Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the options are: cost of goods sold contra revenue account freight out FOB shipping point FOB destination gross profit merchandise inventory non-operating activities profit margin

the options are:

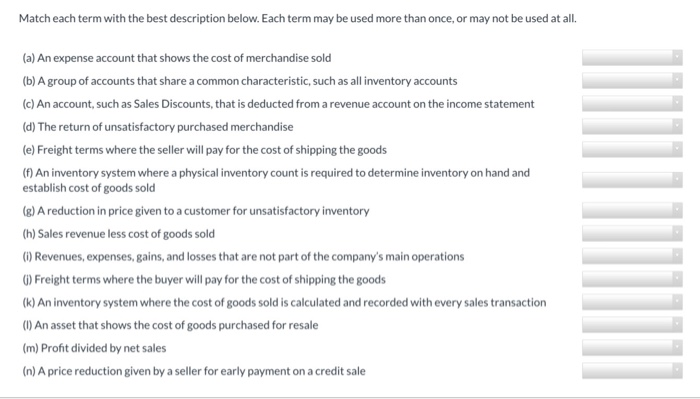

Match each term with the best description below. Each term may be used more than once, or may not be used at all. (a) An expense account that shows the cost of merchandise sold (b) A group of accounts that share a common characteristic, such as all inventory accounts (c) An account, such as Sales Discounts, that is deducted from a revenue account on the income statement (d) The return of unsatisfactory purchased merchandise (e) Freight terms where the seller will pay for the cost of shipping the goods (1) An inventory system where a physical inventory count is required to determine inventory on hand and establish cost of goods sold (8) A reduction in price given to a customer for unsatisfactory inventory (h) Sales revenue less cost of goods sold (0) Revenues, expenses, gains, and losses that are not part of the company's main operations G) Freight terms where the buyer will pay for the cost of shipping the goods (k) An inventory system where the cost of goods sold is calculated and recorded with every sales transaction (1) An asset that shows the cost of goods purchased for resale (m) Profit divided by net sales (n) A price reduction given by a seller for early payment on a credit sale cost of goods sold

contra revenue account

freight out

FOB shipping point

FOB destination

gross profit

merchandise inventory

non-operating activities

profit margin

perpetual inventory system

purchase discounts

periodic inventory system

sales allowance

subsidiary ledger

sales discount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started