Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Oakes realize that if they started from scratch, they would need patience and plenty of capital before they would be able to sell trees.

The Oakes realize that if they started from scratch, they would need patience and plenty of capital before

they would be able to sell trees. Christmas tree operators buy twoyearold trees seedlings for

transplanting onto their land. The cost of each seedling depends on the type of evergreen. Table gives

the prices for seedlings. They plan to continue the tree farm's current operation and plant trees per

acre. However, the agriculture extension service says that with space for access to the trees every four or

five rows and spacing trees six feet apart, operators can plant trees per acre. The trees then grow for

the next to years before being cut down and sold between and years of age. Pricing per tree

depends on the height, type, and quality of the tree. Table provides the current Christmas tree wholesale

and retail prices. Both the seedling cost and tree prices are expected to rise by annually.

The current owners began operating their Christmas tree farm years ago, first as a hobby and later as

their primary source of income. They have always grown Douglas Firs of the trees and Fraser Firs

on the tree farm. Each year they cut onethird of their available trees for selling wholesale, while they

sell the remaining twothirds as cutyourown trees. Table provides information on the acreage planted

with trees and the projected percentage of trees sold.

The current owners now want to sell their business and move closer to their children and grandchildren.

Their listing price for the operation is USD

Sarah and James have received advice on expected revenue and operating expenses from the local

agricultural extension service. Table provides the estimates of operating expenses. These operating

expenses are also expected to increase each year by The purchase includes fixed assets consisting of

land, a barn, skid steer, tree shaker, tractor, and implements see Table While none of this equipment,

all considered to be in good condition, should need to be replaced in the near future, excluding the land,

the couple will be able to depreciate all except for the barn, using a sevenyear MACRS depreciation

schedule see Table The barn will be depreciated using the year schedule. The couple has decided

that they will need one year's worth of operating expenses on hand as cash.

They will obtain a Direct Farm Ownership Loan from the US Department of Agriculture Farm Service

Agency. The rate on this loan is a fixed rate set at basis points above the current prime rate.

Though this loan program could provide financing, the Oakes expect to finance of the

investment from their inheritance. Since their alternative is investing in the equity markets, the Oakes

expect a return on their investment. While they expect to keep the operation until they reach

retirement age, years is used as the time horizon for analysis of this investment. During this time, land

prices are expected to increase by Closing costs associated with this transaction are expected to be

USD Finally, they expect a combined federal and state tax rate of

Sarah and James wonder if this a good investment and how much they should offer for Escarpment

Evergreens.

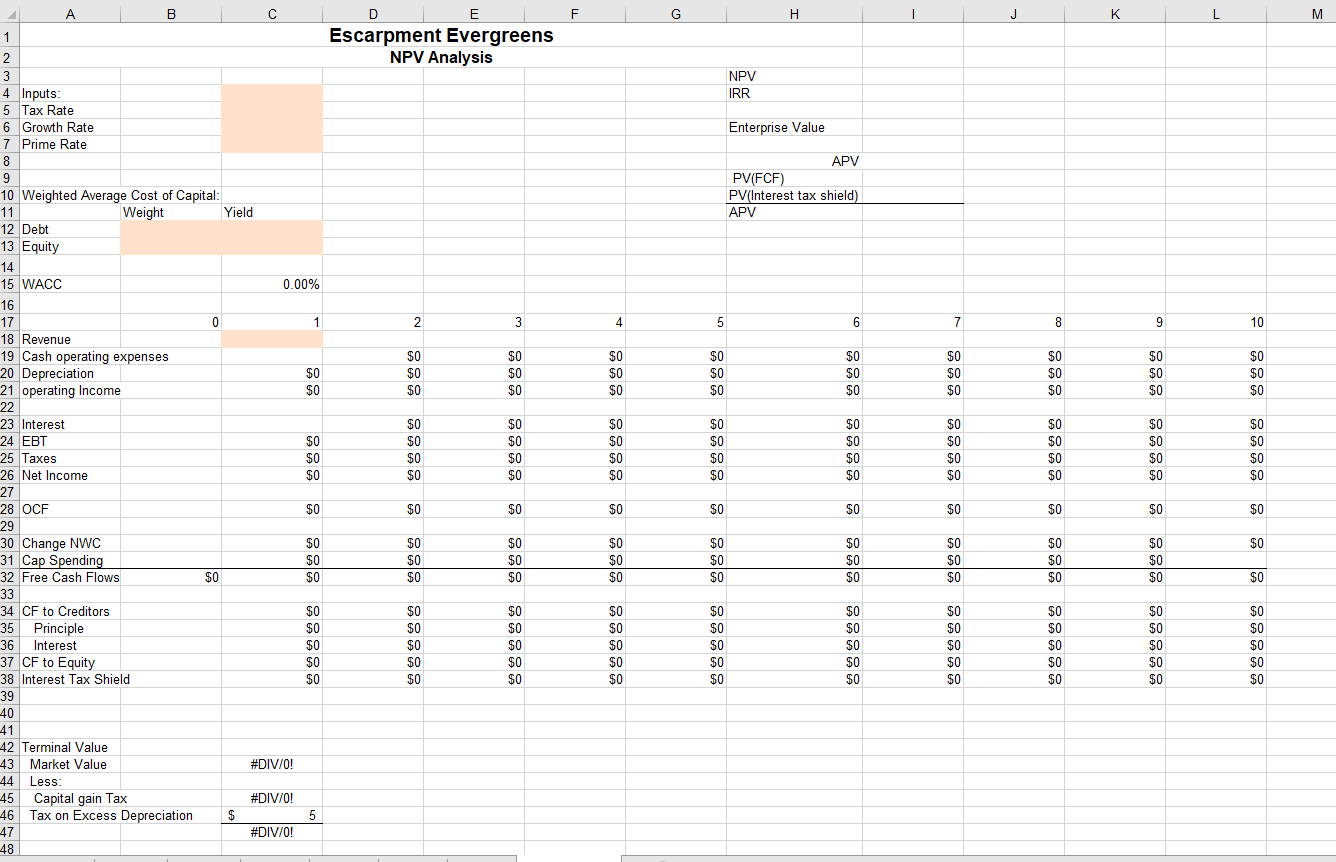

Please show how to do the calculations in excel

Calculate the investment, operating, and terminal cash flows for this investment.

Calculate the weighted average cost of capital and the unlevered required rate of return.

At the asking price of USD would you recommend purchase of Escarpment Evergreens?

Calculate the enterprise value of the investment.

What is the adjusted present value APV for an investment in Escarpment Evergreens? What is the value of the interest tax shield?

How much would you offer for Escarpment Evergreens?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started