Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The M&M theory states that in the presence of differential taxes, the value of the firm may rise by a portion of the amount

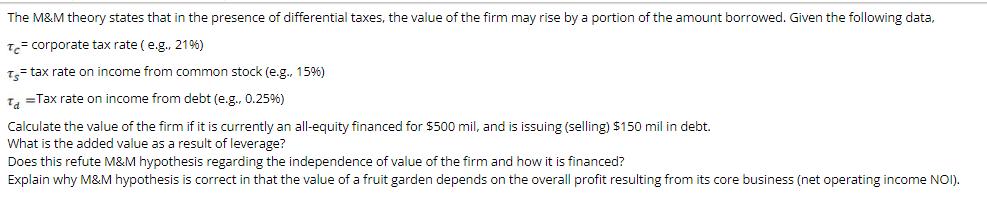

The M&M theory states that in the presence of differential taxes, the value of the firm may rise by a portion of the amount borrowed. Given the following data, Tc corporate tax rate ( e.g., 21%) T= tax rate on income from common stock (e.g., 15%) Td =Tax rate on income from debt (e.g., 0.25%6) Calculate the value of the firm if it is currently an all-equity financed for $500 mil, and is issuing (selling) $150 mil in debt. What is the added value as a result of leverage? Does this refute M&M hypothesis regarding the independence of value of the firm and how it is financed? Explain why M&M hypothesis is correct in that the value of a fruit garden depends on the overall profit resulting from its core business (net operating income NOI).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION The firm is currently allequity financed and valued at 500 mil It is issuing 150 mil of new ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started