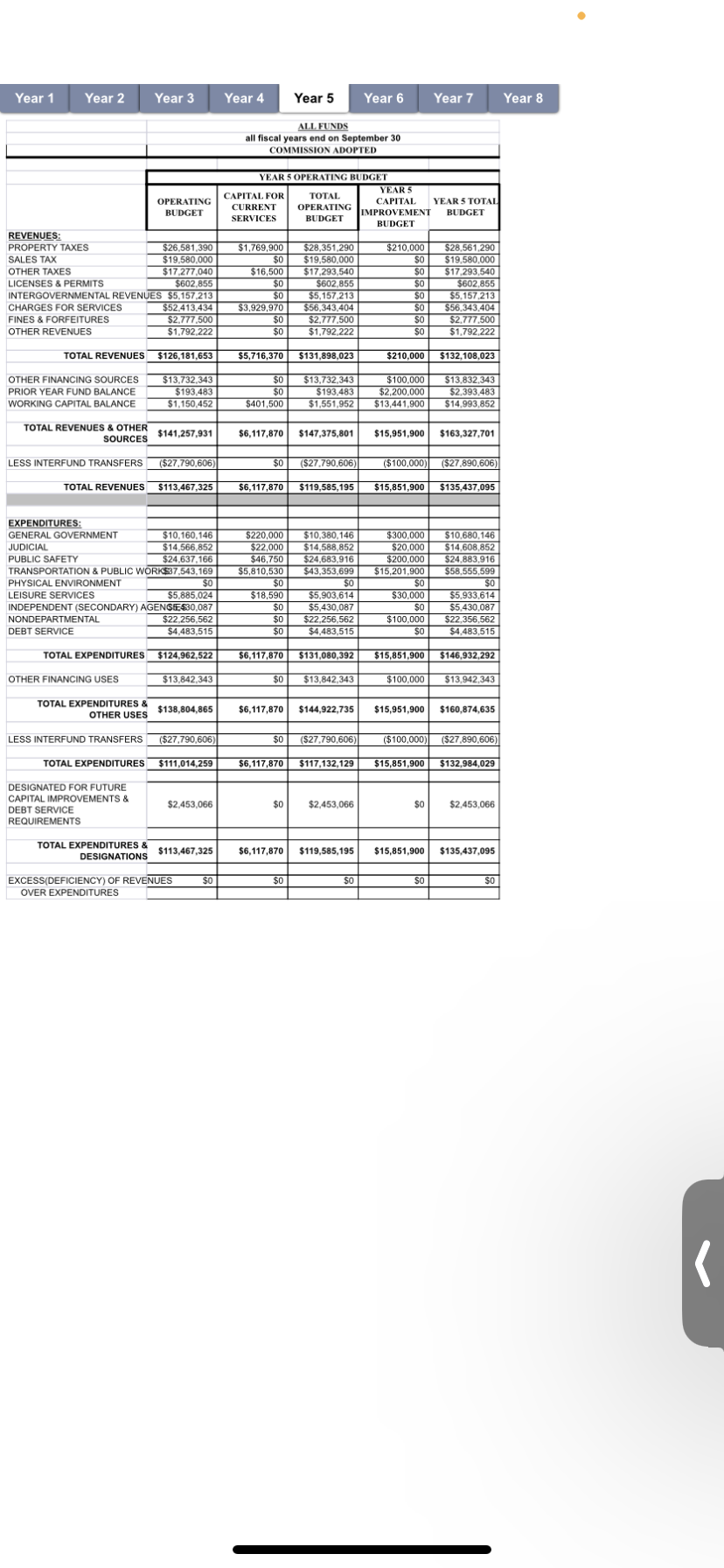

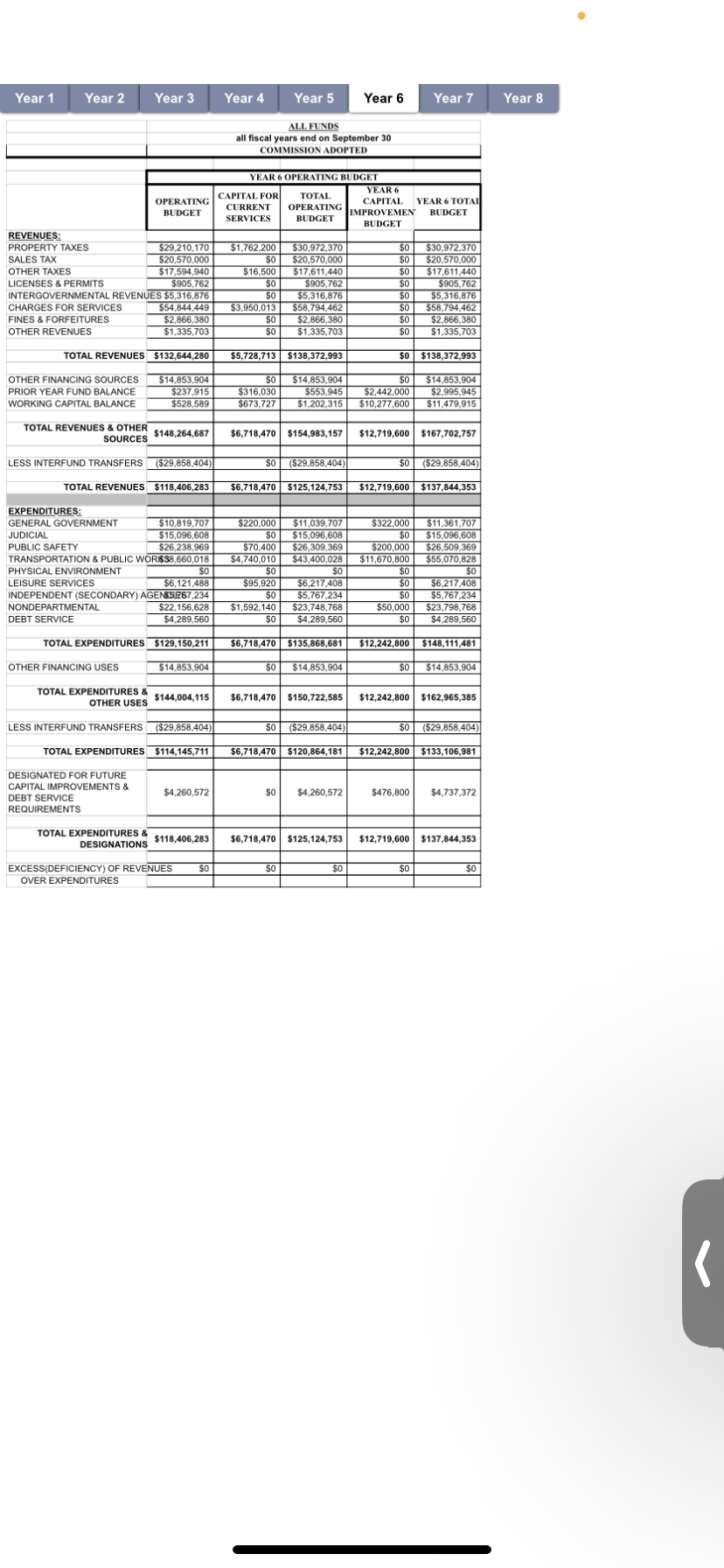

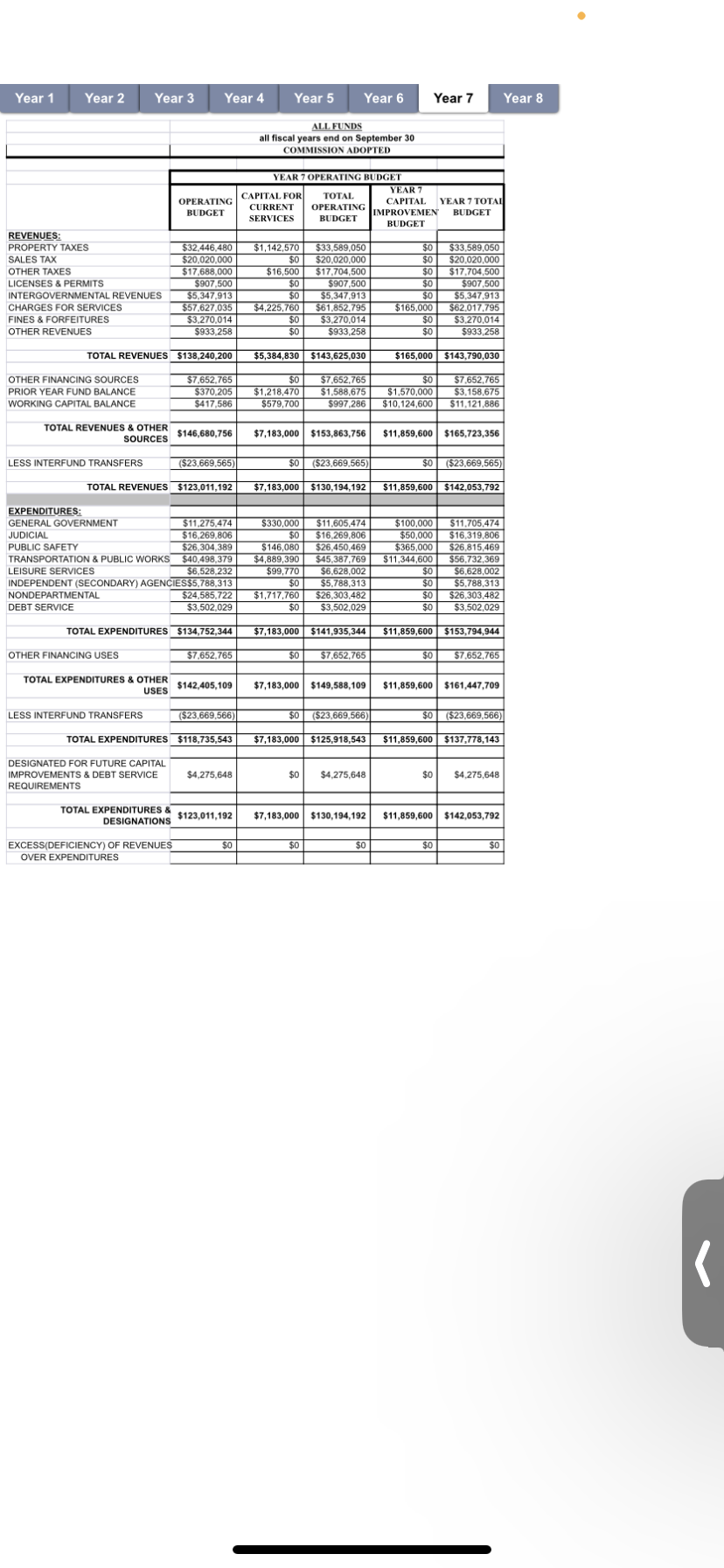

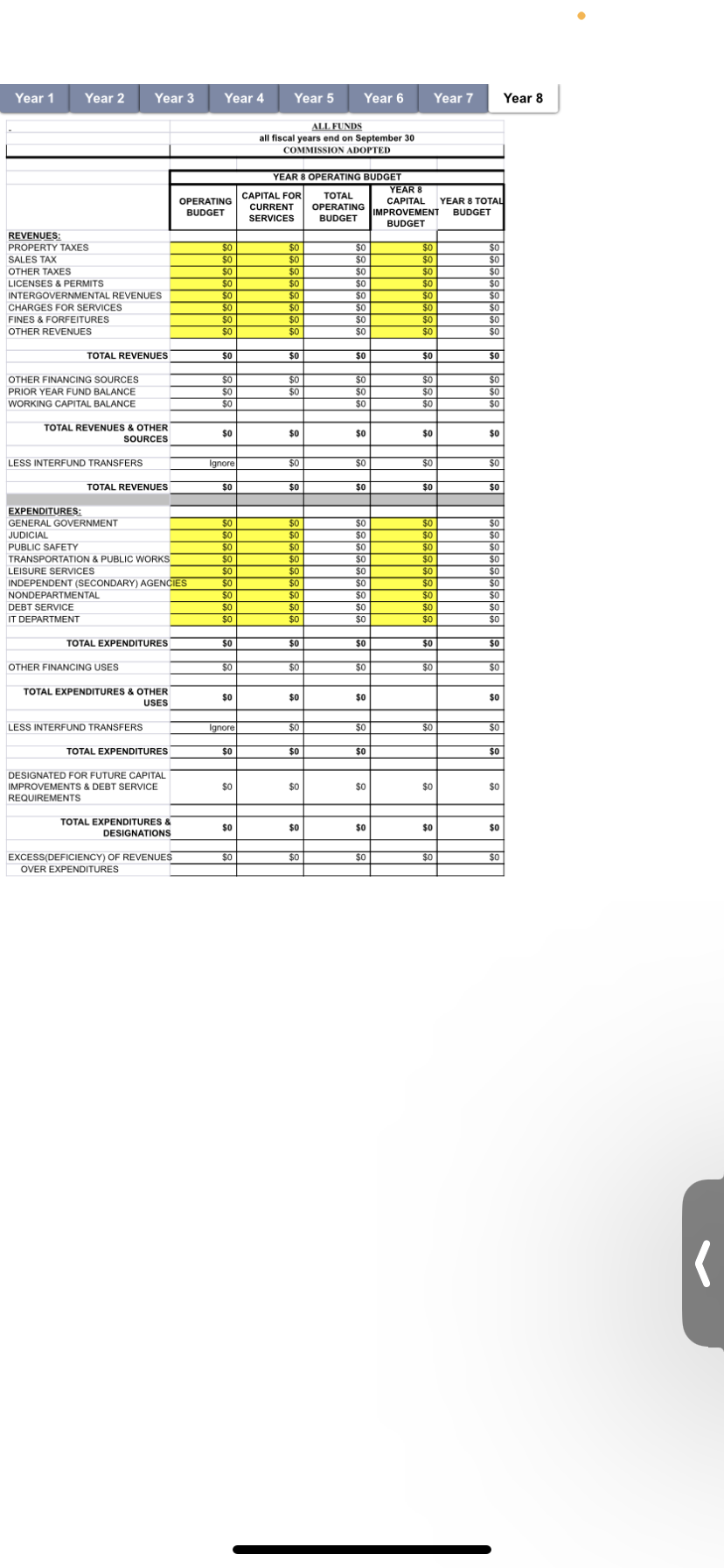

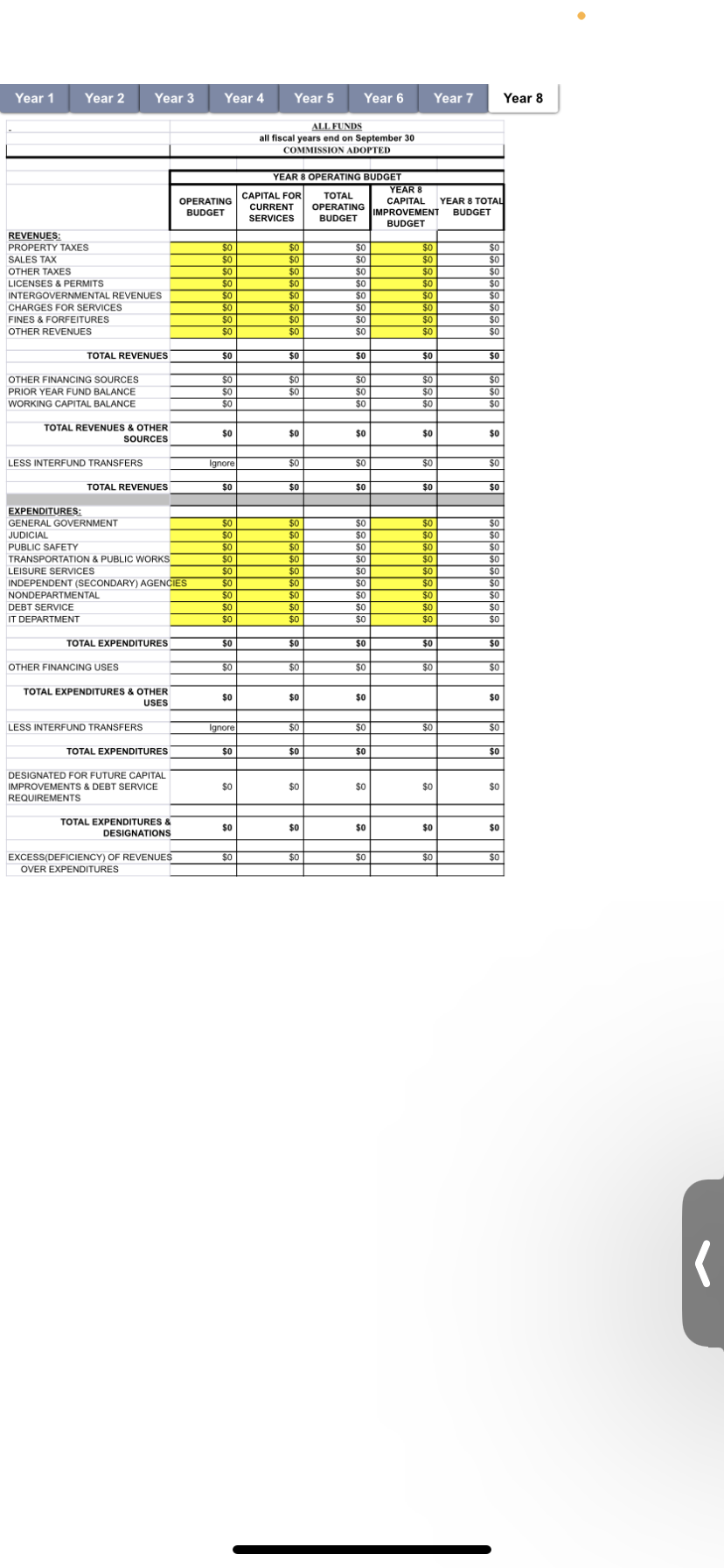

The mayor of a small town recently discovered that the towns Finance and Accounting Department was engaged in many corrupt activities. As a result, the mayor fired everyone associated with planning the citys budget and now need your help to prepare the annual budget. The town was formed 8 years ago, after seceding from a larger town. As a result, the mayor only has budget information for the past 7 years. The attached Microsoft excel file details the towns revenue and expenditure during the 7-year period. The mayor needs your help to figure out the towns estimated revenue and expenditure for Year 8.

You need to estimate the towns revenue and expenditure for Fiscal Year 8, based on Year 1-7 data. The budget should be balanced, where expenditures are very close to revenue. Also, please provide a detailed explanation of the revenue and expenditure numbers.

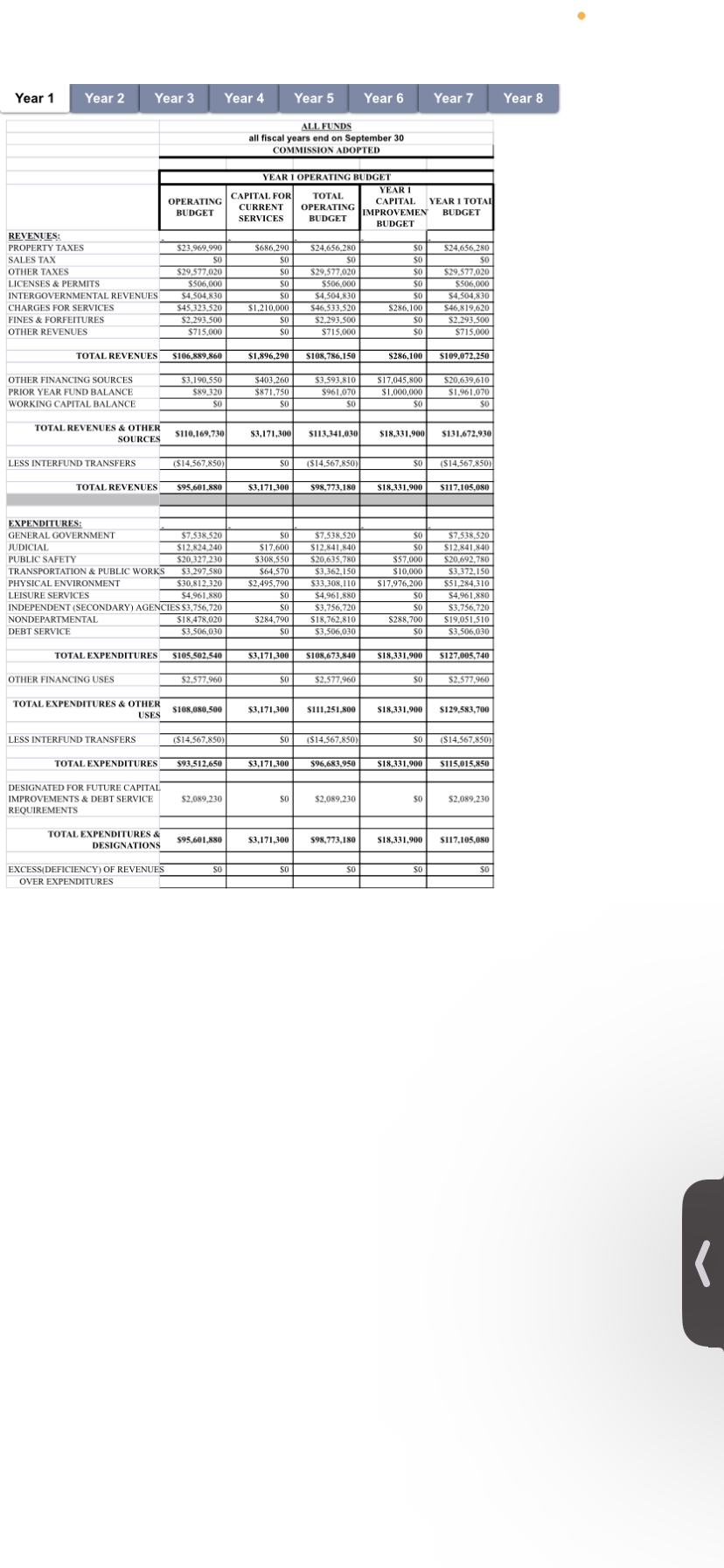

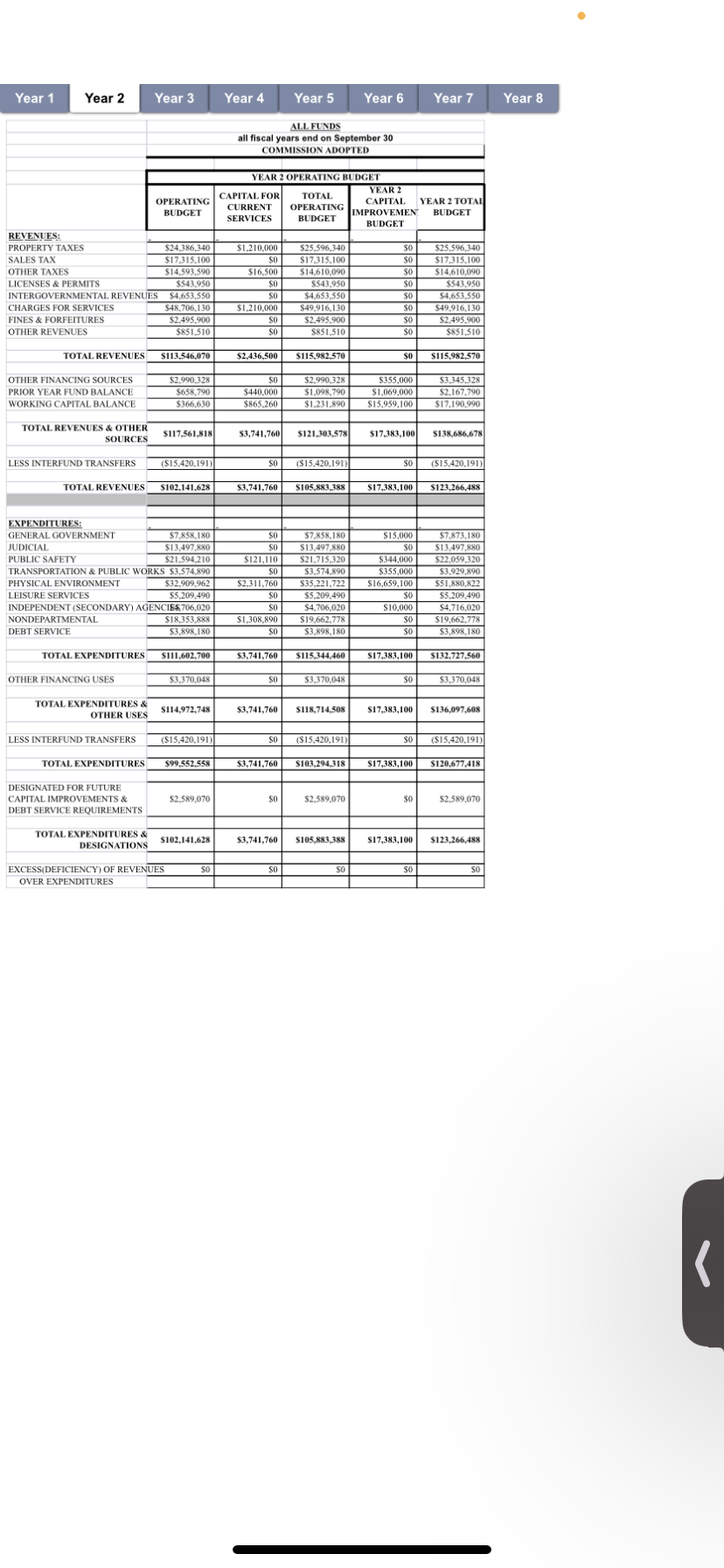

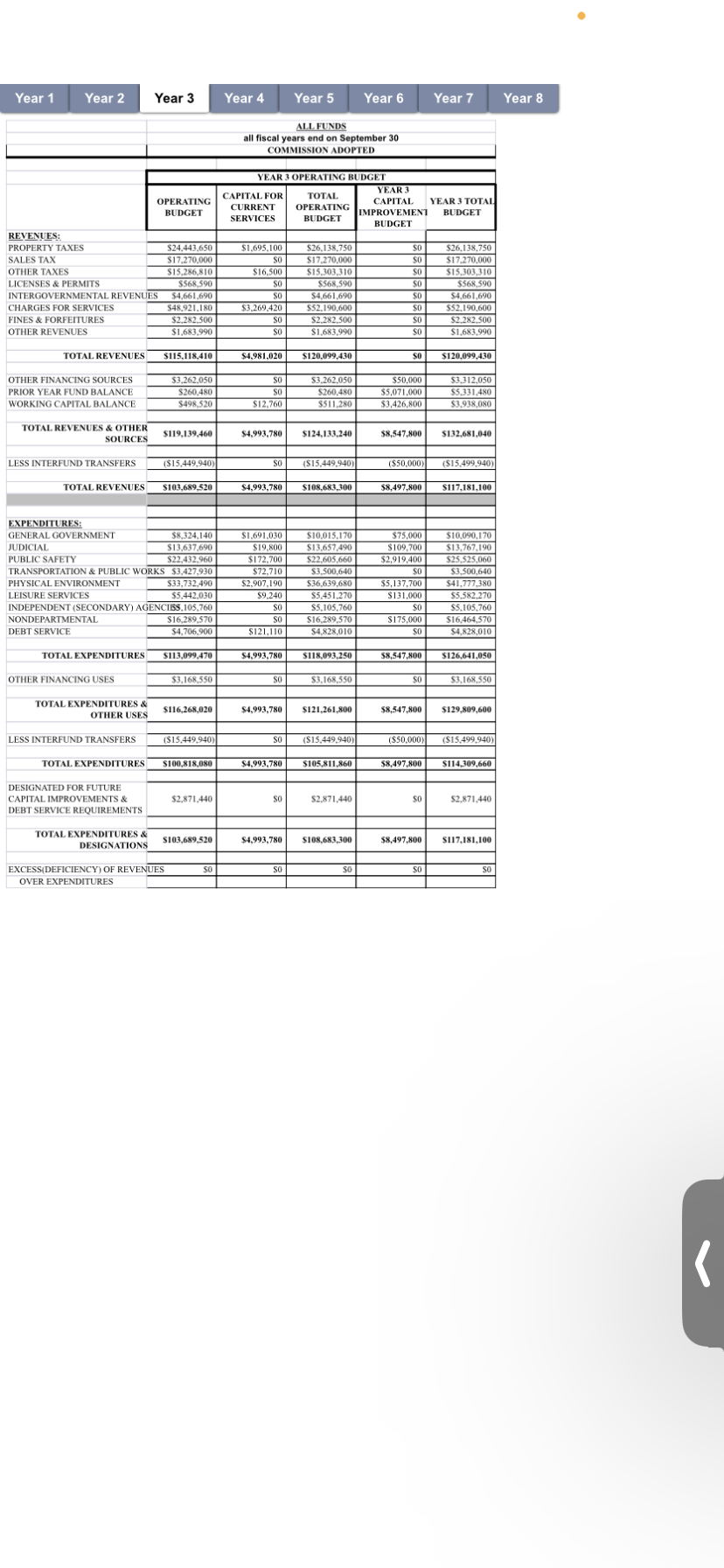

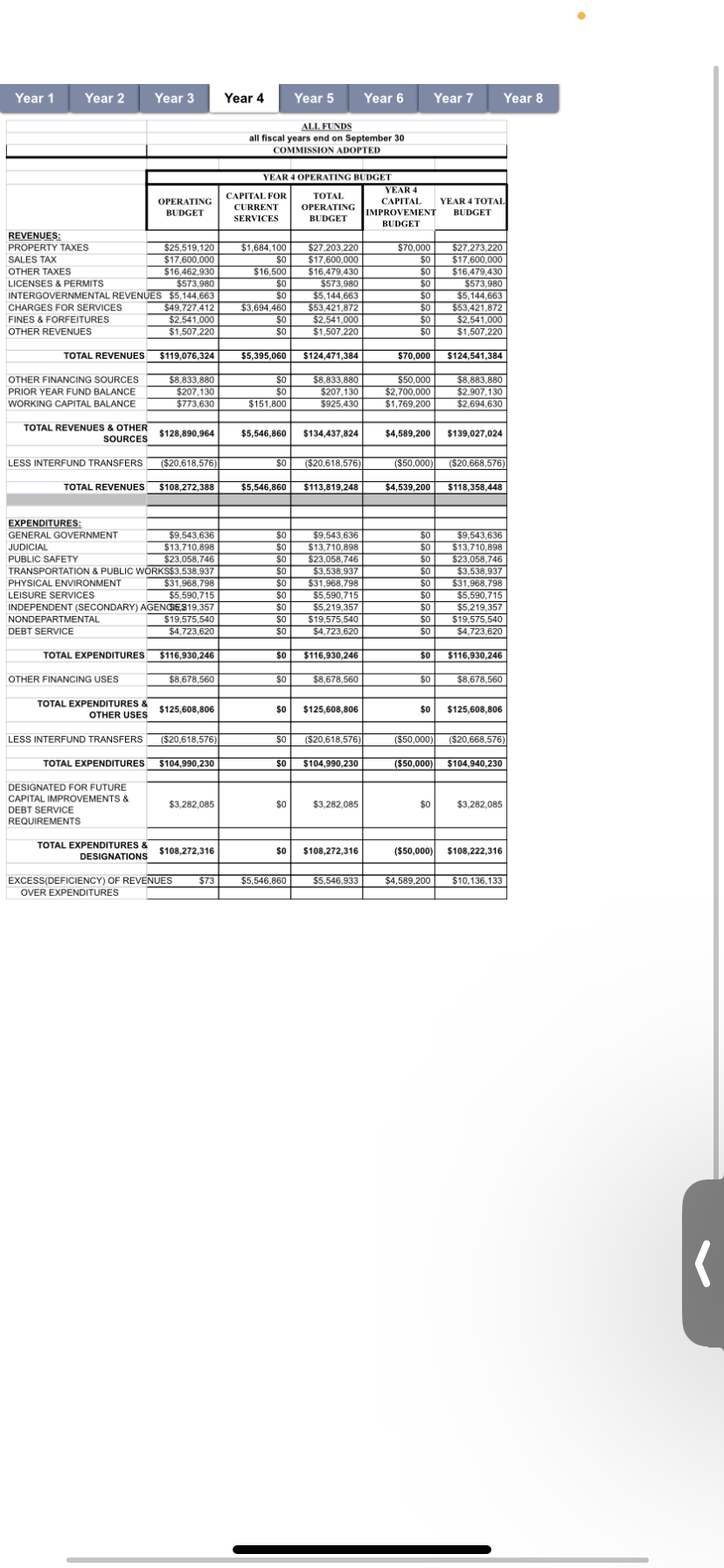

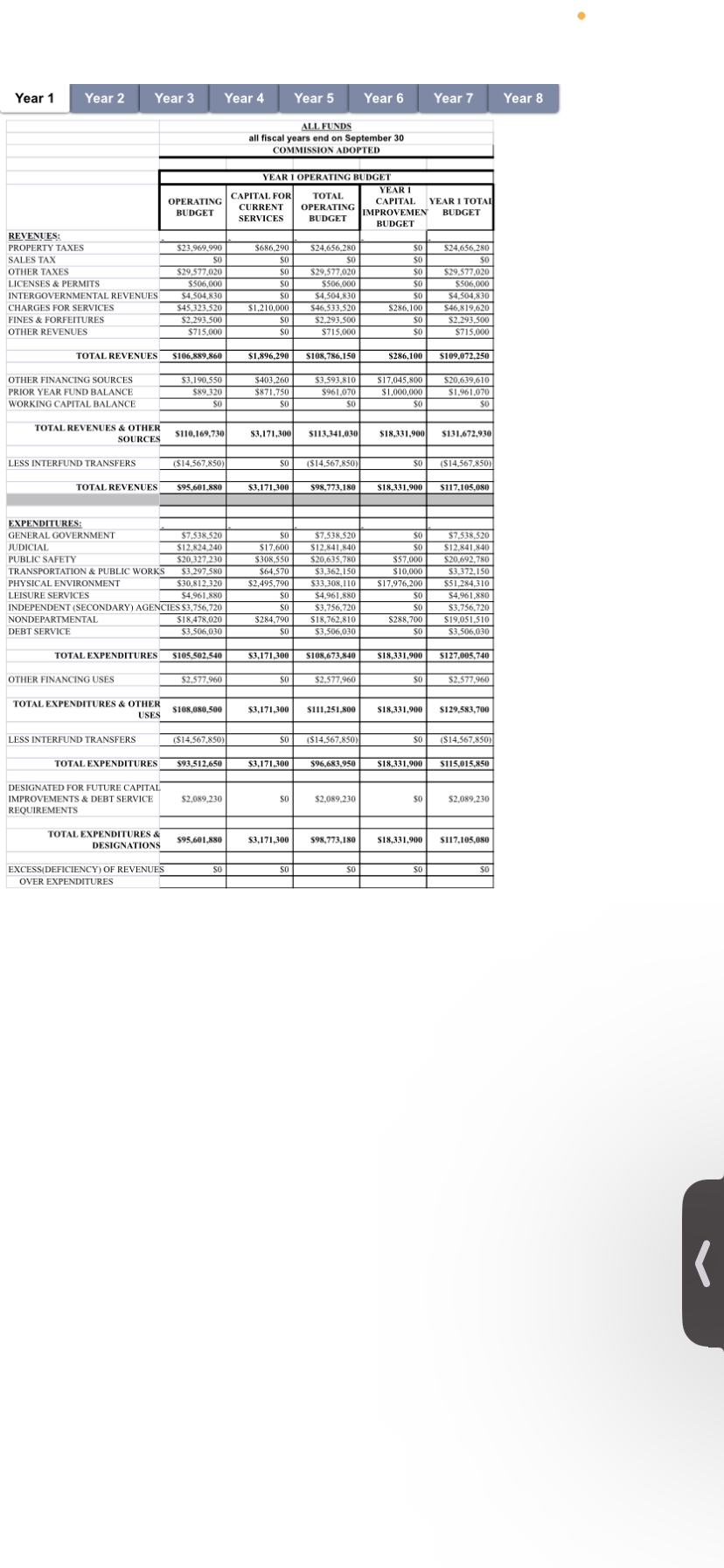

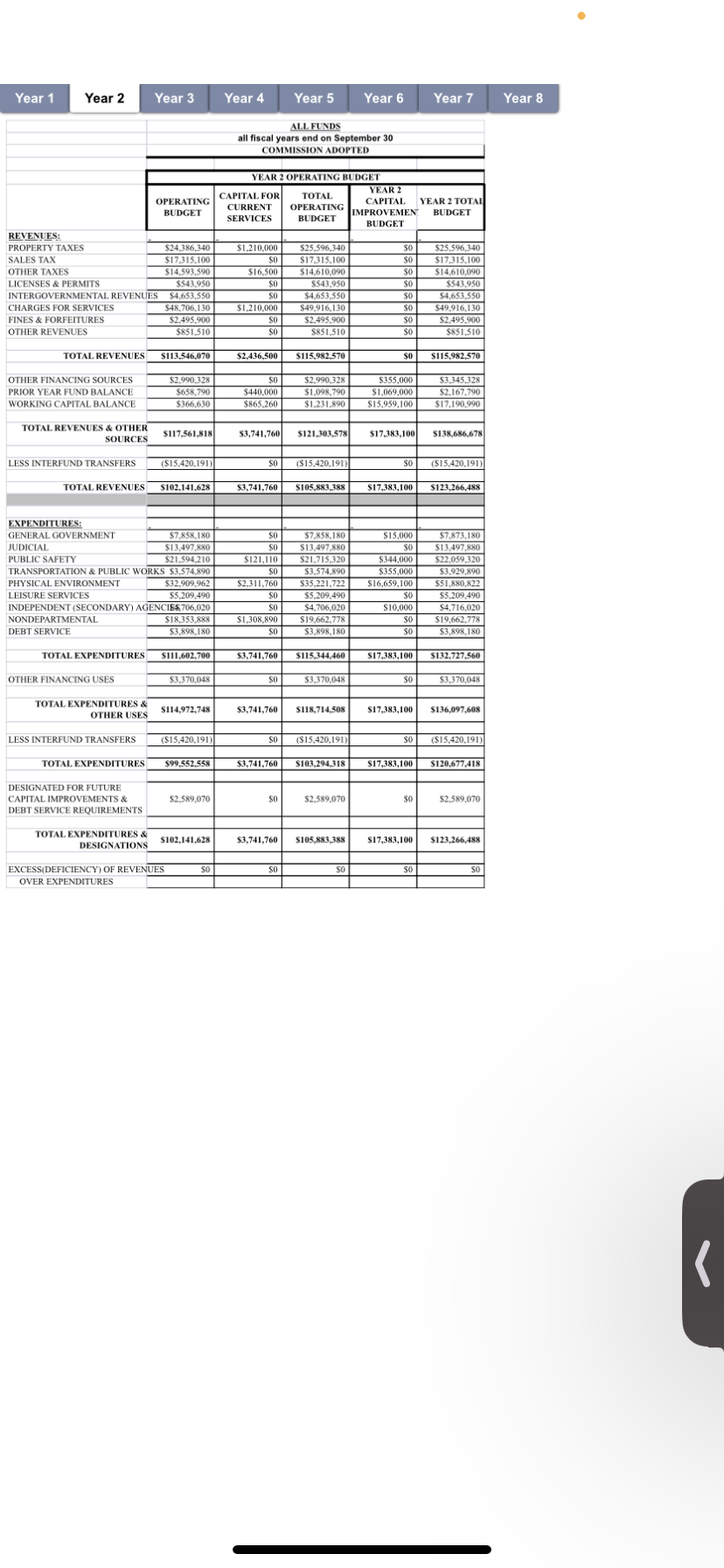

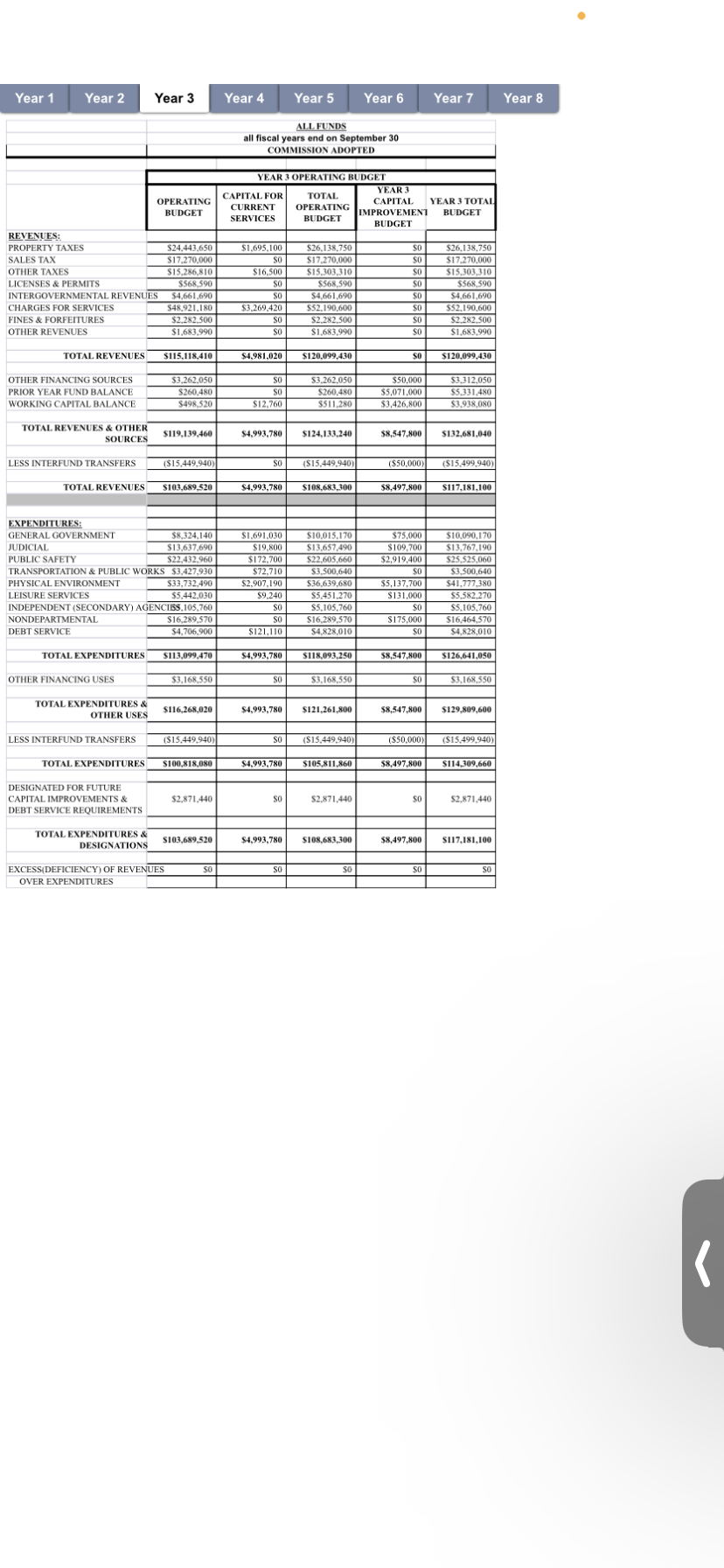

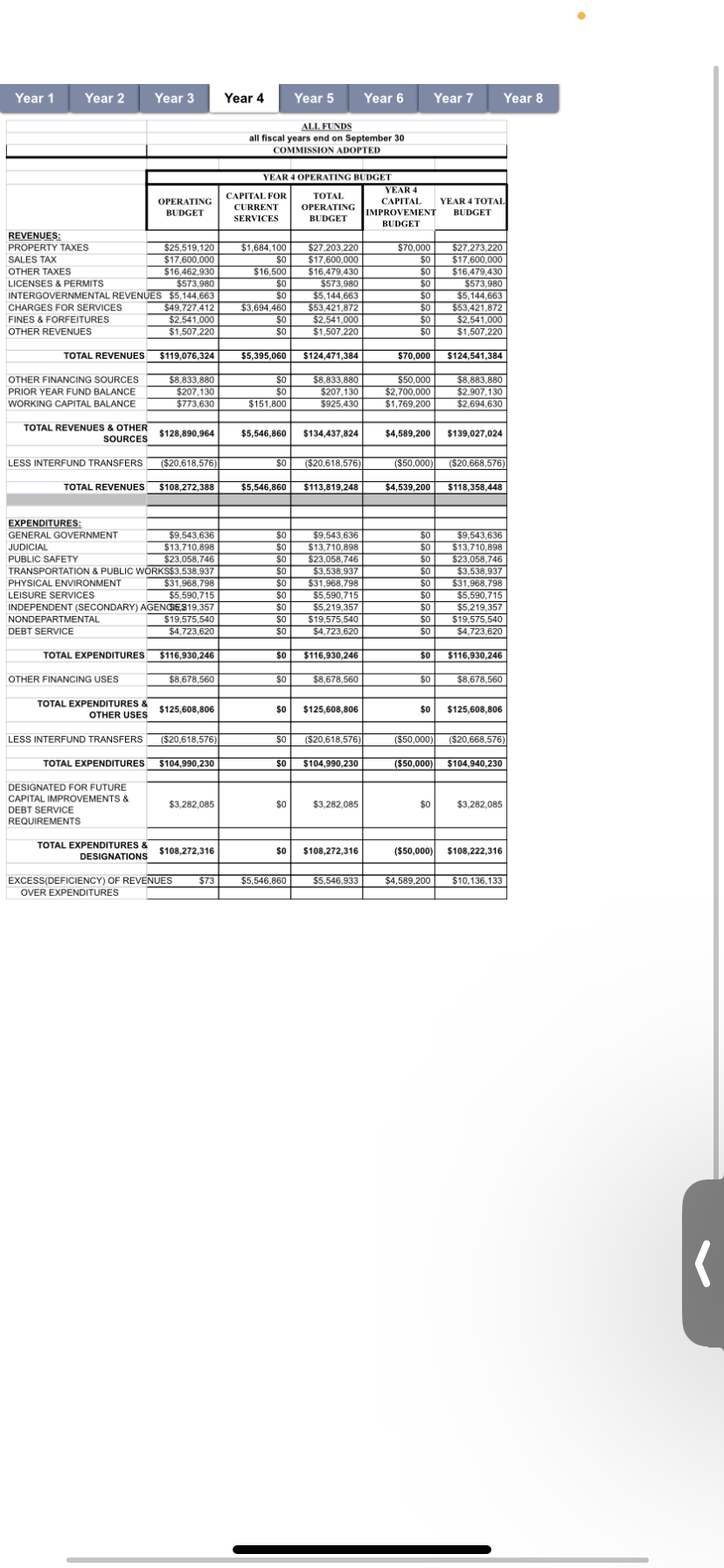

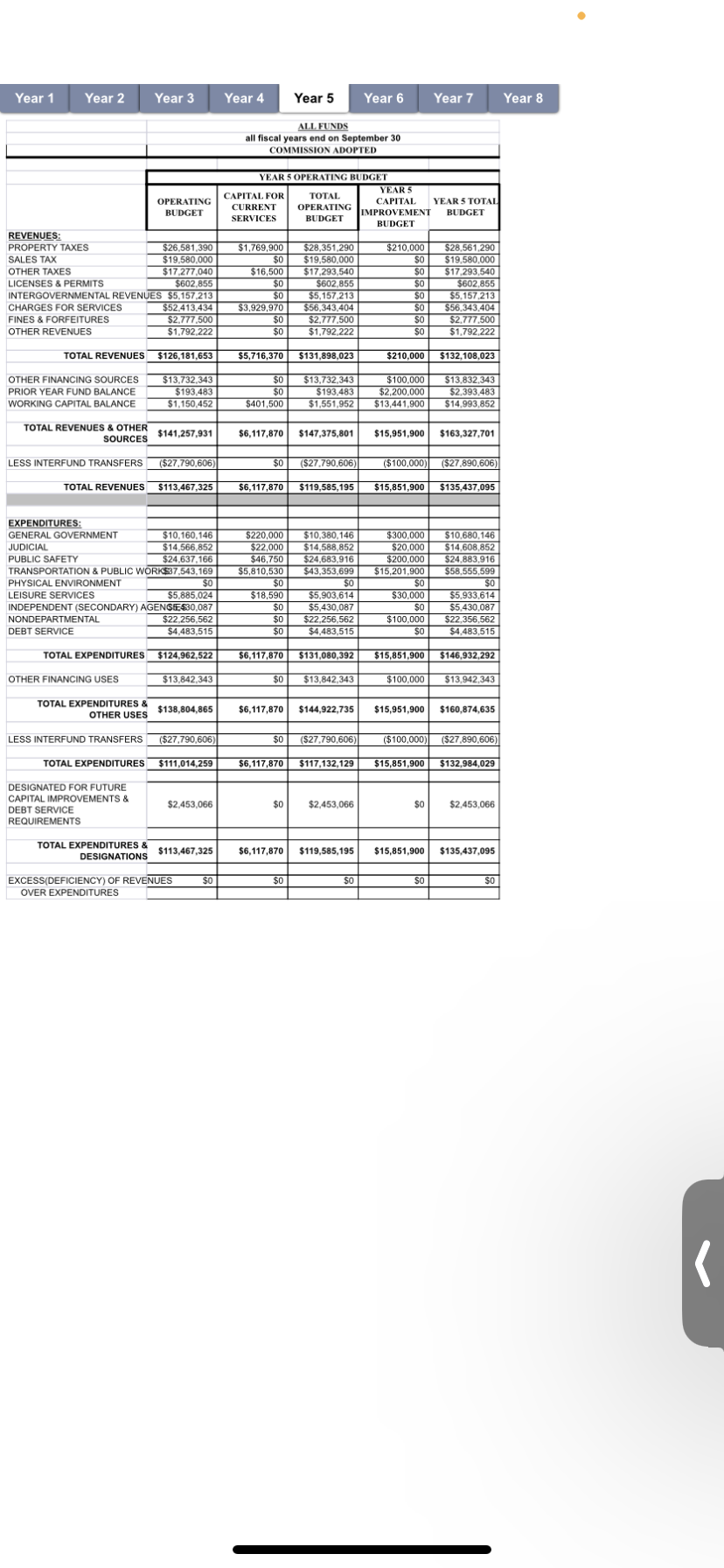

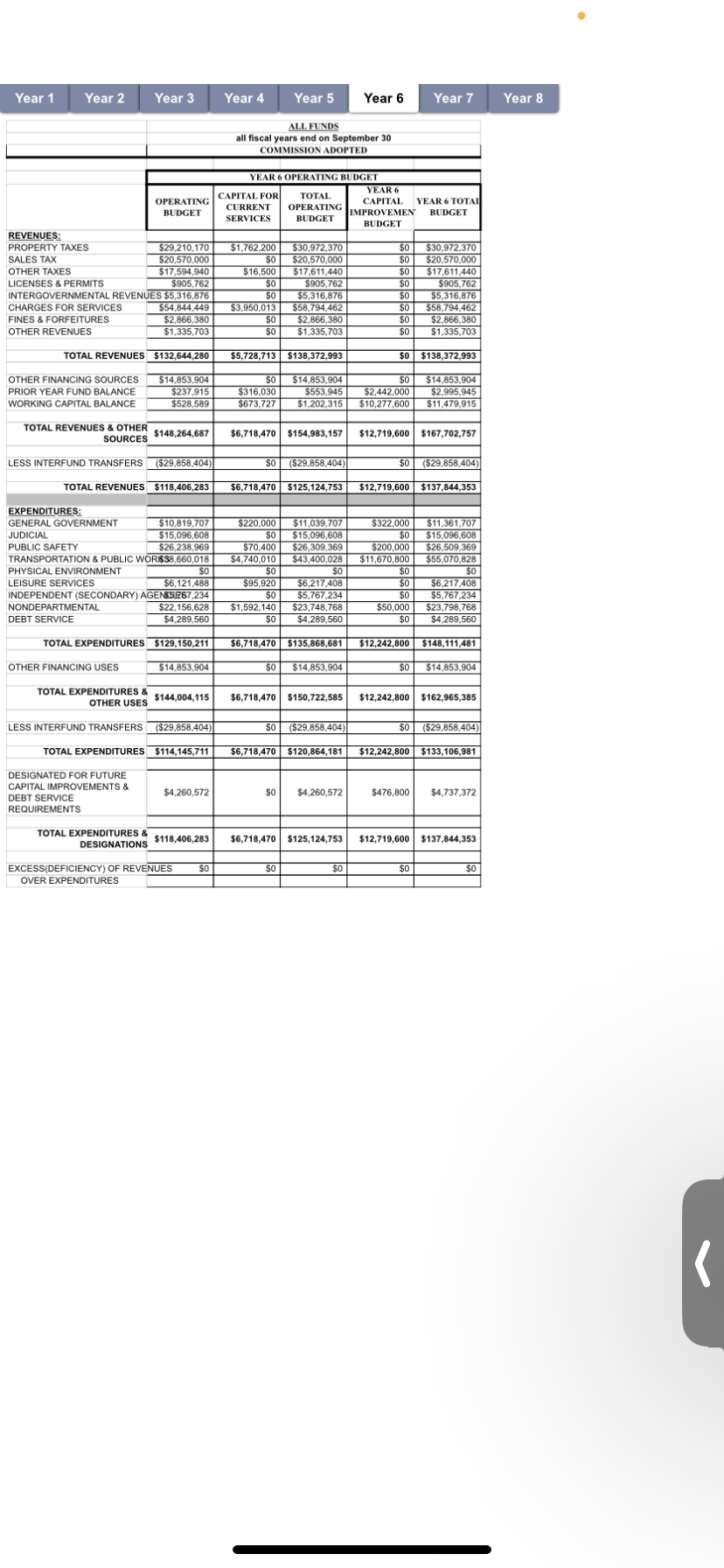

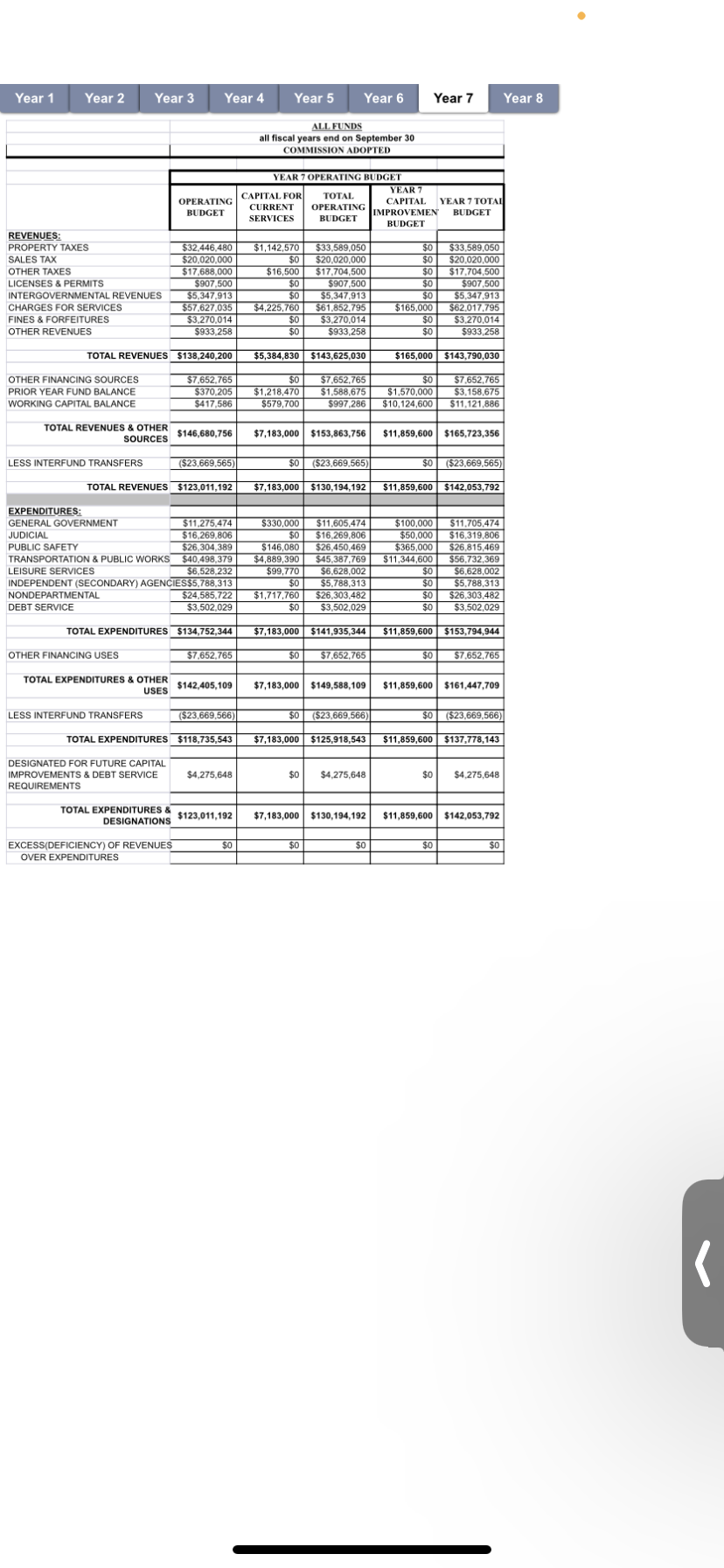

\begin{tabular}{|c|c|c|c|c|c|} \hline \multirow[t]{6}{*}{ Year 1} & Tear 3 & Year 4 & Year 5 & Year 6 & Year 7 \\ \hline & \multicolumn{5}{|c|}{ ALLFUNDS } \\ \hline & \multicolumn{5}{|c|}{\begin{tabular}{l} all fiscal years end on September 30 \\ COMMISsIO ADOPTED \end{tabular}} \\ \hline & \multicolumn{5}{|c|}{ COMMISSION ADOPTED } \\ \hline & \multicolumn{5}{|c|}{ YEAR I OPERATING BUDGET } \\ \hline & \begin{tabular}{l} OPERATING \\ BUDGET \end{tabular} & \begin{tabular}{c} CAPITAL FOR \\ CURRENT \\ SERVICES \end{tabular} & \begin{tabular}{c} TOTAL. \\ OPERATING \\ BUDGET \\ \end{tabular} & \begin{tabular}{c} YEAR 1 \\ CAPITAL \\ IMPROVEMEN \\ BUDGET \end{tabular} & \begin{tabular}{l} YEAR 1 TOTAI \\ BUDGET \end{tabular} \\ \hline \multicolumn{6}{|l|}{ REVENUES: } \\ \hline PROPERTY TAXES & $23,969,990 & $686,290 & $24,656,280 & $s0 & $24,656,280 \\ \hline SALES TAX & $0 & so & so & so & 50 \\ \hline OTHER TAXES & $29,577,020 & $0 & $29,577,020 & so & $29,577,020 \\ \hline LICENSES \& PERMITS & $506,000 & $0 & $506,000 & & $506,000 \\ \hline INTERGOVERNMENTAL REVENUES & 54,504,830 & $ & 54,504,830 & 50 & $4,504,830 \\ \hline CHARGES FOR SERVICES & 545,323,520 & $1,210,000 & $46,533,520 & $286,100 & $46,819,620 \\ \hline FINES \& FORFEITURES & $2,293,500 & $0 & $2,293,500 & $0 & $2,293,500 \\ \hline OTHER REVENUES & $715,000 & $0 & $715,000 & 50 & $715,000 \\ \hline \multirow[t]{2}{*}{ TOTAL REVENUES } & $106,889,860 & $1,896,290 & $108,786,150 & $286,100 & $109,072,250 \\ \hline & \multirow[b]{2}{*}{$3,190,550} & & & & \\ \hline OTHER FINANCING SOURCES & & $403,260 & $3,593,810 & $17,045,800 & $20,639,610 \\ \hline PRIOR YEAR FUND BALANCE & $89,320 & $871,750 & $961,070 & $1,000,000 & $1,961,070 \\ \hline WORKING CAPITAL BALANCE & so & $0 & so & & 50 \\ \hline \begin{tabular}{r} TOTAL REVENUES \& OTHER \\ SOURCES \end{tabular} & $110,169,730 & $3,171,300 & $113,341,030 & $18,331,900 & $131,672,930 \\ \hline LESS INTERFUND TRANSFERS & ($14,567,850) & $0 & ($14,567,850) & $ & ($14,567,850) \\ \hline \multirow{3}{*}{ TOTAL REVENUES } & \begin{tabular}{l|l|} 595,601,880 \\ \end{tabular} & $3,171,300 & $98,773,180 & \begin{tabular}{l|l|} $18,331,900 & \\ \end{tabular} & $117,105,080 \\ \hline & & & & 310,831,900 & 3117,105,080 \\ \hline & & & & & \\ \hline \multicolumn{6}{|l|}{ EXPENDITURES: } \\ \hline GENERAL GOVERNMENT & $57,538,520 & $0 & $7,538,520 & so & $7,538,520 \\ \hline JUDICLAL & $12,824,240 & $17,600 & $12,841,840 & so & $12,841,840 \\ \hline PUBLIC SAFETY & $20,327,230 & $308,550 & $20,635,780 & $57,000 & $20,692,780 \\ \hline TRANSPORTATION \& PUBLIC WORKS & $3,297,580 & $64,570 & $3,362,150 & $10,000 & $3,372,150 \\ \hline PHYSICAL ENVIRONMENT & $30,812,320 & $2,495,790 & $33,308,110 & $17,976,200 & $51,284,310 \\ \hline LEISURE SERVICES & $4,961,880 & $0 & $4,961,880 & & $4,961,880 \\ \hline INDEPENDENT (SECONDARY) AGENC & CIES $3,756,720 & $0 & $3,756,720 & 50 & $3,756,720 \\ \hline NONDEPARTMENTAL & $18,478,020 & $284,790 & $18,762,810 & \begin{tabular}{l|l|} $288,700 & \\ \end{tabular} & $19,051,510 \\ \hline DEBT SERVICE & $3,506,030 & $0 & $3,506,030 & $0 & $3,506,030 \\ \hline TOTAL EXPENDITURES & $105,502,540 & $3,171,300 & 5108,673,840 & \begin{tabular}{l|l|l} 518,331,900 \\ \end{tabular} & $127,005,740 \\ \hline OTHER FINANCING USES & $2,577,960 & $0 & $2,577,960 & 50 & $2,577,960 \\ \hline \begin{tabular}{r} TOTAL EXPENDITURES \& OTHER \\ USES \end{tabular} & $108,080,500 & $3,171,300 & $111,251,800 & $18,331,900 & $129,583,700 \\ \hline LESS INTERFUND TRANSFERS & ($14,567,850) & $0 & ($14,567,850) & & ($14,567,850) \\ \hline TOTAL EXPENDITURES & $93,512,650 & $3,171,300 & $96,683,950 & $18,331,900 & $115,015,850 \\ \hline \begin{tabular}{l} DESIGNATED FOR FUTURE CAPITAL \\ IMPROVEMENTS \& DEBT SERVICE \\ REQUIREMENTS \end{tabular} & $2,089,230 & so & $2,089,230 & so & $2,089,230 \\ \hline \begin{tabular}{r} TOTAL EXPENDITURES \& \\ DESIGNATIONS \end{tabular} & $95,601,880 & $3,171,300 & $98,773,180 & $18,331,900 & $117,105,080 \\ \hline EXCESS(DEFICIENCY) OF REVENUES & \$0 & $0 & & \begin{tabular}{l|l|l} \\ \end{tabular} & $0 \\ \hline OVER EXPENDITURES & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow[t]{6}{*}{ Year 1} & Year 3 & Year 4 & Year 5 & Year 6 & Year 7 \\ \hline & \multicolumn{5}{|c|}{ ALLFUNDS } \\ \hline & \multicolumn{5}{|c|}{ all fiscal years end on September 30} \\ \hline & \multicolumn{5}{|c|}{ COMMISSION ADOPTED } \\ \hline & \multicolumn{5}{|c|}{ YEAR 3 OPERATING BUDGET } \\ \hline & \begin{tabular}{l} OPERATING \\ BUDGET \end{tabular} & \begin{tabular}{c} CAPITAL FOR \\ CURRENT \\ SERVICES \end{tabular} & \begin{tabular}{c} TOTAL \\ OPERATING \\ BUDGET \end{tabular} & \begin{tabular}{c} YEAR 3 \\ CAPITAL \\ IMPROVEMENT \\ BUDGET \end{tabular} & \begin{tabular}{c} YEAR 3 TOTAL \\ BUDGET \end{tabular} \\ \hline \multicolumn{6}{|l|}{ REVENUES: } \\ \hline PROPERTY TAXES & $24,443,650 & $1,695,100 & $26,138,750 & so & $26,138,750 \\ \hline SALES TAX & $17,270,000 & so & $17,270,000 & so & $17,270,000 \\ \hline OTHER TAXES & $15,286,810 & $16,500 & $15,303,310 & so & $15,303,310 \\ \hline LICENSES \& PERMITS & $568,590 & so & $568,590 & $0 & $568,590 \\ \hline INTERGOVERNMENTAL. REVENUE & 54,661,690 & so & $4,661,690 & $0 & $4,661,690 \\ \hline CHARGES FOR SERVICES & $48,921,180 & $3,269,420 & $52,190,600 & $0 & $52,190,600 \\ \hline FINES \& FORFEITURES & $2,282,500 & so & $2,282,500 & $0 & $2,282,500 \\ \hline OTHER REVENUES & $1,683,990 & so & $1,683,990 & so & $1,683,990 \\ \hline \multirow[t]{2}{*}{ TOTAL REVENUES } & $115,118,410 & $4,981,020 & $120,099,430 & so & $120,099,430 \\ \hline & & & & & \\ \hline OTHER FINANCING SOURCES & $3,262,050 & so & $3,262,050 & $50,000 & $3,312,050 \\ \hline \multirow{2}{*}{\begin{tabular}{l} PRIOR YEAR FUND BALANCE \\ WORKING CAPITAL BALANCE \end{tabular}} & $260,480 & so & $260,480 & $5,071,000 & $5,331,480 \\ \hline & $498,520 & $12,760 & $511,280 & $3,426,800 & $3,938,080 \\ \hline \begin{tabular}{r} TOTAL. REVENUES \& OTHER \\ SOURCES \end{tabular} & $119,139,460 & $4,993,780 & $124,133,240 & $8,547,800 & $132,681,040 \\ \hline LESS INTERFUND TRANSFERS & ($15,449,940) & so & ($15,449,940) & ($50,000) & ($15,499,940) \\ \hline \multirow{3}{*}{ TOTAL REVENUES } & $103,689,520 & $4,993,780 & $108,683,300 & $8,497,800 & $117,181,100 \\ \hline & & & & & \\ \hline & \multicolumn{5}{|c|}{ EXPENDITURES: } \\ \hline GENERAL GOVERNMENT & 58,324,140 & $1,691,030 & $10,015,170 & $75,000 & $10,090,170 \\ \hline JUDICLAL & $13,637,690 & $19,800 & $13,657,490 & $109,700 & $13,767,190 \\ \hline PUBLIC SAFETY & $22,432,960 & $172,700 & $22,605,660 & $2,919,400 & $25,525,060 \\ \hline \multicolumn{2}{|c|}{ TRANSPORTATION \& PUBLIC WORKS $3,427,930} & $72,710 & $3,500,640 & $ & $3,500,640 \\ \hline PHYSICAL ENVIRONMENT & $33,732,490 & $2,907,190 & $36,639,680 & $5,137,700 & $41,777,380 \\ \hline LEISURE SERVICES & $5,442,030 & $9,240 & $5,451,270 & $131,000 & $5,582,270 \\ \hline \multicolumn{2}{|c|}{ INDEPENDENT (SECONDARY) AGENCIBS,105,760 } & so & $5,105,760 & so & $5,105,760 \\ \hline NONDEPARTMENTAL & $16,289,570 & so & $16,289,570 & $175,000 & $16,464,570 \\ \hline DEBT SERVICE & $4,706,900 & $121,110 & $4,828,010 & $0 & $4,828,010 \\ \hline TOTAL. EXPENDITURES & \begin{tabular}{l|l|} $113,099,470 \\ \end{tabular} & \begin{tabular}{l|l|l} $4,993,780 \\ \end{tabular} & 5118,093,250 & $8,547,800 & $126,641,050 \\ \hline OTHER FINANCING USES & $3,168,550 & so & $3,168,550 & $0 & $3,168,550 \\ \hline \begin{tabular}{r} TOTAL EXPENDITURES \& \\ OTHER USES \end{tabular} & $116,268,020 & $4,993,780 & $121,261,800 & $8,547,800 & $129,809,600 \\ \hline LESS INTERFUND TRANSFERS & ($15,449,940) & so & ($15,449,940) & ($50,000) & ($15,499,940) \\ \hline TOTAL EXPENDITURES & $100,818,080 & $4,993,780 & $105,811,860 & $8,497,800 & $114,309,660 \\ \hline DESIGNATED FOR FUTURE & & & & & \\ \hline \begin{tabular}{l} DESIGNATED FOR FUTURE \\ CAPITAL. IMPROVEMENTS \& \\ DEBT SERVICE REQUIREMENTS \end{tabular} & $2,871,440 & so & $2,871,440 & so & $2,871,440 \\ \hline \begin{tabular}{r} TOTAL EXPENDITURES & \\ DESIGNATIONS \end{tabular} & $103,689,520 & $4,993,780 & $108,683,300 & $8,497,800 & $117,181,100 \\ \hline EXCESS(DEFICIENCY) OF REVENU & JES & so & $0 & $0 & so \\ \hline OVER EXPENDITURES & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline Year 2 & Year 3 & Year 4 & Year 5 & Year 6 & Year 7 \\ \hline & \multicolumn{5}{|c|}{ ALLFUNDS } \\ \hline & \multicolumn{5}{|c|}{ all fiscal years end on September 30} \\ \hline & \multicolumn{5}{|c|}{ COMMISSION ADOPTED } \\ \hline & \multicolumn{5}{|c|}{ YEAR 5 OPERATING BUDGET } \\ \hline & \begin{tabular}{l} OPERATING \\ BUDGET \end{tabular} & \begin{tabular}{l} CAPITAL FOR \\ CURRENT \\ SERVICES \\ \end{tabular} & \begin{tabular}{c} TOTAL. \\ OPERATING \\ BUDGET \\ \end{tabular} & \begin{tabular}{c} YEAR 5 \\ CAPITAL \\ IMPROVEMENT \\ BUDGET \end{tabular} & \begin{tabular}{l} YEAR 5 TOTAI \\ BUDGET \end{tabular} \\ \hline \multicolumn{6}{|l|}{ REVENUES: } \\ \hline PROPERTY TAXES & $26,581,390 & $1,769,900 & $28,351,290 & $210,000 & $28,561,290 \\ \hline SALES TAX & $19,580,000 & $0 & $19,580,000 & so & $19,580,000 \\ \hline OTHER TAXES & $17,277,040 & $16,500 & $17,293,540 & $0 & $17,293,540 \\ \hline LICENSES \& PERMITS & $602,855 & $0 & $602,855 & so & $602,855 \\ \hline INTERGOVERNMENTAL REVENUE & ES $5,157,213 & $0 & $5,157,213 & So & $5,157,213 \\ \hline CHARGES FOR SERVICES & $52,413,434 & $3,929,970 & $56,343,404 & $0 & $56,343,404 \\ \hline FINES \& FORFEITURES & $2,777,500 & $0 & $2,777,500 & $0 & $2,777,500 \\ \hline OTHER REVENUES & $1,792,222 & $0 & $1,792,222 & $0 & $1,792,222 \\ \hline TOTAL REVENUES & $126,181,653 & $5,716,370 & $131,898,023 & $210,000 & $132,108,023 \\ \hline OTHER FINANCING SOURCES & $13,732,343 & $0 & $13,732,343 & $100,000 & $13,832,343 \\ \hline PRIOR YEAR FUND BALANCE & $193,483 & $0 & $193,483 & $2,200,000 & $2,393,483 \\ \hline WORKING CAPITAL BALANCE & $1,150,452 & $401,500 & $1,551,952 & $13,441,900 & $14,993,852 \\ \hline \begin{tabular}{r} TOTAL REVENUES \& OTHER \\ SOURCES \end{tabular} & $141,257,931 & $6,117,870 & $147,375,801 & $15,951,900 & $163,327,701 \\ \hline LESS INTERFUND TRANSFERS & ($27,790,606) & $0 & ($27,790,606) & ($100,000) & ($27,890,606) \\ \hline \multirow[t]{3}{*}{ TOTAL REVENUES } & $113,467,325 & $6,117,870 & $119,585,195 & $15,851,900 & $135,437,095 \\ \hline & & & & & \\ \hline \multirow{2}{*}{\multicolumn{6}{|c|}{ EXPENDITURES: }} \\ \hline & & & & & \\ \hline GENERAL GOVERNMENT & $10,160,146 & $220,000 & $10,380,146 & $300,000 & $10,680,146 \\ \hline JUDICIAL & $14,566,852 & $22,000 & $14,588,852 & $20,000 & $14,608,852 \\ \hline PUBLIC SAFETY & $24,637,166 & $46,750 & $24,683,916 & $200,000 & $24,883,916 \\ \hline TRANSPORTATION \& PUBLIC WOOF & RK$37,543,169 & $5,810,530 & $43,353,699 & $15,201,900 & $58,555,599 \\ \hline PHYSICAL ENVIRONMENT & $0 & $0 & $0 & $0 & $0 \\ \hline LEISURE SERVICES & $5,885,024 & $18,590 & $5,903,614 & $30,000 & $5,933,614 \\ \hline \multicolumn{2}{|c|}{ INDEPENDENT (SECONDARY) AGENSE $30,087} & $0 & $5,430,087 & \$0 & $5,430,087 \\ \hline NONDEPARTMENTAL & $22,256,562 & $0 & $22,256,562 & $100,000 & $22,356,562 \\ \hline DEBT SERVICE & $4,483,515 & $0 & $4,483,515 & $0 & $4,483,515 \\ \hline TOTAL EXPENDITURES & $124,962,522 & $6,117,870 & $131,080,392 & $15,851,900 & $146,932,292 \\ \hline OTHER FINANCING USES & $13,842,343 & $0 & $13,842,343 & $100,000 & $13,942,343 \\ \hline \begin{tabular}{r} TOTAL EXPENDITURES \& \\ OTHER USES \end{tabular} & $138,804,865 & $6,117,870 & $144,922,735 & $15,951,900 & $160,874,635 \\ \hline LESS INTERFUND TRANSFERS & ($27,790,606) & $0 & ($27,790,606) & ($100,000) & ($27,890,606) \\ \hline \multirow{2}{*}{ TOTAL EXPENDITURES } & $111,014,259 & $6,117,870 & $117,132,129 & $15,851,900 & $132,984,029 \\ \hline & & & & & \\ \hline \begin{tabular}{l} CAPITAL IMPROVEMENTS \& \\ DEBT SERVICE \\ REQUIREMENTS \end{tabular} & $2,453,066 & $0 & $2,453,066 & so & $2,453,066 \\ \hline & & & & & \\ \hline \begin{tabular}{r} TOTAL EXPENDITURES \& \\ DESIGNATIONS \end{tabular} & $113,467,325 & $6,117,870 & $119,585,195 & $15,851,900 & $135,437,095 \\ \hline EXCESS(DEFICIENCY) OF REVEN & NUES & $0 & $0 & \$o & $0 \\ \hline OVER EXPENDITURES & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline Year 2 & Year 3 & Year 4 & Year 5 & Year 6 & Year 7 \\ \hline & \multicolumn{5}{|c|}{ ALLFUNDS } \\ \hline & \multicolumn{5}{|c|}{ all fiscal years end on September 30} \\ \hline & \multicolumn{5}{|c|}{ COMMISSION ADOPTED } \\ \hline & \multicolumn{5}{|c|}{ YEAR 6 OPERATING BUDGET } \\ \hline & \begin{tabular}{l} OPERATING \\ BUDGET \end{tabular} & \begin{tabular}{c} CAPITAL FOR \\ CURRENT \\ SERVICES \end{tabular} & \begin{tabular}{c} TOTAL \\ OPERATING \\ BUDGET \end{tabular} & \begin{tabular}{c} YEAR 6 \\ CAPITAL \\ IMPROVEMEN \\ BUDGET \\ \end{tabular} & \begin{tabular}{l} YEAR 6 TOTAI \\ BUDGET \end{tabular} \\ \hline \multicolumn{6}{|l|}{ REVENUES: } \\ \hline PROPERTY TAXES & $29,210,170 & $1,762,200 & $30,972,370 & $0 & $30,972,370 \\ \hline SALES TAX & $20,570,000 & $0 & $20,570,000 & $0 & $20,570,000 \\ \hline OTHER TAXES & $17,594,940 & $16,500 & $17,611,440 & $0 & $17,611,440 \\ \hline LICENSES \& PERMITS & $905,762 & \$0 & $905,762 & $0 & $905,762 \\ \hline INTERGOVERNMENTAL REVENUE & ES $5,316,876 & so & $5,316,876 & $0 & $5,316,876 \\ \hline CHARGES FOR SERVICES & $54,844,449 & $3,950,013 & $58,794,462 & $0 & $58,794,462 \\ \hline FINES \& FORFEITURES & $2,866,380 & $0 & $2,866,380 & $0 & $2,866,380 \\ \hline OTHER REVENUES & $1,335,703 & \$o & $1,335,703 & $0 & $1,335,703 \\ \hline TOTAL REVENUES & $132,644,280 & $5,728,713 & $138,372,993 & $0 & $138,372,993 \\ \hline OTHER FINANCING SOURCES & $14,853,904 & So & $14,853,904 & $0 & $14,853,904 \\ \hline PRIOR YEAR FUND BALANCE & $237,915 & \begin{tabular}{l|l|l} $316,030 \\ \end{tabular} & $553,945 & $2,442,000 & $2,995,945 \\ \hline WORKING CAPITAL BALANCE & $528,589 & $673,727 & $1,202,315 & $10,277,600 & $11,479,915 \\ \hline \begin{tabular}{r} TOTAL REVENUES \& OTHER \\ SOURCES \end{tabular} & $148,264,687 & $6,718,470 & $154,983,157 & $12,719,600 & $167,702,757 \\ \hline LESS INTERFUND TRANSFERS & ($29,858,404) & $0 & ($29,858,404) & $0 & ($29,858,404) \\ \hline \multirow[t]{2}{*}{ TOTAL REVENUES } & $118,406,283 & $6,718,470 & $125,124,753 & $12,719,600 & $137,844,353 \\ \hline & & & & & \\ \hline \multicolumn{6}{|l|}{ EXPENDITURES: } \\ \hline GENERAL GOVERNMENT & $10,819,707 & $220,000 & $11,039,707 & $322,000 & $11,361,707 \\ \hline JUDICIAL & $15,096,608 & $0 & $15,096,608 & $0 & $15,096,608 \\ \hline PUBLIC SAFETY & $26,238,969 & $70,400 & $26,309,369 & $200,000 & $26,509,369 \\ \hline \multicolumn{2}{|c|}{ TRANSPORTATION \& PUBLIC WORIS $8,660,018} & $4,740,010 & $43,400,028 & $11,670,800 & $55,070,828 \\ \hline PHYSICAL ENVIRONMENT & So & $0 & \$o & $0 & $0 \\ \hline LEISURE SERVICES & $6,121,488 & $95,920 & $6,217,408 & $0 & $6,217,408 \\ \hline \multicolumn{2}{|c|}{ INDEPENDENT (SECONDARY) AGEN\$BS67,234 } & \$0 & $5,767,234 & $0 & $5,767,234 \\ \hline NONDEPARTMENTAL & $22,156,628 & $1,592,140 & $23,748,768 & $50,000 & $23,798,768 \\ \hline DEBT SERVICE & $4,289,560 & $ & $4,289,560 & $0 & $4,289,560 \\ \hline TOTAL EXPENDITURES & $129,150,211 & $6,718,470 & $135,868,681 & $12,242,800 & $148,111,481 \\ \hline OTHER FINANCING USES & $14,853,904 & \$o & $14,853,904 & $0 & $14,853,904 \\ \hline \begin{tabular}{r} TOTAL EXPENDITURES \& \\ OTHER USES \end{tabular} & $144,004,115 & $6,718,470 & $150,722,585 & $12,242,800 & $162,965,385 \\ \hline LESS INTERFUND TRANSFERS & ($29,858,404) & $0 & ($29,858,404) & $0 & ($29,858,404) \\ \hline TOTAL EXPENDITURES & $114,145,711 & $6,718,470 & $120,864,181 & $12,242,800 & $133,106,981 \\ \hline \multirow[b]{2}{*}{\begin{tabular}{l} DESIGNATED FOR FUTURE \\ CAPITAL IMPROVEMENTS \& \\ DEBT SERVICE \\ REQUIREMENTS \end{tabular}} & & & & & \\ \hline & $4,260,572 & \$o & $4,260,572 & $476,800 & $4,737,372 \\ \hline \begin{tabular}{r} TOTAL EXPENDITURES \& \\ DESIGNATIONS \end{tabular} & $118,406,283 & $6,718,470 & $125,124,753 & $12,719,600 & $137,844,353 \\ \hline EXCESS(DEFICIENCY) OF REVEN & NUES & $0 & $0 & $0 & $0 \\ \hline OVER EXPENDITURES & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Year 2 & Year 3 & Year 4 & Year 5 & Year 6 & Year 7 & Year 8 \\ \hline & \multicolumn{5}{|c|}{\begin{tabular}{c} ALL.FUNDS \\ all fiscal years end on September 30 \\ COMMISsION ADOPTED \end{tabular}} & \\ \hline & \multicolumn{5}{|c|}{ YEAR 2 OPERATING BUDGET } & \\ \hline & BUDGETOPERATING & \begin{tabular}{|c|} CAPITAL FOR \\ CURRENT \\ SERVICES \\ \end{tabular} & \begin{tabular}{c} TOTAL \\ OPERATING \\ BUDGET \end{tabular} & \begin{tabular}{|l} YEAR 2 \\ CAPITAL \\ IMPROVEMEN \\ BUDGET \end{tabular} & \begin{tabular}{c} YEAR 2 TOTAI \\ BUDGET \end{tabular} & \\ \hline \multicolumn{6}{|l|}{ REVENUES: } & \\ \hline PROPERTY TAXES & $24,386,340 & $1,210,000 & $25,596,340 & 50 & $25,596,340 & \\ \hline SALES TAX & $17,315,100 & so & $17,315,100 & 30 & $17,315,100 & \\ \hline OTHER TAXES & $14,593,590 & \begin{array}{l} 50 \\ \( \$ 16,500 \\ \end{array} \) & $14,610,090 & 80 & $14,610,090 & \\ \hline LICENSES \& PERMITS & 5543,950 & $0 & $543,950 & 30 & 5543,950 & \\ \hline INTERGOVERNMENTAL. REVENUES & \begin{tabular}{ll} ES & $4,653,550 \\ \end{tabular} & s0 & 54,653,550 & 30 & 54,653,350 & \\ \hline CHARGES FOR SERVICES & $48,706,130 & $1,210,000 & $49,916,130 & 80 & $49,916,130 & \\ \hline FINES \& FORFETTURES & $2,495,900 & $0 & $2,495,900 & 50 & $2,495,900 & \\ \hline OTHER REVENUES & 5851,510 & so & $851,510 & 80 & 5851,510 & \\ \hline \multirow{2}{*}{ TOTAL REVENUES } & $113,546,070 & $2,436,500 & $115,982,570 & 50 & $115,982,570 & \\ \hline & 8 & 80 & & $355000 & & \\ \hline \begin{tabular}{l} OTHER FINANCING SOURCES \\ PRIOR YEAR FUND BALANCE \end{tabular} & 565,790s2,990,0328 & \begin{tabular}{r|r|r|} 800 \\ $40,000 \end{tabular} & & \begin{aligned}\( \$ 355,0000 \\ \$ 1,06000\end{aligned} \) & \begin{aligned} \( 33,345,328 \\ 516790\end{aligned} \) & \\ \hline WORKING CAPITAL BALANCE & $366,630 & \begin{tabular}{l} 38+40,000 \\ 886,260 \\ \end{tabular} & 51,231,890 & $15,059,000 & $17,190,990 & \\ \hline \begin{tabular}{r} TOTAL REVENUES \& OTHER \\ SOURCES \end{tabular} & $117,561,818 & $3,741,760 & $121,303,578 & $17,383,100 & $138,686,678 & \\ \hline \multirow{2}{*}{ LESS INTERFUND TRANSFERS } & ($15,420,191) & so & ($15,420,191) & 50 & ($15,420,191) & \\ \hline & & & & & & \\ \hline \multirow{2}{*}{ TOTAL REVENUES } & $102,141,628 & $3,741,760 & $105,883,388 & $17,383,100 & 5123,266,488 & \\ \hline & & & & & & \\ \hline \multicolumn{6}{|l|}{ EXPENDITURES: } & \\ \hline GENERAL GOVERNMENT & 57,858,180 & so & 57,858,180 & $15,000 & 57,873,180 & \\ \hline JUDICLAL & $13,497,880 & so & $13,497,880 & 80 & $13,497,880 & \\ \hline \multirow{2}{*}{\begin{tabular}{l} PUBLIC SAFETY \\ TRANSPORTATIOY PUBUC \end{tabular}} & $21,594,210 & $121,110 & $21,715,320 & $344,000 & $22,059,320 & \\ \hline & \begin{tabular}{l} $21,594,210 \\ RKS $3,574,890 \\ \end{tabular} & \begin{aligned} \\ \end{aligned} & $3,574,890321,1,7,320 & $355,000 & $3,929,890 & \\ \hline \begin{tabular}{l} TRANSPORTATION \& PUBLIC WORK \\ PHYSICAL ENVIRONMENT \end{tabular} & $32,909,962 & $2,311,760 & $35,221,722 & $16,659,100 & $551,880,822 & \\ \hline LEISURE SERVICES & $5,209,490 & $0 & $5,209,490 & 30 & $5,209,490 & \\ \hline \begin{tabular}{l} INDUKE SERVILES \\ INDEPENDEN (SECONDARY) AGEN \end{tabular} & ENCIS 5706,020 & so & 54,706,020 & $10,000 & $4,716,020 & \\ \hline NONDEPARTMENTAL & \begin{tabular}{l} 518,353,888 \\ \end{tabular} & $1,308,890 & $19,662,778 & s0 & $19,662,778 & \\ \hline DEBT SERVICE & $3,898,180 & so & $3,898,180 & so & $3,898,180 & \\ \hline TOTAL EXPENDITURES ] & SIII,602,700 & $3,741,760 & $115,344,460 & 517,383,100 & $132,727,560 & \\ \hline \multirow{2}{*}{ OTHER FINANCING USES } & $33,370,048 & & $3,370,048 & 30 & $3.370.048 & \\ \hline & 33,570,048 & & 33,570,048 & & & \\ \hline \begin{tabular}{r} TOTAL EXPENDITURES \& \\ OTHER USES \end{tabular} & $114,972,748 & $3,741,760 & $118,714,508 & $17,383,100 & $136,097,608 & \\ \hline LESS INTERFUND TRANSFERS & ($15,420,191) & $0 & ($15,420,191) & 80 & ($15,420,191) & \\ \hline TOTAL EXPENDITURES & $99,552,558 & $3,741,760 & $103,294,318 & $17,383,100 & $120,677,418 & \\ \hline \begin{tabular}{l} DESIGNATED FOR FUTURE \\ CAPITAL IMPROVEMENTS \& \\ DEBT SERVICE REQUIREMENTS \end{tabular} & $2,589,070 & so & $2,589,070 & so & $2,589,070 & \\ \hline \begin{tabular}{l} TOTAL EXPENDITURES \& \\ DESIGNATIONS \end{tabular} & $102,141,628 & $3,741,760 & S105,883,388 & S17,383,100 & $123,266,488 & \\ \hline \multirow{2}{*}{\begin{tabular}{l} EXCESS(DEFICIENCY) OF REVENUE \\ OVER EXPENDITURES \end{tabular}} & 80 & $0 & 50 & so & so & \\ \hline & & & & & & \\ \hline \end{tabular}