Question

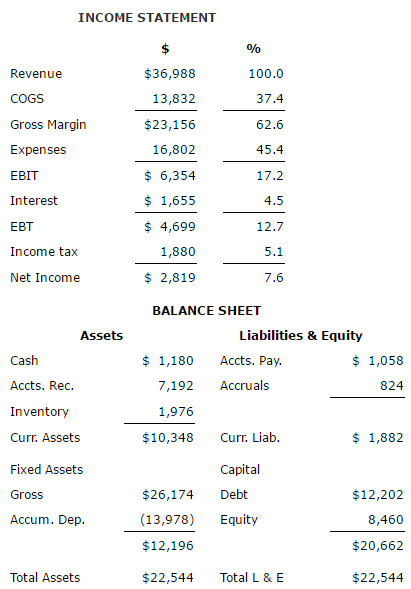

The Owl Corporation is planning for 20X2. The firm expects to have the following financial result in 20X1 ($000). Management has made the following planning

The Owl Corporation is planning for 20X2. The firm expects to have the following financial result in 20X1 ($000).

Management has made the following planning assumptions:

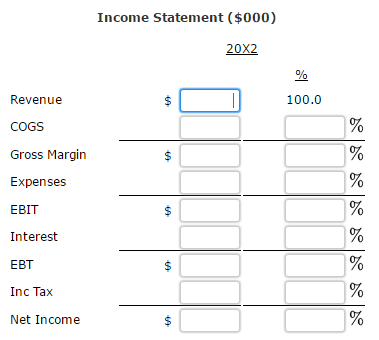

Income Statement

Revenue will grow by 15%.

The cost ratio will improve to 37% of revenues.

Expenses will be held to 49% of revenues.

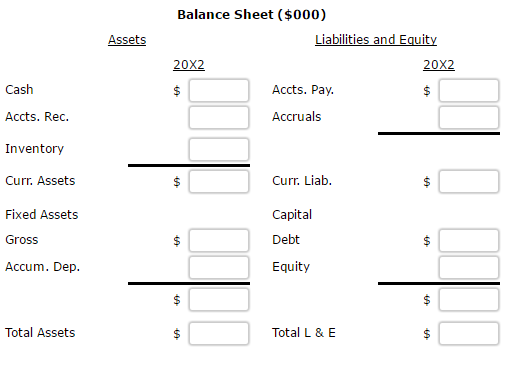

Balance Sheet

The year end cash balance will be $1.7 million.

The ACP will improve to 50 days from the current 70.

Inventory turnover will improve to 9X from 7X.

Trade payables will continue to be paid in 45 days.

New capital spending will be $4 million.

Newly purchased assets will be depreciated over 10 years using the straight line method taking a full year's depreciation in the first year.

The company's annual payroll will be $14.3 million at the end of 20X2.

No dividends or new stock sales are planned. The following facts are also available:

The firm pays 10% interest on all of its debt.

The combined state and federal income tax rate is a flat 40%.

The only significant payables come from inventory purchases, and product cost is 75% purchased materials.

Existing assets will be depreciated by $1,339,000 next year.

The only significant accrual is payroll. The last day of 20X2 will be one week after a payday.

Forecast Owl's income statement and balance sheet for 20X2. Enter your dollar answers in thousands. For example, an answer of $200 thousands should be entered as 200, not 200,000. Round dollar answers to the nearest thousand. Round the percentage values to 1 decimal place. Use a 360-day year. Enter all answers as positive numbers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started