Question: The next step was to determine how much extra value Oracle could generate by making Sun's operatim more elcient, cutting outdated and inefcient products and

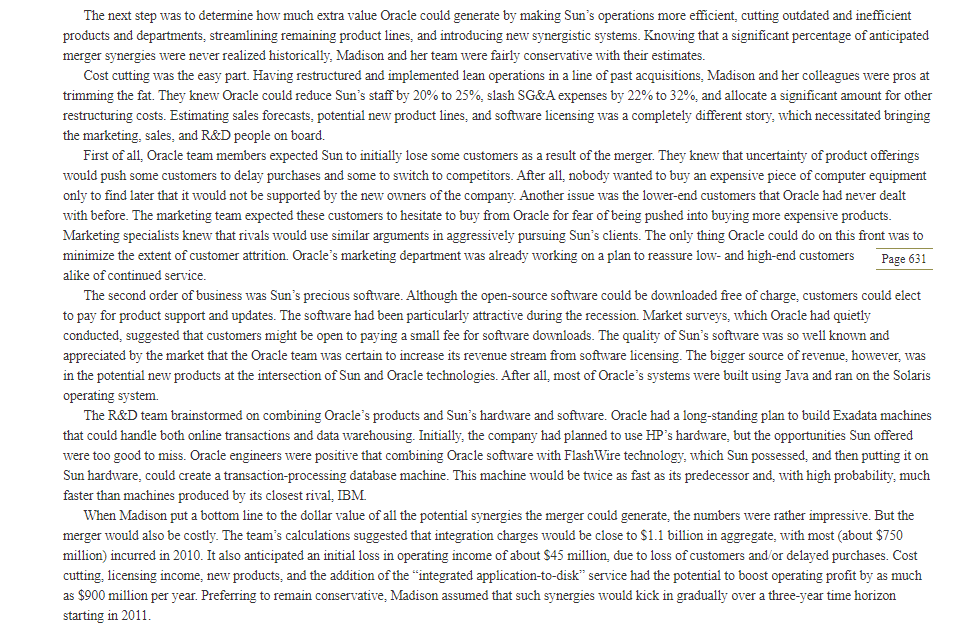

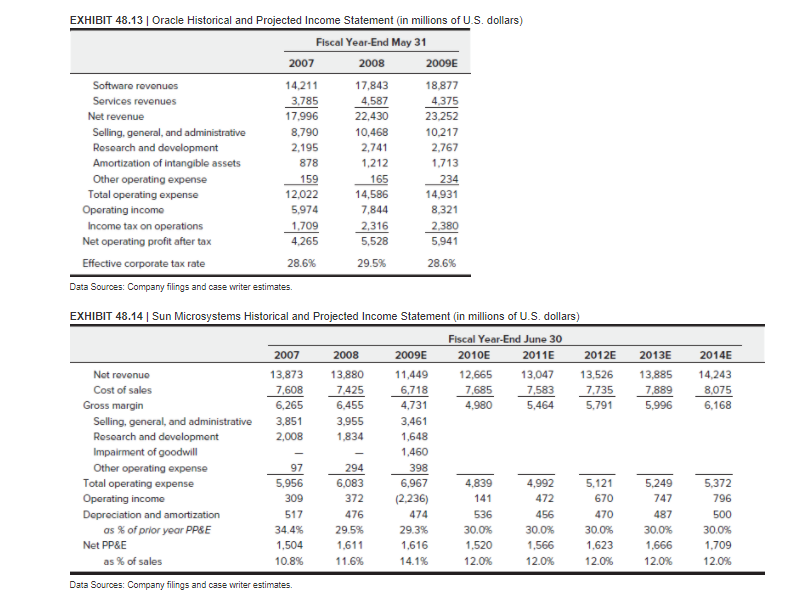

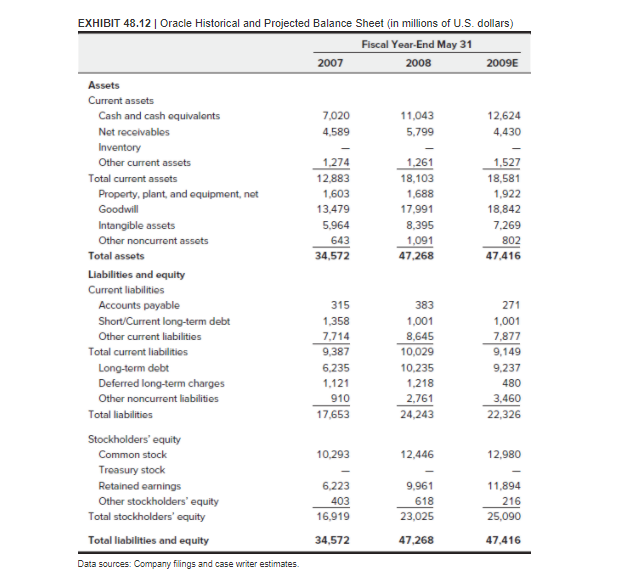

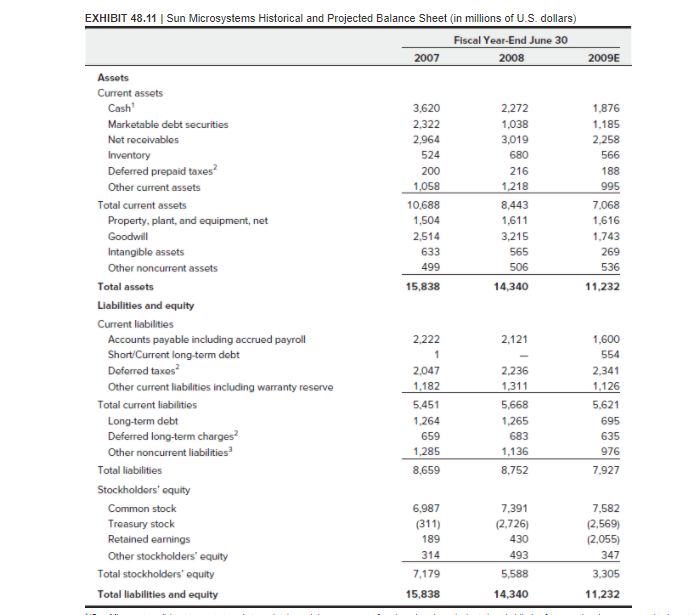

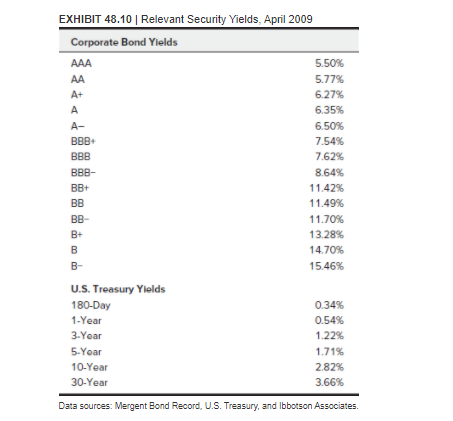

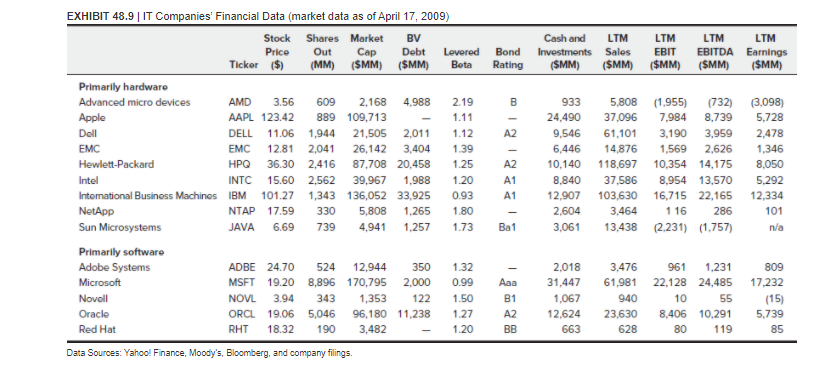

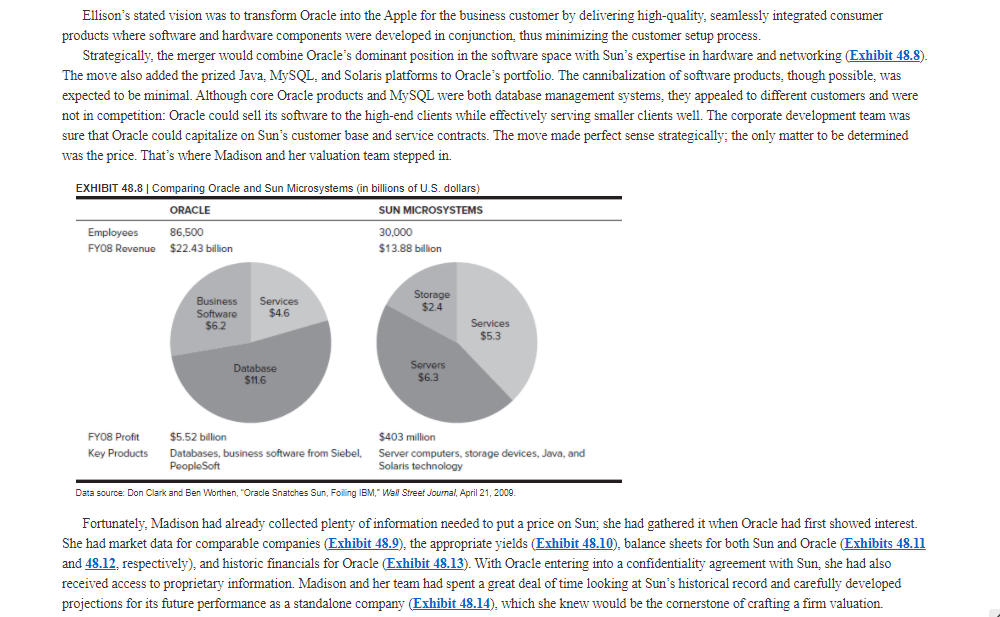

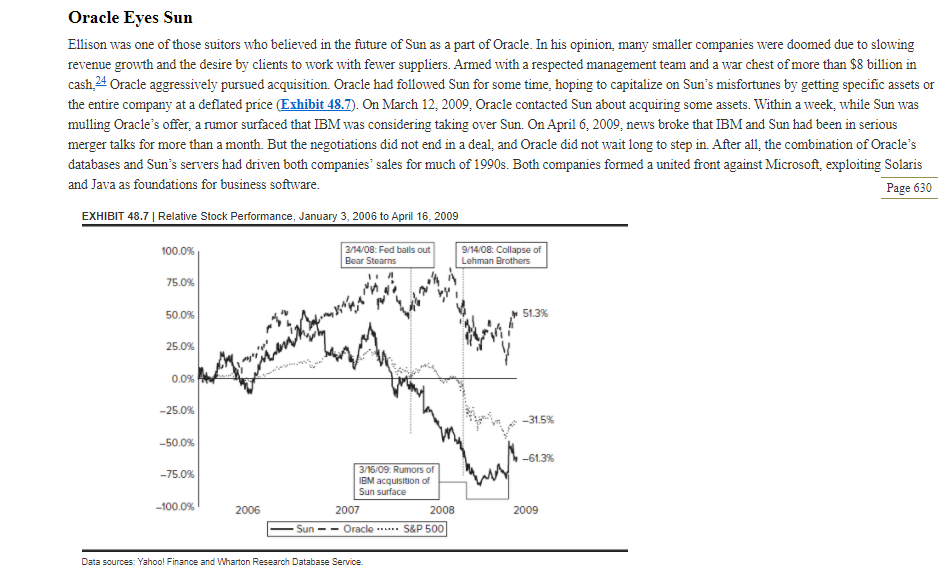

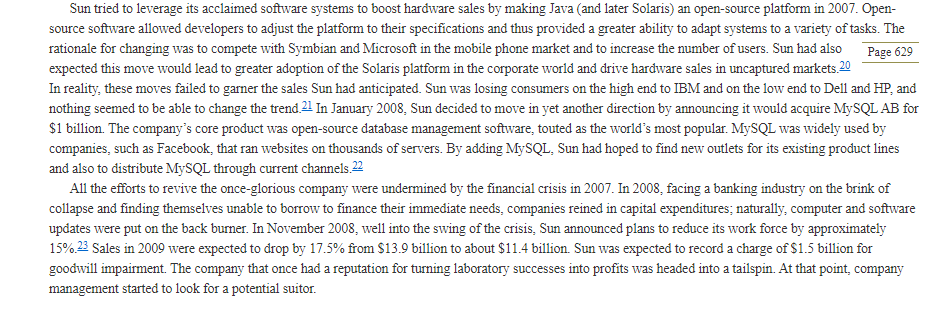

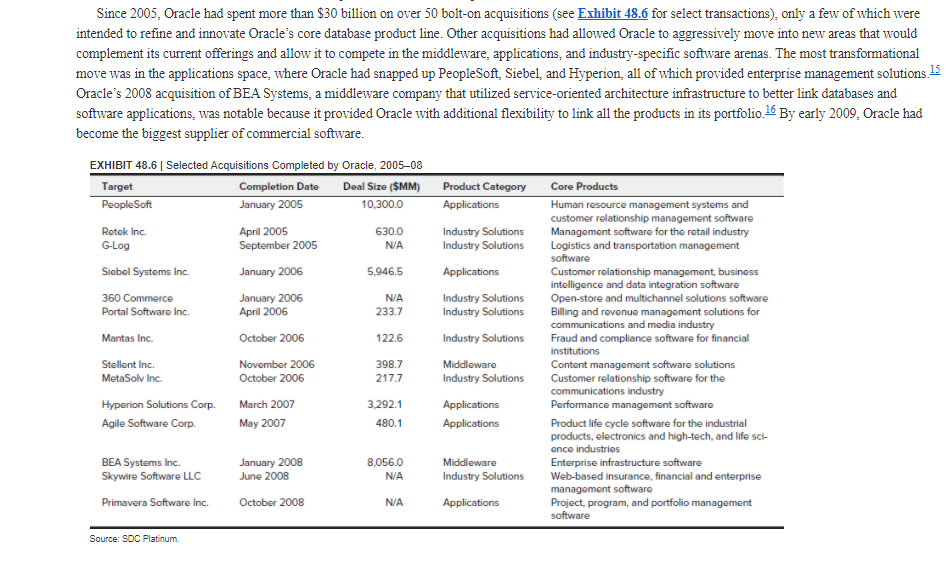

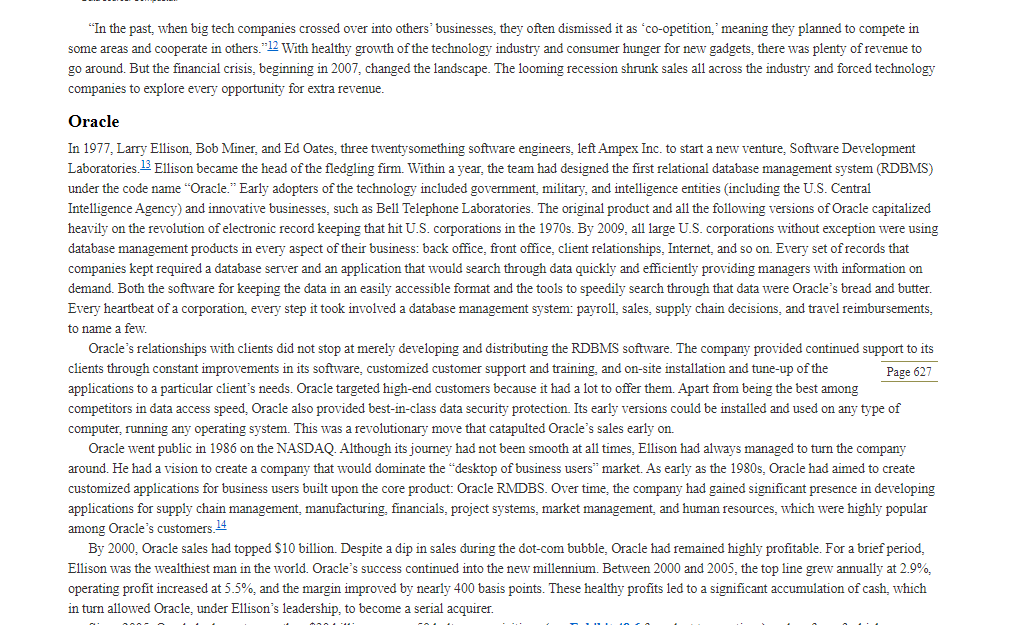

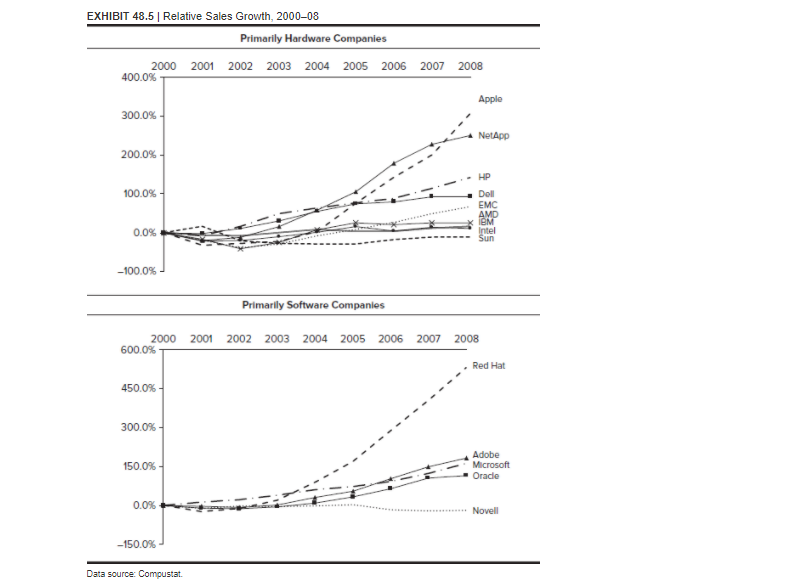

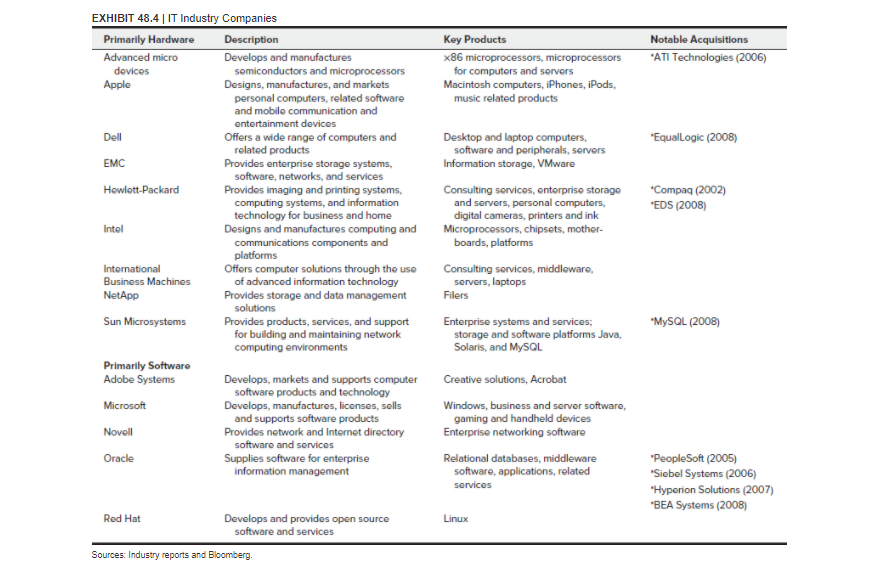

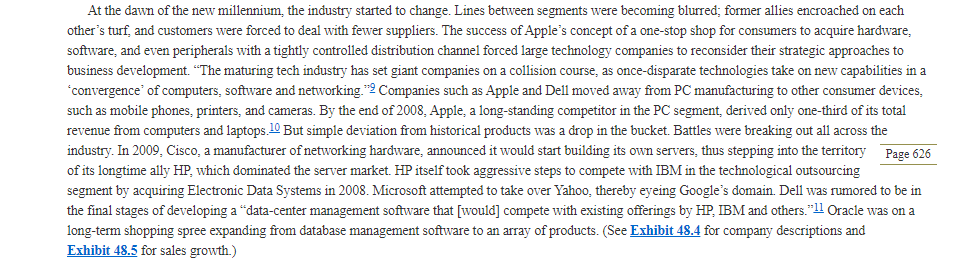

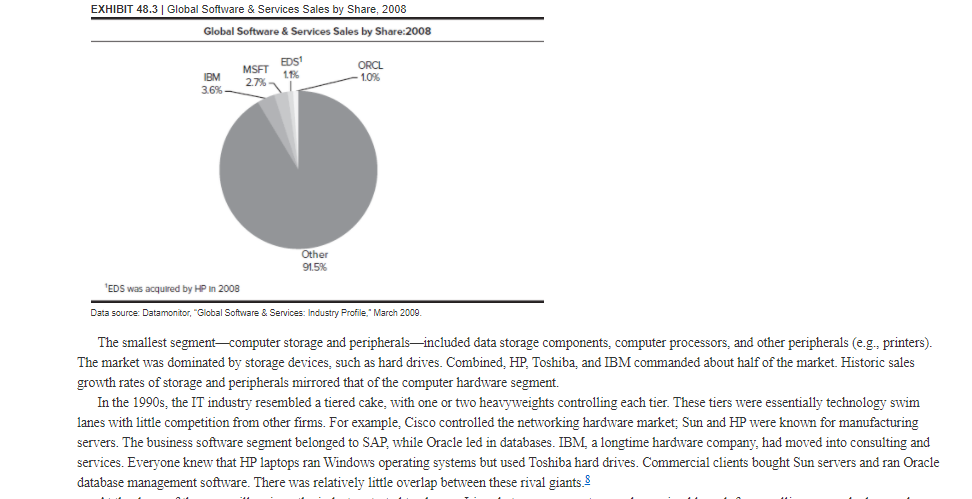

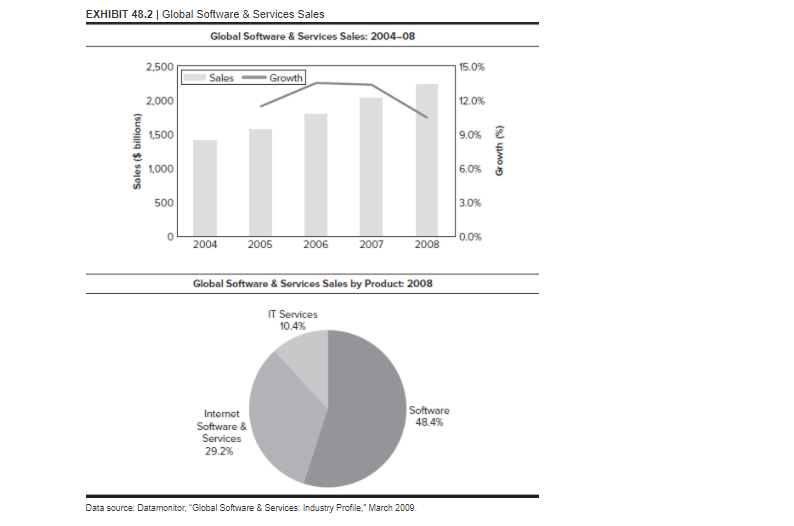

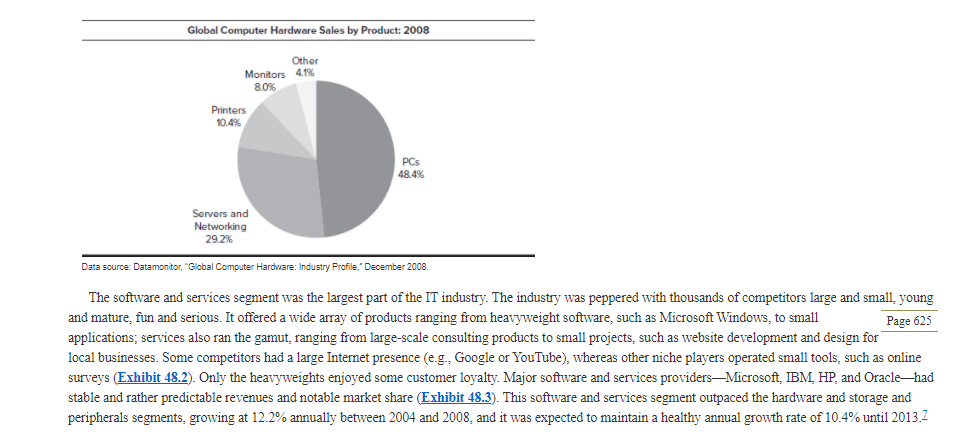

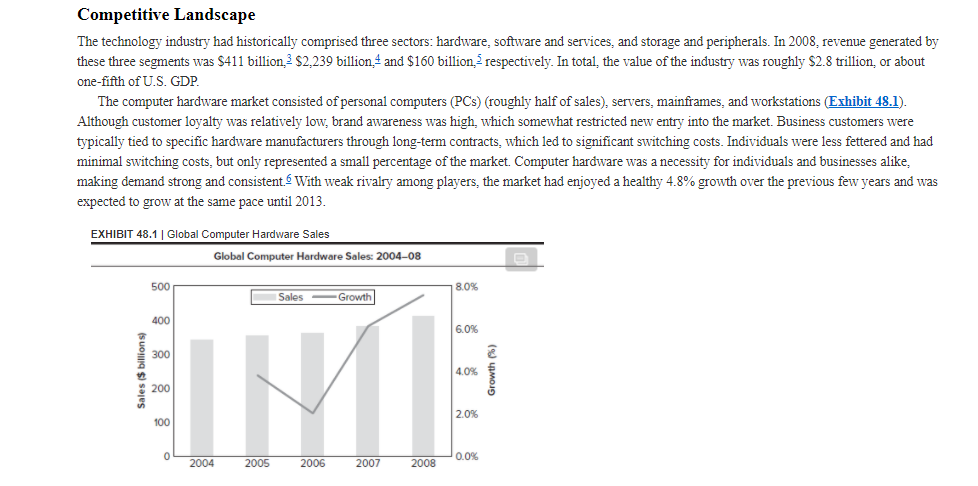

The next step was to determine how much extra value Oracle could generate by making Sun's operatim more elcient, cutting outdated and inefcient products and departments, streamlining remaining product lines, and introducing new synergistic systems. Knowing that a signicant percentage of anticipated merger synergies were never realized historically, Madison and her team were fairly conservative with their estimates. Cost cutting was the easy part. Having restructured and implemented lean operations in a ne ofpast acquisitions= Madison and her colleagues were pros at trimming the fat They knew Oracle could reduce Sun's staffby 20% to 25%, slash SGMexpenses by 22% to 32%, and allocate a signicant amount for other restructuring costs. Estimating sales forecasts, potential new product lines, and software licensing was a completely diferent story. which necessitated bringing the marketing, sales= and R&D people on board. First of all, Oracle team members expected Sun to initially lose some customers as a result of the merger They [mew that uncertainty of product offerings would push some customers to delay purchases and some to switch to competitors. Aer all, nobody wantedto buy an expensive piece of computer equipment only to nd later that it would not be supported by the new owners of the company. Another issue was the lowerend customers that Oracle had never dealt with before. The maiketing team expected these customers to hesitate to buy from Oracle for fear of being pushed into buying more expensive products. Marketing specialists knew that rivals would use similar arguments in aggressively pursuing Sun's clients. The only thing Oracle could do on this front was to minimize the extent of customer attrition Oracle's marketing department was already working on a plan to reassure low and high-end customers m alike of continued service. The second order of business was Sun's precious software. Although the opensource software could be downloaded free of charge, customers could elect to pay for product support and updates. The software had been particularly attractive during the recession Maiket sun'eys, which Oracle had quietly conducted, suggested that customers might be open to paying a small fee for software downloads. The quality of Sun's soware was so well known and appreciated by the market that the Oracle team was certainto increase its revenue stream om software licensing. The bigger source of revenue, however, was in the potential new products at the intersection ome and Oracle technologies. Alter all, most of Oracle's systems were built using Java and ran on the Solaris 093mg swim The RdtD team brainstormed on comhining Oracle's products and Sun's hardware and soware. Oracle had a longstanding plan to build Exadata machines that could handle both online transactions and data warehousing. Initially, the company had planned to use HP's hardware, but the opportunities Sun offered were too good to miss. Oracle engineers were positive that combining Oracle software with Flash'Wire technology, which Sun possessed, and then putting it on Sun hardware, could create a transactionprocessing database machine. This machine would be twice as fast as its predecessor and, with high probability much fasterthan machines produced by its closest rival, IBM. When Madison put a bottom line to the dollar value of all the potential synergies the merger could generate, the numbers were rather impressive. But the merger would also be costly. The team's calculations suggestedthat integration charges would be close to $1.1 billion in aggregate, with most (about $760 million) incurred in 2010. It also anticipated an initial loss in operating income of about $45 million, due to loss of customers and-"or delayed purchases. Cost cutting, licensing income, new products, and the addition of the \"integrated apphcationtodisk\" service had the potential to boost operating prot by as much as $900 million per year. Preferring to remain conserv'atise, Madison assumed that such synergies would kick in gadually over a threeyear time horizon starting in 2011. EXHIBIT 48.13 | Oracle Historical and Projected Income Statement (in millions of U.S. dollars) Fiscal Year-End May 31 2007 2008 2009E Software revenues 14,211 17,843 18,877 Services revenues 3,785 4,587 4,375 Net revenue 17.996 22.430 23.252 Selling, general, and administrative 8,790 10,468 10.217 Research and development 2,195 2,741 2,767 Amortization of intangible assets 878 1,212 1,713 Other operating expense 159 165 234 Total operating expense 12,022 14,586 14.931 Operating income 5,974 7,844 8,321 Income tax on operations 1,709 2,316 2.380 Net operating profit after tax 4.265 5.528 5.941 Effective corporate tax rate 28.6% 29.5%% 28.6% Data Sources: Company filings and case writer estimates EXHIBIT 48.14 | Sun Microsystems Historical and Projected Income Statement (in millions of U.S. dollars) Fiscal Year-End June 30 2007 2008 2009E 2010E 2011E 2012E 2013E 2014E Not revenue 13,873 13,880 11,449 12,665 13,047 13,526 13,885 14,243 Cost of sales 7,608 7,425 6,718 7.685 7,583 7,735 7,889 8.075 Gross margin 6,265 6.455 4,731 4.980 5.464 5,791 5,996 6.168 Selling, general, and administrative 3,851 3,955 3,461 Rosearch and development 2,008 1,834 1,648 Impairment of goodwill 1.460 Other operating expense 97 294 398 Total operating expense 5,956 6.083 6,967 4.839 4.992 5,121 5.249 5,372 Operating income 309 372 (2,236) 141 472 670 747 796 Doprociation and amortization 517 476 474 536 456 470 487 500 as % of prior year PP&E 34.4% 29.5% 29.3% 30.0% 30.0% 30.0% 30.0% 30.0% Net PP&E 1,504 1.611 1,616 1,520 1,566 1.623 1,666 1,709 as % of sales 10.8% 11.6% 14.1% 12.0% 12.0% 12.0% 12.0% 12.0% Data Sources: Company filings and case writer estimates.EXHIBIT 48.12 | Oracle Historical and Projected Balance Sheet (in millions of U.S. dollars) Fiscal Year-End May 31 2007 2008 2009E Assets Current assets Cash and cash equivalents 7,020 11,043 12.624 Not receivables 4.589 5,799 4.430 Inventory Other current assets 1.274 1,261 1,527 Total current assots 12,883 18,103 18,581 Property, plant, and equipment, not 1,603 1,688 1,922 Goodwill 13.479 17.991 18,842 Intangible assets 5.964 8,395 7.269 Other noncurrent assets 643 1.091 802 Total assets 34,572 47,268 47.416 Liabilities and equity Current liabilities Accounts payable 315 383 271 Short/Current long-term debt 1.358 1.001 1.001 Other current liabilities 7,714 8,645 7,877 Total current liabilities 9,387 10,029 9,149 Long-term debt 6.235 10.235 9.237 Deferred long-term charges 1.121 1.218 480 Other noncurrent liabilities 910 2,761 3.460 Total liabilities 17.653 24,243 22,326 Stockholders' equity Common stock 10.293 12.446 12,980 Treasury stock Retained earnings 6.223 9.961 11.894 Other stockholders' equity 403 618 216 Total stockholders' equity 16,919 23,025 25,090 Total liabilities and equity 34,572 47,268 47.416 Data sources: Company filings and case writer estimates\f\f\fEllison's stated vision was to transform Oracle into the Apple for the business customer by delivering high-quality, seamlessly integrated consumer products where software and hardware components were developed in conjunction, thus minimizing the customer setup process. Strategically, the merger would combine Oracle's dominant position in the software space with Sun's expertise in hardware and networking (Exhibit 48.8). The move also added the prized Java, MySQL, and Solaris platforms to Oracle's portfolio. The cannibalization of software products, though possible, was expected to be minimal. Although core Oracle products and MySQL were both database management systems, they appealed to different customers and were not in competition: Oracle could sell its software to the high-end clients while effectively serving smaller clients well. The corporate development team was sure that Oracle could capitalize on Sun's customer base and service contracts. The move made perfect sense strategically; the only matter to be determined was the price. That's where Madison and her valuation team stepped in. EXHIBIT 48.8 | Comparing Oracle and Sun Microsystems (in billions of U.S. dollars) ORACLE SUN MICROSYSTEMS Employees 86,500 30,000 FY08 Revenue $22.43 billion $13.88 billion Business Services Storage Software $4.6 $2.4 $6.2 Services $5.3 Database Sorvors $11.6 $6.3 FY08 Profit $5.52 billion $403 million Key Products Databases, business software from Siebel, Server computers, storage devices, Java, and PeopleSoft Solaris technology Data source: Don Clark and Ben Worthen, "Oracle Snatches Sun, Foiling IBM," Wall Street Journal, April 21, 2009. Fortunately, Madison had already collected plenty of information needed to put a price on Sun; she had gathered it when Oracle had first showed interest. She had market data for comparable companies (Exhibit 48.9), the appropriate yields (Exhibit 48.10), balance sheets for both Sun and Oracle (Exhibits 48.11 and 48.12, respectively), and historic financials for Oracle (Exhibit 48.13). With Oracle entering into a confidentiality agreement with Sun, she had also received access to proprietary information. Madison and her team had spent a great deal of time looking at Sun's historical record and carefully developed projections for its future performance as a standalone company (Exhibit 48.14), which she knew would be the cornerstone of crafting a firm valuation.\fSun tried to leverage its acclaimed software systems to boost hardware sales by making Java (and later Solaris) an opensource platform in 2007. Open source soware allowed developers to adjust the platform to their specications and thus provided a greater ability to adapt systems to a variety of tasks. The rationale :or changing was to compete with Symbian and Microsoft in the mobile phone market and to increase the number of users. Sun had also W expected this move would lead to greater adoption of the Solaris platform in the corporate world and drive hardware sales in Imcaptured markets In reality: these moves failed to garner the sales Sun had anticipated Sun was losing consumers onthe high end to IBM and on the low end to Dell and HP, and nothing seemed to be able to change the triend In January 2008: Sun decidedto move in yet another direction by announcing it would acquire MySQL AB for $1 billion. The company's core product was open-source database management software, touted as the world's most popular. MySQL was widely used by companies, such as Faceboolr, that ran websites onthousands of servers. By adding MySQL. Sun had hoped to find new outlets for its existing product lines and also to distribute MySQL through current channels.E All the efforts to revive the onceglorious company were undermined by the nancial crisis in 2007. In 2008, facing a banking industry on the brink of collapse and nding themselves unable to borrow to nance their immediate needs, companies reined in capital expenditures; naturally, computer and software updates were put onthe back burner. Ln November 2008, well into the swing of the crisis: Sun announced plans to reduce its work force by approximately 15%. Sales in 2009 were expected to drop by 17.5% om $13.9 billionto about $11.4 billion Sunwas expected to record a charge of$1.5 billion for goodwill impairment The company that once had a reputation for turning laboratory successes into prots was headed into a tailspin. At that point, company management started to look for a potential suitor. Sun Nlicrosystems Sun Microsystems, Inc. established in l9 82 by three Stanford gaduate students, built desktop computers and workstations. Sun entered the market at a time when pairing proprietary hardware, operating systems, and software was the norm. Sun broke new ground with its UNDEbased Solaris, which made W its computers compatible with many other software and hardware products available onthe marlth Sun's success= similar to Oracle. was attributed to rapid computerization of the companies records where new workstations rapidly replaced the behemoth \"minicomputersf' From 1935 to 1939: Sun grew at average annual rate of 145% reaching the status of fastest-growing company inAmerica. The next step in Sun's stardom was due to its development, in 1939, of a new chipset based on scalable performance architecture (SPARQ. Sun's EPARCs enhanced existing products by allowing it to create the smallest and stest workstations on the market at the time. Combining the hiquality hardware with excellent on and offsite customer service was a recipe for success. Alongside the bestinitsclass wcnkstations, Sunhad beenthe proud owner of the Solaris operating system which snccessrlly competed with Microsoft Windows in the corporate world and was treasured by many in the industry. In 1995, the company had also developed the Java programming language: which customers universally loved and had become an industry standard for developing sottware for web applications. 1t-'ir'tually all PCs and eventually mobile phones required Java, which Sun licensed for a small fee. In 199?, Oracle converted to Sun's Java proganrming language, thus allowing its applications to be easily used by web developers. Oracle had also adopted the Linux operating system. Sun went public in 1986 with a solid product oermg dominated by its hardware sales. It had thrived until the turn out the century when competition and market trends had turned against the company. Alter an altercation with Microsoft in the late 1990s, Sunwas forced to maloe .Tava and Solaris available to users gratis. The burst of the dotcom bubble had hit Sun hard by almost annihilating its highend hardware sales to the nancial sector. The economic downturn following the dotcom bust had forced nancial conglomerates to cut costs and move to lowerend hardware offered by Sun's competitors .5 Companies had also started to shy away from the SPARC proprietary chip line fawning more widely used chips from Lntel andAdvanced Micro Devices. Sun's product mix had begun to move from predmninantly hardware to a mix of hardware, soware, and services, but waning hardware sales were not offset by gains in other offerings.E Since 2005, Oracle had spent more than $30 billion on over 50 bolt-on acquisitions (see Exhibit 48.6 for select transactions), only a few of which were intended to refine and innovate Oracle's core database product line. Other acquisitions had allowed Oracle to aggressively move into new areas that would complement its current offerings and allow it to compete in the middleware, applications, and industry-specific software arenas. The most transformational move was in the applications space, where Oracle had snapped up PeopleSoft, Siebel, and Hyperion, all of which provided enterprise management solutions.12 Oracle's 2008 acquisition of BEA Systems, a middleware company that utilized service-oriented architecture infrastructure to better link databases and software applications, was notable because it provided Oracle with additional flexibility to link all the products in its portfolio. By early 2009, Oracle had become the biggest supplier of commercial software. EXHIBIT 48.6 | Selected Acquisitions Completed by Oracle, 2005-08 Target Completion Date Deal Size ($MM) Product Category Core Products PeopleSoft January 2005 10.300.0 Applications Human resource management systems and customer relationship management software Rotok Inc. April 2005 630.0 Industry Solutions Management software for the retail industry G-Log September 2005 N/A Industry Solutions Logistics and transportation management software Siobol Systems Inc. January 2006 5,946.5 Applications Customer relationship management, business intelligence and data integration software 360 Commerce January 2006 N/A Industry Solutions Open-store and multichannel solutions software Portal Software Inc. April 2006 233.7 Industry Solutions Billing and revenue management solutions for communications and media industry Mantas Inc. October 2006 122.6 Industry Solutions Fraud and compliance software for financial institutions Stellent Inc. November 2006 398.7 Middleware Content management software solutions MetaSolv Inc. October 2006 217.7 Industry Solutions Customer relationship software for the communications industry Hyperion Solutions Corp. March 2007 3,292.1 Applications Performance management software Agile Software Corp. May 2007 480.1 Applications Product life cycle software for the industrial products, electronics and high-tech, and life sci- once industries BEA Systems Inc. January 2008 8,056.0 Middleware Enterprise infrastructure software Skywire Software LLC June 2008 N/A Industry Solutions Web-based insurance, financial and enterprise management software Primavera Software Inc. October 2008 N/A Applications Project, program, and portfolio management software Source: SDC Platinum.__.____.__ __..'.__.__ \"In the past, when big tech companies crossed over into others" businesses, they often dismissed it as 'coopetrtion,' meaning they planned to compete in some areas and cooperate in others."3 With healthy grouth of the technology industry and consumer hunger for new gadgets, there was plenty of revem1e to go around. Butthe nancial crisis, beginning in 200?, changedthe landscape. The looming recession shrunk sales all across the industry and forced technology companies to explore every opportunity for extra revenue. Oracle In 19W, Larry Ellison, Bob Miner. and 3d Oates, three twentysomething software engineers. leftAmpex Inc. to start a new venture, Software Development Laboratories. Ellisonbecame the head of the edgling firm. Within a year= the team had designed the rst relational database management system (RDBMS) under the code name \"Oracle.\" Early adopters of the technology included government; military and intelligence entities {including the U.S. Central Intelligence Agency} and innovative businesses, such as Bell Telephone Laboratories. The original product and all the following versions of Oracle capitalized heavily onthe revolution of electronic record keeping that hit U. S. corporations inthe 1970s. By 2009, all large U.S. corporations without exception were using database management products in every aspect of their business: baclr ofce, front ofce, client relationships, Internet, and so on. Every set of records that companies lrept required a database server and an applicationthat would search through data quickly and etciently providing managers with information on demand. Both the software for keeping the data in an easily accessible format and the tools to speedily search through that data were Oracle's bread and butter. Every heartbeat of a corporation, every step ittook involved a database management system: payroll, sales= supply chain decisions. and travel reimbursements= to name a few. Oracle's relationships with clients did not stop at merely developing and distributing the RDBMS software. The company provided continued support to its clients through constant improvements in its software= customized customer support and training= and onsite installation and tuneup ofthe W applications to a particular client's needs. Oracle targeted high-end customers because it had a lot to o'er them. Apart from being the best among 7 competitors in data access speed, Oracle also provided bestinclass data security protection. Its early versions could be installed and used on any type of computer, running any operating system. This was a revolutionary move that catapulted Oracle's sales early on. Oracle went public in 1986 on the NASDAQ. Although its journey had not been smooth at all times= Ellison had always managed to trim the company around. He had a vision to create a company that would dominate the \"desktop ofbusiness users\" market. As early as the 1930s, Oracle had aimed to create customized applications for business risers built uponthe core product: Oracle RMDBS. Over time, the company had gained signicant presence in developing applications for supply chain management manufacturing= nancials, project systems, market management; and human resources, \"nch were highly popular among Oracle's customers.H By 2000, Oracle sales had topped $10 billion. Despite a dip in sales during the dot-com bubble, Oracle had remained highly protable. For a briefperiod, Ellison was the wealthiest man in the world Oracle's success continued into the new millennium. Between 2000 and 2005, the top line grew annually at 2.9%, operating prot increased at 5.5%, and the margin improved by nearly 400 basis points. These healthy prots led to a signicant accumulation ofcash, which in turn allowed Oracle, under Ellison's leadership, to become a serial acquirer. -....._ ... . a.-.\" -n. .. . ..........-.. . .. .. r . .. n EXHIBIT 48.5 | Relative Sales Growth, 2000-08 Primarily Hardware Companies 2000 2001 2002 2003 2004 2005 2006 2007 2008 400.0% Apple 300.0% -A NetApp 200.0% HP 100.0% - Doll EMC AMD 0.0% Intel Sun -100.0% - Primarily Software Companies 2000 2001 2002 2003 2004 2005 2006 2007 2008 600.0% Red Hat 450.0% - 300.0% - Adobe 150.0% - Microsoft Orade 0.0% ..*: Novell -150.0% - Data source: Compustat.EXHIBIT 48.4 | IT Industry Companies Primarily Hardware Description Key Products Notable Acquisitions Advanced micro Develops and manufactures x86 microprocessors, microprocessors "ATI Technologies (2006) devices semiconductors and microprocessors for computers and servers Apple Designs, manufactures, and markets Macintosh computers, iPhones, iPods, personal computers, related software music related products and mobile communication and entertainment devices Dell Offers a wide range of computers and Desktop and laptop computers, 'EqualLogic (2008) related products software and peripherals, servers EMC Provides enterprise storage systems, Information storage, VMware software, networks, and services Howlott-Packard Provides imaging and printing systems, Consulting services, enterprise storage "Compaq (2002) computing systems, and information and servers, personal computers, EDS (2008) technology for business and home digital cameras, printers and ink Intel Designs and manufactures computing and Microprocessors, chipsets, mother- communications components and boards, platforms platforms Intornational Offers computer solutions through the use Consulting services, middleware, Business Machines of advanced information technology servers, laptops NetApp Provides storage and data management Filers solutions Sun Microsystems Provides products, services, and support Enterprise systems and services; "MySQL (2008) for building and maintaining network storage and software platforms Java, computing environments Solaris, and MySQL Primarily Software Adobe Systems Develops, markets and supports computer Creative solutions, Acrobat software products and technology Microsoft Develops, manufactures, licenses, sells Windows, business and server software, and supports software products gaming and handheld devices Novell Provides network and Internet directory Enterprise networking software software and services Oracle Supplies software for enterprise Relational databases, middleware "PeopleSoft (2005) information management software, applications, related "Siebel Systems (2006) services 'Hyperion Solutions (2007) 'BEA Systems (2008) Red Hat Develops and provides open source Linux software and services Sources: Industry reports and Bloomberg.At the dawn of the new millennium, the industry started to change. Lines between segments were becoming blurred; former allies encroached on each other's turf, and customers were forced to deal with fewer suppliers. The success cprple's concept of a one-stop shop for consumers to acquire hardware, so'ware, and even peripherals with atightly controlled distribution channel forced large technology companies to reconsider their strategic approaches to business development. \"The maturing tech industry has set giant companies on a collision course, as oncedisparate technologies take on new capabilities in a 'cont'ergence" of computers, software and networking"? Companies such as Apple and Dell moved away from 30 manufacturing to other consumer devices, such as mobile phones, printers, and cameras. By the end of 2008, Apple, a longstanding competitor inthe PC segment, derived only onethird of its total revenue from computers and laptops. Brit simple deviation from historical products was a drop inthe bucket. Battles were breaking out all across the industry. In 2009, Cisco, a manufacturer of networking hardware, announced it would start building its own servers, thus stepping into the territory W ofits longtime ally HP, which dominated the server market. HP itselftook aggressive steps to compete with IBM in the technological outsourcing segment by acquiring Electronic Data Systems in 2008. Micros-oh attemptedtc take over Yahoo, thereby eyeing Google's domain Dell was mmmed to be in the nal stages of developing a \"data-center management software that [would] compete with existing offerings by HP, IBM and cthers.\" Oracle was on a long-term shopping spree expanding from database management software to an array of products. (See Exhibit 48.4 for company descriptions and Exhibit 48.5 for sales growth.) EXHIBIT 48.3 | Global Sowale 8t Services Sales by Share. 2008 nbulkmroimS-hbym 335' on user m. m m ' 1.095 3.6% 91.5% 'Eosnaauqmdm til-tacos Dale SOUI'EE Damion 'Glohal Soware S Senoa: Instisn'y Pmte.' Mardl 21309. The smallest segmentcomputer storage and peripheralsincluded data storage components, computer processors, and other peripherals (e.g., printers). The market was dominated by storage devices= such as hard drives. Combined, HP, Toshiba, and IBM commanded about hatfof the market. Historic sales growth rates of storage and peripherals mirrored that of the computer hardware segment. In the 19905, the IT indirsttj,r resembled a tiered cake= with one or two heavyweights controlling each tier. These tiers were essentially technology swim lanes with little competition from other rms. For example, Cisco controlled the networking hardware market; Sun and HP were known for manufacturing servers. The business software segment belonged to SAP, while Oracle led in databases. [ELL a longtime hardware company, had moved into consulting and services. Everyone knew that HP laptops ran'Mndows operating systems but used Toshiba hard drives. Commercial clients bought Sun servers and ran Oracle database management software. There was relatively little overlap between these [ital giants.s \fGlobal Computer Hardware Sales by Product: 2008 Other Monitors 4.1% 8.0% Printers 10.4% PCs 48.4% Servers and Networking 29.2% Data source: Datamonitor, "Global Computer Hardware: Industry Profile." December 2008. The software and services segment was the largest part of the IT industry. The industry was peppered with thousands of competitors large and small, young and mature, fun and serious. It offered a wide array of products ranging from heavyweight software, such as Microsoft Windows, to small Page 625 applications; services also ran the gamut, ranging from large-scale consulting products to small projects, such as website development and design for local businesses. Some competitors had a large Internet presence (e.g., Google or YouTube), whereas other niche players operated small tools, such as online surveys (Exhibit 48.2). Only the heavyweights enjoyed some customer loyalty. Major software and services providers-Microsoft, IBM. HP, and Oracle-had stable and rather predictable revenues and notable market share (Exhibit 48.3). This software and services segment outpaced the hardware and storage and peripherals segments, growing at 12.2% annually between 2004 and 2008, and it was expected to maintain a healthy annual growth rate of 10.4% until 2013.-Competitive Landscape The technology industry had historically comprised three sectors: hardware, soware and services and storage and peripherals. In 2008. revenue generated by these three segments was $411 billion; $2,239 hliomi and $160 billion; respectively. In total, the value of the industry was roughly $2.3 trillion, or about onefth of U.S. GDP. The commuter hardware market consisted of personal computers (PCs) (roughly halfof sales), sewers, mainframes, and workstations {Exhibit 43.1]. Although customer loyalty was relatively low, brand awareness was high, which somewhat restricted new entry into the market. Business customers were typically tied to specic hardware manufactmers through longterm contracts= which led to signicant switching costs. Individuals were less fettered and had minimal stir-"itching costs, but only represented a small percentage of the market Computer hardware was a necessity for individuals and businesses alike, making demand strong and consistent. Withweali rivalry among players, the market had enjoyed a healthy 4.3% growth over the previous few years and was expected to grow at the same pace until 2013. EXHIBIT 48.1 | Global Computer Hardware Sales Global Com Hum-r Sal-e: 200108 500 30% m 400 . ems i am is n a ans. 2 5 200 I, a 20% 100 . o 0.0!. 2004 2005 2068 200? 2006 CASE lg! Sun Microsystems Oracle will be the only comparing that can engineer an integrated system-application to dirtwhere of! fire pieces t {again-er so the customers do not have to do it themselves . . . Our customers being?! as their systems integration costs go down while systempeij'brmce, reliability mdreeta'ii}= go 1.3:. L l.l'l'_\\-' Ellison, CEO, Oracle Cor-pm-at'un-nl It was the rst time in the last two weeks that Margaret Madison, a member ofOracle's corporate development team, had not stayed in the ofce until two in the morning. At the close of business earlier that day, Friday, April 1?, 2009, Oracle had put in an offer of $133 billion, or $9.50 per share, to acquire Sun Microsystems. Only nine months into her position, Madison, a recent MBA graduate, had found herselfto be a member of Oracle's valuation team, assessing a potential merger with Sun The journey, however, was not over yet Sun had a mimber of potential suitors, IBM standing prominently among them, and Madison and her colleagues expected IBMto counter Oracle's offer. Oracle, a California-based business software company, was one of the world's largest and most reputable sellers of database management systems and other related software. With $23.6 billion in anmial revenue, the company was a leviathan, led forward with lightning speed by the only CEO Oracle had ever had, Larry Ellison Sunwas nothing to scoff at either. Once the darling of Silicon Valley, it had fallen on toughtimes but was still competitive. Sun had started as a hardware and seners producer, but over the years, it had established a solid position in the software industry with its Java programming language, Solaris operating system, and MySQL database management software. Combining these two companies had the potential to create the Wail-Mart of the enterprise soware industry. Ellison \"had a vision for creating an endtoend vendor [that] clients go to for all their technology" needs! W Oracle's bid of $9.50 per share was more than a 40% premium over Sun's $6.69 closing price that day. But only a few weeks prior, IBM Oracle's chiefrival inthe $15 billion database software businesshad offered $9.40 pershare for Sun. The talks had stalled due to antitrust concerns, employment contracts, and the nal price, which opened a window ofopportunity for Oracle to step in and ensure that Sun did not tall into a competitor's hands. Oracle had been on a successful shopping spree over the past several years. The ability to acquire 10% margin companies and turn them into 40% margin companies had distinguished Ellison and his team as ruthless cost-cutters who planned ahead well before making purchases. As a member of the corporate development team, Madison knew that better than anyone else. She had spent the last few weeks careilly poring over every part of Sun's nancials, business lines, Rd'cD gures, and personnel expenditures. Today was a break from the 20hour work days, the sight of empty Chinese food cartm, documents strewn across the table, and wearyeyed bankers. Today had been a better day, but only delivered brief respite to the team All the questions they had worked on so diligently still remained. Had they considered everything? Was the nal o'er appropriate? If competitors upped their bids, how much more could Oracle offer