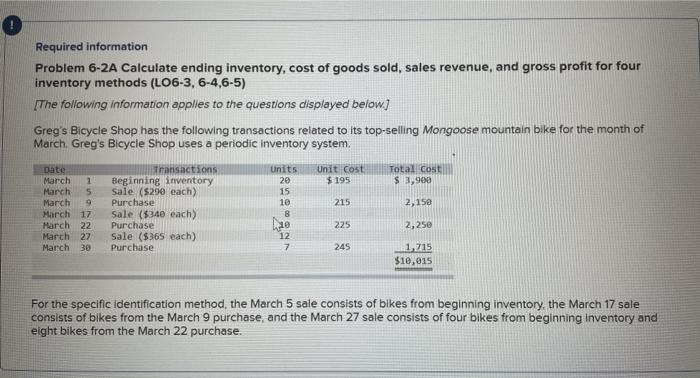

the number by the mouse is 10 so sorry, didnt relaize the mouse was kinda covering it.

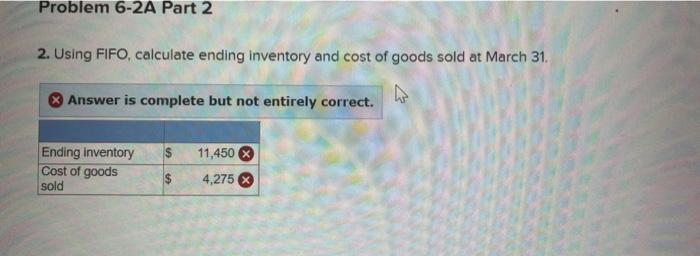

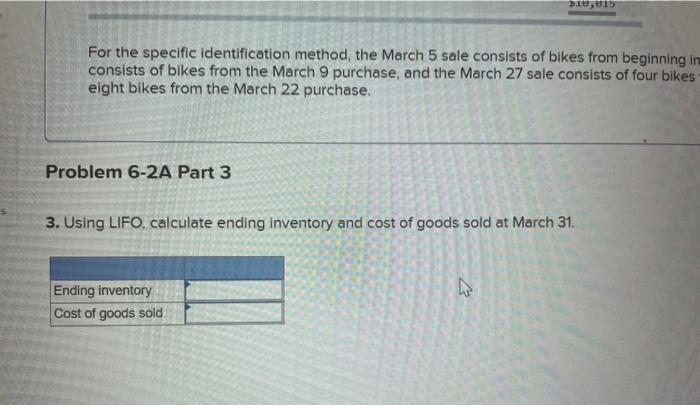

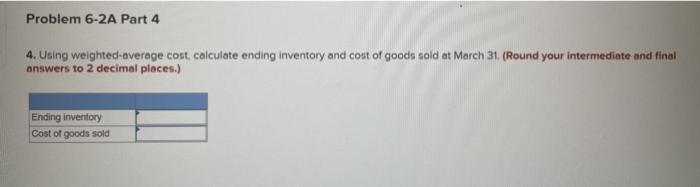

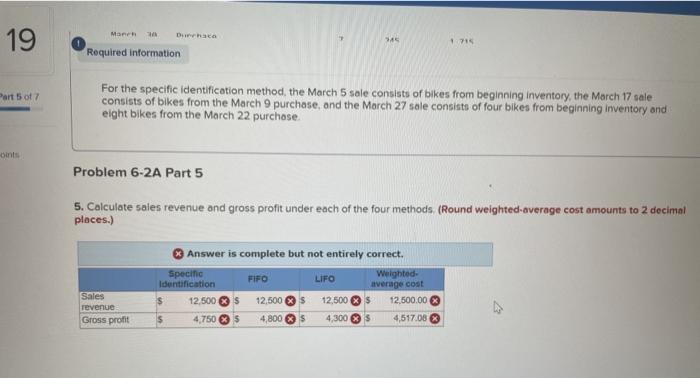

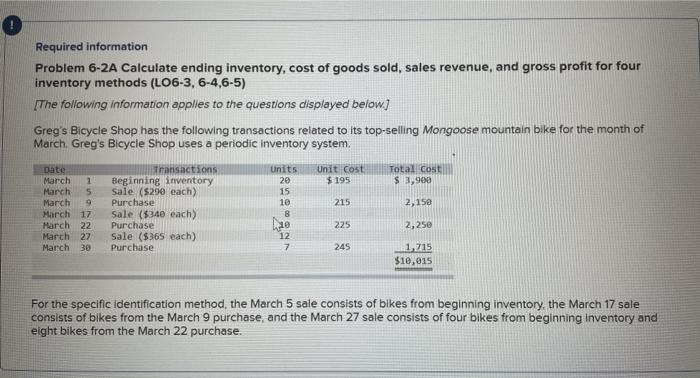

Required information Problem 6-2A Calculate ending inventory, cost of goods sold, sales revenue, and gross profit for four inventory methods (LO6-3, 6-4,6-5) The following information applies to the questions displayed below) Greg's Bicycle Shop has the following transactions related to its top-selling Mongoose mountain bike for the month of March Greg's Bicycle Shop uses a periodic inventory system. Transactions Units Unit Cost Total cost March Beginning inventory 20 $ 195 $ 3,900 5 Sale ($290 each) 15 March Purchase 10 2,150 March Sale ($340 each) 8 March Purchase 10 2,25 March 27 Sale ($365 each) March 30 Purchase 1,215 $10,015 Date 1 March 215 9 17 22 225 12 7 245 For the specific identification method, the March 5 sale consists of bikes from beginning inventory, the March 17 sale consists of bikes from the March 9 purchase, and the March 27 sale consists of four bikes from beginning inventory and eight bikes from the March 22 purchase. Problem 6-2A Part 2 2. Using FIFO, calculate ending inventory and cost of goods sold at March 31. Answer is complete but not entirely correct. Ending inventory Cost of goods sold 11,450 $ 4,275 DUIS For the specific identification method, the March 5 sale consists of bikes from beginning in consists of bikes from the March 9 purchase, and the March 27 sale consists of four bikes eight bikes from the March 22 purchase. Problem 6-2A Part 3 3. Using LIFO, calculate ending Inventory and cost of goods sold at March 31. Ending inventory Cost of goods sold Problem 6-2A Part 4 4. Using weighted average cost, calculate ending inventory and cost of goods sold at March 31. (Round your intermediate and final answers to 2 decimal places.) Ending inventory Cost of goods sold Man Daca 19 +7 Required information Part 5 of 7 For the specific identification method, the March 5 sale consists of bikes from beginning inventory, the March 17 sale consists of bikes from the March 9 purchase, and the March 27 sale consists of four bikes from beginning inventory and eight bikes from the March 22 purchase. bits Problem 6-2A Part 5 5. Calculate sales revenue and gross profit under each of the four methods (Round weighted average cost amounts to 2 decimal places.) Answer is complete but not entirely correct. Specific FIFO LIFO Weighted Identification average cost $ 12 500 $ 12,500 $ 12,500 X $ 12,500.00 $ 4,750 $ 4,800 $ 4,300 $ 4,517.08 Sales revenue Gross profit

the number by the mouse is 10 so sorry, didnt relaize the mouse was kinda covering it.

the number by the mouse is 10 so sorry, didnt relaize the mouse was kinda covering it.