each customer is $50, what is the ROI of the total allocation and the ROI of each channel? [Point of clarification: use the allocation you found in Q5 for your calculations.) (10 marks) Table 1: Returns to Promotional Channels Channel A Channel B. Investment Exposure Exposure 1,000,000 40,000 37,500 2,000,000 90,000 75,000 3,000,000 130,000 120,000 4,000,000 160,000 156,000 5,000,000 180,000 171,600 6,000,000 190.000 175.000 Table 1: Returns to Promotional Channels Channel A Investment Exposure 1,000,000 40,000 = 10,000 converted 2,000,000 90,000 = 22,500 converted 3,000,000 130,000 -- 32,500 converted 4,000,000 160,000 = 40,000 converted 5,000,000 180,000 = 45,000 converted 6,000,000 190,000 -47,500 converted 25% conversion rate Channel B Exposure 37500 = 28,125 converted 75000 - 56,250 converted 120000 = 90,000 converted 156000 = 117,000 converted 171600 = 128,700 converted 175000 = 131,250 converted 75% conversion rate 1) Budget = $6,000,000 Historical Allocation: Channel A = 2/3 of budget, Channel B = 1/3 of budget Channel A = $6,000,000 * (2/3) - $4,000,000 Channel B = $6,000,000 (1/3) = $2,000,000 3