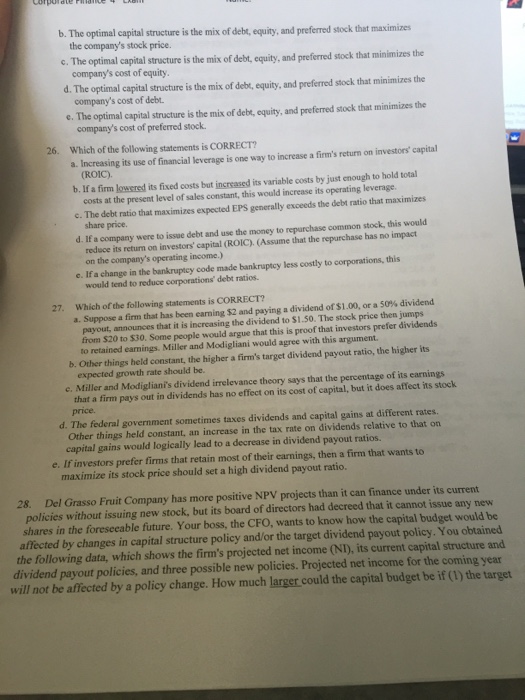

The optimal capital structure is the mix of debt. equity. and preferred stock that maximizes the company's stock price. The optimal capital structure is the mix of debt, equity, and preferred stock that minimizes the company's com of equity. The optimal capital structure is the mix of debt, equity. and preferred flock that minimizes the company's cost of debt. The optimal capital structure is the mix of debt. equity, and preferred flock that minimizes the company's cost of preferred stock. Which of the following statements is CORRECT? Increasing its use of financial leverage is one way to increase a firm's return on investors' capital (ROIC) If a firm lowered its fixed costs hut increased its variable costs by just enough to hold total costs at the present level of sales constant, this would increase its operating leverage. The debt ratio that maximizes expected TPS generally exceeds the debt ratio that maximizes share price. If a company wife to issue debt and use the money to repurchase common stock, this would reduce its return on investees' capital (ROIC). (Assume that the repurchase has no impact on the company's operating income.) e. If a change in the bankruptcy code made bankruptcy less costly to corporations, this would tend to reduce corporations' debt ratios. Which of the following statements is CORRECT? Suppose a firm that has been earning $2 and paying a dividend of $1.00. or a 50% dividend payout, announces that it is increasing the dividend to $1.50. The stock price then jumps 6cm $20 to $30. Some people would argue that this is proof that investors prefer dividends to retained comings Miller and Modigliani would agree with this argument. Other things held constant, the higher a firm's target dividend payout ratio, the higher its expected growth rate should be. Miller and Modigliani's dividend irrelevance theory says that the percentage of its earnings that a firm pays oat in dividends has no effect on its cost of capital, but it does affect ITS stock price. The federal government sometimes taxes dividends and capital gains at different rates. Other things held constant, an increase in the tax rate on dividends relative to that on capital gains would logically lead to a decrease in dividend payout ratios. If investors prefer firms that retain most of their earnings, then a firm that wants to maximize its stock price should set a high dividend payout ratio. Del Grasso Fruit Company has more positive NPV projects than it can finance under its current policies without issuing new stock, but its board of directors had decreed that it cannot issue any new shares in the foreseeable future. Your boss, the CFO. wants to know how the capital budget would be affected by changes in capital structure policy and/or the target dividend payout policy. You obtained the following data, which shows the firm's projected net income (NI), its current capital structure and dividend payout policies, and three possible new policies. Projected net income for the coming, year will not be affected by a policy change. How much larger could the capital budget be if (I) the target