Answered step by step

Verified Expert Solution

Question

1 Approved Answer

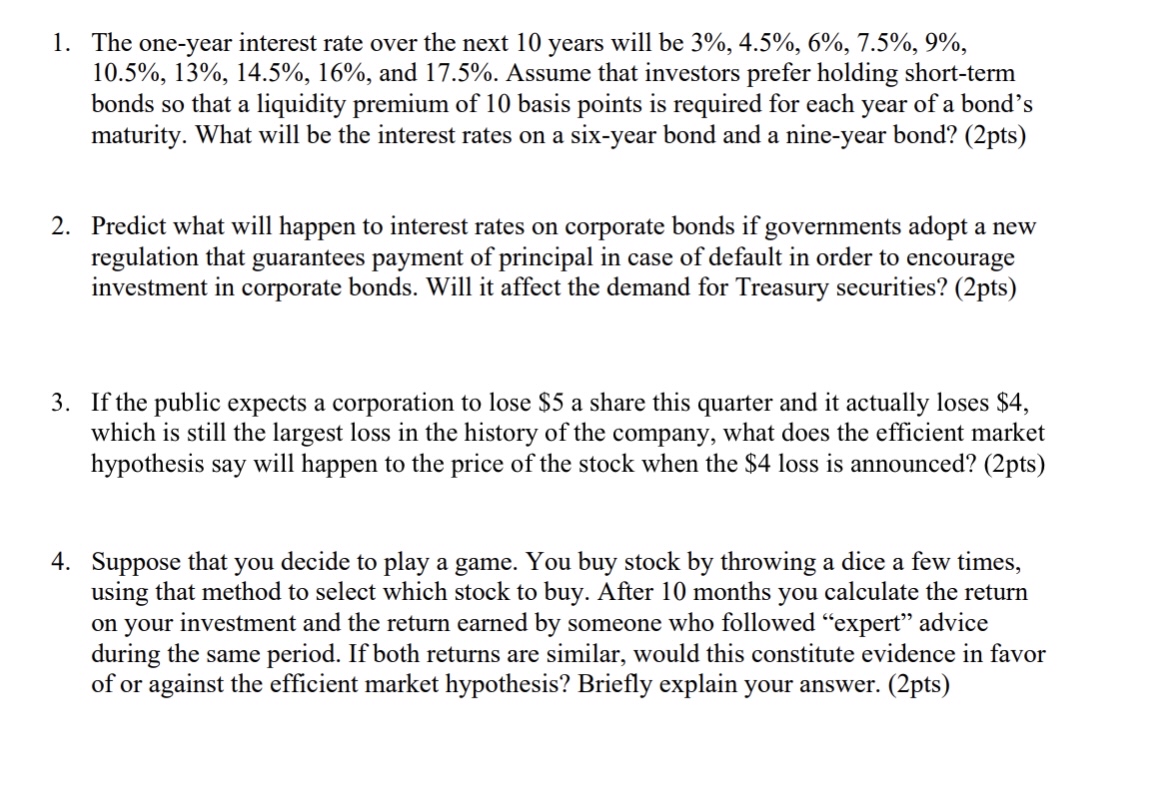

The one - year interest rate over the next 1 0 years will be 3 % , 4 . 5 % , 6 % ,

The oneyear interest rate over the next years will be

and Assume that investors prefer holding shortterm

bonds so that a liquidity premium of basis points is required for each year of a bond's

maturity. What will be the interest rates on a sixyear bond and a nineyear bond? pts

Predict what will happen to interest rates on corporate bonds if governments adopt a new

regulation that guarantees payment of principal in case of default in order to encourage

investment in corporate bonds. Will it affect the demand for Treasury securitiespts

If the public expects a corporation to lose $ a share this quarter and it actually loses $

which is still the largest loss in the history of the company, what does the efficient market

hypothesis say will happen to the price of the stock when the $ loss is announced? pts

Suppose that you decide to play a game. You buy stock by throwing a dice a few times,

using that method to select which stock to buy. After months you calculate the return

on your investment and the return earned by someone who followed "expert" advice

during the same period. If both returns are similar, would this constitute evidence in favor

of or against the efficient market hypothesis? Briefly explain your answer. pts

The oneyear interest rate over the next years will be

and Assume that investors prefer holding shortterm

bonds so that a liquidity premium of basis points is required for each year of a bond's

maturity. What will be the interest rates on a sixyear bond and a nineyear bond? pts

Predict what will happen to interest rates on corporate bonds if governments adopt a new

regulation that guarantees payment of principal in case of default in order to encourage

investment in corporate bonds. Will it affect the demand for Treasury securities pts

If the public expects a corporation to lose $ a share this quarter and it actually loses $

which is still the largest loss in the history of the company, what does the efficient market

hypothesis say will happen to the price of the stock when the $ loss is announced? pts

Suppose that you decide to play a game. You buy stock by throwing a dice a few times,

using that method to select which stock to buy. After months you calculate the return

on your investment and the return earned by someone who followed "expert" advice

during the same period. If both returns are similar, would this constitute evidence in favor

of or against the efficient market hypothesis? Briefly explain your answer. pts

The oneyear interest rate over the next years will be

and Assume that investors prefer holding shortterm

bonds so that a liquidity premium of basis points is required for each year of a bond's

maturity. What will be the interest rates on a sixyear bond and a nineyear bond? pts

Predict what will happen to interest rates on corporate bonds if governments adopt a new

regulation that guarantees payment of principal in case of default in order to encourage

investment in corporate bonds. Will it affect the demand for Treasury securities pts

If the public expects a corporation to lose $ a share this quarter and it actually loses $

which is still the largest loss in the history of the company, what does the efficient market

hypothesis say will happen to the price of the stock when the $ loss is announced? pts

Suppose that you decide to play a game. You buy stock by throwing a dice a few times,

using that method to select which stock to buy. After months you calculate the return

on your investment and the return earned by someone who followed "expert" advice

during the same period. If both returns are similar, would this constitute evidence in favor

of or against the efficient market hypothesis? Briefly explain your answer. pts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started