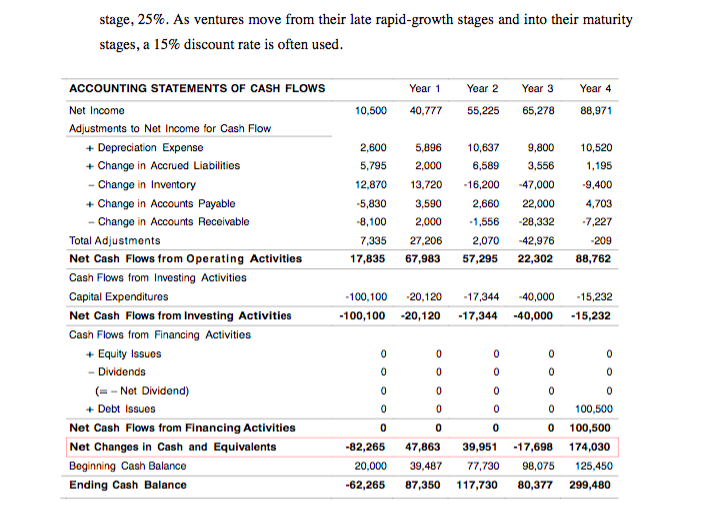

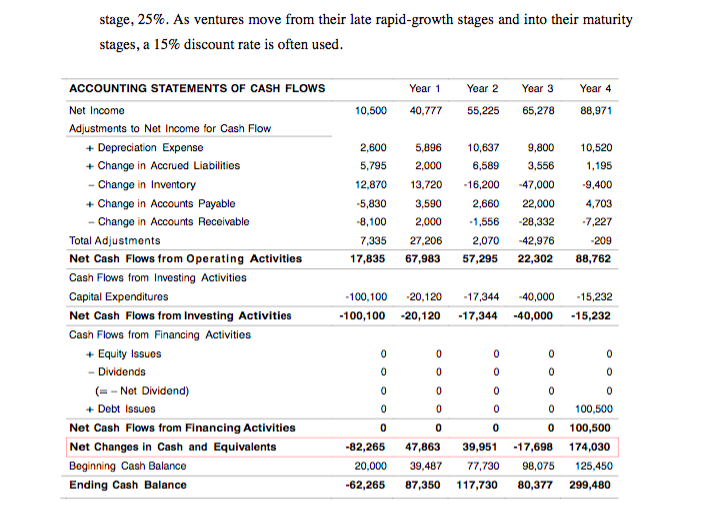

The owner of WINSEC, wants to determine the present value of his investment. WINSEC is currently in the development stage. The flows during the next 4 years are expected to be as follows in the projected Cash Flows Statement. Cash inflows are expected to be $500,000 in Year 5 and are expected to grow at a 6% annual rate thereafter. Recall that venture investors often use different discount rates when valuing ventures at various stages of their life cycles. For example, target discount rates by life cycle stage are: development stage, 40% startup stage, 45%; survival stage, 35%; and early rapid-growth stage, 25%. As ventures move from their late rapid-growth stages and into their maturity stages, a 15% discount rate is often used. Year 2 Year 3 Year 1 40,777 Yoar 4 88,971 10,500 55,225 65,278 10,520 9,800 3,556 2,600 5,795 12,870 -5,830 -8,100 7,335 17,835 5,896 2,000 13,720 3,590 2,000 27,206 67,983 10,637 6,589 -16,200 2,660 -1.556 2,070 57,295 -47,000 22,000 -28,332 -42,976 22,302 1,195 -9,400 4,703 -7,227 -209 88,762 ACCOUNTING STATEMENTS OF CASH FLOWS Net Income Adjustments to Net Income for Cash Flow + Depreciation Expense + Change in Accrued Liabilities - Change in Inventory + Change in Accounts Payable - Change in Accounts Receivable Total Adjustments Net Cash Flows from Operating Activities Cash Flows from Investing Activities Capital Expendituros Net Cash Flows from Investing Activities Cash Flows from Financing Activities + Equity Issues - Dividends (=- Not Dividend) + Debt Issues Net Cash Flows from Financing Activities Net Changes in Cash and Equivalents Beginning Cash Balance Ending Cash Balance -100,100 20,120 -100,100-20,120 -17,344 -17,344 -40,000 -40,000 -15,232 -15,232 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 100,500 100,500 174,030 125,450 -82,265 20,000 -62,265 0 39,951 77,730 117,730 47,863 39,487 87,350 -17,698 98,075 80,377 299,480 d) What is the Equity Value of WINSEC? e) What percent ownership should WINSEC be willing to give today to a venture investor, for $200,000 investment? f) Apply the VCSC to value the venture. g) What percent ownership should WINSEC be willing to give today to a venture investor, for $200,000 investment? The owner of WINSEC, wants to determine the present value of his investment. WINSEC is currently in the development stage. The flows during the next 4 years are expected to be as follows in the projected Cash Flows Statement. Cash inflows are expected to be $500,000 in Year 5 and are expected to grow at a 6% annual rate thereafter. Recall that venture investors often use different discount rates when valuing ventures at various stages of their life cycles. For example, target discount rates by life cycle stage are: development stage, 40% startup stage, 45%; survival stage, 35%; and early rapid-growth stage, 25%. As ventures move from their late rapid-growth stages and into their maturity stages, a 15% discount rate is often used. Year 2 Year 3 Year 1 40,777 Yoar 4 88,971 10,500 55,225 65,278 10,520 9,800 3,556 2,600 5,795 12,870 -5,830 -8,100 7,335 17,835 5,896 2,000 13,720 3,590 2,000 27,206 67,983 10,637 6,589 -16,200 2,660 -1.556 2,070 57,295 -47,000 22,000 -28,332 -42,976 22,302 1,195 -9,400 4,703 -7,227 -209 88,762 ACCOUNTING STATEMENTS OF CASH FLOWS Net Income Adjustments to Net Income for Cash Flow + Depreciation Expense + Change in Accrued Liabilities - Change in Inventory + Change in Accounts Payable - Change in Accounts Receivable Total Adjustments Net Cash Flows from Operating Activities Cash Flows from Investing Activities Capital Expendituros Net Cash Flows from Investing Activities Cash Flows from Financing Activities + Equity Issues - Dividends (=- Not Dividend) + Debt Issues Net Cash Flows from Financing Activities Net Changes in Cash and Equivalents Beginning Cash Balance Ending Cash Balance -100,100 20,120 -100,100-20,120 -17,344 -17,344 -40,000 -40,000 -15,232 -15,232 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 100,500 100,500 174,030 125,450 -82,265 20,000 -62,265 0 39,951 77,730 117,730 47,863 39,487 87,350 -17,698 98,075 80,377 299,480 d) What is the Equity Value of WINSEC? e) What percent ownership should WINSEC be willing to give today to a venture investor, for $200,000 investment? f) Apply the VCSC to value the venture. g) What percent ownership should WINSEC be willing to give today to a venture investor, for $200,000 investment