Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The partners decided to embark on a more professional approach to managing the boutique and one of the high-priority initiatives is to implement a cash

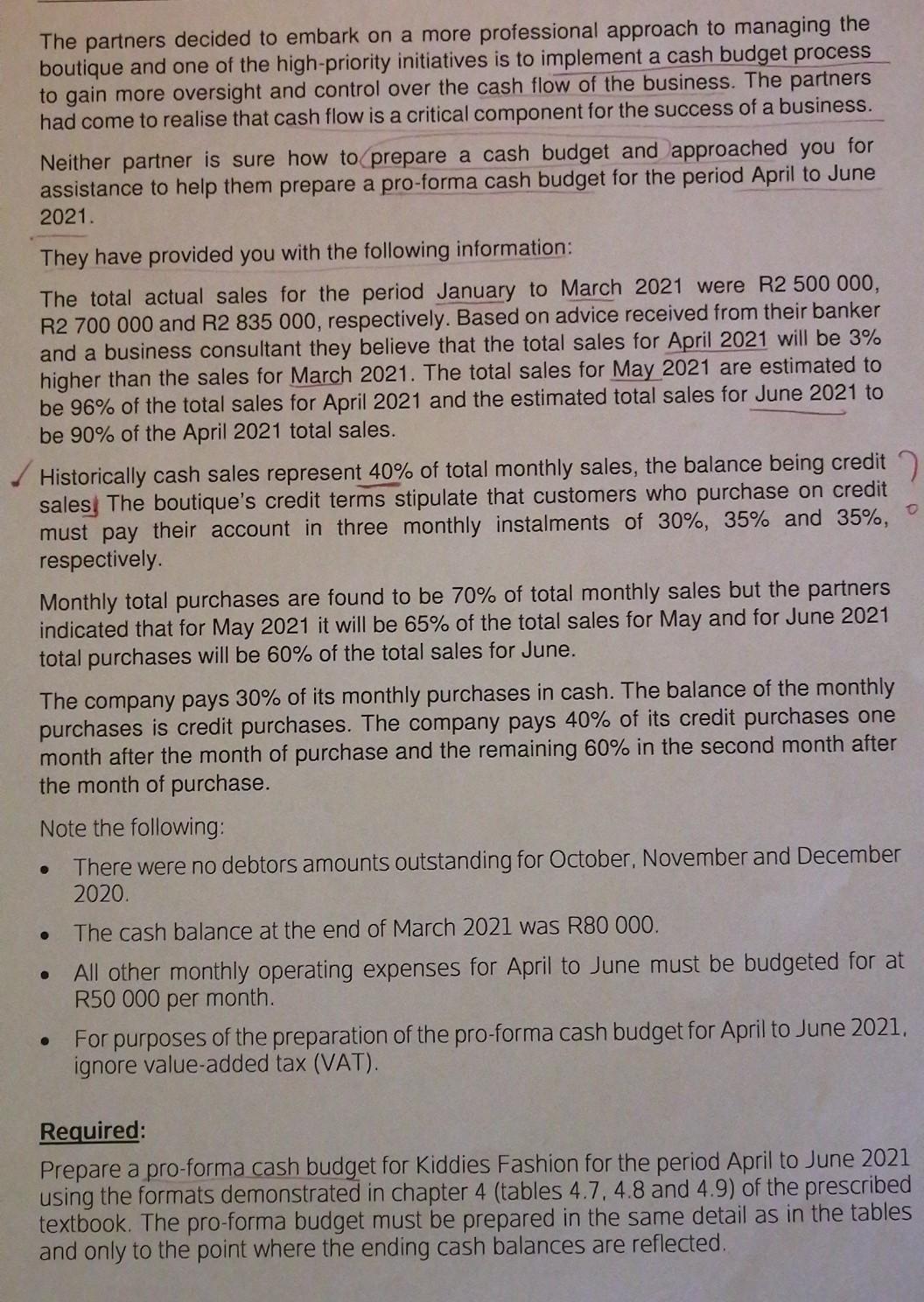

The partners decided to embark on a more professional approach to managing the boutique and one of the high-priority initiatives is to implement a cash budget process to gain more oversight and control over the cash flow of the business. The partners had come to realise that cash flow is a critical component for the success of a business. Neither partner is sure how to prepare a cash budget and approached you for assistance to help them prepare a pro-forma cash budget for the period April to June 2021. They have provided you with the following information: The total actual sales for the period January to March 2021 were R2 500 000, R2 700 000 and R2 835 000, respectively. Based on advice received from their banker and a business consultant they believe that the total sales for April 2021 will be 3% higher than the sales for March 2021. The total sales for May 2021 are estimated to be 96% of the total sales for April 2021 and the estimated total sales for June 2021 to be 90% of the April 2021 total sales. Historically cash sales represent 40% of total monthly sales, the balance being credit sales, The boutique's credit terms stipulate that customers who purchase on credit must pay their account in three monthly instalments of 30%, 35% and 35%, respectively. Monthly total purchases are found to be 70% of total monthly sales but the partners indicated that for May 2021 it will be 65% of the total sales for May and for June 2021 total purchases will be 60% of the total sales for June. The company pays 30% of its monthly purchases in cash. The balance of the monthly purchases is credit purchases. The company pays 40% of its credit purchases one month after the month of purchase and the remaining 60% in the second month after the month of purchase. Note the following: There were no debtors amounts outstanding for October, November and December 2020. The cash balance at the end of March 2021 was R80 000. All other monthly operating expenses for April to June must be budgeted for at R50 000 per month. For purposes of the preparation of the pro-forma cash budget for April to June 2021. ignore value-added tax (VAT). . Required: Prepare a pro-forma cash budget for Kiddies Fashion for the period April to June 2021 using the formats demonstrated in chapter 4 (tables 4.7.4.8 and 4.9) of the prescribed textbook. The pro-forma budget must be prepared in the same detail as in the tables and only to the point where the ending cash balances are reflected

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started