Answered step by step

Verified Expert Solution

Question

1 Approved Answer

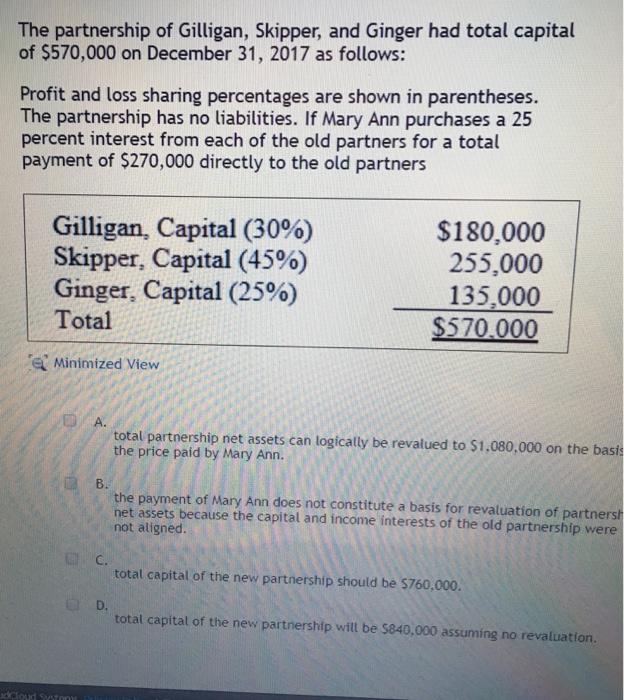

The partnership of Gilligan, Skipper, and Ginger had total capital of $570,000 on December 31, 2017 as follows: Profit and loss sharing percentages are

The partnership of Gilligan, Skipper, and Ginger had total capital of $570,000 on December 31, 2017 as follows: Profit and loss sharing percentages are shown in parentheses. The partnership has no liabilities. If Mary Ann purchases a 25 percent interest from each of the old partners for a total payment of $270,000 directly to the old partners Gilligan, Capital (30%) Skipper, Capital (45%) Ginger, Capital (25%) Total $180,000 255,000 135,000 $570.000 Minimized View total partnership net assets can logically be revalued to $1.080,000 on the basis the price paid by Mary Ann. B. the payment of Mary Ann does not constitute a basis for revaluation of partnersh net assets because the capital and income interests of the old partnership were not aligned. O C. total capital of the new partnership should be $760,000. D. total capital of the new partnership will be $840,000 assuming no revaluation. adcloud Saten

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Required solution Answer Option A is Correct Partnership ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635da25f9f2fb_177513.pdf

180 KBs PDF File

635da25f9f2fb_177513.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started