Answered step by step

Verified Expert Solution

Question

1 Approved Answer

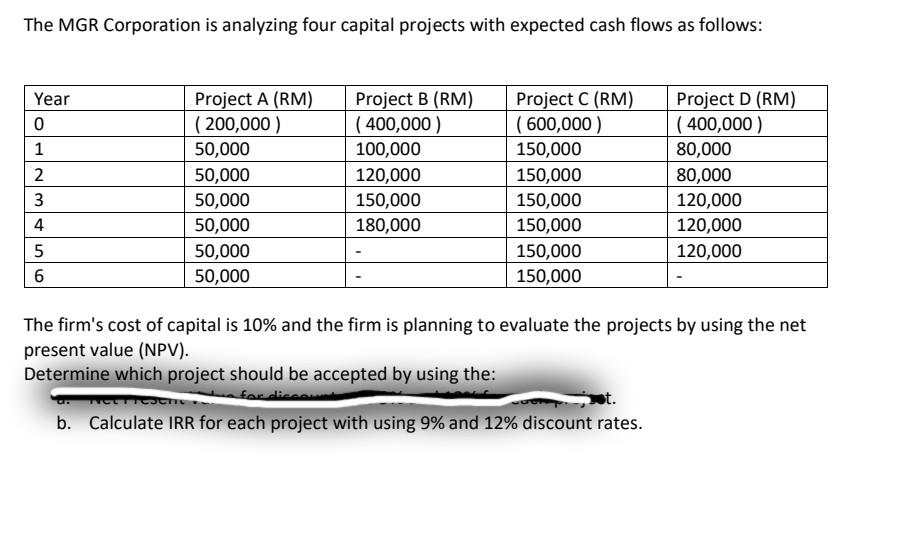

The MGR Corporation is analyzing four capital projects with expected cash flows as follows: Year 0 1 2 3 Project A (RM) (200,000) 50,000 50,000

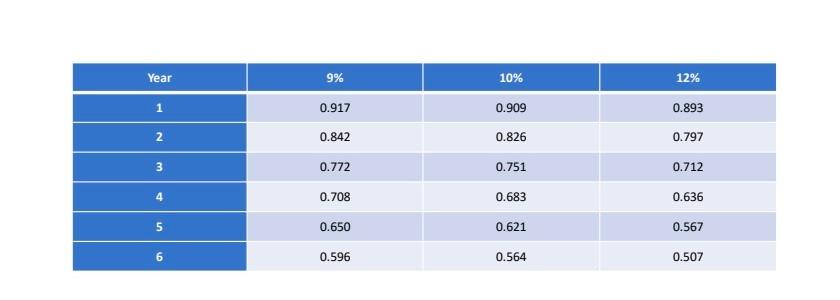

The MGR Corporation is analyzing four capital projects with expected cash flows as follows: Year 0 1 2 3 Project A (RM) (200,000) 50,000 50,000 50,000 50,000 50,000 50,000 Project B (RM) (400,000) 100,000 120,000 150,000 180,000 Project C (RM) (600,000) 150,000 150,000 150,000 150,000 150,000 150,000 Project D (RM) ( 400,000) 80,000 80,000 120,000 120,000 120,000 4 5 6 The firm's cost of capital is 10% and the firm is planning to evaluate the projects by using the net present value (NPV). Determine which project should be accepted by using the: fac b. Calculate IRR for each project with using 9% and 12% discount rates. Year 9% 10% 12% 1 0.917 0.842 0.909 0.826 0.893 0.797 N 0.772 0.751 0.712 3 4 0.708 0.683 0.636 5 0.650 0.621 0.567 6 0.596 0.564 0.507

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started