Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the memo on yon. Clerk score, yas beleve that you wa pay 4S% on a 30-year m. trikt haned You are planning to purchase a

the memo

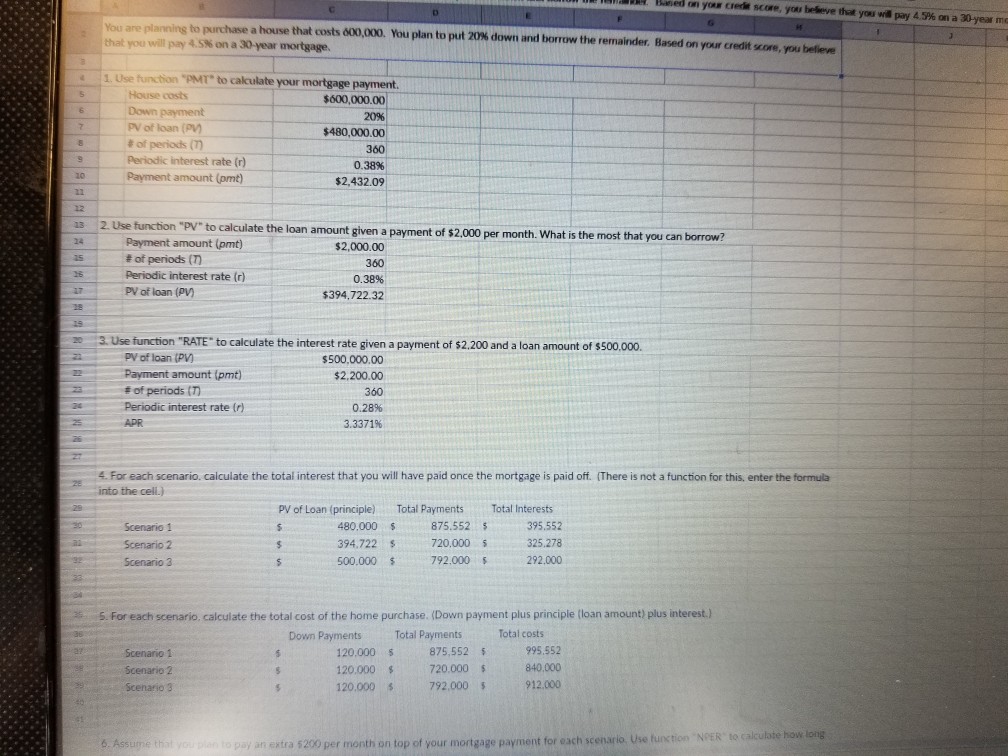

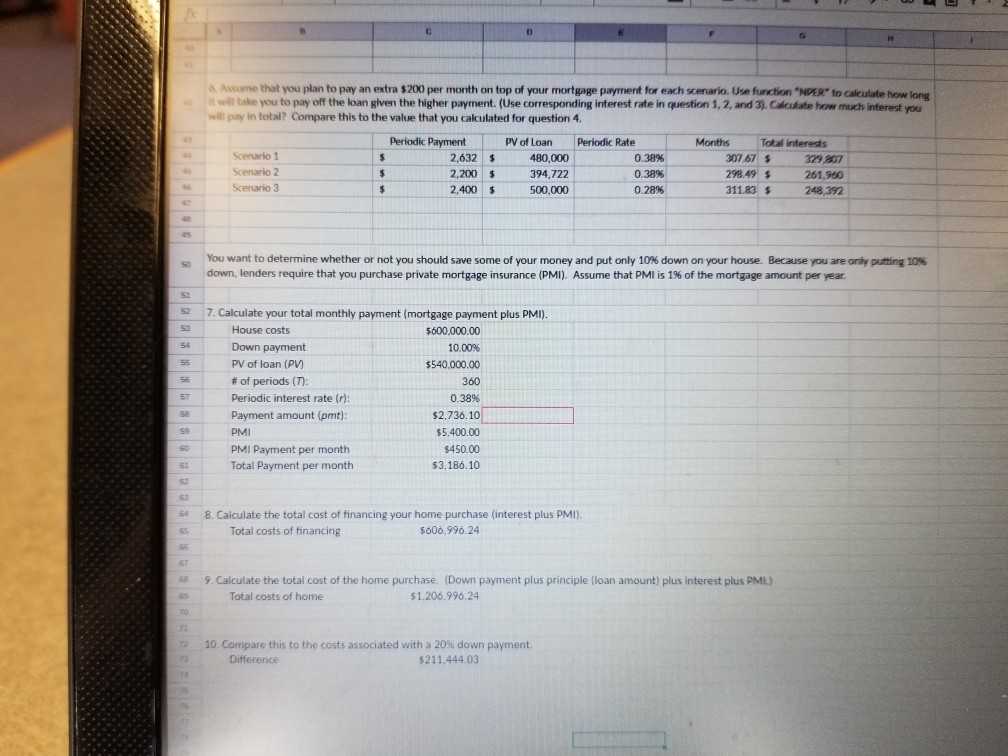

on yon. Clerk score, yas beleve that you wa pay 4S% on a 30-year m. trikt haned You are planning to purchase a house that you will pay 4.5%on a 30-year mortgage. hat costs 00 00. ouplan topt20% down and borrow the remainder Based on yo rere ore you be r 1.Use function-PMT" to calculate your mortgage payment. ? House costs Down payment PV of loan (PV) #Of periods (T) Periodic interest rate (r) Payment amount (pmt) $600,000.00 20% $480,000.00 360 0.38% $2,432.09 10 as 2 Use function "PV" to calculate the loan amount given a payment of $2.000 per month. What is the most that you can borrow? Payment amount (pmt) # of periods (T) Periodic interest rate (r) PV of loan (PV $2,000.00 360 0.38% $394,722.32 20 3. Use function "RATE to calculate the interest rate given a payment of $2.200 and a loan amount of $500.000. PV of loan IPV Payment amount (pmt) # of periods (n Periodic interest rate (r) $500,000.00 2,200.00 360 0.28% 3.3371% 4. For each scenario. calculate the total interest that you will have paid once the mortgage is paid off. (There is not a function for this, enter the formula into the cell.) PV of Loan (principle) Total PaymentsTotal Interests Scenario 2 Scenario 3 480.000$ 394.722 s 875.552 720,000 792.000 292.000 395,552 325.278 5. For each scenario. calculate the total cost of the home purchase. (Down payment plus principle (loan amount) plus interest.) Down Payments Total Payments Total costs 875,552 s 720.000 120.000 s 792,000912.000 995.552 840,000 1 Scenario 1 Scenario 2 Scenario 120,000 s 120.000 NPER to calculate how long 6. Assume th pay an extra 5200 per month on top of your mortgage payment for each scenario Use tunction on yon. Clerk score, yas beleve that you wa pay 4S% on a 30-year m. trikt haned You are planning to purchase a house that you will pay 4.5%on a 30-year mortgage. hat costs 00 00. ouplan topt20% down and borrow the remainder Based on yo rere ore you be r 1.Use function-PMT" to calculate your mortgage payment. ? House costs Down payment PV of loan (PV) #Of periods (T) Periodic interest rate (r) Payment amount (pmt) $600,000.00 20% $480,000.00 360 0.38% $2,432.09 10 as 2 Use function "PV" to calculate the loan amount given a payment of $2.000 per month. What is the most that you can borrow? Payment amount (pmt) # of periods (T) Periodic interest rate (r) PV of loan (PV $2,000.00 360 0.38% $394,722.32 20 3. Use function "RATE to calculate the interest rate given a payment of $2.200 and a loan amount of $500.000. PV of loan IPV Payment amount (pmt) # of periods (n Periodic interest rate (r) $500,000.00 2,200.00 360 0.28% 3.3371% 4. For each scenario. calculate the total interest that you will have paid once the mortgage is paid off. (There is not a function for this, enter the formula into the cell.) PV of Loan (principle) Total PaymentsTotal Interests Scenario 2 Scenario 3 480.000$ 394.722 s 875.552 720,000 792.000 292.000 395,552 325.278 5. For each scenario. calculate the total cost of the home purchase. (Down payment plus principle (loan amount) plus interest.) Down Payments Total Payments Total costs 875,552 s 720.000 120.000 s 792,000912.000 995.552 840,000 1 Scenario 1 Scenario 2 Scenario 120,000 s 120.000 NPER to calculate how long 6. Assume th pay an extra 5200 per month on top of your mortgage payment for each scenario Use tunctionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started