The Nolan Corporation finds it is necessary to determine its marginal cost of capital. Nolans current capital structure calls for 45 percent debt, 15 percent

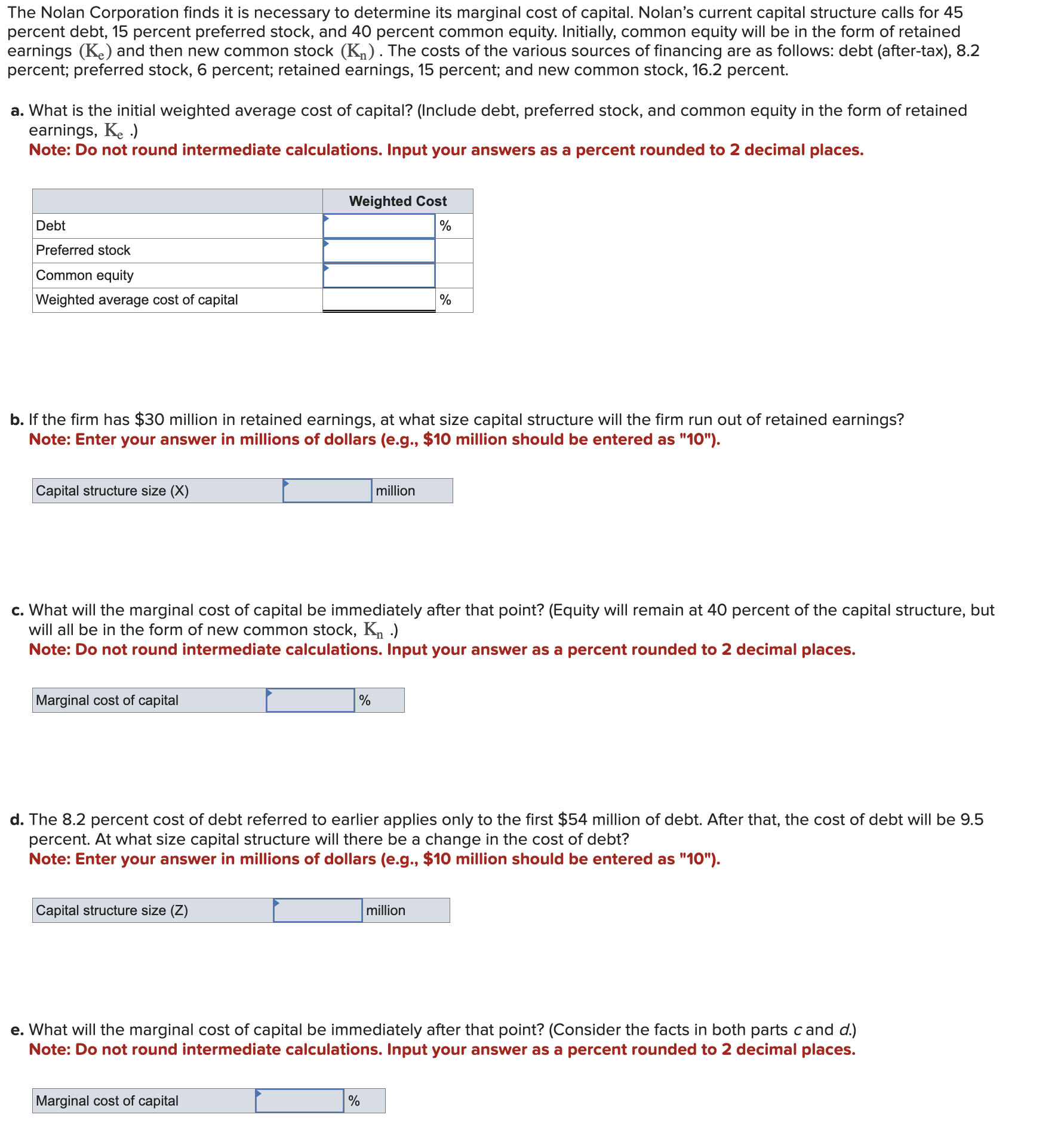

The Nolan Corporation finds it is necessary to determine its marginal cost of capital. Nolans current capital structure calls for 45 percent debt, 15 percent preferred stock, and 40 percent common equity. Initially, common equity will be in the form of retained earnings (Ke)() and then new common stock (Kn)() . The costs of the various sources of financing are as follows: debt (after-tax), 8.2 percent; preferred stock, 6 percent; retained earnings, 15 percent; and new common stock, 16.2 percent.

a. What is the initial weighted average cost of capital? (Include debt, preferred stock, and common equity in the form of retained earnings, Ke .)

Note: Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.

Debt ____%

Preferred stock ____

Common equity _____

Weighted average cost of capital ____%

b. If the firm has $30 million in retained earnings, at what size capital structure will the firm run out of retained earnings?

Note: Enter your answer in millions of dollars (e.g., $10 million should be entered as "10").

Capital structure size (x) _____million

c. What will the marginal cost of capital be immediately after that point? (Equity will remain at 40 percent of the capital structure, but will all be in the form of new common stock, Kn .)

Note: Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.

Marginal cost of capital ______%

d. The 8.2 percent cost of debt referred to earlier applies only to the first $54 million of debt. After that, the cost of debt will be 9.5 percent. At what size capital structure will there be a change in the cost of debt?

Note: Enter your answer in millions of dollars (e.g., $10 million should be entered as "10").

Capital structure size (z) _____million

e. What will the marginal cost of capital be immediately after that point? (Consider the facts in both parts c and d.)

Note: Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.

Marginal cost of capital ______%

The Nolan Corporation finds it is necessary to determine its marginal cost of capital. Nolan's current capital structure calls for 45 percent debt, 15 percent preferred stock, and 40 percent common equity. Initially, common equity will be in the form of retained earnings (Ke) and then new common stock (Kn). The costs of the various sources of financing are as follows: debt (after-tax), 8.2 percent; preferred stock, 6 percent; retained earnings, 15 percent; and new common stock, 16.2 percent. a. What is the initial weighted average cost of capital? (Include debt, preferred stock, and common equity in the form of retained earnings, Ke.) Note: Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places. b. If the firm has $30 million in retained earnings, at what size capital structure will the firm run out of retained earnings? Note: Enter your answer in millions of dollars (e.g., $10 million should be entered as "10"). c. What will the marginal cost of capital be immediately after that point? (Equity will remain at 40 percent of the capital structure, but will all be in the form of new common stock, Kn.) Note: Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places. d. The 8.2 percent cost of debt referred to earlier applies only to the first $54 million of debt. After that, the cost of debt will be 9.5 percent. At what size capital structure will there be a change in the cost of debt? Note: Enter your answer in millions of dollars (e.g., $10 million should be entered as "10"). e. What will the marginal cost of capital be immediately after that point? (Consider the facts in both parts c and d.) Note: Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started