Answered step by step

Verified Expert Solution

Question

1 Approved Answer

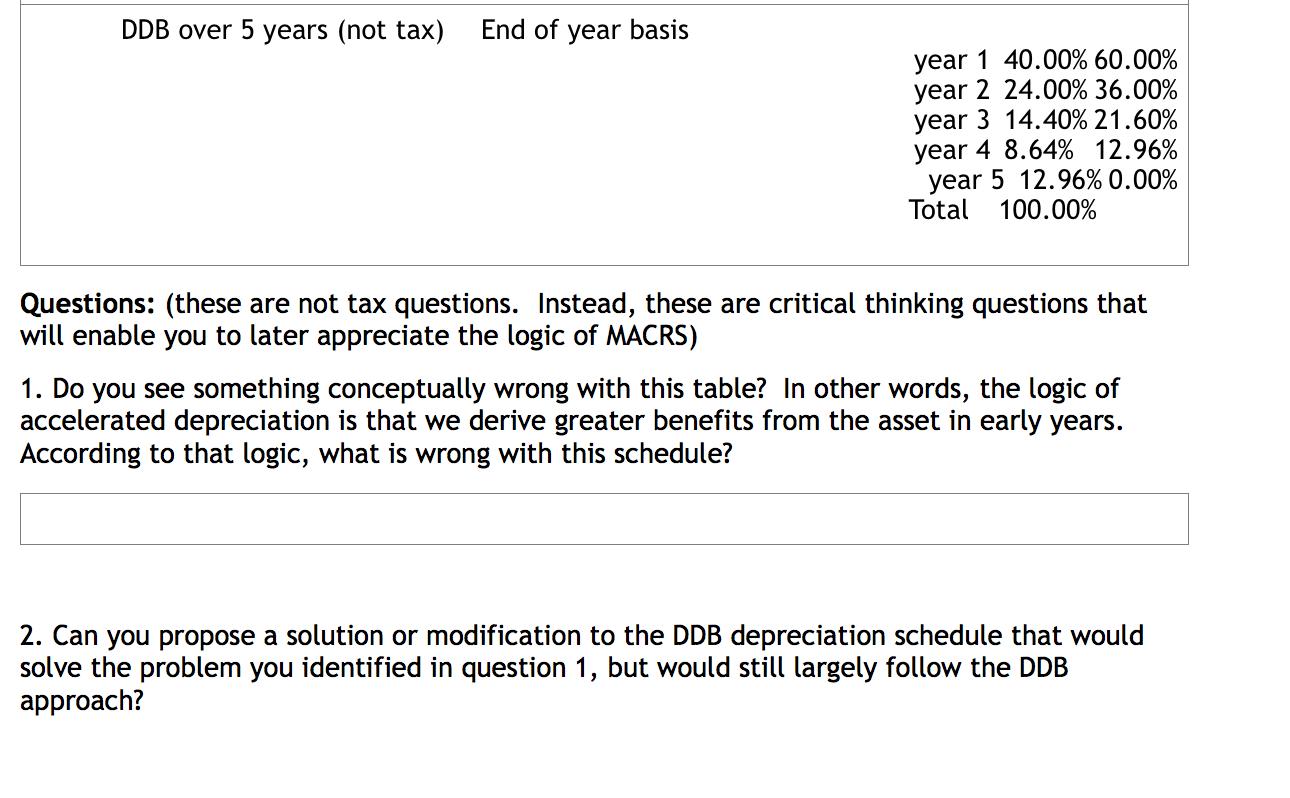

DDB over 5 years (not tax) End of year basis year 1 40.00% 60.00% year 2 24.00% 36.00% year 3 14.40% 21.60% year 4

DDB over 5 years (not tax) End of year basis year 1 40.00% 60.00% year 2 24.00% 36.00% year 3 14.40% 21.60% year 4 8.64% 12.96% year 5 12.96% 0.00% Total 100.00% Questions: (these are not tax questions. Instead, these are critical thinking questions that will enable you to later appreciate the logic of MACRS) 1. Do you see something conceptually wrong with this table? In other words, the logic of accelerated depreciation is that we derive greater benefits from the asset in early years. According to that logic, what is wrong with this schedule? 2. Can you propose a solution or modification to the DDB depreciation schedule that would solve the problem you identified in question 1, but would still largely follow the DDB approach?

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 The concept of accelerated depreciation is being violated in this question As the r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started