Question

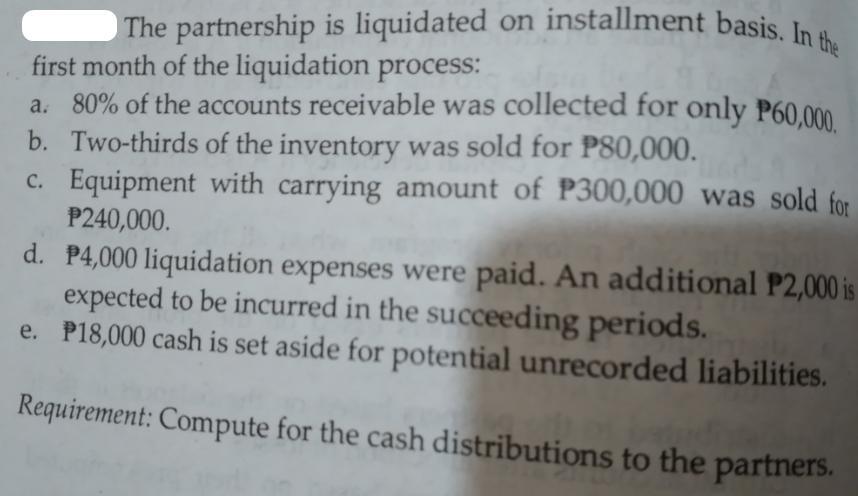

The partnership is liquidated on installment basis. In the first month of the liquidation process: a. 80% of the accounts receivable was collected for

The partnership is liquidated on installment basis. In the first month of the liquidation process: a. 80% of the accounts receivable was collected for only P60,000. b. Two-thirds of the inventory was sold for P80,000. c. Equipment with carrying amount of P300,000 was sold for P240,000. d. P4,000 liquidation expenses were paid. An additional P2,000 is expected to be incurred in the succeeding periods. e. P18,000 cash is set aside for potential unrecorded liabilities. Requirement: Compute for the cash distributions to the partners.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the cash distributions to the partners we need to determine the total cash available for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cornerstones of Managerial Accounting

Authors: Maryanne M. Mowen, Don Hanson, Dan L. Heitger, David McConomy, Jeffrey Pittman

2nd Canadian edition

978-0176721237, 978-0176530884

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App