Answered step by step

Verified Expert Solution

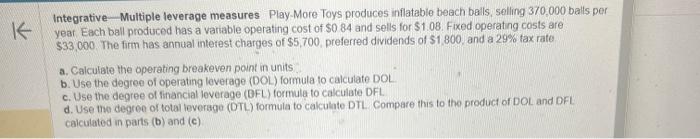

Question

1 Approved Answer

The operating breakeven point in units is units. (Round to the nearest integer.) The degree of operating leverage is (Round to four decimal places.) The

- The operating breakeven point in units is units. (Round to the nearest integer.)

- The degree of operating leverage is (Round to four decimal places.)

- The degree of financial leverage is (Round to four decimal places.)

- The degree of total leverage is (Round your answer to two decimal places.)

Compare this to the product of DOL and DFL calculated in parts (b) and (c).

The degree of total leverage is . (Round your answer to two decimal places.)

The values for the degree of total leverage calculated above are

(Note: If the difference between the two

calculated values above is 0.01 or less, these are considered as equal values. Select from the drop-down menu.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started