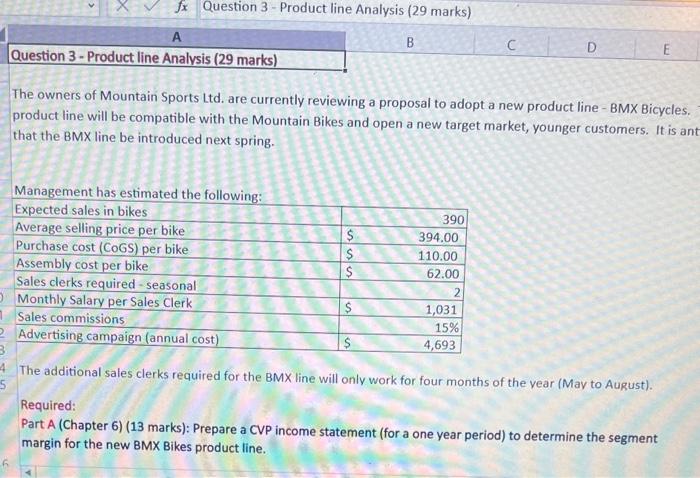

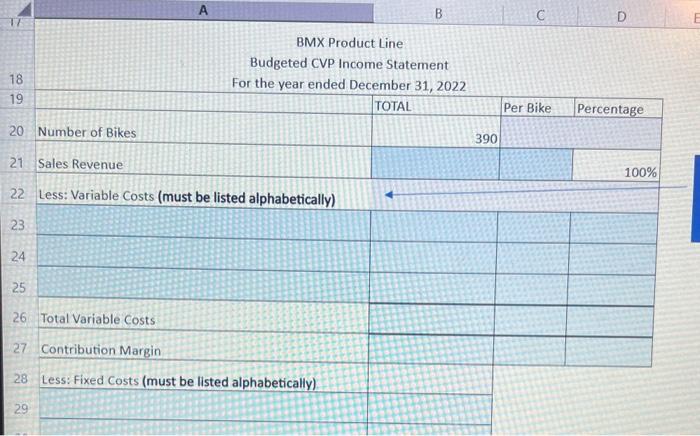

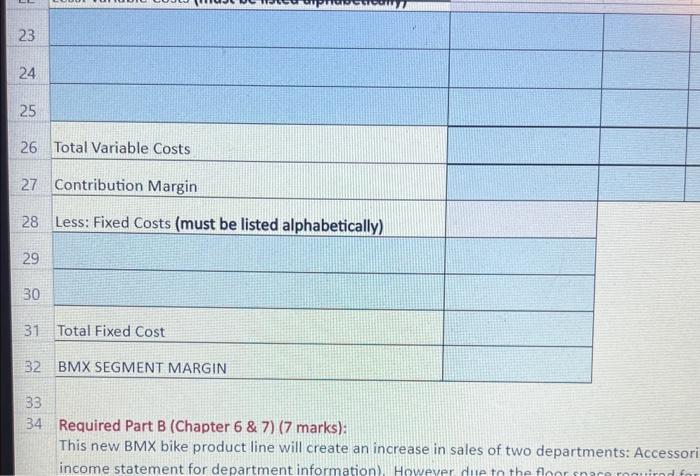

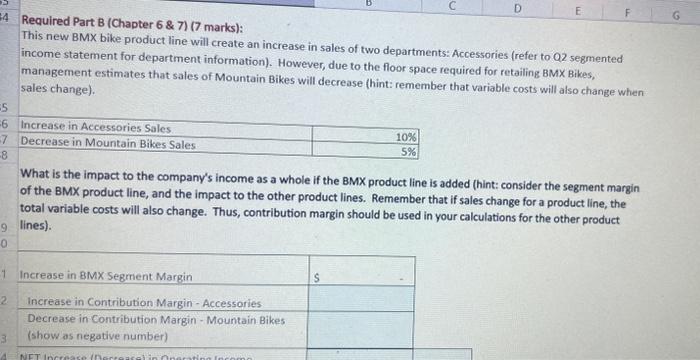

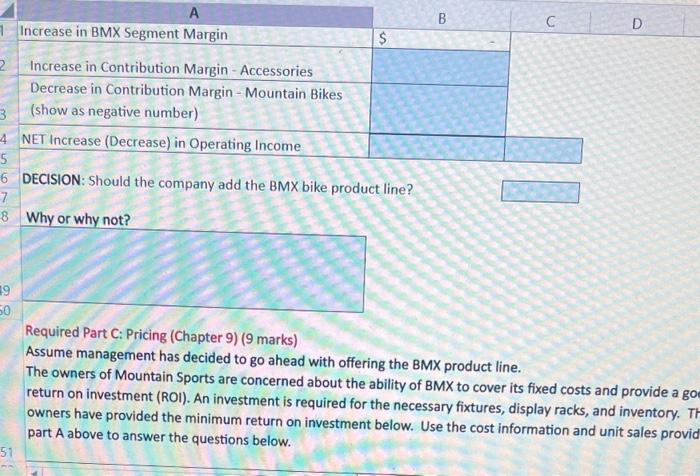

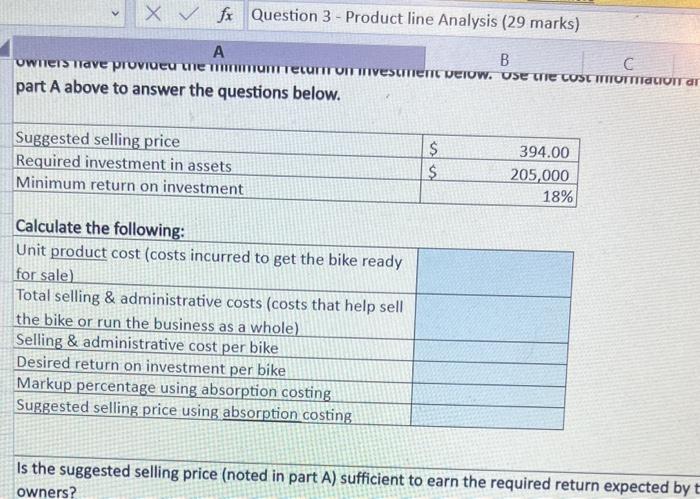

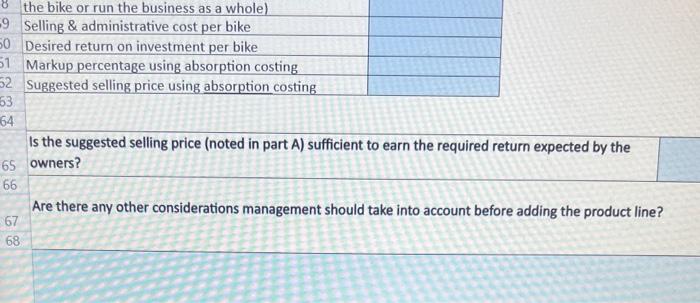

The owners of Mountain Sports Ltd. are currently reviewing a proposal to adopt a new product line - BMX Bicycles. product line will be compatible with the Mountain Bikes and open a new target market, younger customers. It is ant that the BMX line be introduced next spring. The additional sales clerks required for the BMX line will only work for four months of the vear (May to August). Required: Part A (Chapter 6) (13 marks): Prepare a CVP income statement (for a one year period) to determine the segment margin for the new BMX Bikes product line. Required Part B (Chapter 6 \& 7) (7 marks): This new BMX bike product line will create an increase in sales of two departments: Accessori income statement for department information Required Part B (Chapter 6 \& 7) (7 marks): This new BMX bike product line will create an increase in sales of two departments: Accessories (refer to Q2 segmented income statement for department information). However, due to the floor space required for retailing BMX Bikes, management estimates that sales of Mountain Bikes will decrease (hint: remember that variable costs will also change when sales change). What is the impact to the company's income as a whole if the BMX product line is added (hint: consider the segment margin of the BMX product line, and the impact to the other product lines. Remember that if sales change for a product line, the total variable costs will also change. Thus, contribution margin should be used in your calculations for the other product lines). Required Part C: Pricing (Chapter 9) ( 9 marks) Assume management has decided to g ahead with offering the BMX product line. The owners of Mountain Sports are concerned about the ability of BMX to cover its fixed costs and provide a go return on investment (ROI). An investment is required for the necessary fixtures, display racks, and inventory. T owners have provided the minimum return on investment below. Use the cost information and unit sales provio part A above to answer the questions below. part A above to answer the questions below. Is the suggested selling price (noted in part A) sufficient to earn the required return expected by owners? Is the suggested selling price (noted in part A) sufficient to earn the required return expected by the owners? Are there any other considerations management should take into account before adding the product line