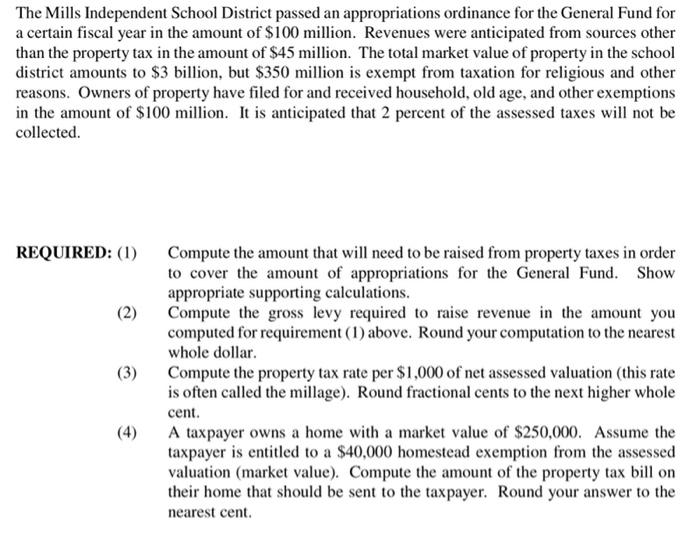

The Mills Independent School District passed an appropriations ordinance for the General Fund for a certain fiscal year in the amount of $100 million. Revenues were anticipated from sources other than the property tax in the amount of $45 million. The total market value of property in the school district amounts to $3 billion, but $350 million is exempt from taxation for religious and other reasons. Owners of property have filed for and received household, old age, and other exemptions in the amount of $100 million. It is anticipated that 2 percent of the assessed taxes will not be collected. REQUIRED: (1) (3) Compute the amount that will need to be raised from property taxes in order to cover the amount of appropriations for the General Fund. Show appropriate supporting calculations. Compute the gross levy required to raise revenue in the amount you computed for requirement (1) above. Round your computation to the nearest whole dollar Compute the property tax rate per $1,000 of net assessed valuation (this rate is often called the millage). Round fractional cents to the next higher whole cent. A taxpayer owns a home with a market value of $250,000. Assume the taxpayer is entitled to a $40,000 homestead exemption from the assessed valuation (market value). Compute the amount of the property tax bill on their home that should be sent to the taxpayer. Round your answer to the nearest cent. The Mills Independent School District passed an appropriations ordinance for the General Fund for a certain fiscal year in the amount of $100 million. Revenues were anticipated from sources other than the property tax in the amount of $45 million. The total market value of property in the school district amounts to $3 billion, but $350 million is exempt from taxation for religious and other reasons. Owners of property have filed for and received household, old age, and other exemptions in the amount of $100 million. It is anticipated that 2 percent of the assessed taxes will not be collected. REQUIRED: (1) (3) Compute the amount that will need to be raised from property taxes in order to cover the amount of appropriations for the General Fund. Show appropriate supporting calculations. Compute the gross levy required to raise revenue in the amount you computed for requirement (1) above. Round your computation to the nearest whole dollar Compute the property tax rate per $1,000 of net assessed valuation (this rate is often called the millage). Round fractional cents to the next higher whole cent. A taxpayer owns a home with a market value of $250,000. Assume the taxpayer is entitled to a $40,000 homestead exemption from the assessed valuation (market value). Compute the amount of the property tax bill on their home that should be sent to the taxpayer. Round your answer to the nearest cent