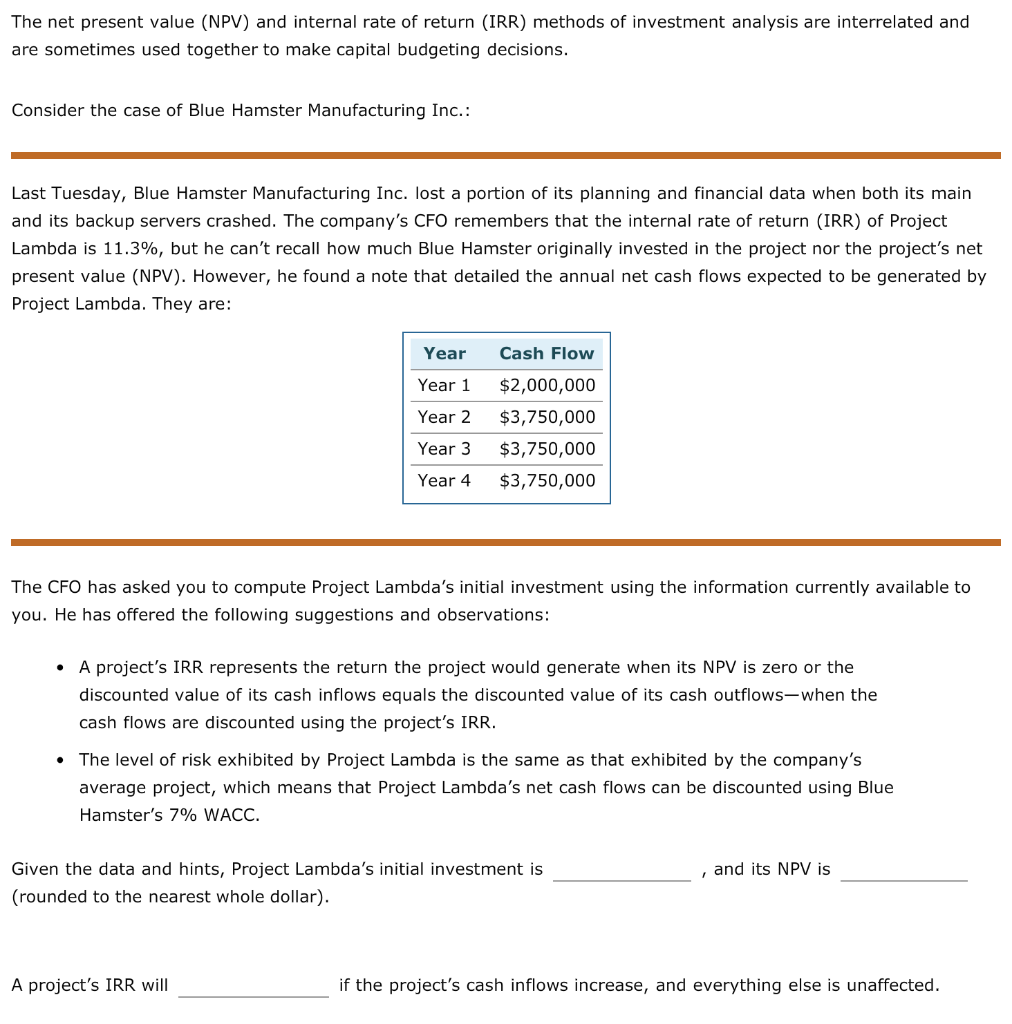

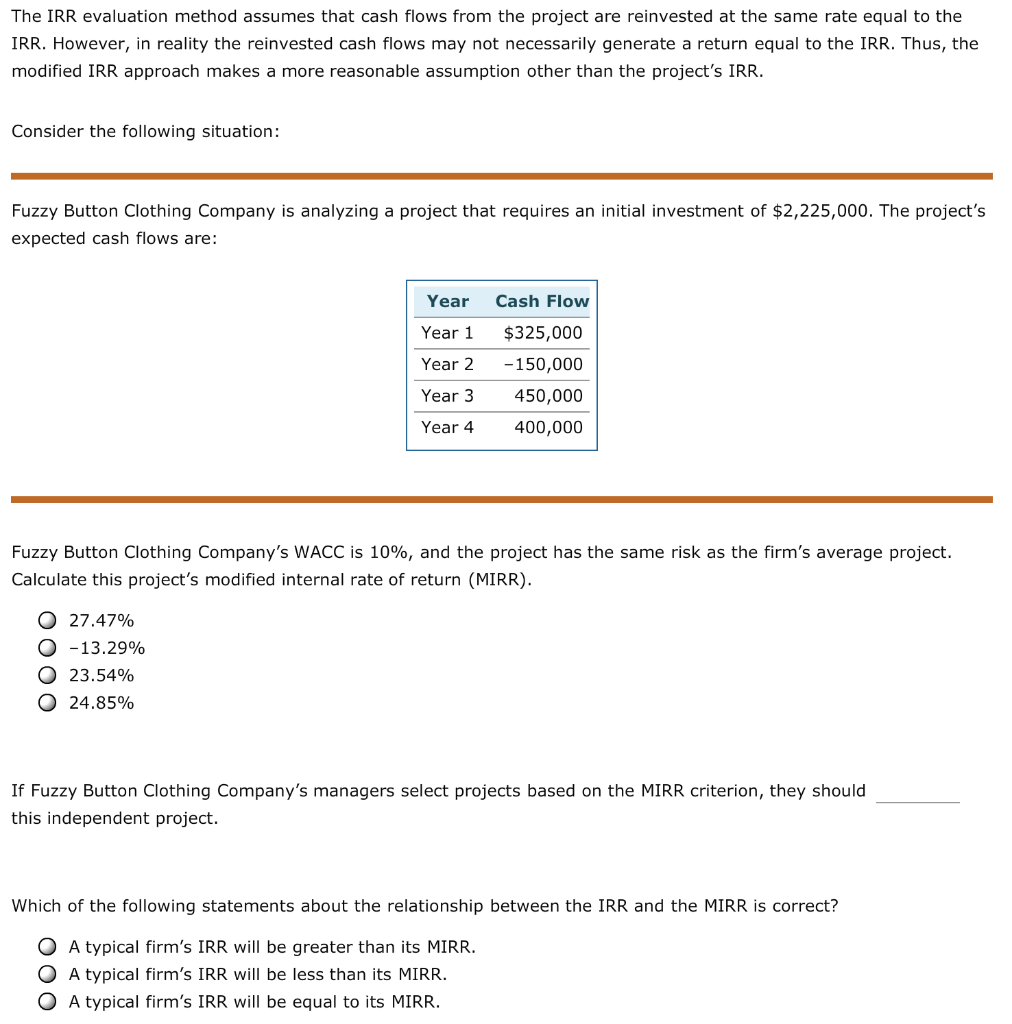

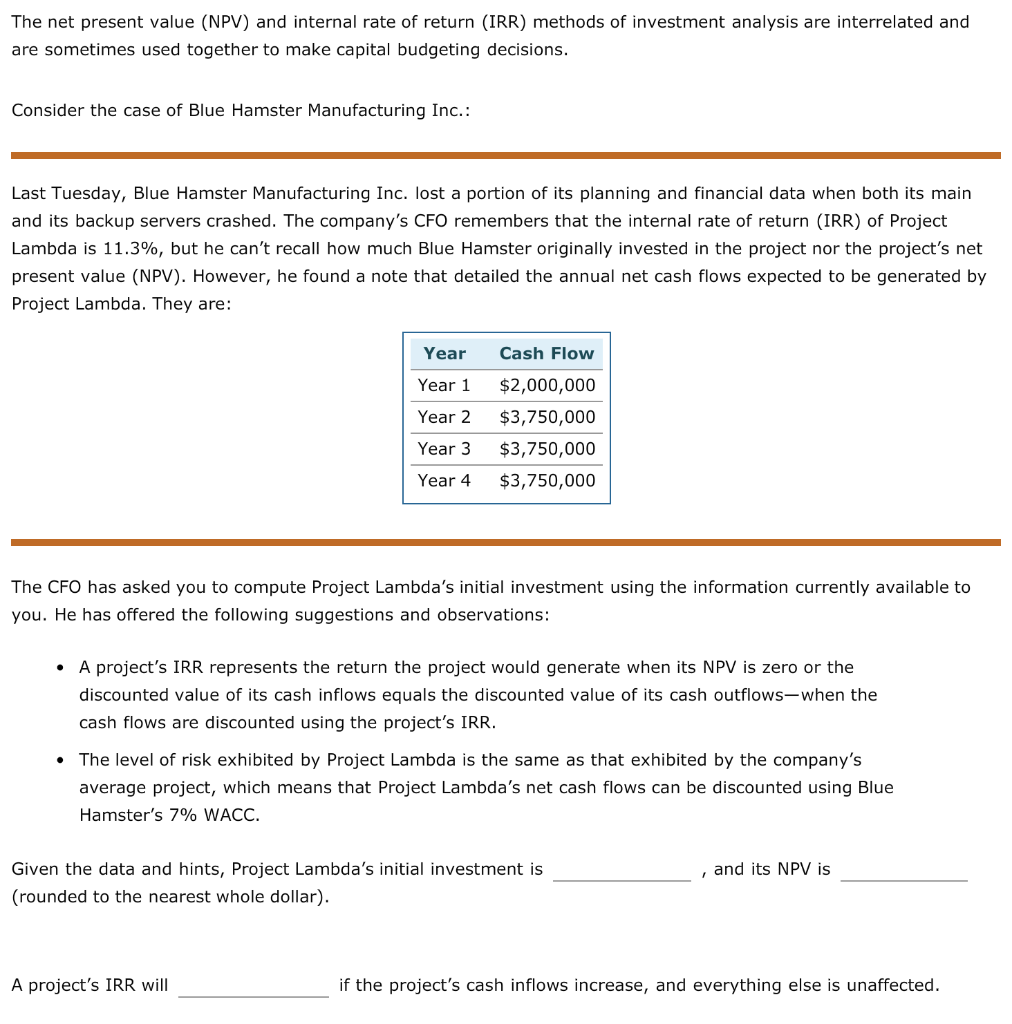

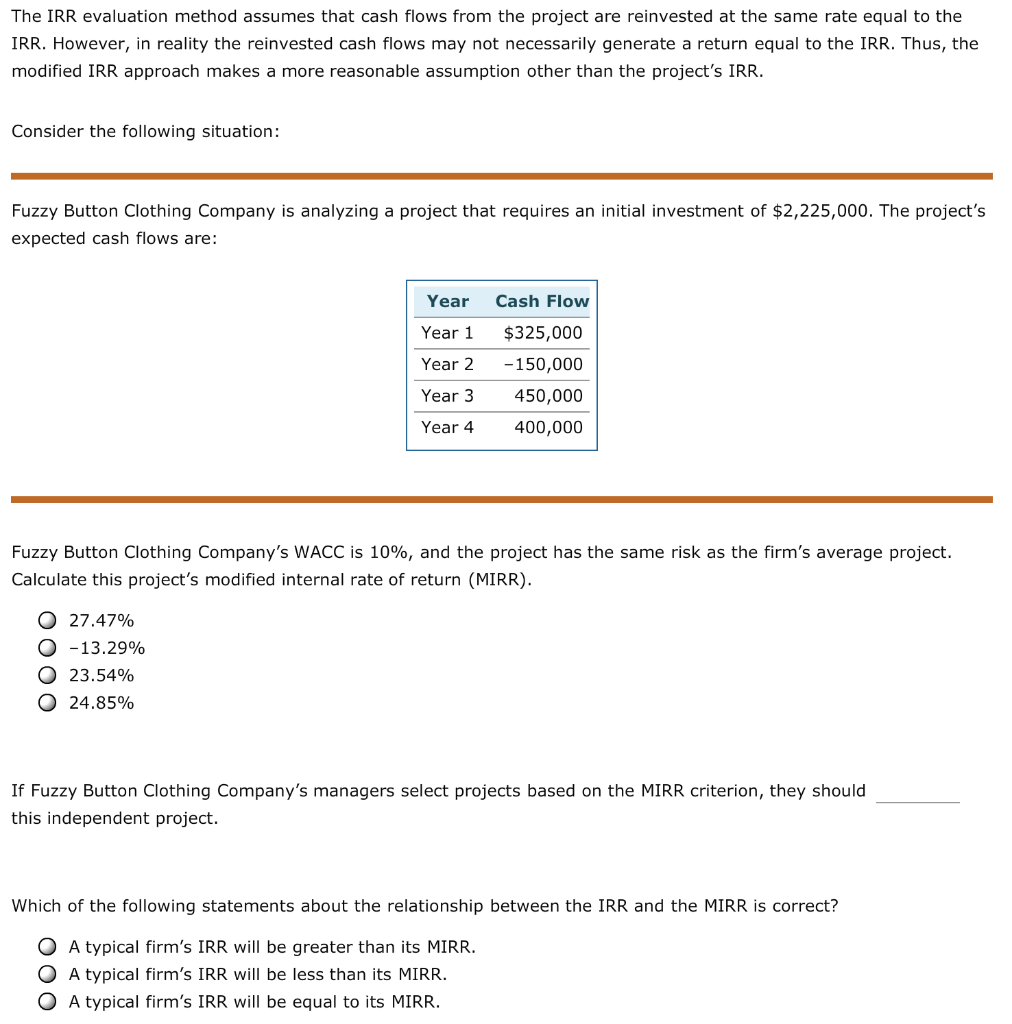

The net present value (NPV) and internal rate of return (IRR) methods of investment analysis are interrelated and are sometimes used together to make capital budgeting decisions. Consider the case of Blue Hamster Manufacturing Inc.: Last Tuesday, Blue Hamster Manufacturing Inc. lost a portion of its planning and financial data when both its main and its backup servers crashed. The company's CFO remembers that the internal rate of return (IRR) of Project Lambda is 11.3%, but he can't recall how much Blue Hamster originally invested in the project nor the project's net present value (NPV). However, he found a note that detailed the annual net cash flows expected to be generated by Project Lambda. They are: Year Cash Flow Year 1 Year 2 Year 3 Year 4 $2,000,000 $3,750,000 $3,750,000 $3,750,000 The CFO has asked you to compute Project Lambda's initial investment using the information currently available to you. He has offered the following suggestions and observations: A project's IRR represents the return the project would generate when its NPV is zero or the discounted value of its cash inflows equals the discounted value of its cash outflows-when the cash flows are discounted using the project's IRR. The level of risk exhibited by Project Lambda is the same as that exhibited by the company's average project, which means that Project Lambda's net cash flows can be discounted using Blue Hamster's 7% WACC. , and its NPV is Given the data and hints, Project Lambda's initial investment is (rounded to the nearest whole dollar). A project's IRR will if the project's cash inflows increase, and everything else is unaffected. The IRR evaluation method assumes that cash flows from the project are reinvested at the same rate equal to the IRR. However, in reality the reinvested cash flows may not necessarily generate a return equal to the IRR. Thus, the modified IRR approach makes a more reasonable assumption other than the project's IRR. Consider the following situation: Fuzzy Button Clothing Company is analyzing a project that requires an initial investment of $2,225,000. The project's expected cash flows are: Year Year 1 Year 2 Year 3 Year 4 Cash Flow $325,000 -150,000 450,000 400,000 Fuzzy Button Clothing Company's WACC is 10%, and the project has the same risk as the firm's average project. Calculate this project's modified internal rate of return (MIRR). 0 27.47% 0 -13.29% 0 23.54% 24.85% If Fuzzy Button Clothing Company's managers select projects based on the MIRR criterion, they should this independent project. Which of the following statements about the relationship between the IRR and the MIRR is correct? O O O A typical firm's IRR will be greater than its MIRR. A typical firm's IRR will be less than its MIRR. A typical firm's IRR will be equal to its MIRR