Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The number of companies in the Australian retail clothing industry is always changing. Roosters Active Wear Limited is a company that has been in

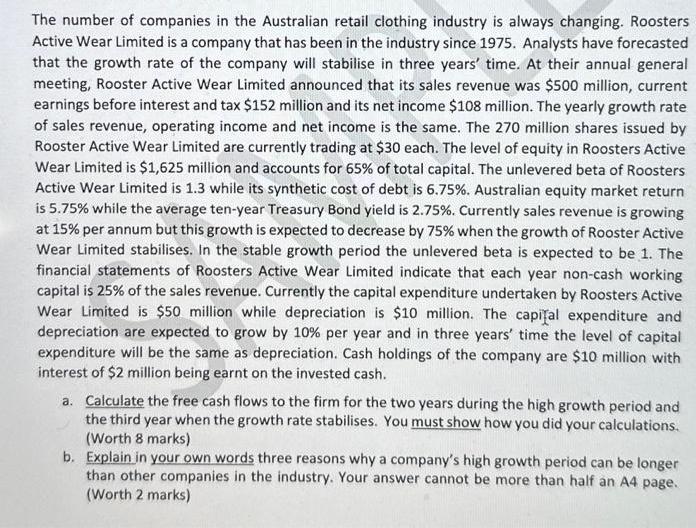

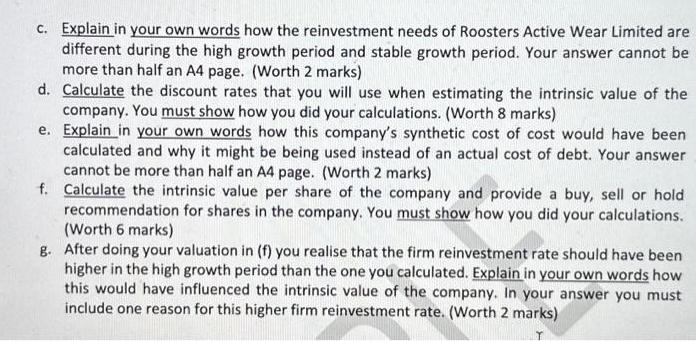

The number of companies in the Australian retail clothing industry is always changing. Roosters Active Wear Limited is a company that has been in the industry since 1975. Analysts have forecasted that the growth rate of the company will stabilise in three years' time. At their annual general meeting, Rooster Active Wear Limited announced that its sales revenue was $500 million, current earnings before interest and tax $152 million and its net income $108 million. The yearly growth rate of sales revenue, operating income and net income is the same. The 270 million shares issued by Rooster Active Wear Limited are currently trading at $30 each. The level of equity in Roosters Active Wear Limited is $1,625 million and accounts for 65% of total capital. The unlevered beta of Roosters Active Wear Limited is 1.3 while its synthetic cost of debt is 6.75%. Australian equity market return is 5.75% while the average ten-year Treasury Bond yield is 2.75%. Currently sales revenue is growing at 15% per annum but this growth is expected to decrease by 75% when the growth of Rooster Active Wear Limited stabilises. In the stable growth period the unlevered beta is expected to be 1. The financial statements of Roosters Active Wear Limited indicate that each year non-cash working capital is 25% of the sales revenue. Currently the capital expenditure undertaken by Roosters Active Wear Limited is $50 million while depreciation is $10 million. The capital expenditure and depreciation are expected to grow by 10% per year and in three years' time the level of capital expenditure will be the same as depreciation. Cash holdings of the company are $10 million with interest of $2 million being earnt on the invested cash. a. Calculate the free cash flows to the firm for the two years during the high growth period and the third year when the growth rate stabilises. You must show how you did your calculations. (Worth 8 marks) b. Explain in your own words three reasons why a company's high growth period can be longer than other companies in the industry. Your answer cannot be more than half an A4 page. (Worth 2 marks) c. Explain in your own words how the reinvestment needs of Roosters Active Wear Limited are different during the high growth period and stable growth period. Your answer cannot be more than half an A4 page. (Worth 2 marks) d. Calculate the discount rates that you will use when estimating the intrinsic value of the company. You must show how you did your calculations. (Worth 8 marks) e. Explain in your own words how this company's synthetic cost of cost would have been calculated and why it might be being used instead of an actual cost of debt. Your answer cannot be more than half an A4 page. (Worth 2 marks) f. Calculate the intrinsic value per share of the company and provide a buy, sell or hold recommendation for shares in the company. You must show how you did your calculations. (Worth 6 marks) g. After doing your valuation in (f) you realise that the firm reinvestment rate should have been higher in the high growth period than the one you calculated. Explain in your own words how this would have influenced the intrinsic value of the company. In your answer you must include one reason for this higher firm reinvestment rate. (Worth 2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started