Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The one-year spot rate for year one is its annualized yield of 7.50%. Using this value and the yield to maturity for year 2,

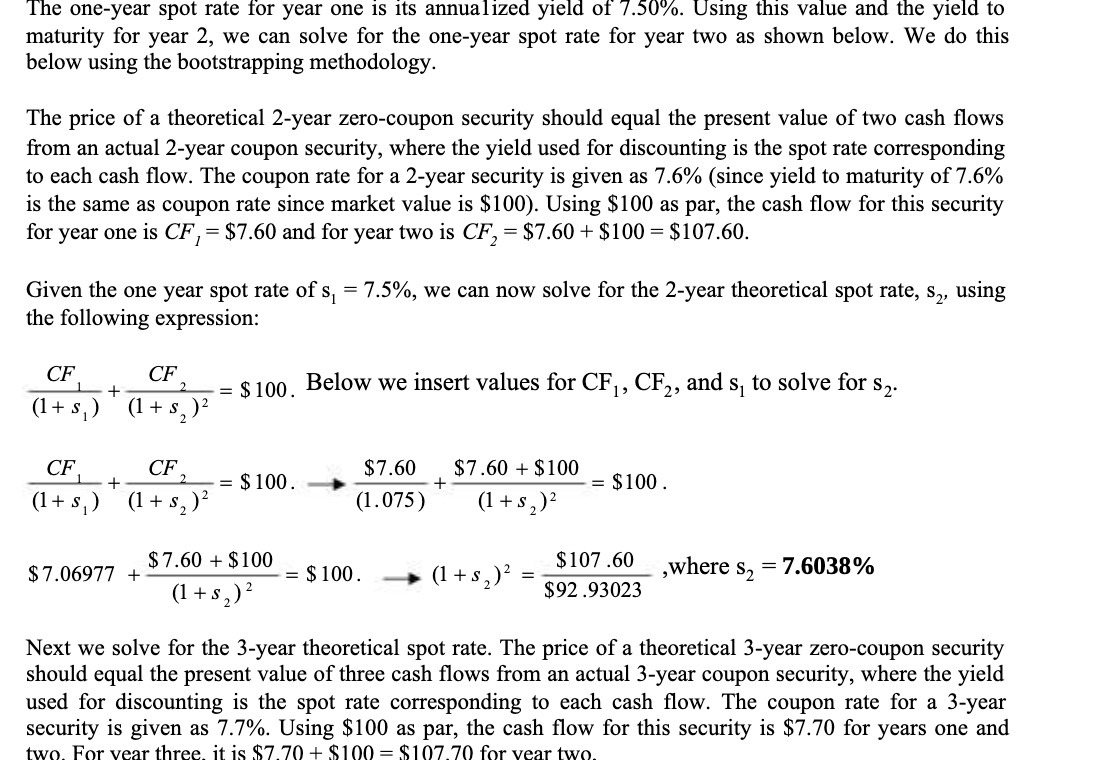

The one-year spot rate for year one is its annualized yield of 7.50%. Using this value and the yield to maturity for year 2, we can solve for the one-year spot rate for year two as shown below. We do this below using the bootstrapping methodology. The price of a theoretical 2-year zero-coupon security should equal the present value of two cash flows from an actual 2-year coupon security, where the yield used for discounting is the spot rate corresponding to each cash flow. The coupon rate for a 2-year security is given as 7.6% (since yield to maturity of 7.6% is the same as coupon rate since market value is $100). Using $100 as par, the cash flow for this security for year one is CF, = $7.60 and for year two is CF = $7.60 + $100 = $107.60. Given the one year spot rate of s = 7.5%, we can now solve for the 2-year theoretical spot rate, s, using the following expression: CF 2 + (1 + s ) (1+ s + CF CF 2 (1+) (1+s) $7.06977 + = $100. Below we insert values for CF, CF, and s to solve for $2. $) CF = $100. $7.60 + $100 (1+5) $7.60 (1.075) = $100. + $7.60 + $100 (1+s) (1 + s) = $100. $107.60 $92.93023 ,where = 7.6038% $2 Next we solve for the 3-year theoretical spot rate. The price of a theoretical 3-year zero-coupon security should equal the present value of three cash flows from an actual 3-year coupon security, where the yield used for discounting is the spot rate corresponding to each cash flow. The coupon rate for a 3-year security is given as 7.7%. Using $100 as par, the cash flow for this security is $7.70 for years one and two. For year three. it is $7.70+ $100 = $107.70 for year two.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To solve for the 3year theoretical spot rate we will utilize the bootstrapping methodology Given Cou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started