Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Optical Scam Company has forecast a sales growth rate of 20 percent for next year. Current assets, fixed assets, and short-term debt are proportional

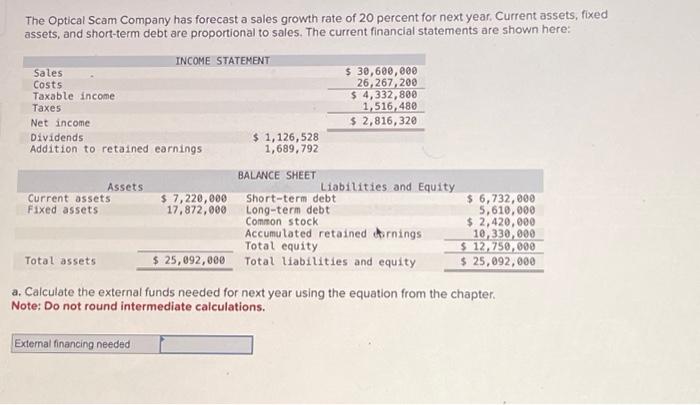

The Optical Scam Company has forecast a sales growth rate of 20 percent for next year. Current assets, fixed assets, and short-term debt are proportional to sales. The current financial statements are shown here: Sales Costs Taxable income Taxes Net income Dividends Addition to retained earnings Assets Current assets Fixed assets Total assets INCOME STATEMENT External financing needed $ 7,220,000 17,872,000 $ 25,092,000 $ 1,126,528 1,689,792 BALANCE SHEET $ 30,600,000 26,267,200 $ 4,332,800 1,516,480 $ 2,816,320 Liabilities and Equity Short-term debt Long-term debt Common stock Accumulated retained earnings Total equity Total liabilities and equity $ 6,732,000 5,610,000 $ 2,420,000 10,330,000 $ 12,750,000 $ 25,092,000 a. Calculate the external funds needed for next year using the equation from the chapter. Note: Do not round intermediate calculations.

this is the full question

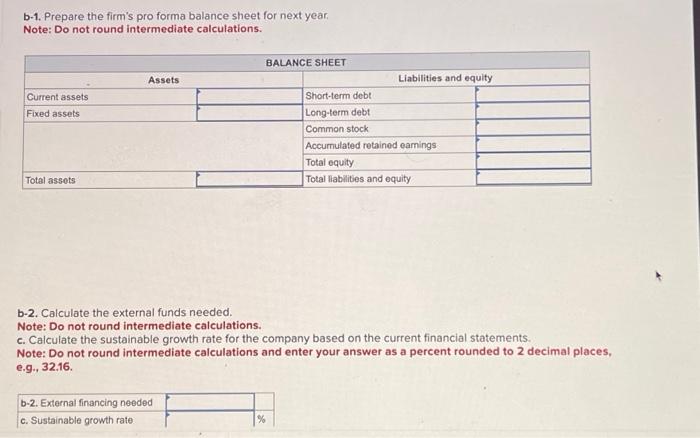

The Optical Scam Company has forecast a sales growth rate of 20 percent for next year. Current assets, fixed assets, and short-term debt are proportional to sales. The current financial statements are shown here: a. Calculate the external funds needed for next year using the equation from the chapter. Note: Do not round intermediate calculations. b-1. Prepare the firm's pro forma balance sheet for next year. Note: Do not round intermediate calculations. b-2. Calculate the external funds needed. Note: Do not round intermediate calculations. c. Calculate the sustainable growth rate for the company based on the current financial statements. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started